Is Buffett Losing It?

![]() Is Buffett Losing It?

Is Buffett Losing It?

Hard to believe, but it was only a week ago today that Warren Buffett was one of a farrago of factors tanking the stock market.

Hard to believe, but it was only a week ago today that Warren Buffett was one of a farrago of factors tanking the stock market.

Recession worries… the unwinding of the “yen carry trade”... election uncertainty… Middle East uncertainty…

All of those figured into the mix — but Buffett was definitely in there too.

The previous weekend, Buffett’s Berkshire Hathaway disclosed that it sold off big slugs of stock during the second quarter — including nearly half of its stake in Apple, about $80 billion worth.

To be sure, Buffett had been unloading stocks steadily since mid-2022. And the vaunted “Warren Buffett indicator” — the value of the U.S. stock market relative to U.S. GDP — sits at highs exceeding the 2000 dot-com bubble and even the 2022 post-COVID boom in tech stocks. By Buffett’s preferred measure, the stock market is vastly overvalued.

Still… Berkshire’s cash pile swelled nearly 47% in the last quarter alone — from $189 billion to $277 billion.

So even while most of the worries that wrecked the stock market last Monday have abated for now… it’s worth taking a closer look at Buffett’s sense of timing

Or lack thereof?

Warren Buffett “is not a god, he is a person,” says Paradigm’s AI and crypto authority James Altucher — who published a book called Trade Like Warren Buffett nearly 20 years ago.

Warren Buffett “is not a god, he is a person,” says Paradigm’s AI and crypto authority James Altucher — who published a book called Trade Like Warren Buffett nearly 20 years ago.

[No less a luminary than Fisher Investments founder Ken Fisher called it “a noteworthy addition to the library on Warren Buffett.”]

“Even legendary investors can mistime the market,” says James — and he suspects that’s what Buffett has done here.

It’s not just the AAPL sale (which we’ll get to momentarily). It’s also Buffett’s involvement in the aforementioned yen carry trade.

It’s not just the AAPL sale (which we’ll get to momentarily). It’s also Buffett’s involvement in the aforementioned yen carry trade.

As a reminder from last week, the yen carry trade entails borrowing in dirt-cheap yen and plowing the funds into almost anything that can generate a better return than the cost of borrowing. Many high-powered investors opted for U.S. Treasury bills and U.S. tech stocks.

When the Bank of Japan jacked up interest rates at the end of July and signaled its intention to keep raising rates… suddenly the yen carry trade no longer looked so attractive. Billions of dollars in leveraged bets reliant on the yen carry trade started to blow up.

“In recent years,” says James, “Buffett and Berkshire Hathaway have borrowed roughly $10 billion of Japanese yen to take advantage of the very low interest rates.

“Unlike other traders, Buffett has been less aggressive with his carry trade investments… using the money to invest in local Japanese businesses, which provides some protection against a strengthening yen.”

Still, Buffett reeled in about $1 billion during the first half of the year from the yen carry trade — returns that, ummm, probably won’t be replicated during the second half.

As for the AAPL sale, it’s not that surprising given Buffett’s general squeamishness when it comes to tech investments.

As for the AAPL sale, it’s not that surprising given Buffett’s general squeamishness when it comes to tech investments.

“It took him years to even come around to the idea of investing in Apple,” James reminds us.

It wasn’t until 2016 that Berkshire took a position in AAPL. And even then it wasn’t on the strength of Apple’s tech prowess but rather its power as a consumer-products brand. (In other words, Buffett saw Apple the same way he’s long seen Coca-Cola.)

Buffett’s slow walk toward the stock-market exit door coincides almost perfectly with the AI boom.

“To an outsider,” says James, “ AI might look like another tech bubble like the dot-com craze or cryptocurrency.

“However, AI is vastly different in a very critical way. Unlike other tech bubbles, the benefits of AI are already here. Already, millions of people are using AI in their jobs every single day.

“While the technology still has room to improve, even in its current form it is already improving productivity and work quality across large portions of the economy.”

And as we’ve chronicled in these virtual pages during 2024, Apple is taking its usual slow-and-steady approach when it comes to AI — letting other players make the early mistakes, methodically refining its approach to create something consumers will see as a must-have.

“The iPhone maker has yet to even release its AI capabilities to the public,” James reminds us.

“The iPhone maker has yet to even release its AI capabilities to the public,” James reminds us.

“The upcoming launch of Apple’s new Siri and AI features will not only provide greater access to AI tools but will likely result in a supercycle of phone and computer upgrades.”

James’ conclusion: “While Buffett's tech-averse strategy has served him well in the past, the rapid adoption of AI — and the benefits it generates — indicates that the tech boom may be more sustainable than previous bubbles.”

![]() The Number to Watch: 5,420

The Number to Watch: 5,420

The new week begins where the old one left off — with the S&P 500 and the Nasdaq solidly in the green.

The new week begins where the old one left off — with the S&P 500 and the Nasdaq solidly in the green.

At last check, the S&P is up nearly half a percent or 23 points at 5,367. As Paradigm’s floor-trading veteran Alan Knuckman sees it, the number to watch is 5,420.

That number marks the rough midpoint between the S&P’s record high of 5,667 on July 16… and the most recent low of 5,186 a week ago today.

“That’ll act as a magnet,” Alan told readers of The Profit Wire late last week. “If we get back above that magnet, then you should see a full V recovery to the all-time forever top” — which again is 5,667.

One of the outside-Paradigm experts we follow is Craig Johnson of Piper Sandler. He has an uncanny knack for accurate year-end S&P 500 predictions. Over the weekend on the Financial Sense podcast, he issued his latest year-end outlook — 5,800, albeit with considerable volatility along the way.

Precious metals are starting the week strong — gold up nearly $27 to $2,457 and silver up 34 cents to $27.78.

Precious metals are starting the week strong — gold up nearly $27 to $2,457 and silver up 34 cents to $27.78.

But crude is up even stronger — a barrel of West Texas Intermediate up over 2% at $78.48, busting back over the 200-day moving average to the highest levels since mid-July.

Not surprising considering that a U.S. aircraft carrier is under orders to “accelerate” its transit to the Middle East… Ukraine is attacking inside Russian territory with U.S. weaponry… and no one really knows who’s calling the shots inside the White House.

Bitcoin hovers just below $60,000.

For the record: It’s 49 days until East Coast and Gulf Coast dockworkers go on strike — and contract talks aren’t going well.

For the record: It’s 49 days until East Coast and Gulf Coast dockworkers go on strike — and contract talks aren’t going well.

International Longshoremen’s Association President Harold Daggett describes talks with the U.S. Maritime Alliance as “at an impasse.” The current contract expires Sept. 30.

The North American head of the Maersk shipping line says even a one-week walkout would foul up deliveries of imported goods for at least four weeks, maybe six.

With that timeframe occurring in the teeth of election season, it’s a safe bet someone in the Biden administration will move heaven and earth to bring the two sides closer together — as happened with a dispute between the freight railroads and their unions leading up to the 2022 midterms.

![]() Awaiting America’s “Liz Truss Moment”

Awaiting America’s “Liz Truss Moment”

Uncle Sam’s finances are approaching the point of no return.

Uncle Sam’s finances are approaching the point of no return.

The U.S. Treasury recently published its “Monthly Treasury Statement” for June. It shows that the federal government spent $140.24 billion to cover interest on the national debt. Meanwhile, personal income tax revenue totaled $184.91 billion.

In other words, interest on the debt ate up nearly 76% of all personal income tax receipts.

To be sure, June looks like an outlier. And the feds do have other sources of tax revenue. But the overall trend is still disturbing.

Late last year, the Heritage Foundation reckoned that 40% of personal income tax revenue covered interest on the debt alone. This spring, the Committee for a Responsible Federal Budget came up with a similar figure for halfway through the fiscal year.

"If federal finances continue on their current path, we are only a few years from the entirety of income taxes being needed to finance the debt," Heritage research fellow E.J. Antoni tells Fox News.

Little wonder that in the bond market, there’s growing chatter about an approaching “Liz Truss moment” for the United States.

Little wonder that in the bond market, there’s growing chatter about an approaching “Liz Truss moment” for the United States.

Truss was the hapless prime minister of the U.K. whose term lasted all of 49 days in 2022. What did her in was the “mini-budget” her cabinet submitted to Parliament — complete with generous energy subsidies and tax cuts. An already-yawning gap between revenue and expenses was set to widen further.

In short order, the pound fell to a record low against the U.S. dollar.

Much worse, confidence collapsed in British government debt — sending bond yields sky-high. The Bank of England had to step in and buy the bonds to prop up the market and prevent a possible default.

We hardly knew ye: Truss resigns after 49 days on Oct. 20, 2022

[Prime Minister’s Office photo]

Truss’ successors haven’t exactly been paragons of fiscal responsibility — but they have managed to get the U.K.’s budget deficit as a percentage of its GDP to climb down from crazy-high levels last seen in the aftermath of World War II.

Still, even those modest efforts at budgetary discipline threw the U.K. into a mild recession during the second half of 2023.

Here in the United States of 2024, no one in the presidential campaign is even trying to give lip service to “fiscal responsibility.” More war, more boondoggles, more spending out of an empty pocket — that’s America’s future no matter who wins. Our own Liz Truss moment could easily arrive during the next president’s term.

![]() Yeah, but They Really Stuck It to Putin!

Yeah, but They Really Stuck It to Putin!

Here’s Lesson No. 206 in “How Sanctions Backfire”...

Here’s Lesson No. 206 in “How Sanctions Backfire”...

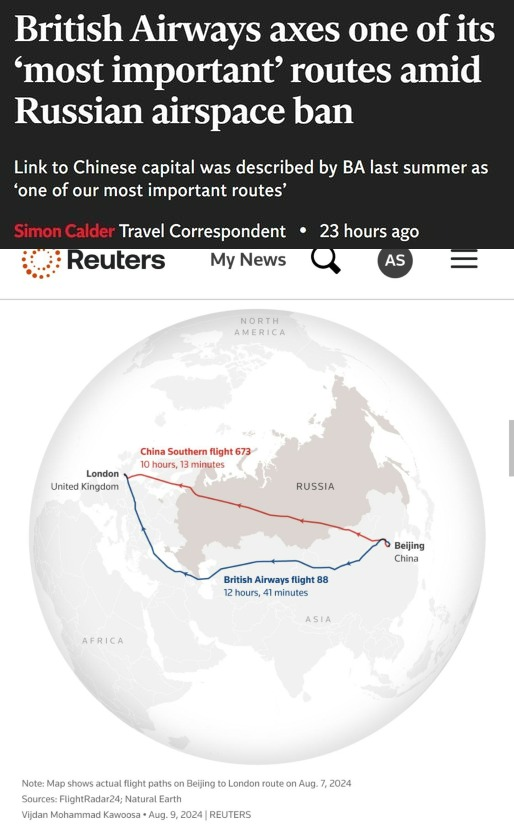

British Airways is giving up on what it once called “one of our most important routes” — London to Beijing.

The airline launched the route in 1980, shortly after China’s opening to the West. Flights between the two cities were suspended in 2020 because of COVID restrictions — resuming with great fanfare in June 2023.

But they were no longer the same. After Russia invaded Ukraine in 2022, Western governments imposed sanctions and Moscow fought back with a host of its own measures — including a ban on Western airlines flying over Russian airspace.

Result — a London-Beijing flight time of 11 hours, 30 minutes on BA89. That’s two hours longer than Air China and China Southern, which still have access to Russian skies.

“In addition,” reports The Independent, “fares on Chinese airlines are much lower — partly reflecting the shorter journey and lower costs of fuel, crew and engine wear.”

The price discrepancy is so wide — British Airways is almost 60% higher — that while BA is obliged to buy seats on Chinese carriers for passengers who’ve already booked flights beyond October… it’ll probably be cheaper if they just claim a refund and rebook themselves.

Allegedly the suspension is temporary, until November 2025. Yeah, check back with us then…

![]() A [CENSORED] Mailbag

A [CENSORED] Mailbag

We heard from several readers after our annual censorship issue on Thursday…

We heard from several readers after our annual censorship issue on Thursday…

“Hi, Dave — Can't sympathize with your concerns enough. Hang in there. I think you have an advantage from the standpoint that you are mostly email it seems (at least what I see). So maybe you won't be the first to be silenced.

“Unfortunately, I think it's just a matter of time, especially when too many think that speech can be dangerous. And as free speech goes, there goes our freedom and country. Keep up the good fight.”

Another: “Thursday's ‘Don't You Dare Call It a Recession!’ is perhaps THE most insightful ‘single-topic deep dive’ in your editorial history.

“Relabeling as a deep state propaganda tool has no impact on citizens' economic choices. When people feel poorer, they act poorer, regardless of social-media scolding. Keep up the good work! And thank you.”

One more: “In the Coffee & Covid newsletter, Florida lawyer Jeff Childers posted that Robert F. Kennedy Jr. filed a lawsuit in federal court after SCOTUS ruled the plaintiffs in Murthy v. Missouri did not have standing.

“Childers stated that RFK Jr. will absolutely have standing, so there is still hope even though the process will take a while.”

Dave responds: Thank you for the reminder. The case to watch here is Kennedy v. Biden — although it appears, incredibly, that the Biden administration will try to resort to the standing excuse here as well.

Yes, email distribution is “safer,” relatively speaking, than relying on the social media giants. But marketing our email distribution so that people will hear about us in the first place is another matter entirely. There’s a thicket of rules to comply with — and we have people on our team who spend the better part of their day navigating that thicket.

Regardless, we press on. As the Bartles & Jaymes guys used to say, “Thank you for your support.”