Intel’s Road Map to Trillion-Dollar Status

![]() Intel’s Strategic Shift

Intel’s Strategic Shift

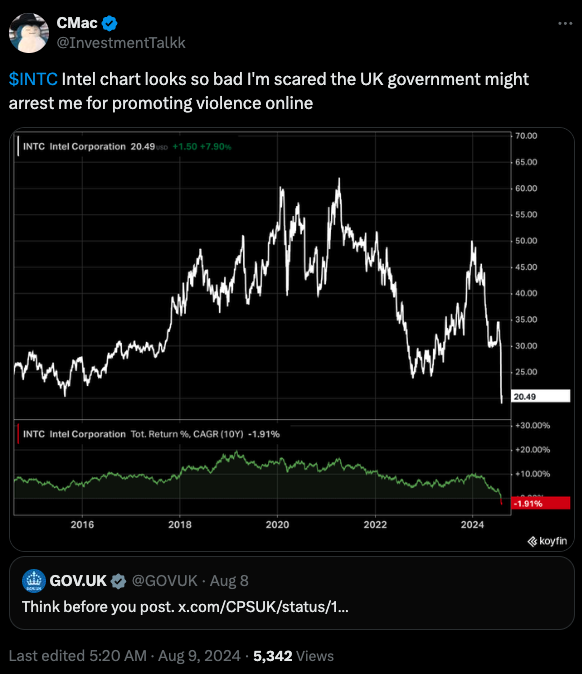

“Intel Corp. (INTC) got slammed last week,” says Paradigm’s DeFi specialist James Altucher.

“Intel Corp. (INTC) got slammed last week,” says Paradigm’s DeFi specialist James Altucher.

Following the company's negative earnings report, the market reacted: INTC shares tumbled 26% on Friday with an additional 6% decline during manic Monday’s widespread sell-off.

As one cheeky bloke implies at X-Twitter, he might even run afoul of U.K. censorship…

“I don’t see disaster,” James maintains. “In fact, I’m buying.”

But before we get there, first the bad news…

“Intel's recent earnings report and guidance were disappointing,” James admits.

“Intel's recent earnings report and guidance were disappointing,” James admits.

Intel’s CEO Pat Gelsinger wrote last week: “Our costs are too high, our margins are too low. We need bolder actions to address both — particularly given our financial results and outlook for the second half of 2024, which is tougher than previously expected.”

“As part of a massive cost-cutting and restructuring plan,” Fox Business says, “Intel [is] cutting 15% of its workforce, which translates to around 15,000 jobs” — job cuts which will be made by the end of the year.

Intel also announced plans to reduce operating expenses and cut capital expenditures by over $10 billion in 2025, exceeding its initial projections.

“Cuts aren’t an easy decision,” James says, “but they show that Intel’s management is committed to maintaining profitability and improving efficiency.

“I like Intel,” James confirms. “And the recent plunge in Intel's stock price doesn't change that. If anything, it makes the opportunity more attractive.

“I like Intel,” James confirms. “And the recent plunge in Intel's stock price doesn't change that. If anything, it makes the opportunity more attractive.

“Under Gelsinger's leadership, Intel is on track to introduce its 20A (2 nanometer) process node in 2024 and 18A (1.8 nanometer) process node by the end of 2025. Mass-producing these advanced chips will put Intel back on the map.

“It isn't just talk,” James adds. “Intel has been hitting its milestones so far, giving me confidence in its ability to execute.”To James’ way of thinking, last week's earnings call also highlighted significant progress:

- Gelsinger revealed that Intel had released the 1.0 Process Design Kit (PDK) for 18A in July, a crucial development. “18A is a technical achievement and represents Intel’s fifth new process launch in just four years — demonstrating Intel's ability to deliver on its road map,” says James

- In the past, Intel exclusively manufactured chips for its own products, but the company now has an established foundry business to produce chips for outside customers. Intel has forged a deal with committed clients valued at $15 billion, and the 18A Process Design Kit has generated heightened interest from more potential customers

- “On top of that,” James says, “Intel is making significant strides in the AI PC category. The company has already shipped more than 15 million Windows AI PCs since December. It’s on track to ship over 40 million by year-end

- “Intel's participation in the AI chip market, particularly with its Gaudi 3 AI accelerator, [promises] to deliver roughly twice the performance per dollar in both inference and training compared to Nvidia's H100. And with Nvidia delaying the launch of its new Blackwell accelerators by months, it could create a great opening for Intel,” James says.

“By aiming to become the manufacturer of choice for leading semiconductor design companies worldwide, Intel is positioning itself to capture a significant portion of the high-end chip market — a market currently dominated by Taiwan Semiconductor (TSMC).

“With concerns over the concentration of advanced chip manufacturing in Taiwan,” he highlights, “Intel's focus on U.S. and European production facilities offers an alternative.”

James’ gutsy takeaway: “I believe Intel has the potential to reach a trillion-dollar valuation by 2030.

James’ gutsy takeaway: “I believe Intel has the potential to reach a trillion-dollar valuation by 2030.

“While the market focuses on quarterly results, I'm looking at Intel's potential over the next five–10 years,” he adds.“The company's progress in process technology, foundry services and AI accelerators are still in their early stages.

“Yes, there will be challenges. Competition is fierce, and Intel must flawlessly execute its ambitious road map…

- “If successful,” James adds, “Intel's revamp could be one of the greatest turnarounds in tech history, right up there with Apple after Steve Jobs came back to the company in 1997

“At just under $20 per share, Intel represents what I believe to be a rare opportunity to invest in a potential trillion-dollar company at a fraction of that valuation, so consider buying the dip here.

“I believe Intel's current share price presents a great buying opportunity,” James doubles down. “It often pays to be greedy when others are fearful.”

![]() Small Caps’ Time to Shine

Small Caps’ Time to Shine

“The market is about to undergo a major rotation out of the mega-cap stocks that have driven most of the gains over the past several years,” says Paradigm’s retirement-and-income authority Zach Scheidt.

“The market is about to undergo a major rotation out of the mega-cap stocks that have driven most of the gains over the past several years,” says Paradigm’s retirement-and-income authority Zach Scheidt.

“As the Federal Reserve pivots on its interest rate policy, [money] flows in the market will dramatically change. When interest rates start to decline,” Zach notes, “it typically benefits smaller, growth-oriented companies more than their larger counterparts.

“Meanwhile, the mega-caps that have been the market darlings might start to lose their luster. That includes Microsoft Corp. (MSFT), one of the Mag 7 stocks that garnered so much attention over the past year.

“We added this tech giant to our Lifetime Portfolio nearly four years ago,” Zach says of his paid subscription service. “In that time, shares more than doubled, peaking recently at the beginning of July.

“That’s an impressive run-up for a blue chip stock — especially a company as big as Microsoft,” he adds.

“The company, along with other mega-cap tech stocks, benefited from the flight to quality and its ability to weather higher interest rates. But as the tide turns, investors are starting to view companies like Microsoft as overvalued and overexposed.

“Here's why I believe the company is particularly vulnerable to this rotation…

“Microsoft is trading at a premium valuation, roughly 34 times next year's expected profits. This leaves little room for error and makes it susceptible to a pullback,” Zach says.

“Microsoft is trading at a premium valuation, roughly 34 times next year's expected profits. This leaves little room for error and makes it susceptible to a pullback,” Zach says.

“On top of that, Big Tech is facing increased scrutiny from regulators worldwide, which could impact Microsoft's ability to make acquisitions or maintain its dominance.

“And as I mentioned earlier, capital is likely to flow out of large caps like Microsoft and into smaller, more nimble companies.

“Don’t get me wrong… Microsoft is still a good company,” says Zach. “But even though it’s performed well, I think there are better opportunities ahead.

“With the winds of change blowing through Wall Street,” he concludes, “the good news is that this rotation is just getting started, so we can still lock in some attractive profits.”

In like a lion, out like a lamb? For the week that started with a panicky sell-off, all the major U.S. stock indexes are in the green as we check our screen today.

In like a lion, out like a lamb? For the week that started with a panicky sell-off, all the major U.S. stock indexes are in the green as we check our screen today.

In first place, the S&P 500 has gained 0.20% to 5,325; meanwhile, the tech-heavy Nasdaq is up 0.15% to 16,680 and the staid Dow is up about 0.10% to 39,470.

The outlook is similar for commodities (with one exception). Oil is up 0.40% to $76.47 for a barrel of West Texas crude. And the yellow metal is up 0.15% to $2,467.40 per ounce. Silver, however, is the exception: down 0.25% to $27.53. Copper’s up about 1%, just a hair under $4.00.

The market that never sleeps — crypto — is similarly positioned in the green. Bitcoin is up 1% to $60,320 and Ethereum is up 0.30% to $2,590.

![]() Kill Bill? California Style

Kill Bill? California Style

The debate over a California AI-centric bill has ignited interest outside Sacramento. Senate Bill 1047, proposed by state Sen. Scott Wiener, aims to require safety assessments for large-scale AI models.

The debate over a California AI-centric bill has ignited interest outside Sacramento. Senate Bill 1047, proposed by state Sen. Scott Wiener, aims to require safety assessments for large-scale AI models.

As one might expect, the bill is in the line of fire from Silicon Valley venture capital firms who argue it could stifle innovation and harm California’s economy.

Forward Observer summarizes: “California is the home to most AI-focused tech startups and companies, and hamstringing AI development would likely set the U.S. back in the AI war with China. If S.B. 1047 passes, AI companies are also likely to move to states with more friendly regulations.”

Netscape’s co-founder Marc Andreessen has been one of the bill’s vocal opponents, fearing it could set a precedent for AI regulation nationwide. To wit, a snippet from a June 19 advisory note from his venture capital firm Andreessen Horowitz says:

Nonetheless, the bill has progressed through the state legislature, and awaits approval from the Appropriations Committee before it can be put to the vote, and potentially signed by Gov. Gavin Newsom.

Newsom has yet to telegraph his stance on the bill. With the legislative session nearing its end, all eyes are on whether he will support or amend the bill before it reaches his desk.

![]() Reverse (Gold) ATMs

Reverse (Gold) ATMs

In June, a Chinese jewelry company launched automated gold exchange machines in several Chinese cities.

In June, a Chinese jewelry company launched automated gold exchange machines in several Chinese cities.

Following the machines’ launch, Kinghood Group debuted its global version at the 2024 China Gold Congress and Expo in Shanghai last month.

So imagine a sort of reverse ATM…

Courtesy: X, China Pictorial

“These machines collect a variety of items made of the precious metal, weighing anywhere between 3 grams and 1 kilogram, including gold bars, jewelry and K-gold, irrespective of brand or make,” China Daily says.

“The system evaluates the gold purity, weight and price within three minutes, and completes the melting inspection and fund transfer process in just 30 minutes, thereby creating an efficient and closed-loop gold trading process,” says Xiao Yingjie of Kinghood Group.

Plus, the “gold ATMs” are equipped to integrate with international payment systems, transacting in major global currencies. Some users, however, have balked at high transaction fees — 18 yuan ($2.51 USD) per gram.

We assume they’ve never been extorted by ATM fees here stateside…

![]() Mailbag: Market Notes and Perplexity.ai

Mailbag: Market Notes and Perplexity.ai

“Providing daily market notes in the 5 Bullets helps readers avoid wasting time checking these numbers themselves,” a reader says in defense of our daily market notes section. “I appreciate receiving this information because I rarely — and I mean rarely — check it myself.”

“Providing daily market notes in the 5 Bullets helps readers avoid wasting time checking these numbers themselves,” a reader says in defense of our daily market notes section. “I appreciate receiving this information because I rarely — and I mean rarely — check it myself.”

A follow-up reader responds to Dave’s praise for Perplexity.ai. “Don’t dislike it,” our reader writes, “but ask about the safety and effectiveness of the COVID jabs.”

Emily: OK, here goes…

Perplexity.ai’s answer?

Fairly anodyne, in my opinion. It’s certainly no Joe Biden circa 2021: “You’re not going to get COVID if you have these vaccinations.”

That hasn’t aged well. Even at the time, the mainstream media essentially issued a retraction on Biden’s behalf…