Haters Gonna Hate (Apple’s Latest)

![]() Blurred Vision?

Blurred Vision?

As striking as the juxtaposition is, I’m not going to dwell today on the parallel universes that unfolded split-screen last night. I’ll leave that to others.

As striking as the juxtaposition is, I’m not going to dwell today on the parallel universes that unfolded split-screen last night. I’ll leave that to others.

Suffice to say that while Vladimir Putin delivered a tour de force disquisition on global affairs to Tucker Carlson (Was it self-serving? Of course, but what would you expect?)... Joe Biden simultaneously confused the president of Egypt with the president of Mexico even as he attempted to defend his soundness of mind.

If Biden can’t be prosecuted for purloining classified documents because he’s an “elderly man with a poor memory”... then isn’t it 25th Amendment time? Of course, then it would also be President Harris time — so that’s not going to happen.

With that, let’s move on to lighter fare as the weekend approaches. You’re welcome…

The hate with which the Apple Vision Pro has been welcomed is a wonder to behold.

The hate with which the Apple Vision Pro has been welcomed is a wonder to behold.

“Apple Vision Pro Turned the Real World Into a ‘Black Mirror’ Episode Overnight,” says a headline at Vice.

“The Vision Pro, Apple’s new VR and mixed-reality headset, generated a wealth of dystopian images as influencers took the premium device out for a spin in the real world after its launch on Friday.”

To wit…

A week ago today when the Vision Pro first went on sale, I mentioned that I wanted to read Nick Bilton’s take in Vanity Fair — and I did last weekend.

Although Bilton was granted access to both CEO Tim Cook and the product itself while it was still in development, his conclusion was that the product was too good:

When I take it off, every other device feels flat and boring: My 75-inch OLED TV feels like a CRT from the ’90s; my iPhone feels like a flip phone from yesteryear; and even the real world around me feels surprisingly flat. And this is the problem.

In the same way that I can’t imagine driving a car without a stereo, in the same way I can’t imagine not having a phone to communicate with people or take pictures of my children, in the same way I can’t imagine trying to work without a computer, I can see a day when we all can’t imagine living without an augmented reality. When we’re enveloped more and more by technology, to the point that we crave these glasses like a drug, like we crave our iPhones today but with more desire for the dopamine hit this resolution of AR can deliver.

But my favorite hot take of all comes from an X-formerly-Twitter account belonging to one Alex Finn.

But my favorite hot take of all comes from an X-formerly-Twitter account belonging to one Alex Finn.

In a short video, he describes how the Vision Pro has transformed his morning routine, enhancing his productivity by orders of magnitude.

Even before getting out of bed, he can check the Bitcoin price on one screen while inspecting the likes/retweets his X account generated overnight (for the dopamine hit to keep him motivated throughout the day, of course).

After an hour or two of that, he makes his way to the couch, where on one screen he can check the status of the naked call options on GameStop (GME) that he trades daily... use another screen to stay on top of cultural trends on TikTok… and of course continue to keep tabs on his X likes/retweets…

After another two hours, he makes his way to the john — where he has the latest Mr. Beast video ready to go on YouTube while on a separate screen he opens his gratitude journal…

Talk about crushing it!

OK, I’ve done kind of a spoiler here — because the genius of the video is that the moment you realize he’s putting you on? It’s a little different for everyone.

But that’s just the first week’s reaction. As time goes by, people who want it and can afford it will find good and valid uses for the Vision Pro.

But that’s just the first week’s reaction. As time goes by, people who want it and can afford it will find good and valid uses for the Vision Pro.

Even the Vice article acknowledges as much, albeit halfway through: “The good news is that there’s very little chance of that sci-fi dystopian future coming to pass anytime soon. The viral content around the Vision Pro so far is just that: Content made by professional posters that is purposefully outlandish and provocative in order to get a reaction.” [Gotta get those likes/retweets!]

![]() Bad Breadth Doesn’t Have to Be Bad News

Bad Breadth Doesn’t Have to Be Bad News

Just because the market’s “breadth” is poor does not guarantee the market is set for a big fall.

Just because the market’s “breadth” is poor does not guarantee the market is set for a big fall.

On Monday we spotlighted research from Piper Sandler that showed only two companies — Microsoft and Nvidia — accounted for 43% of the S&P 500’s year-to-date gains.

Meanwhile, Paradigm trading pro Alan Knuckman — our eyes and ears at the Chicago options and futures exchanges — directs our attention to similar findings from LPL Financial.

The LPL researchers find that four stocks — Microsoft and Nvidia plus Meta (Facebook) and Amazon — account for 75% of the S&P 500’s total return so far in 2024.

But while it’s tempting to think we’re setting up for a replay of the dot-com bust — toward the end of the bubble in early 2000, it was Microsoft, Cisco, Dell and Intel dominating the market — Alan says not so fast.

“From my standpoint as a trader, I like the laggards,” he told subscribers of The Profit Wire yesterday. “They have the best risk-reward, and I’m looking for a lot of these stocks to play catch-up.”

In the meantime, this might be the day — and the week — the S&P 500 closes above the “psychologically significant” level of 5,000.

In the meantime, this might be the day — and the week — the S&P 500 closes above the “psychologically significant” level of 5,000.

At last check, the index is up a third of a percent at 5,014. Meanwhile, the Nasdaq is up nearly 1%, while the Dow is slightly in the red.

News-making names include the shipping giant Maersk (AMKBY) — which tanked 15% yesterday after suspending its share buyback. The ongoing attacks on shipping via the Red Sea are taking a toll on profitability.

Precious metals can’t catch a break — gold down to $2,020 and silver at $22.32. Crude is holding on to yesterday’s gains at $76.38. Bitcoin has powered past $47,000, equaling its January peak.

After a quiet week for economic numbers, the action heats up again next week with the official inflation numbers on Tuesday, plus retail sales and industrial production Thursday.

![]() When Investments Get Controversial

When Investments Get Controversial

“The iShares China Large-Cap ETF (FXI) just made a nice little bottom formation,” said the aforementioned Alan Knuckman on our every-Wednesday editorial conference call.

“The iShares China Large-Cap ETF (FXI) just made a nice little bottom formation,” said the aforementioned Alan Knuckman on our every-Wednesday editorial conference call.

“It’s controversial,” chimed in our income-investing pro Zach Scheidt. “But if I were a wealth manager, I would be putting a lot of emphasis on China.”

As we mentioned a few days ago, China’s stock market recently touched five-year lows. “Chinese stocks are under-owned, despised and oversold,” says Zach.

“Meanwhile, the Chinese government is finally getting serious about supporting the country’s economy and propping up the Chinese stock market.

“As a free-market capitalist, I don’t expect these measures to be effective long term. No government policy can change the fundamental laws of supply and demand. But totalitarian governments like China can prop up a domestic stock market for a while.”

To that end, state-managed investment pools are now under orders to buy Chinese ETFs. And regulators have set restrictions on sell orders made by institutional investors.

“These measures should drive shares of Chinese stocks higher, at least over the next several months,” says Zach.

Now’s not a bad time to buy FXI shares, although Zach laid out a more lucrative strategy yesterday for readers of The Income Alliance — selling FXI put options to generate instant income.

If you’re blanching at the thought of any investment pertaining to China, hear us out.

If you’re blanching at the thought of any investment pertaining to China, hear us out.

Allow me to share some thoughts I penned in late 2021 — addressing a reader of The Profit Wire, an options trading service I work on along with the aforementioned Alan Knuckman.

If we started screening our recommendations for every possible ethical objection… Well, that would severely narrow the scope of what we could recommend here.

You don’t like FXI because you object to China. Meanwhile, other readers might take issue with some of our previous recommendations.

The stench of scandal still lingers at Wells Fargo & Co. (WFC), one of those too-big-to-fail banks. Freeport-McMoRan Inc. (FCX) has been a terrible steward of the environment at its giant Grasberg mine in Indonesia. Some people have a major problem with the COVID vaccine produced by Pfizer Inc. (PFE).

Yet we’ve played all three of these companies for 100% gains in no more than three weeks.

Do you see our conundrum here? With almost every recommendation, someone could object to something and accuse us of enabling villainous activity.

Every so often, I cite the words of the late investment newsletter legend Harry Browne: “Maximizing profits and conforming to social policies are separate endeavors,” he wrote in 1995. “You can cater to one endeavor only at the expense of the other.

“The stock exchange isn’t a pulpit. If you want to promote a particular environmental policy, political philosophy or other personal enthusiasm, do it with the profits you make from hardheaded investing."

That said, each of us will have personal red lines.

That said, each of us will have personal red lines.

If you follow our sister e-letter The Rude Awakening, you know colleague Sean Ring is high on Palantir Technologies Inc. (PLTR). And his reasoning is rock-solid.

But I can’t bring myself to help finance the operations of a company that took seed money from In-Q-Tel (sometimes called “the CIA’s venture capital arm”) and that aided the buildout of the post-9/11 surveillance state.

In the end, only you will know when a line is crossed and you can’t sleep at night.

That line will be different for everyone — and so the Paradigm editors maintain a strict agnosticism when it comes to their recommendations. If you don’t like a particular investment or trade idea… well, there’s always another one coming next week or next month.

![]() AI on Super Bowl Sunday

AI on Super Bowl Sunday

AI will be the focus of a Super Bowl commercial this Sunday.

AI will be the focus of a Super Bowl commercial this Sunday.

(Presumably it won’t be the ill omen that crypto commercials were in 2022. Heh...)

On Wednesday, Microsoft released a preview of a spot touting its Copilot AI software.

“In the ad,” says Paradigm’s AI advocate James Altucher, “Microsoft demonstrates the various uses for Copilot, including image generation, writing software code, as a study aid and as an assistant tool.” Over time, Copilot will be integrated into all Windows computers as well as Microsoft Office.

“I expect we’ll see an increasing number of AI-related marketing activities in the next 12 months as companies race to become the leaders in the growing space.

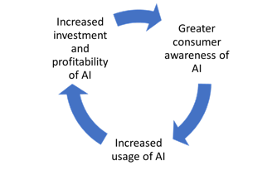

“This creates a virtuous cycle for investors — greater consumer awareness of AI will increase AI usage, which will drive investment and profitability of AI software, which will in turn be used to increase awareness.

A diagram of the virtuous cycle of AI awareness (generated by AI)

“For AI investors, the timing is incredible,” James told his Altucher Investment Network readers yesterday.

“We’re still at the point in AI development where most people still haven’t used it or know anything about it. However, Microsoft's inclusion of Copilot with some of its bestselling software is set to ignite massive user adoption in the coming months.”

![]() Mailbag: A Correction (of Sorts) and Politics (Yet Again)

Mailbag: A Correction (of Sorts) and Politics (Yet Again)

“Regarding Jason Goepfert,” a reader writes in response to an ominous market parallel we spotted Tuesday…

“Regarding Jason Goepfert,” a reader writes in response to an ominous market parallel we spotted Tuesday…

“It's different this time… LOL!!!”

Dave responds: I have to confess I was sloppy in spelling out Goepfert’s case.

A casual reading of his tweet would lead you to believe that since 1962 “there were only two days when fewer than 30% of [NYSE] issues rallied” — when of course there were many such days during, for instance, the crash in 2008.

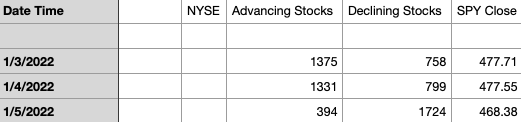

And in fact there were many days when fewer than 30% of NYSE-traded companies rallied even as the S&P 500 was within spitting distance of all-time highs. The aforementioned Alan Knuckman sent me this table of the first three trading days in 2022…

Note that on Jan. 5, fewer than 20% of NYSE-traded companies had an up day. Only two days earlier, Jan. 3, the S&P 500 registered an all-time closing high. However, by day’s end on the 5th, the S&P was about 2% below that record close.

So apparently Goepfert was being extremely specific — only two days in which fewer than 30% of issues rallied when the S&P was within 0.35% of an all-time high.

That’s mighty granular data. The fact that Monday was the third such day since 1962 (and that fewer than 20% of issues rallied) is interesting for sure. But it’s simply too soon to say it’s a broad sell signal.

A couple of readers took us to task for our lead topic yesterday, and they sound like newer readers…

A couple of readers took us to task for our lead topic yesterday, and they sound like newer readers…

“I wanted stock advice. Not a bunch of Republican NRA bull**** like the last email.”

Another: “I probably wouldn't have given your organization my money if I knew I would be getting politicized rhetoric.”

Dave responds: I’m not going to rehash my recent thoughts about how politics are increasingly intertwined with money. Nor will I re-up my old friend and mentor Addison Wiggin’s line about how “Politics are the problem, and you ignore them at your peril.” (Well, OK, I just did.)

I will underscore what I said yesterday at the conclusion of that bullet — which I imagine these readers overlooked: “Even if you’re not a gun owner, you should care because there might be some activity of yours now or in the future that the feds will flag as ‘suspicious.’”

If you fear Donald Trump in power, ponder for a moment how he could use this sort of authority against you — even potentially freezing bank or brokerage accounts.

Political power is dangerous in the hands of anyone, and if you care about your money and your future you must be vigilant no matter who’s in charge.