Last Line of Defense

![]() Last Line of Defense

Last Line of Defense

Another week, another close call for the guided-missile destroyer USS Gravely. It does not bode well for the prospect of global shipping returning to “normal.”

Another week, another close call for the guided-missile destroyer USS Gravely. It does not bode well for the prospect of global shipping returning to “normal.”

As we mentioned last Friday, the Gravely got into a scrape as it was escorting a couple of American container ships into the Red Sea. The Houthi faction in Yemen launched a missile attack — and one of the missiles landed within 100 meters of the container ship M/V Maersk Detroit.

The Pentagon tried to spin it as the Houthis harmlessly lobbing a few missiles in the Gravely’s direction. There was nothing in its initial release about the escort operation — and definitely nothing about how the convoy had to turn around and abandon its plans to transit the Red Sea.

Turns out the Gravely had an even closer call on Tuesday — a Houthi missile coming within a mile of the warship before it was shot down.

Turns out the Gravely had an even closer call on Tuesday — a Houthi missile coming within a mile of the warship before it was shot down.

“In previous incidents,” says a CBS News tweet, “Houthi missiles have been intercepted at ranges of eight–10 miles, but in the Tuesday incident the USS Gravely had to use its Close-in Weapon System to shoot the incoming missile down.”

The Close-in Weapon System or CIWS is the last line of missile defense for U.S. warships. In other words, at least three other means of engaging the missile from a greater distance failed before the CIWS had to save the day. That would include the sophisticated Aegis defense system.

By some accounts, the Gravely and its crew of 300 were a mere five seconds from taking a direct hit.

In other words, it’s only a matter of time before the Houthis manage a successful strike on an American warship.

Oh, and presumably this was another failed escort operation — with commercial ships hoping to transit the Red Sea having to turn around instead and take the long route around Africa to reach their destination.

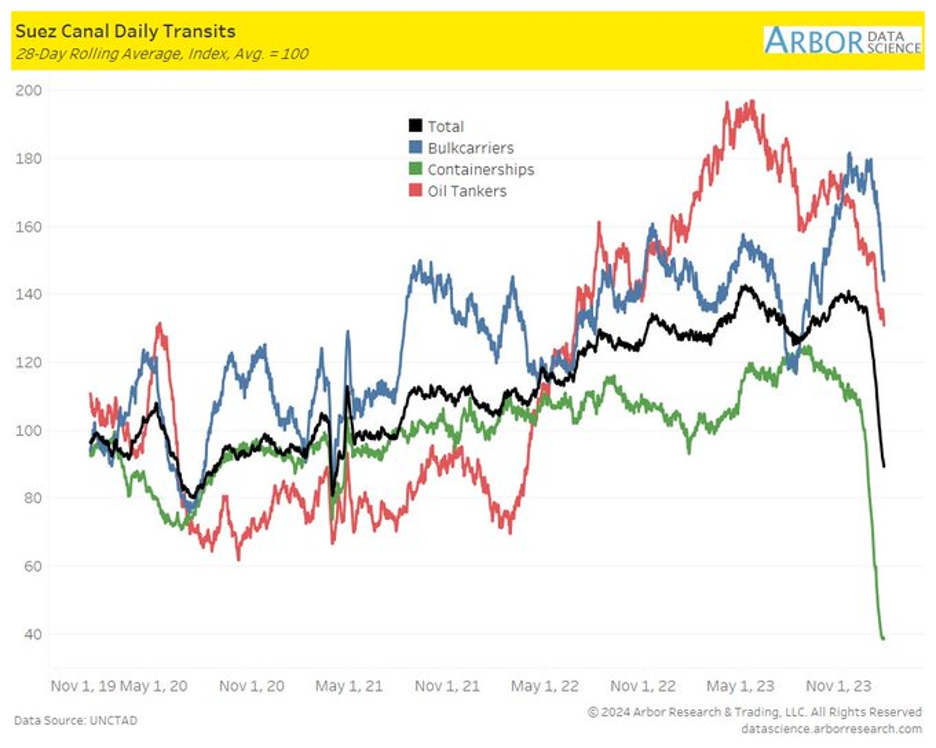

All told, commercial shipping traffic through the Suez Canal — at the north end of the Red Sea — is down by a third since the Houthis began their missile campaign in November.

All told, commercial shipping traffic through the Suez Canal — at the north end of the Red Sea — is down by a third since the Houthis began their missile campaign in November.

That’s according to this chart tweeted by the researchers at Arbor Data Science…

Normally, about 12% of global shipping and 10% of global oil shipping takes this route. But not now. Going around the horn of Africa adds up to 40% in fuel costs, overtime, etc.

The Houthi harassment began with ships that were either Israeli-owned or docking at Israeli ports — an act of solidarity with the Palestinians of Gaza.

Even though the targets weren’t American, Joe Biden decided Washington had to butt in. As a result, U.S. forces have been bombing Houthi targets since Jan. 12. Naturally the Houthis are now targeting U.S. ships.

As we’ve mentioned previously, this is extremely costly for the Pentagon. Many of the Houthi attacks use $2,000 drones — while the American missiles shooting them down cost up to $2 million a pop.

Meanwhile, the rising cost of moving goods from Point A to Point B? That will help keep inflation elevated through 2024.

Europeans will feel it worse than Americans — but Americans will feel it nonetheless.

![]() After All That Drama…

After All That Drama…

Wall Street’s Very Big Week is winding down with the S&P 500 in spitting distance of record territory.

Wall Street’s Very Big Week is winding down with the S&P 500 in spitting distance of record territory.

First came the mixed bag of Microsoft and Google earnings on Tuesday… followed by the Federal Reserve disappointing Mr. Market with its rate-cut plans on Wednesday.

Yesterday after the close we got earnings from three more of the Magnificent 7 companies — Apple, Amazon and Facebook parent Meta. And this morning we got the January job numbers.

Let’s start with the job numbers — because for all the euphoric reaction of the corporate media, there’s less here than meets the eye.

Let’s start with the job numbers — because for all the euphoric reaction of the corporate media, there’s less here than meets the eye.

The wonks at the Bureau of Labor Statistics conjured 353,000 new jobs for the month — double the guess of the typical Wall Street economist. What’s more, the December number was revised higher, a reversal from the revising-downward pattern we saw much of last year. Meanwhile, the official unemployment rate ticked down to 3.7% — 23 straight months of sub-4% readings.

But there are a couple of caveats. First, the statisticians do a “reset” to their methodology at the start of every year, based on new figures from the Census Bureau’s annual American Community Survey. This has the effect of creating wild statistical anomalies that don’t smooth themselves out until later in the year.

For another thing — and admittedly I haven’t spent enough time making this distinction — there are two surveys that go into the government’s monthly jobs report.

There’s the “establishment” survey — asking business establishments about how many jobs they added or cut. That’s the survey that generates the X-number-of-new-jobs number every month.

But then there’s the “household” survey — asking regular folks about whether they’re employed or not.

Increasingly, the two surveys are serving up a wildly divergent picture. The household survey, before the usual “seasonal adjustments,” shows 1.1 million fewer employed people in January, on top of nearly 1.4 million in December. All those job cuts at big companies you’re seeing headlines about? This is where they’re showing up.

But it’s the 353,000 new jobs getting all the attention. It’s one more data point that will prevent the Fed from cutting interest rates until May at the earliest.

![]() Big Tech Blowout

Big Tech Blowout

As for Big Tech earnings… well, that’s what’s propelling the broad stock market to new heights.

As for Big Tech earnings… well, that’s what’s propelling the broad stock market to new heights.

The standout numbers come from Facebook parent Meta — its best quarterly sales growth in over two years. META’s investments in AI have made its targeted ads even more well targeted than before.

Hell, Meta is so flush that it will start paying a dividend for the first time. Mark Zuckerberg’s hip, happenin’ company launched from his Harvard dorm room 20 years ago is turning positively square.

Despicable as Zuckerberg is, you underestimate the guy at your peril. A decade ago I remember writing about skeptics who said Facebook would never survive the transition from desktop to mobile. People wouldn’t tolerate the ads hogging a smaller amount of real estate on a smartphone screen, nor would they put up with video ads counting against their monthly data caps.

Wrong on both counts: By April 2014, mobile already accounted for 59% of the company’s revenue. Yes, the company stumbled with its metaverse foray in 2021–22, but this morning shares up are a staggering 21% to all-time highs.

Meanwhile, the holidays were good to Amazon. Quarterly sales rose faster than expected. AMZN shares are up 7% on the day — although they still have a way to go to equal their 2021 record.

The lone disappointment from this Big Tech trio is Apple — although it’s down less than 1% as we write. The company broke its four-quarter streak of falling sales, but worries remain about iPhone sales in China.

But as I said off the top yesterday, Apple’s quarterly numbers and the market reaction are a nothingburger compared with what dropped this morning.

But as I said off the top yesterday, Apple’s quarterly numbers and the market reaction are a nothingburger compared with what dropped this morning.

The company formally launched its Vision Pro “mixed reality” headset — a device aimed at making everyone forget about the failure of the “augmented reality” Google Glass and the niche appeal of Facebook’s “virtual reality” Oculus Rift. (Almost no one uses the Rift for anything other than gaming.)

It’s not an exaggeration to say CEO Tim Cook is betting the company’s future on this $3,499 device.

“It won’t be hard to get people to try the Apple Vision Pro; buying it may be another story,” writes Nick Bilton at Vanity Fair. “Though fortunately for Apple, seemingly anyone who has strapped one on prior to Friday’s launch is preaching with the zeal of the converted about all the wondrous things it can do.” That includes the film director James Cameron.

(I haven’t read Bilton’s article in full yet — brought to my attention by my wife. Bilton did one of the earliest and best takedowns of Theranos huckster Elizabeth Holmes a few years ago — so this new piece is definitely on my weekend reading pile.)

Of course, as our own James Altucher pointed out during his Apple Market Disruption Event last night, the real money to be made off Vision Pro will not be from Apple itself, but rather from a much smaller company few have ever heard of.

If you chose not to take advantage of the opportunity, I can’t promise when something similar will come around again. On the other hand, if you did seize on the chance to join our Paradigm Mastermind Group, we’ll reiterate James’ guidance here — please, please, please stick to his buy-up-to price, and use a limit order.

As for the major U.S. stock averages… the S&P is up two-thirds of a percent to 4,938. If that holds by day’s end it will eclipse Monday’s record close. The Nasdaq is up 1.2%, while the Dow is slightly in the red.

As for the major U.S. stock averages… the S&P is up two-thirds of a percent to 4,938. If that holds by day’s end it will eclipse Monday’s record close. The Nasdaq is up 1.2%, while the Dow is slightly in the red.

Bonds are selling off, pushing yields higher. The yield on a 10-year Treasury has zoomed past 4% again. Precious metals are likewise selling off — gold down 1% to $2,034 and silver down 2.5% (ugh) to $22.56. Crude is down $1.66 to $72.16. Bitcoin is back above $43,000.

![]() Backyard Gardens Are Bad for Climate!

Backyard Gardens Are Bad for Climate!

From our bulging climate-follies file…

From our bulging climate-follies file…

I wish I could tell you that was from the Babylon Bee or The Onion back when The Onion was funny — but no, it’s from the London Telegraph. Similar articles turn up at The Hill and in Forbes. (Malcolm Forbes must be rolling in his grave seeing what’s happened to his once-legendary magazine.)

I guess the idea is we’re just supposed to grow wildflowers so that we can eat ze bugs they attract? Either that or Soylent Green…

![]() Mailbag: Getting Political (Again)

Mailbag: Getting Political (Again)

“Trying to figure out why you have to be political at all, especially with your inferences and name-calling,” says the first entry in our mailbag as readers weigh in on the political bent that makes its way into these daily missives.

“Trying to figure out why you have to be political at all, especially with your inferences and name-calling,” says the first entry in our mailbag as readers weigh in on the political bent that makes its way into these daily missives.

“By your admission, politics is ‘a pox on everyone.’ Wouldn't it be better to make an effort to leave the politics out altogether?

“Explain why you may not agree with a particular governmental policy or corporate decision and then express what you would rather see to reason your disagreement to your audience...

“It's confusing, especially in an incredibly polarized environment, that you would not make an effort to not push your subscribers away...

“It sounds as if you have a mini-Musk attitude: ’F*** ‘em.’ Just saying!”

“Dave, I find it interesting when people write in and either comment or complain about ‘politics’ entering into your missives,” a reader writes — as if responding to our first entry today.

“Dave, I find it interesting when people write in and either comment or complain about ‘politics’ entering into your missives,” a reader writes — as if responding to our first entry today.

“I am not sure what that even means. Within the context of money, the economy and markets, what the government does and what politicians promise to do or not do is core to those things. This is not ‘politics’ entering into some imaginary box that supposedly is unaffected by politics in real terms. It's being realistic and complete in your analysis that what some think is ‘politics’ and actually isn't that at all.

“For the one that observed that you are more ‘right leaning’ than in the past, again, it is not ‘right leaning’ to observe that the government, certain politicians and their plans have an effect on money, the economy and markets and that some perspectives are more favorable to all those things than others (generally the more right-leaning and libertarian ones). So this is not political leaning one way or the other, it's being realistic about all the factors that matter in these areas.

“The only time it would seem that politics (and right-leaning ones at that) inappropriately (to some) work their way into your perspective is with more properly called ‘cultural’ issues. Otherwise, it is not justified to say politics are entering your missives at all, including those involving free speech, wars, etc. These all have huge effects on money, the economy and markets.

“So ignore these people whose worldview actually conflicts with their supposed economic well-being because there's simply no way to fix everyone's internal conflicts.”

Dave responds: Yeah, I weighed in exactly once last year on culture-war stuff — and only in a circumspect, descriptive way.

Where I will weigh in forcefully and regularly is on foreign policy. What was once a free republic has been hijacked by a national security state that’s been eating out our substance and hollowing out our prosperity going back to the Truman Doctrine and the National Security Act of 1947. I expounded at length on this phenomenon last September.

My guidestar is the one Thomas Jefferson set out in his first inaugural — “peace, commerce and honest friendship with all nations, entangling alliances with none.”

All nations — even Russia, China and Iran. And the sooner we can be rid of the chains binding us to the governments of Ukraine, Saudi Arabia and Israel, the better.

And yes, the free speech issue is central to our mission of covering money and markets without fear or favor. So I will continue to cover that regularly.

Which reminds me…

Oh, and as for the first reader’s “mini-Musk” epithet — my take on Musk is, well, complicated. If you’re a newer reader and you’re so inclined, you can catch up here.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets