Why Did Corporate America “Go Woke”?

- Starbucks, Bud Light, Target, etc.

- All things to all people: A brief history of world-class brands

- Corporations, consultants, activists… and capitalism!

- The great crypto migration

- “Semi-hysterical warnings about the fate of the USD.”

![]() Starbucks, Bud Light, Target, Etc.

Starbucks, Bud Light, Target, Etc.

The Starbucks strike that started last Friday is set to continue through the week.

The Starbucks strike that started last Friday is set to continue through the week.

It’s not widespread: Out of nearly 9,400 company-owned U.S. stores, Starbucks says it shut down 21 and service is limited at 104 more.

Still, SBUX shares tumbled 2.5% on Friday. The share price stabilized yesterday and today.

At issue? “Earlier this month,” says The Wall Street Journal, “Starbucks Workers United accused the company of limiting the ability for workers to hang Pride decorations in stores… Starbucks’s chief executive defended the company’s commitment to the LGBTQ community and suggested advocates for the union were wrongly exploiting the situation.”

To be clear, I have zero interest in sussing out who’s right and who’s wrong today.

From where I sit, that’s not nearly as interesting as the fact this controversy has broken out in the first place — and what it says about how name brands and publicly traded companies are navigating treacherous waters in the 2020s.

Throughout the Bud Light and similar business controversies of 2023, your editor has steered clear — until today.

Throughout the Bud Light and similar business controversies of 2023, your editor has steered clear — until today.

That’s not because I shy away from controversy — e.g., my take on the fate of Taiwan — but because I seek something different and interesting to say. Something that stands apart from whatever it is you’re seeing elsewhere online. “The story no one else is telling,” as we like to say at Paradigm Press.

I did address certain issues related to “wokeism” during the surreal summer of 2020 — when we were supposed to stay confined indoors unless we were protesting systemic racism.

But throughout I stuck to two additional principles: 1) There had to be a money-and-markets angle and; 2) I would address them in a descriptive way, not a normative one.

I’ll revisit some of those thoughts today and bring the same approach to more recent developments.

First, a little history…

![]() All Things to All People: A Short History of World-Class Brands

All Things to All People: A Short History of World-Class Brands

For as long as brand advertising has existed, brand advertisers were leery about hawking their wares in proximity to “controversial” content.

For as long as brand advertising has existed, brand advertisers were leery about hawking their wares in proximity to “controversial” content.

In 2020, I cited some old-media examples from the previous three decades…

- In 2009, Procter & Gamble and Geico were among the name-brand advertisers who bailed from Glenn Beck’s daily program on Fox News because Beck labeled Barack Obama a “” High viewership notwithstanding, Fox dispensed with Beck and his chalkboard in 2011

- In 1997, several regular advertisers on the sitcom Ellen — including Chrysler and JCPenney — sat out the episode where Ellen DeGeneres’ character came out as a lesbian

- In 1989, Coca-Cola apologized for airing a Coke spot during an especially raunchy episode of Married… With Children. For a while, McDonald’s and Procter & Gamble also bailed from the sitcom. However, in an instance of the “Streisand effect,” the publicity ended up drawing even more attention to the show. Advertisers eventually returned, and the nascent Fox network had its first genuine hit.

Then and now, Coca-Cola and its peers want to be all things to all people. That’s how you build and maintain a world-class brand to begin with.

What I also observed in 2020 was that it had become more difficult — maybe impossible — to be all things to all people.

What I also observed in 2020 was that it had become more difficult — maybe impossible — to be all things to all people.

Undoubtedly it started with the political rise of Donald Trump in 2016. By 2020, between COVID and George Floyd, everything was becoming politicized.

That was a tricky environment for a name-brand advertiser — and an uncharted one. Ditching Peggy Bundy in 1989 or Ellen DeGeneres in 1997 or Glenn Beck in 2009 were easy calls. No one was going to stop buying Coke or Crest as a consequence.

But when a boycott knocks down Bud Light’s share of the beer market by 25% in only three months? That’s an earthquake.

Whatever furor it was that started gathering in 2016 or 2020 has reached a crescendo during Pride Month in 2023.

Whatever furor it was that started gathering in 2016 or 2020 has reached a crescendo during Pride Month in 2023.

“Pride™ has become so accepted it’s inescapable,” writes Bridget Phetasy in an outstanding piece for The Spectator. “Corporations change their social media logos to rainbows (unless, of course, it’s their Saudi account).

“On the surface this might look like capitalism at work. These companies just want the gay dollar! Though there’s some truth to that, there’s also an undertow dragging these huge corporations down. They aren’t making decisions that are in the best interest of their shareholders; they are acting out of concern for their social credit score.”

Hmmm… Unfortunately, Ms. Phetasy didn’t expand on the concept of a company’s “social credit score.”

Hmmm… Unfortunately, Ms. Phetasy didn’t expand on the concept of a company’s “social credit score.”

Perhaps she means the ESG or “environmental, social and governance” scores assigned to companies.

Assigned by whom, you ask? A host of firms including Bloomberg, Moody’s and most of the big outfits that construct market indexes like MSCI, FTSE Russell and S&P Global.

And there does seem to be an aspect of the China-style “social credit score” to the whole thing.

"I don't believe that ESG scores are really being used for the reason that they say they are," Justin Haskins of the Heartland Institute tells Fox News. "I think it's mostly about controlling society … and about pushing a left-wing agenda."

➢ Ironically, one of the figures who’s led the ESG charge — BlackRock CEO Larry Fink — is now slinking away from the term. "I'm not going to use the word ESG because it's been misused by the far left and the far right," he said on Sunday at the elite Aspen Ideas Festival.

![]() The Corporations, the Consultants… and the Activists

The Corporations, the Consultants… and the Activists

“Corporate publicists are misleading their clients to pay for pricey Pride initiatives, which generate backlash for both corporations AND gays,” says Mitchell Jackson, founder of the Miami-based public relations firm BCC Communications.

“Corporate publicists are misleading their clients to pay for pricey Pride initiatives, which generate backlash for both corporations AND gays,” says Mitchell Jackson, founder of the Miami-based public relations firm BCC Communications.

Jackson was one of many LGBT figures interviewed for Phetasy’s article. He expanded on his quotes in a LinkedIn post.

“Corporations seek Pride sponsorships because gays spend more on products,” he went on. “We are one of the wealthiest demos on the planet.

“But these corporations aren’t getting any gay dollars from their Pride fiascos. For one, gays hate corporations at Pride. Activists call it ‘pink-washing,’ and more mainstream gays roll their eyes at banks’ Pride floats. It comes across as pandering.

“Worst of all, these corporate campaigns backfire on LGBTQ people. Currently, most polls show a decline in acceptance of homosexuals.”

As Jackson sums up pithily, “Gay rights are being threatened again because big-box stores needed to sell tucking underwear” — a reference to a recent controversy at Target.

As Jackson sums up pithily, “Gay rights are being threatened again because big-box stores needed to sell tucking underwear” — a reference to a recent controversy at Target.

But why did they feel the need to do so?

Answer: Because they and their consultants fell under the sway of LGBTQ activist groups.

As Jackson explained in Phetasy’s article, “Corporations go to these groups for advice, hoping to avoid a woke controversy, and they get led into a hornet’s nest — and then these nonprofits can fundraise off of the Bud Light controversy of the week.”

Please reread the preceding paragraph and let it sink in.

The activist groups aren’t looking out for the companies’ best interests or even the interests of the people on whose behalf they advocate. They’re ginning up controversy to line their own pockets, indifferent to the collateral damage.

It’s an age-old strategy — transcending time, technology and political differences.

It’s an age-old strategy — transcending time, technology and political differences.

If you’re old enough and conservative enough, you might remember snail-mail fundraising letters from the late ’80s and early ’90s railing against PBS, NPR and the National Endowment for the Arts.

It was all pointlessly performative. Even when they had the power to do so, the Republicans never defunded these institutions. There was too much money to raise off the outrage they generated!

In the present moment it’s also a case of the gay rights movement becoming a victim of its own success.

“What changed is that LGBT activist groups could not afford to obtain victory,” journalist Glenn Greenwald tells Phetasy.

“When activist groups win, their reason for existing, and their large budgets and salaries, dry up.”

This too is an age-old phenomenon. The March of Dimes was formed to combat polio — but once polio had been contained, it’s not as if the organizers were going to fold their tent. So they seamlessly shifted to combating birth defects.

This too is an age-old phenomenon. The March of Dimes was formed to combat polio — but once polio had been contained, it’s not as if the organizers were going to fold their tent. So they seamlessly shifted to combating birth defects.

Of course in the present moment, the consequences are much more divisive.

Greenwald again: “They always have to push debates into whatever places Americans resist. They also have to be losing, have a claim to victimhood, a reason to assert that they are righting the bigotry of Americans.”

Not that you need to shed a tear for AB InBev, the maker of Bud Light. But if you’ve wondered how the heck this state of affairs came about, well, now you’ve got some context that maybe you won’t run across elsewhere.

With that, let’s move on to the markets and the mailbag…

![]() The Great Crypto Migration

The Great Crypto Migration

On a sleepy summer day, the most interesting thing in the markets is Bitcoin at its highest level in over a year.

On a sleepy summer day, the most interesting thing in the markets is Bitcoin at its highest level in over a year.

At last check, it’s less than $200 away from $31,000. Ethereum is looking stout too, approaching $1,900.

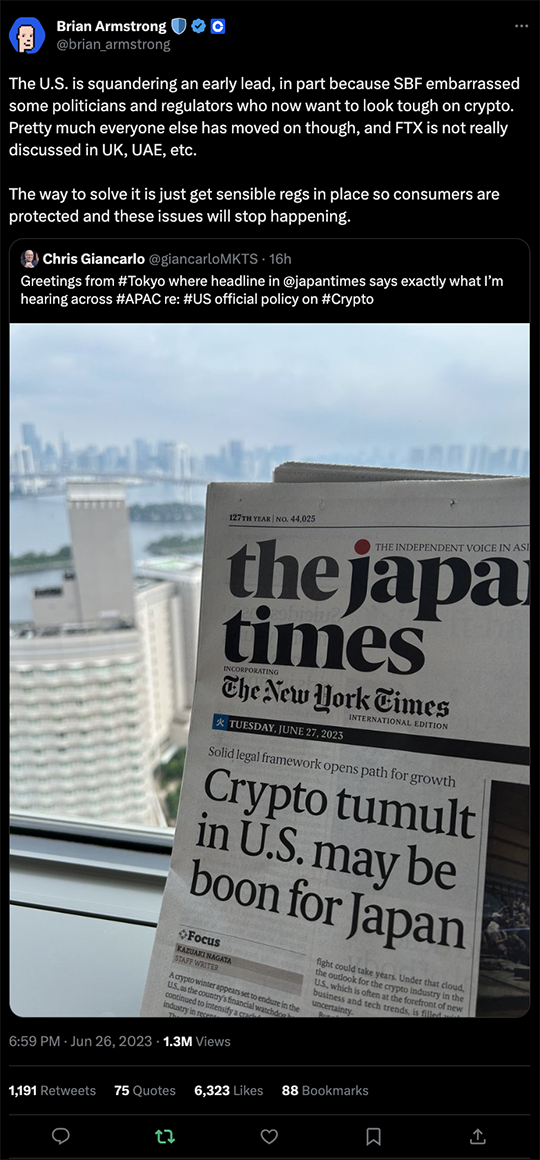

Perhaps that’s because the migration of crypto innovation away from the United States and toward nearly everywhere else is becoming front-page news. Coinbase CEO Brian Armstrong is frustrated, and who could blame him?

Heck, even Hong Kong is opening up to crypto… and nothing happens in Hong Kong these days without the approval of Chinese leadership in Beijing, who severely cracked down on crypto in 2021.

Elsewhere, the major U.S. stock indexes are all up about a third of a percent. Gold is stuck in the mud at $1,915. Crude has dipped below the $69 mark.

The standout economic number of the day is durable goods orders — up 1.7% in May, fueled by orders for civilian aircraft and parts. If you back out aircraft and military hardware — both of them crazy-volatile month to month — the “core capital goods” figure rose 0.7%. Unfortunately, the previous month’s huge gain was revised down.

Meanwhile, new home sales surged 12.2% in May, way more than expected. Then again, it’s inevitable the shortage of inventory among existing homes will push buyers toward new construction. The median price of new construction is $416,300, down from over $450,000 a year earlier.

![]() Crying Wolf Much?

Crying Wolf Much?

We got an earful after banging the drum yesterday for Jim Rickards’ Emergency Dollar Warning briefing — still underway as we hit the “send” button. (If you missed it, keep an eye on your email for a replay link later this afternoon.)

We got an earful after banging the drum yesterday for Jim Rickards’ Emergency Dollar Warning briefing — still underway as we hit the “send” button. (If you missed it, keep an eye on your email for a replay link later this afternoon.)

“Dave,” a reader writes, “your first bullet regarding Jim Rickards' ‘urgent note’ and his previous semi-hysterical warnings about the fate of the U.S. dollar remind me of similar frantic warnings from Charles Vernon Myers (Vern to those who knew him), going back a generation or two.

“As far back as 1968 Vern gave shrill warnings, in his newsletter Myers Finance and Energy, about the American banking system imploding due to overexposure to ‘banana republics.’

“For the next 25 years he made similar chilling forecasts, none of which ever happened. Oh, I suppose the market crash of 1987 did give him some validity but that was a minor disturbance in the overall scheme of things.

“Sadly, Jim Rickards is now falling into the same trap of being toooo convincing about far-fetched scenarios. He therefore loses a lot of support from people like me. Remember, he has called for gold going to $10,000 per ounce since at least 2014, which in my mind makes him wrong.

“Anyone can predict anything, and given enough time he will be right almost every time. So my point is... you should back off with the extreme views or at least downplay them somewhat.”

Dave responds: Brings to mind the old joke about how “So-and-so has predicted 12 of the last three market crashes.”

Obviously I wasn’t going to bother Jim as he was getting ready for his event today. But I suspect if I pressed him, he’d have no apologies for the cautious note he’s struck consistently for more than a decade.

Even before he joined our firm, I remember sitting in a Vancouver hotel conference room in 2013 watching him describe his preferred asset mix — gold, cash, land, fine art, private equity.

Notice that stocks are absent. Unlike most entry-level newsletters, there’s no portfolio on the back page of Strategic Intelligence, and there never has been.

Jim is always on alert for something to go wrong in the stock market because it is inextricably linked to the banks and the financial system. That’s just how he rolls, having had a front-row seat to the near-calamity that was the collapse of Long Term Capital Management in 1998. It’s a lived experience and a worldview that commands a loyal following.

As for the dollar, the reality is that U.S. economic warfare against Russia starting 16 months ago has touched off a worldwide backlash.

I’ve been careful to emphasize that de-dollarization is a process and not an event — but there will be wake-up calls for the elites along the way and we want to tip readers off before it becomes front-page news and everyone else is saying What just happened?

As for the $10,000 gold prediction, Jim’s been very circumspect about not attaching a timeframe. There’s sound math behind that estimate, though; we ran through the numbers years ago in this issue from deep in the archives of 5 Bullets’ predecessor e-letter.

And by the way, Jim’s re-run the numbers — and come up with $15,000. Heh…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets