Gold and (Once) Great Nations

- China’s gold gap

- Don’t call it a “pause”

- The commodity you CAN’T put in your pocket

- Artificial intelligence is thirsty

- Americans, brotherhood and breadsticks

![]() China’s Gold Gap

China’s Gold Gap

About two weeks ago, the Chinese renminbi fell to a 16-year low against the U.S. dollar.

About two weeks ago, the Chinese renminbi fell to a 16-year low against the U.S. dollar.

Put another way, the renminbi’s strength relative to the dollar dropped below levels during Beijing’s draconian lockdowns last year, in compliance with the CCP’s hapless “Zero COVID” policy.

In fact, the renminbi’s show of weakness came about after “an official release showed China’s exports dropped 8.8% in August compared with a year ago,” The Financial Times says.

“Sustained weakness in trade and manufacturing — two of the economy’s main growth engines — comes as Chinese policymakers face concerns that the post-pandemic recovery has failed to take off.”

Yeah, it’s safe to say China’s “reopening” narrative is dead in the water as the world’s second-largest economy contracts.

Which would explain why…

“China’s central bank has lifted temporary curbs on gold imports… in a bid to defend the renminbi,” FT reports.

“China’s central bank has lifted temporary curbs on gold imports… in a bid to defend the renminbi,” FT reports.

“The central bank controls how much gold enters the country’s domestic market through a system of quotas given to commercial banks. The tool is used as an unofficial mechanism to adjust metal flows and market behavior…

“The gold import curbs were lifted last Friday,” FT says. In the interim: “The currency has bounced back from its low [against] the dollar on Monday afternoon.”

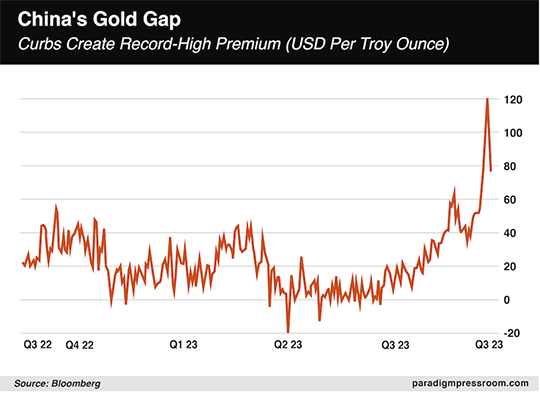

The PBOC’s short-term provision has also eased the premium on gold which hit a record-high $121 per troy ounce on Thursday, representing the spread between the price of gold in Shanghai versus London.

“The gap in the gold price has been steadily widening from early July,” FT says. “Traders and regulatory insiders said the premium was partially due to the import curbs.” Following the easing of gold-import curbs, the spread on Monday narrowed to just $76.

In brief, when it comes to backstopping a country’s faltering currency — or economy — gold is still the asset of choice. Even Beijing can appreciate something that retired Rep. Ron Paul (R-TX) remembers Reagan telling him: “No nation has abandoned gold… and remained great.”

[DISCLOSURE: Paradigm’s macro expert Jim Rickards invites you to participate in his #1 gold play… A deal which he and several Paradigm Press employees — including Doug Hill, Matt Insley and James Altucher — have already invested in.

Jim’s invitation is short and sweet. And it’s your exclusive chance to partner alongside him on the backdoor gold play he’s moving his own money into. Learn how to become one of Jim’s ‘gold partners’ here.]

![]() Don’t Call It a “Pause”

Don’t Call It a “Pause”

“The FOMC voted to leave its target rate for fed funds unchanged,” says Paradigm’s macro expert Jim Rickards, summarizing the FOMC meeting yesterday afternoon.

“The FOMC voted to leave its target rate for fed funds unchanged,” says Paradigm’s macro expert Jim Rickards, summarizing the FOMC meeting yesterday afternoon.

“This leaves the target rate at 5.25–5.50% as set at the July 26, 2023, meeting.

“A skip does not mean that the Fed is done hiking rates,” he emphasizes. “It means they want to slow the tempo. So instead of raising rates at every meeting, they can raise rates at any tempo they choose.

“The Fed’s decision not to raise rates is not the much anticipated ‘pause’ in this rate hike cycle. A pause is understood as the end of the rate hikes. After the pause is reached, the Fed will sit tight for a prolonged period of time before cutting rates and starting a new rate cut cycle.”

Jay Powell is keeping his “options open,” Jim says. “Inflation is still above the Fed's 2% target with evidence of rising inflation from the past several CPI reports.”

The FOMC “meeting also included the notorious ‘dots,’ technically the Summary of Economic Projections (SEP) offered by the 19 Fed governors and regional reserve bank presidents and presented in graphical form as a dot plot,” Jim continues.

The FOMC “meeting also included the notorious ‘dots,’ technically the Summary of Economic Projections (SEP) offered by the 19 Fed governors and regional reserve bank presidents and presented in graphical form as a dot plot,” Jim continues.

“The dots showed that a majority (12–7) of the 19 participants found it more likely than not that the Fed will raise rates one more time this year. The SEP median fed funds rate projection at the end of 2023 was 5.60%... That clearly implies one more rate hike in 2023.

“Here’s the recent history of Fed policy moves:

- May 3, 2023: Rate increase

- June 14, 2023: Skip

- July 26, 2023: Rate increase

- Sept. 20, 2023: Skip

- Nov. 1, 2023: ???

“Based on this pattern as well as the fact that inflation is not dead,” Jim expects “another rate hike on Nov. 1, 2023.

“We’ll closely monitor this situation,” he says, “and you’ll be the first to know about future policy moves.”

The Fed’s rate “skip” certainly has sucked the oxygen out of the stock market. The tech-heavy Nasdaq is the biggest loser, down 1.20% to 13,300; meanwhile, the S&P 500 and Dow are both in the red, down 1% and 0.50% respectively.

The Fed’s rate “skip” certainly has sucked the oxygen out of the stock market. The tech-heavy Nasdaq is the biggest loser, down 1.20% to 13,300; meanwhile, the S&P 500 and Dow are both in the red, down 1% and 0.50% respectively.

It’s a mixed bag for commodities. Predictably, oil is up 0.60% to $90.20 for a barrel of WTI. As for precious metals, gold’s down 0.65% to $1,917.30 per ounce, per Kitco, while silver is slightly in the green, hanging out above $23.

And it’s a no-good day for crypto: Bitcoin is down 1% to $26,600 while Ethereum is down almost 2%, below $1,600.

For the day’s economic numbers…

- First-time unemployment claims: Down in the past week to 201,000, the lowest level since January

- Mid-Atlantic manufacturing: Back in negative territory (-13.5) and far worse than the -0.7% economists expected for September’s reading, according to the Philadelphia Fed Manufacturing Index.

From where we sit, the leading economic index is the big one — posting a 17th-straight month of decline in August. Thus the Conference Board, which crunches 10 composite numbers, projects a “possible recession” in the next year.

![]() The Commodity You Can’t Put in Your Pocket

The Commodity You Can’t Put in Your Pocket

“Electricity demand is skyrocketing around the world, especially in developed nations,” says Paradigm’s income-investing ace Zach Scheidt.

“Electricity demand is skyrocketing around the world, especially in developed nations,” says Paradigm’s income-investing ace Zach Scheidt.

“The growing fleet of electric vehicles on the road is a big part of this demand,” he says, and “cloud computing, cryptocurrency mining and artificial intelligence all require tremendous amounts of electricity, creating even more demand for power.

“Of course, Washington is putting pressure on traditional methods of generating electricity,” says Zach, via coal, natural gas, oil, hydroelectric, etc.

“Regardless of your position on the issue, it’s clear we need to develop new sources for generating electricity. And we need to do it in a way that minimizes environmental harm.

“All of this brings us back to nuclear power…

“As we use more nuclear reactors to generate electricity, we’ll need a very specific fuel: uranium,” Zach says.

“As we use more nuclear reactors to generate electricity, we’ll need a very specific fuel: uranium,” Zach says.

“Thanks to strong electricity demand, new reactors are finally being built. And old reactors are getting upgraded to meet international standards so they can begin producing electricity again.

“We're seeing strong demand for uranium while supplies are very limited. And it will take a while for uranium production to pick up to where supply matches demand.

“It’s no wonder the price of uranium is surging and driving many related investments higher,” says Zach. “And if you'd like to tap into this trend, I have two ideas for you today…

- “First, consider buying shares of Cameco Corp. (CCJ), one of the most well-known uranium miners. While CCJ faces cost pressures from higher equipment and fuel expenses, the rising price of uranium should keep profits rolling in

- “A second play would be the Sprott Uranium Miners ETF (URNM). It’s a more diversified way to invest in a handful of international miners that produce this important resource.

“You can't buy uranium and put it in a safety-deposit box like some other commodities,” Zach concludes. “But the growing demand for uranium creates a unique opportunity for you to generate some extra retirement wealth.”

![]() Artificial Intelligence Is Thirsty

Artificial Intelligence Is Thirsty

“ChatGPT could ‘drink’ a 16-ounce bottle of water in as few as five of your queries, depending on the weather,” says Paradigm’s science-and-technology expert Ray Blanco.

“ChatGPT could ‘drink’ a 16-ounce bottle of water in as few as five of your queries, depending on the weather,” says Paradigm’s science-and-technology expert Ray Blanco.

In other words, “it takes a lot of water to cool the supercomputers that ChatGPT-4 was trained on,” he says.

“These data centers” — located in rural Iowa, by the way — “need to work extremely hard, which generates a lot of heat,” he says. “The warmer the weather, the more water that needs to be pumped in from cooling towers.”

Citing Microsoft’s most recent environmental-impact report, “from 2021–2022 the company’s global water consumption increased 34%, a jump widely credited to their AI research. This increase was just shy of 600 million gallons of water, equivalent to 850 Olympic-sized swimming pools.

“The current rate of water usage is officially not sustainable. The West Des Moines Water Works along with the city government declared that they will only consider future data center projects from Microsoft if they can ‘demonstrate and implement technology to significantly reduce peak water usage from the current levels.’

“We’re in the early days of AI,” Ray adds. “You may have been blown away by dial-up internet when it first came out, but its inefficiencies created many opportunities.

“There is clearly lots of room to grow and improve these early AI offerings, and we’re sure to see many innovations in the months and years to come.”

![]() Americans, Brotherhood and Breadsticks

Americans, Brotherhood and Breadsticks

Has the midlevel chain restaurant become America’s new place of worship?

Has the midlevel chain restaurant become America’s new place of worship?

In some respects, yes, according to a research paper by Maxim Massenkoff of the Naval Postgraduate School and Nathan Wilmers of the MIT Sloan School of Management.

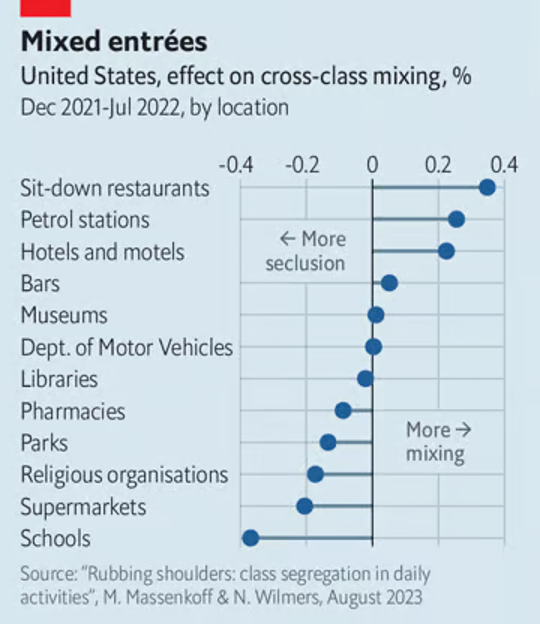

The researchers find that in the case of “social isolation” — which Massenkoff and Wilmers define as associating primarily with others in a similar income bracket — “full-service restaurants top the chart of places where integration of classes happens most,” the paper says.

Courtesy: The Economist

“Our results demonstrate that the places that contribute most to mixing by economic class are not civic spaces like churches or schools, but large, affordable chain restaurants,” Massenkoff and Wilmers add.

“Chain restaurants like Olive Garden and Applebee’s are typically built in centralized locations,” The Takeout comments, which “don’t favor one residential neighborhood over another. When everyone is traveling beyond their home base to reach these restaurants, social mixing is more likely to occur.”

Since we’re perennially looking for a story’s financial angle, Olive Garden’s parent company, Darden Restaurants, Inc. (DRI), is up over 7% year-to-date. Even though Olive Garden, like most every restaurant, has raised menu prices, they still undercut inflation.

Meaning, the fraternization at Olive Garden might have more to do with value than anything else.

Take care, reader! We’ll be back tomorrow with another round of 5 Bullets.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets