From Watergate to Reagan and Back Again

![]() Prologue: “I Am No Longer Among My People”

Prologue: “I Am No Longer Among My People”

The plane landed, and the post-landing murmurings sounded foreign to me.

The plane landed, and the post-landing murmurings sounded foreign to me.

I ventured from my small-town abode in the Upper Midwest to Mordor on the Potomac — Washington, D.C. — to meet with Jim Rickards and other Paradigm Press colleagues.

It’s a two-hop flight, the second hop from Chicago-O’Hare to Washington-Reagan. Not much passenger chatter I could hear on that second hop… but at the end, with the engines cut, I could make out too-earnest utterances about “public health” and “climate change.”

All I could think to myself is, I am no longer among my people.

But the thought passed quickly after the short cab ride to the Watergate Hotel — yes, that Watergate Hotel — where I would gather with my Paradigm compadres for two days of discussions, several of them recorded on video for your benefit. (The first is set for release this afternoon — the latest in our ever-popular Whiskey Bar roundtable series. The fireworks are set for 3:30 p.m. EDT today; watch your inbox for a link to the stream.)

We collectively figured the Watergate was as good a venue as any. It’s been 50 years since Richard Nixon’s resignation. The stock market put in a meaningful bottom that year — and 1974 was the year that Americans could once again own gold bullion legally.

And while reminders of the Nixon scandals are everywhere — the card keys to the guest rooms say NO NEED TO BREAK IN — it’s another president I have on my mind.

![]() From Watergate to “Morning in America”

From Watergate to “Morning in America”

Flying into Reagan National for the first time — it was simply “National” until 1998 — I got to thinking about the line you can trace from Watergate to Morning in America.

Flying into Reagan National for the first time — it was simply “National” until 1998 — I got to thinking about the line you can trace from Watergate to Morning in America.

Many factors fueled Reagan’s landslide victory in 1980. But one of them was undoubtedly the lingering revulsion over the twin debacles of Vietnam and Watergate — a disgust that transcended partisan differences. And so the zeitgeist was ripe for a message about “getting government off our backs.”

Sadly, it was all a joke. Reagan tripled the national debt during his two terms — a feat still unmatched by any of his free-spending successors.

Worse, Reagan was easily manipulated by the shadowy forces known today as the “deep state.”

Worse, Reagan was easily manipulated by the shadowy forces known today as the “deep state.”

Case in point: In early 1986 Reagan got a letter at the White House from the Soviet leader Mikhail Gorbachev. Gorbachev had been on the job less than a year, but he’d already begun his program of epic reforms. For his part, cold-warrior Reagan felt Gorbachev was a Soviet leader he could work with.

The letter proposed eliminating all nuclear weapons by 2000.

Reagan mused about upping the ante. “Why wait until the year 2000?” he asked his aides in the Oval Office.

The deep state swung into action. “Secretary of Defense Caspar Weinberger and CIA Director William Casey, who had done their best to sabotage earlier nuclear treaties, were appalled,” wrote Jacob Weisberg in a 2016 Atlantic article. “Few others inside the Reagan administration took the idea of nuclear abolition seriously.”

The best Reagan and Gorby could pull off was eliminating a single class of nukes in continental Europe, with the Intermediate-Range Nuclear Forces Treaty of 1987. (Which Donald Trump withdrew from in 2019, swayed by his own deep state advisers.)

An equally pitiful example was told by the late columnist Robert Novak.

An equally pitiful example was told by the late columnist Robert Novak.

Reagan appointed a U.S. Gold Commission early during his first term to investigate whether the United States should return to some sort of gold backing for the U.S. dollar. In the end, the Commission voted 15-2 against. (Rep. Ron Paul was one of the two dissenters.)

During his second term, Reagan granted a one-on-one interview to Novak at the White House. From Novak’s 2007 autobiography:

I asked Reagan: “What ever happened to the gold standard? I thought you supported it.”

“Well,” the president began and then paused (a ploy he frequently used to collect his thoughts), “I still do support the gold standard, but —”

At that point, Reagan was interrupted by his chief of staff. “Now, Mr. President,” said Don Regan, “we don't want to get bogged down talking about the gold standard.”

“You see?” the president said to me, with palms uplifted in mock futility. “They just won't let me have my way.”

It was Donald Regan — the Merrill Lynch veteran who was Treasury secretary during Reagan’s first term — who stacked the U.S. Gold Commission with supporters of fiat money.

We remember the Reagan era fondly only by comparison with what came before: After Vietnam and Watergate, almost anything was bound to be an improvement.

We remember the Reagan era fondly only by comparison with what came before: After Vietnam and Watergate, almost anything was bound to be an improvement.

The irony is thick: The guy who swept into office saying that government is the problem and not the solution… left office eight years later having kinda-sorta restored Americans’ faith in government.

True, there were some close shaves. Coming only 15 years after Watergate, the Iran-Contra scandal had the potential to permanently shatter Americans’ confidence in the system.

But the deep state worked hand-in-hand with corporate media to ensure the whole ugly affair would not emerge in one fell swoop. Really, imagine if it had come out in 1987 that the CIA turned a blind eye to their Nicaraguan Contra cutouts running cocaine into Los Angeles; instead, that sordid aspect of the story was consigned to the realm of “conspiracy theory” until maybe 10 years ago.

Back to the present moment, and Paradigm’s springtime gathering at the Watergate: Jim Rickards — who served as a twentysomething aide in the Nixon White House — will be joined this afternoon by several of his colleagues for one of our always-popular Whiskey Bar roundtables.

Back to the present moment, and Paradigm’s springtime gathering at the Watergate: Jim Rickards — who served as a twentysomething aide in the Nixon White House — will be joined this afternoon by several of his colleagues for one of our always-popular Whiskey Bar roundtables.

Joining Jim is Rude Awakening editor Sean Ring, Jim’s senior analyst Dan Amoss, Paradigm senior geologist Byron King, Paradigm income specialist Zach Scheidt and a first-time participant — Andrew Zatlin, aka “the Moneyball economist.”

The loose agenda includes inflation, geopolitics, AI and (of course) the 2024 election and its impact on markets and the economy.

The video stream begins promptly at 3:30 p.m. EDT today. You don’t need to sign up in advance and we won’t try to sell you anything. Just keep an eye on your inbox for a link to the stream. (And yes, we’ll make a replay available.)

![]() Climate Complainers Are “Good” Stock Pickers

Climate Complainers Are “Good” Stock Pickers

It’s rarely a good idea to invest in a company based on the enemies it makes, but… Exxon Mobil just might be a buy right now.

It’s rarely a good idea to invest in a company based on the enemies it makes, but… Exxon Mobil just might be a buy right now.

The big story on the front page of today’s Financial Times is Exxon Mobil CEO Darren Woods lashing out at CalPERS, the giant retirement plan for California state government workers.

CalPERS has come out in support of two large Exxon shareholders who are demanding the company do more to cut carbon emissions. Says Woods: “CalPERS’ fiduciary duty is not furthered by their attack on our company (or any company). They should leave politics to the politicians.”

“Charts don’t lie: The climate complainers are becoming extremely proficient at spotting strong investment candidates,” says Paradigm chart hound Greg “Gunner” Guenthner.

“Charts don’t lie: The climate complainers are becoming extremely proficient at spotting strong investment candidates,” says Paradigm chart hound Greg “Gunner” Guenthner.

The pattern is unmistakable: “The louder they scream about a company’s environmental issues, the stronger the trend.”

Consider Royal Caribbean — which just launched its $2 billion Icon of the Seas, the world’s biggest cruise ship, accommodating 7,600 passengers. “RCL shares have gained more than 200% off the October 2022 lows,” says Gunner, “compared to a gain of 37% in the S&P 500. That’s some serious climate change alpha.

“This little trick doesn’t just work on party boats. If we mosey on over the energy space, you’ll see the dirty coal stocks are beginning to firm up as they approach breakout levels.

“Arch Resources (ARCH) has posted a nice little run, gaining almost 30% over the last six months. I doubt the clean energy folks are too happy about that! But what about some of the alternative energy names? Will the climate complaint trick work in reverse?

“Let’s check in on solar. Most of these stocks remain well off their 2021 highs. In fact, the Invesco Solar ETF (TAN) has dropped almost 50% over the past 12 months. Score another point for ‘team dirty.’”

As it happens, the big news-making names today are in the fossil fuel space — ConocoPhillips buying Marathon Oil in a $17.1 billion all-stock deal.

As it happens, the big news-making names today are in the fossil fuel space — ConocoPhillips buying Marathon Oil in a $17.1 billion all-stock deal.

“Two great companies, now becoming one,” says Paradigm’s energy-and-mining maven Byron King. As the Street sees it, the deal is much better for Marathon (up 8% on the day) than for Conoco (down 4%).

As for the major averages, they’re all in the red — with the Nasdaq holding up best, down less than a half percent. The Dow is down nearly 1%. The S&P 500 is down close to two-thirds of a percent at 5,273 — about 50 points below its record close a week ago yesterday.

Gold has been whacked $21, the bid now $2,340 — still impressive considering how it’s held the line on $2,300 for much of April and May. Silver continues to hold the line on $32 today thanks to heavy demand in China; by one reckoning silver trades at a 12% premium in Shanghai compared with the New York price.

No economic numbers of note today, but American Airlines’ earnings report is a good substitute: The company is warning of a slowdown in air travel during the current quarter. That’s an ill omen for the mighty American consumer. AAL shares are being punished mercilessly, down over 14% at last check.

![]() Don’t Count Google Out (Pizza Glue Notwithstanding)

Don’t Count Google Out (Pizza Glue Notwithstanding)

“I wouldn’t count Google out of the races yet,” says Paradigm’s AI authority James Altucher.

“I wouldn’t count Google out of the races yet,” says Paradigm’s AI authority James Altucher.

True, as we chronicled yesterday, Google has once again beclowned itself in the AI realm — this time with its AI search feature that advises, among other things, to use “non-toxic glue” to help cheese stick to pizza better.

(Oh, and there’s a new one that’s emerged — the assertion that 13 U.S. presidents graduated from the University of Wisconsin-Madison.)

As it turns out, Google CEO Sundar Pinchai is taking a sorry-not-sorry stance to the whole thing: "There are still times it’s going to get it wrong, but I don’t think I would look at that and underestimate how useful it can be at the same time," he tells The Verge website. "We have definitely made progress when we look at metrics on factuality year on year.”

Now the buzz is about who Apple will partner with to introduce AI features to the next major iOS release. The announcement might come in two weeks during Apple’s annual Worldwide Developers Conference — and the buzz is that Sam Altman’s OpenAI will get the nod over Google.

James’ assessment: “Although OpenAI seems to have a small lead on Google’s AI technology, the search giant appears to be rapidly closing the gap.

James’ assessment: “Although OpenAI seems to have a small lead on Google’s AI technology, the search giant appears to be rapidly closing the gap.

“Earlier this month, Google announced its own set of new AI capabilities set to roll out in the coming weeks and months. These tools build heavily on Google’s existing customer relationships.

“More specifically, Google has billions of users across its various products like Search, YouTube, Maps, Gmail, Drive, Android and more. Google intends to build on this advantage by making its own AI the standard used by new features within these tools.”

![]() When AI Avoids Politics

When AI Avoids Politics

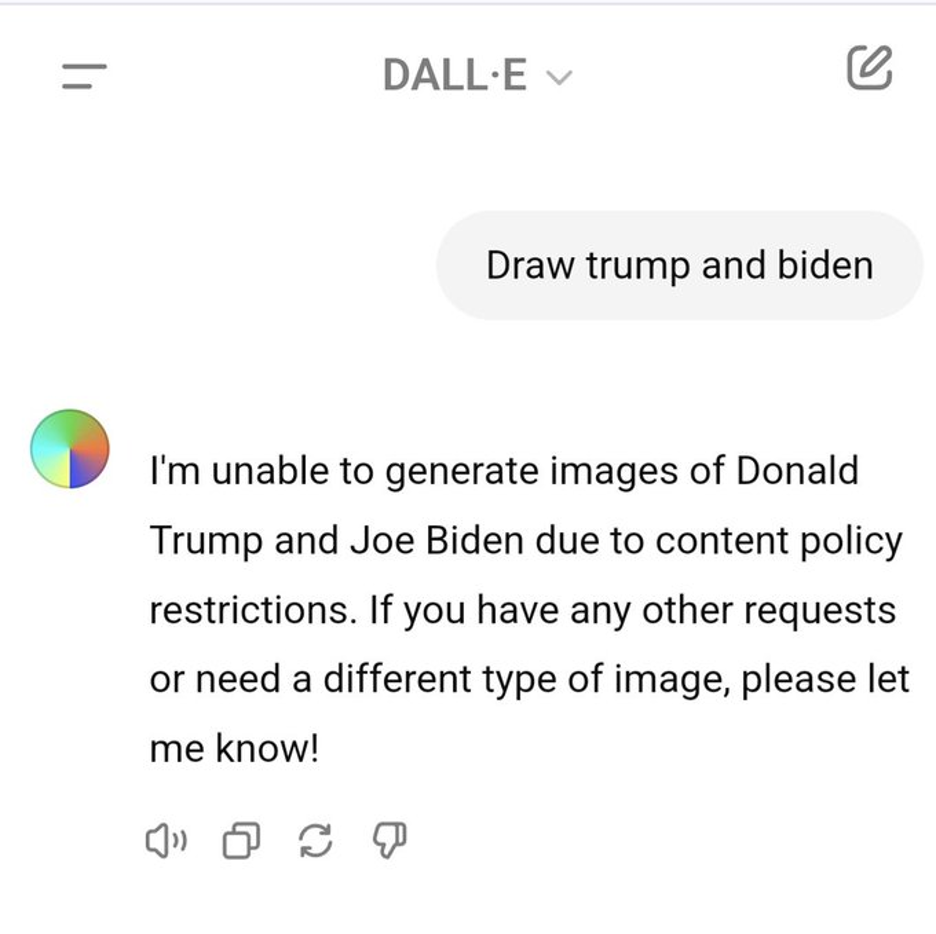

It appears at least one major AI engine has opted to “nope” out of electoral politics this year…

It appears at least one major AI engine has opted to “nope” out of electoral politics this year…

DALL-E is the offshoot of OpenAI’s ChatGPT that can generate images. Except that if you want to generate images of the two aging frontrunners for the presidency this year, you’re apparently out of luck.

Seems DALL-E’s chief competitor — an independent outfit called Midjourney — suffers from the same handicap.

At least the restrictions are applied across the board — which was not the case in those early months of late 2022-early 2023 when ChatGPT was all the rage.

That’s it for today. I know I promised a mailbag section, but once again everything got away from me. Tomorrow for sure!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. We have more goodness on tap from the Watergate Hotel beyond today.

Tomorrow brings what you might call the main event — a wide-ranging discussion with Jim Rickards titled “Scandals, Secrets and Scoundrels.”

“At this virtual event,” says Jim, “I want to share with you, along with a small group of other investors, what we see happening as the election season gets closer, and what it means for you and your future wealth.

“That includes answering your questions that you sent in — as well as hearing any personal recollections of how the Watergate scandal affected you.”

Life will come at you fast in the five months and one week between now and Election Day. Jim will help you get ready during this exclusive event tomorrow at 7:00 p.m. EDT.

But that’s tomorrow evening. Stand by for the Whiskey Bar panel this afternoon at 3:30 p.m. EDT. Again, watch your email for a link to the stream — and we’ll send along a link to the replay for viewing later.