Here Come the ’70s Again

- A super ’70s stagflation flashback

- An immediate threat to the market (UPS strike)

- Zach Scheidt: “Big Oil is in a bind”

- Biden’s green energy folie a deux

- The downside of stockpiling.

![]() Super ’70s Stagflation Flashback

Super ’70s Stagflation Flashback

It was a time of a weak economy… a soaring cost of living… and, worst of all, this:

It was a time of a weak economy… a soaring cost of living… and, worst of all, this:

And while it’s unlikely the leisure suit will make a comeback anytime soon, Paradigm Press macro maven Jim Rickards says we are starting down the prospect of “stagflation” — a portmanteau of stagnation and inflation that came into widespread use to describe the economy of the late 1970s.

Before we engage in any more uncomfortable ’70s flashbacks, let’s set some context by hopscotching through the morning’s financial headlines…

Before we engage in any more uncomfortable ’70s flashbacks, let’s set some context by hopscotching through the morning’s financial headlines…

Shortly after we went to virtual press yesterday afternoon, the Fed released the minutes from its mid-June meeting.

At the risk of repeating myself, Fed “minutes” are not like the minutes from your local school board meeting. They’re not an objective record of who said what. They’re a thoroughly political document calculated to mess with Mr. Market’s mind.

There was a decidedly hawkish tilt to yesterday’s “minutes.”

The key passage was about how several of the officials present were open to raising interest rates last month — even though in the end, there was a unanimous vote to forgo an increase for the first time since March 2022.

The minutes went out of their way to describe the rationale for raising again in June, even though that’s not what the Fed did: “Momentum in economic activity had been stronger than earlier anticipated, and there were few clear signs that inflation was on a path to return to the committee’s 2% objective over time.”

Which brings us to the market-moving number of the day.

Which brings us to the market-moving number of the day.

Every month, the big payroll firm ADP issues an estimate of the growth in private-sector payrolls. It usually comes out a day or two before the Labor Department issues its monthly job numbers, although ADP’s predictive value for the government figures is — at best — suspect.

In any event, ADP says the number of private payrolls rose by a staggering 497,000 during June — more than double the consensus guess among Wall Street economists. The biggest contributors included leisure and hospitality (232,000), construction (97,000) and mining/natural resources (69,000).

The numbers may or may not be accurate… but there’s nothing in them to suggest the labor market is slowing down. Which comes back to that passage in the Fed minutes about “stronger” momentum in economic activity, and the Fed’s determination to keep raising rates.

We’ll resurrect a relevant meme we’ve already shared at least once this year…

Here’s the problem, and we can’t point this out often enough: The Fed is obsessed with a correlation between jobs and inflation that simply doesn’t exist.

Here’s the problem, and we can’t point this out often enough: The Fed is obsessed with a correlation between jobs and inflation that simply doesn’t exist.

For decades, Fed economists have been enamored with a concept called the “Phillips curve.” The Phillips curve says all else being equal, low unemployment is accompanied by high inflation, and high unemployment comes with low inflation.

But all else is rarely equal, including now. If inflation is coming down (and it is, even if it’s still elevated), shouldn’t unemployment be rising?

“The fact is the unemployment rate has not risen much at all even after 16 months of monetary tightening,” says Jim Rickards.

Look back in history, Jim implores: “The 1930s were a period of high unemployment and low inflation. The 1960s were a period of low unemployment and low inflation. The late 1970s were a period of high unemployment and high inflation. History and data show that there is no correlation between unemployment and inflation.”

A second misperception on the Fed’s part has to do with the source of inflation at any given moment.

A second misperception on the Fed’s part has to do with the source of inflation at any given moment.

There’s supply-side inflation and demand-side inflation.

“The inflation of 2021–2023 was real,” says Jim, “but it was caused by supply chain bottlenecks and shortages of critical goods and industrial inputs. The supply chain disruptions were exacerbated by unprecedented economic and financial sanctions because of the war in Ukraine.

“This kind of supply-side inflation tends to be self-negating. The high prices cause reduced demand, which in turn tends to cause lower prices. We’re seeing this every day starting at the gas pump where the record high prices of the summer of 2022 have come down significantly (although still higher than 2021).”

But here’s the thing: If inflation persists long enough, it shifts from the supply side to the demand side.

“If inflationary psychology takes hold in the general public,” Jim explains, “it can feed on itself despite recession and declining real wages. The models don’t show this but history does.

“This is exactly what happened in the 1970s,” Jim goes on.

“This is exactly what happened in the 1970s,” Jim goes on.

“The inflation then began from the supply side with the Arab oil embargo of 1973 after the Yom Kippur War. The U.S. suffered a severe recession from 1973–1975 with peak unemployment of 9.0%. The U.S. had another recession in 1980, and a third in 1981–1982 in which unemployment hit 10.8%. That last recession was the most severe at the time since the Great Depression.

“Despite three recessions in nine years, double-digit unemployment and two stock market crashes, the mid-to-late 1970s and early 1980s witnessed the highest inflation since the end of World War II. By 1981, inflation had reached 15% and interest rates were raised to 20% to combat the inflation.”

Low growth + high inflation = stagflation.

“The inflation that began on the supply side in 1973 had moved to the demand side by 1977 and was out of control,” Jim says. “Recessions couldn’t stop it.”

And with falling-but-still-persistent inflation now, and a still-looming recession… it’s easy to see how a similar scenario could unfold through the mid-2020s, no?

“This is one of the worst economic outcomes possible,” Jim concludes.

“This is one of the worst economic outcomes possible,” Jim concludes.

“It means losses for stocks (because of recession), losses for government bonds (because of inflation), losses for corporate bonds (because of business failures) and major losses for commercial real estate (because of low occupancy rates and mortgage defaults).”

The clear winner in this scenario — as it was from 1977–1980 — is gold.

Still, you don’t want to go all-in on gold. You never want to put all your eggs in one basket and Jim has said for years that 10% of your portfolio in gold is plenty to cover any losses you might incur from your other holdings.

But what do you do with the other 90% for both safety and profit potential?

Jim strongly urges you to consider putting a chunk into a strategy that proved itself many times over during 2022… while the stock market tumbled nearly 20%.

While the stock market tumbled nearly 20%, this strategy generated rapid gains such as 57%... 85%... and 166%. “Just think about what this kind of wealth could mean,” says Jim.

![]() It’s Not Getting Better (UPS Strike Threat)

It’s Not Getting Better (UPS Strike Threat)

A more immediate threat to the markets is the looming prospect of a strike at UPS — and the disruptions that would mean for the economy.

A more immediate threat to the markets is the looming prospect of a strike at UPS — and the disruptions that would mean for the economy.

Talks between UPS and the Teamsters have now broken down. The current contract expires at the end of this month.

We spelled out the stakes a week ago today. The point today is that the mainstream is still downplaying the risks — for instance, citing a UPS statement claiming “we have nearly a month left to negotiate.”

Not so, says Jim Rickards’ senior analyst Dan Amoss: Assuming the two sides can even come to terms, “the Teamsters leaders need time to persuade most union members to vote for the deal they made with management. So the real deadline may be mid-July, not July 31.”

In the meantime, markets are reacting in knee-jerk fashion to the aforementioned ADP number and everything it implies for Fed policy.

In the meantime, markets are reacting in knee-jerk fashion to the aforementioned ADP number and everything it implies for Fed policy.

At last check, all the major U.S. stock indexes are down about 1.3% — the S&P 500 back below 4,400. Gold is in danger of cracking below $1,900 again. Silver has already broken way below $23. Crude is down a buck to $70.73. Bitcoin is back below $30,000 for the first time in a week.

Bonds are also selling off, pushing yields up: The yield on a 10-year Treasury is back above 4% for the first time in four months.

And the yield curve is still sharply inverted, a sure sign of recession sooner or later: The yield on a 2-year T-note is over 5% now, the highest in 16 years.

![]() Damned if They Drill, Damned if They Don’t

Damned if They Drill, Damned if They Don’t

“Big Oil is in a bind,” says Paradigm income-investing specialist Zach Scheidt.

“Big Oil is in a bind,” says Paradigm income-investing specialist Zach Scheidt.

Oil giants like Exxon and Shell booked record profits last year. “These companies have primarily passed their profits back to shareholders,” says Zach, “with huge dividend payments and massive share buybacks.

“But plenty of leaders in Washington, including the Biden administration, have openly called on the oil industry to invest the extra cash into new projects that will boost production instead.”

Yes, that begs the question why these companies would invest in more production when Joe Biden campaigned on a platform of “we’re going to end fossil fuel.”

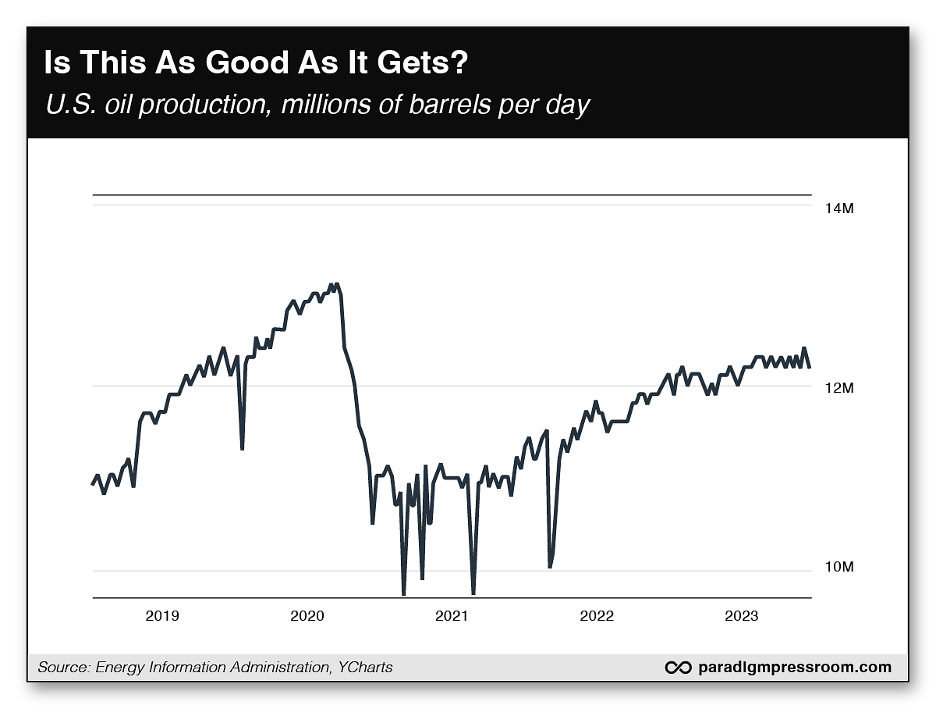

Be that as it may, the oil industry has rebounded big-time from the lockdown lows of April 2020 — when crude prices went negative for a few hours. “Production steadily (if slowly) recovered,” says Zach. “Prices were even quicker to rebound once economic activity picked up and adjusted to the new normal.

“Sanctions on Russian oil after the Ukraine invasion coincided with the post-pandemic economic recovery to send oil prices skyrocketing last year.” The price briefly touched $130 a barrel in March last year, before retreating to the high $60s and low $70s the last couple months.

With that, U.S. production has hit a plateau this year — and it’s still nowhere near the late 2019–early 2020 peak.

With that, U.S. production has hit a plateau this year — and it’s still nowhere near the late 2019–early 2020 peak.

But here’s the thing: “Oil prices may have peaked last year,” Zach allows, “but oil companies are still raking in healthy profits. And that means they have plenty of cash to invest in drilling projects.”

Case in point: “At the end of the first quarter, Exxon was sitting on roughly $33 billion in cash, the most it’s had on hand since 2008. And this large pile of cash can help fund drilling projects even if oil prices fall.

“As long as oil prices remain high (even if not quite as high as last year), Big Oil still has an incentive to keep drilling and tap into reserves.”

That’s especially good news for the oil field service companies — the outfits that help oil drillers with critical functions like engineering, maintenance and geological surveying.

For a couple of months now, Zach has recommended one name in particular, and we’re keeping that reserved for Lifetime Income Report readers. If you prefer to spread the risk among several companies in the space, there are always ETFs like the VanEck Oil Services ETF (OIH).

![]() Green Energy Follies

Green Energy Follies

Now they tell us: The Biden administration has fessed up that Uncle Sam doesn’t have anywhere near the funds to build out a national charging network for electric vehicles.

Now they tell us: The Biden administration has fessed up that Uncle Sam doesn’t have anywhere near the funds to build out a national charging network for electric vehicles.

Gabe Klein is executive director of the Joint Office of Energy and Transportation. He tells Politico that the $7.5 billion the White House has set aside for EV charging is only about 1/10th of what’s needed.

States and private industry will have to stump up for the other $67.5 billion. And how likely is that?

As Politico points out, “Americans bought nearly a million EVs last year, but a recent report found more than half of those who declined to buy one cited charging availability as the primary reason.”

On that score, Toyota just pushed back its timeline for fast-charging next-generation EV batteries.

On that score, Toyota just pushed back its timeline for fast-charging next-generation EV batteries.

“Solid-state” battery technology promises a range of nearly 750 miles and a charging time of 10 minutes or less.

In 2017, Toyota promised it could make the technology commercially viable by 2025. Now it’s saying 2027. And even that target looks ambitious to outside experts cited by the Financial Times, to wit: “A lot of developers have been saying ‘in five years’ time’ for the past 10 years.”

Staying in the Land of the Rising Sun, Japan Airlines is offering customers the chance to be climate-friendly by offering… clothing rental.

Staying in the Land of the Rising Sun, Japan Airlines is offering customers the chance to be climate-friendly by offering… clothing rental.

The idea is that you can pack light and rent your clothes upon your arrival. This way, you help keep the weight of the airplane down and curb JAL’s carbon emissions.

No, this is not a Babylon Bee article.

“The rental clothes — a combination of excess stock from retailers and secondhand garments collected by a partner company — will be delivered to a hotel or Airbnb accommodation ahead of arrival and collected at the end of the visit to be washed and recycled,” says the Financial Times.

Two hot takes: 1) If the airlines already have trouble keeping track of your luggage from airport to airport, how likely is it that JAL will get this right consistently? 2) If you’re that concerned about carbon emissions, shouldn’t you just refrain from air travel in the first place?

![]() The Downside of Stockpiling

The Downside of Stockpiling

“Your ideas of stocking up are not wrong, but you did not consider a lot of variables,” a reader writes after our revisit of the late John Pugsley’s Alpha Strategy in our Independence Day edition.

“Your ideas of stocking up are not wrong, but you did not consider a lot of variables,” a reader writes after our revisit of the late John Pugsley’s Alpha Strategy in our Independence Day edition.

“Suppose you move and need to transport your stockpile? There is cost and inconvenience involved with that. Also the mental stress of owning more stuff compared with less.

“It would be much easier to hold onto a gold bar or store a couple Bitcoins offline. Your thoughts?”

Dave responds: Sure, it would be easier in the sense you imply.

But you’re still taking the intermediate step of converting your fiat into gold/Bitcoin and then converting it again into consumer goods.

With that in mind, don’t overlook the wild fluctuations in the prices of gold/Bitcoin, even if the overall trend is up.

When gold made its epic run from $300 in mid-1979 to over $800 in early 1980, there were many sharp pullbacks along the way — including one from $450 down to $380 in early October amid Fed chief Paul Volcker’s “Saturday Night Special” move with interest rates. Would you be OK with the mental stress of selling a chunk of your gold reserve after that pullback just so you could get your week’s groceries?

And while Pugsley said he didn’t design the Alpha Strategy to contend with societal breakdown… the fact is we no longer live in an era when retailers can count on just-in-time inventory practices to deliver the goods they need when they need them. So there is a peace-of-mind aspect to the whole thing.

There’s no right or wrong to any of this, just food for thought. And as you suggest, the Alpha Strategy is not for the minimalist-minded!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets