Johnson’s “Pure Stupidity”

![]() The House Speaker’s “Egregious Blunder”

The House Speaker’s “Egregious Blunder”

Only a few weeks into his stint as House speaker, Rep. Mike Johnson “has committed a blunder so egregious that it could rock the global financial system and cause a financial panic,” says Paradigm macroeconomics authority Jim Rickards.

Only a few weeks into his stint as House speaker, Rep. Mike Johnson “has committed a blunder so egregious that it could rock the global financial system and cause a financial panic,” says Paradigm macroeconomics authority Jim Rickards.

Johnson is a bit of a throwback. He’s not a MAGA guy, really. Born in 1972, he came of age during the Reagan years.

So he’s a classic Reaganite conservative — embracing the central contradiction of Reaganism that I’ve identified before. That is, he thinks it’s possible for America to have a giant military-industrial complex wielding its might around the globe — while you and I can still have individual liberty and limited government at home. (Sorry, it doesn’t work that way.)

Although he wouldn’t want to admit it, Johnson is in basic agreement with Joe Biden — that both Israel and Ukraine deserve Washington’s full support, and money is no object.

Which brings us to the blunder Jim Rickards wishes to warn us about…

The background: “Right now, the U.S. holds about $300 billion of Russian assets that were frozen after the Ukraine war broke out in February 2022,” Jim reminds us.

The background: “Right now, the U.S. holds about $300 billion of Russian assets that were frozen after the Ukraine war broke out in February 2022,” Jim reminds us.

“Most of those assets came from the Central Bank of Russia and consist of U.S. Treasury securities. Technically, those assets have not been converted to U.S. ownership; they have merely been frozen and still belong to Russia even though Russia cannot use them.

“Now Johnson wants to convert those assets to U.S. ownership and use the proceeds to pay for the war in Ukraine.”

As Johnson put it earlier this month, “It would be pure poetry to fund the Ukrainian war effort with Russian assets.”

“Pure stupidity is more like it,” Jim counters.

“Pure stupidity is more like it,” Jim counters.

Think about it for a moment: “Such an action would amount to a default on U.S. government debt since the securities were legally owned by Russia.

“Nations around the world would take note and accelerate their dumping of Treasury securities and their flight from the U.S. dollar. This would increase interest rates in the U.S. and hurt everyone from homebuyers to everyday consumers.

“It would make U.S. debt permanently more difficult to sell and less desirable to hold. It would introduce a new risk premium on U.S. debt over and above the existing inflation premium. At its worst, it could trigger a dollar panic and full-scale flight from the dollar.”

As we’ve mentioned before, the dollar’s share of global currency reserves plunged from 55% in 2021 to 47% in 2022. So the mere freezing of Russia’s dollar-based assets is already prompting a flight from the dollar. Confiscating Russia’s Treasuries would only turbocharge the process.

“Johnson is playing with fire and has no idea what he is doing,” Jim concludes. “Let’s hope he receives some sound advice before he goes too far.”

[Editor’s note: Speaking of Jim, we’ve got our own Black Friday special going for one of his premium advisories. New subscribers to The Situation Report can claim — well, I can’t say too much about it here, but it comes in a small black box and is worth about $300. It was part of a giveaway offer Jim put on a few weeks ago… and we need to clear out the warehouse space.

If we’ve piqued your curiosity, you can find all the details from Paradigm’s customer care director at this link.]

![]() All-Time Highs By Year-End?

All-Time Highs By Year-End?

What was it we said at the end of yesterday’s edition about how there’s nothing standing in the way of the S&P 500 running to at least 4,600 before year-end?

What was it we said at the end of yesterday’s edition about how there’s nothing standing in the way of the S&P 500 running to at least 4,600 before year-end?

Yesterday, after the closing bell, Nvidia reported its quarterly numbers. NVDA booked record sales… but the guidance going into next year was a little squishy. At last check, shares are down more than 2.5% on the day.

As a reminder, NVDA is one of the Magnificent Seven stocks — the seven tech-adjacent companies that have propped up the rest of the stock market all year. Seriously — through last Friday, the S&P 500 is up nearly 15% year-to-date, but if you took out those big seven, the gain would be only 2.6%.

It wouldn’t have been surprising at all to see the NVDA reaction spill over into its Magnificent Seven brethren — Apple, Microsoft, Alphabet, Amazon, Meta, Tesla — but that’s not at all what’s happening today.

Checking our screens, the S&P 500 is up 21 points to 4,559 — only 30 points below its year-to-date high set at the end of July. At this rate, we could be looking at 4,600 by the end of the month — and flirt with all-time highs near 4,800 by the end of the year.

By the way, Microsoft is doing just fine today — up nearly 1.5% — even though it appears Sam Altman will return to his post as CEO of OpenAI instead of leading an AI team at Microsoft. Given Microsoft’s 49% ownership of OpenAI, that’s not exactly a heartbreaker.

Crude’s rebound of recent days was just dealt a setback — thanks to a falling-out among the OPEC+ countries.

Crude’s rebound of recent days was just dealt a setback — thanks to a falling-out among the OPEC+ countries.

Oil ministers from the group were scheduled to meet starting Saturday. But the gathering has now been pushed back to a week from tomorrow.

There’s no official statement explaining the delay, but Bloomberg reports that “talks ran into trouble amid Saudi dissatisfaction with other members’ oil production levels.” In other words, the Saudi princes want to extend current production cuts while other producers want to pump more.

Checking our screens, a barrel of West Texas Intermediate is down nearly two bucks to $75.83. That’s still meaningfully higher than the $73 levels of last Thursday,

Elsewhere in the commodity complex, gold’s latest run to $2,000 couldn’t stick — the bid back to $1,991. Silver’s down a dime to $23.62.

The crypto market is shrugging off the resignation and guilty plea of Changpeng Zhao — CEO of Binance, the biggest crypto exchange on the globe.

The crypto market is shrugging off the resignation and guilty plea of Changpeng Zhao — CEO of Binance, the biggest crypto exchange on the globe.

The feds had been going after Zhao for years. Despite its overwhelming size, Binance never officially pursued U.S. customers. That way it wouldn’t have to fuss over U.S. law. But prosecutors say Binance indeed had U.S. users — and egged them on to obscure their location.

If you’re curious, you can read more about it almost anywhere. Suffice to say that after a plea deal, Zhao will pay a $50 million fine and faces up to 18 months in Club Fed.

Looking at a screen of crypto prices, you wouldn’t suspect anything happened: Bitcoin is back below $37,000, while Ethereum is still over $2,000.

The major economic number of the day is durable goods orders, which came in much weaker than expected — down 5.4% in October.

The major economic number of the day is durable goods orders, which came in much weaker than expected — down 5.4% in October.

To be sure, this number can be skewed by orders for aircraft and military hardware, which are notoriously volatile month-to-month. If you strip those out, you get a category called “core capital goods.” Here, we get a modest drop of 0.1%. Unfortunately, Wall Street economists were counting on a 0.2% increase. Worse, the September number was revised from a 0.5% gain… to 0.2% loss.

![]() IRS Nightmare Postponed

IRS Nightmare Postponed

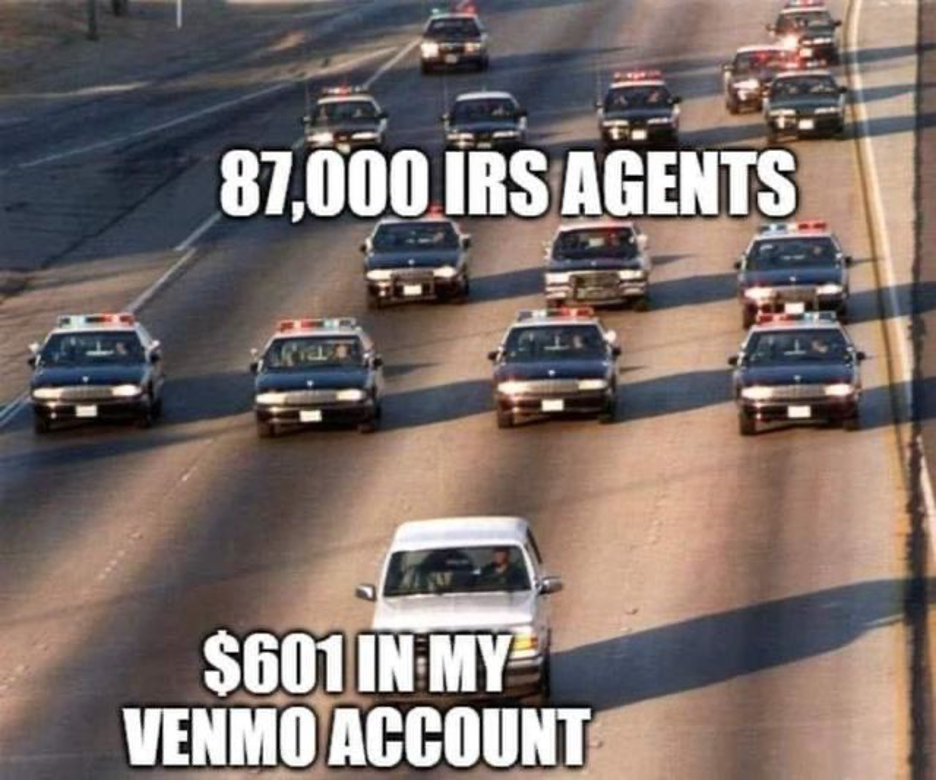

Once more, the worst change to the tax code enacted during the Biden administration is being postponed.

Once more, the worst change to the tax code enacted during the Biden administration is being postponed.

Under the spend-a-palooza American Rescue Plan Act of 2021, there was a sly grab for more revenue: Third-party payment networks like PayPal and Venmo would have to start sending you — and the IRS — a Form 1099-K for transactions totaling as little as $600 a year. The previous reporting threshold was $20,000.

The aim is to capture more unreported business income. But the practical effect is a new paperwork nightmare for tens of millions of Americans — eBay sellers, part-time Uber drivers, small-time Airbnb owners and anyone with a Venmo account, even if the money coming in isn’t taxable income.

“These forms pose a potential challenge for people selling goods or performing services online because the numbers that taxpayers get don’t translate neatly onto their tax returns,” reports The Wall Street Journal. “For example, online sellers can subtract their costs before calculating income. Some transactions, such as selling used clothing at a loss, might be reported on Form 1099-K even though they aren’t taxable.”

Apparently it won’t be a headache just for taxpayers, but for the IRS as well. The Government Accountability Office projects that if enforcement went ahead as scheduled, the IRS would be inundated with 44 million 1099-Ks early next year — three times as many as this year.

Yesterday, the IRS acknowledged it can’t possibly process all of that — not when it’s still backed up with returns from tax year 2022.

As a result, enforcement — already delayed a year ago by 12 months — has been pushed back another 12 months. The reporting requirement won’t kick in until tax year 2024 — and even then, the reporting threshold will be $5,000, not $600.

Congress could fix this if it wanted — there’s a bipartisan proposal to raise the threshold to $10,000 — but as was the case a year ago, we’re not holding our breath.

![]() Jeffrey Epstein… and JPM

Jeffrey Epstein… and JPM

A follow-up to yesterday’s edition — specifically about Jeffrey Epstein and his relationship with the biggest bank in the country.

A follow-up to yesterday’s edition — specifically about Jeffrey Epstein and his relationship with the biggest bank in the country.

(By the way, we got a lot of feedback — which we’ll start to share in today’s Bullet No. 5.)

I was writing in a sort of “white heat”... and with a word count already spiraling out of control… I completely forgot about Epstein’s lengthy relationship with JPMorgan Chase.

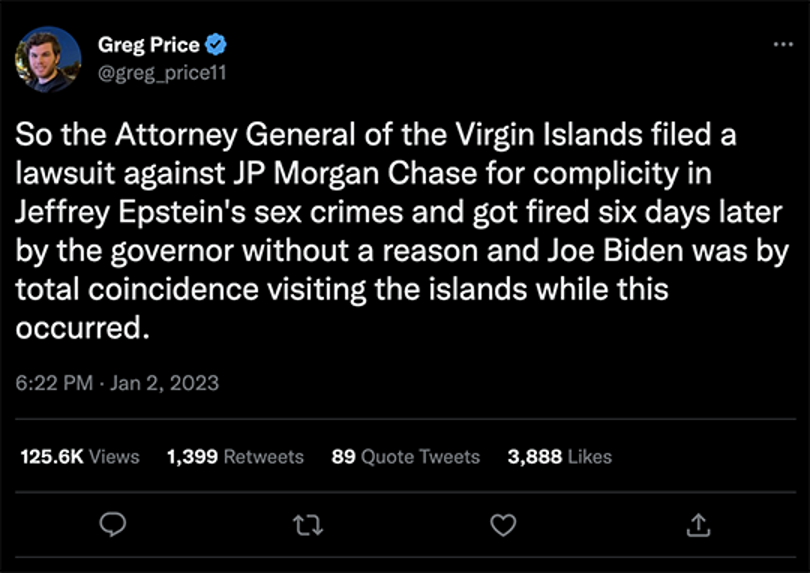

Last June, JPM settled out of court with Jeffrey Epstein’s accusers for $290 million. Their lawsuit claimed JPM routinely looked the other way when it came to Epstein’s sex trafficking because of all the wealthy new clients he kept bringing in.

A separate lawsuit brought against JPM by the government of the Virgin Islands was set to go to trial in October. But before that could happen, that suit was also settled — for $75 million. JPM admitted no wrongdoing, saying only it “deeply regrets” its 15-year relationship with Epstein.

The pittance of a settlement — about 0.18% of JPM’s quarterly revenue — was shocking in light of documents submitted by the Virgin Islands government pre-trial.

Those documents alleged that JPM “actively participated in Epstein’s sex-trafficking venture from 2006–2019.”

Those documents alleged that JPM “actively participated in Epstein’s sex-trafficking venture from 2006–2019.”

Which is even more outrageous than it sounds, because JPM supposedly dumped Epstein as a client in 2013.

The documents also revealed huge wads of physical cash changing hands — up to $80,000 a pop, several times a month, while the bank was well aware that Epstein paid off his victims in cash. Over a 10-year period, JPM handled more than $5 million in outgoing cash transactions.

It’s safe to say that in the process, the bank was skirting the federal requirement to report all cash transactions over $10,000 to the U.S. Treasury.

And then there’s this, from earlier in the year — which I stumbled across this morning while looking for something I’d written previously about the $600 IRS reporting requirement…

If true, then the fix was in from the beginning, no?

![]() From JFK to Jeffrey Epstein: Readers Write

From JFK to Jeffrey Epstein: Readers Write

On this 60th anniversary of the JFK assassination, our remembrance yesterday — along with related musings about Epstein, COVID and military recruitment — brought a flood of responses…

On this 60th anniversary of the JFK assassination, our remembrance yesterday — along with related musings about Epstein, COVID and military recruitment — brought a flood of responses…

“Thanks for putting into words what I've long known but didn't have the words for,” says one. “Much appreciation.”

“Very good article, Dave,” says another. “Thanks — I agree with you 100%!”

“You consistently put out interesting and cogent material,” adds a third, “but this email was one of THE BEST. What are we (not) teaching in schools, for chrissakes?! Critical thought, history, you name it. Thanks again, and Happy Thanksgiving.”

“Next to your letter about censorship this was the best I ever received,” writes a fourth. “And I fully agree with your viewpoints.

“Next to your letter about censorship this was the best I ever received,” writes a fourth. “And I fully agree with your viewpoints.

“Of course the Epstein videos won't be released, because they are a good tool to control the elite. And for that reason the trafficking will continue and leaders will comply in the future. So no prosecutors will go after the truth.

“We need someone independent like Julian Assange, who paid a dear price, to blow up the trafficking and expose the people involved. I can only hope this will happen in the future.”

“The details around the Epstein ‘suicide’ stink to high heaven, but the murder/assassination of Oswald by Jack Ruby less than 48 hours after Kennedy's assassination, and before Oswald was able to talk to anyone who might report what he said, also stinks to high heaven,” writes a member of our Omega Wealth Circle.

“The details around the Epstein ‘suicide’ stink to high heaven, but the murder/assassination of Oswald by Jack Ruby less than 48 hours after Kennedy's assassination, and before Oswald was able to talk to anyone who might report what he said, also stinks to high heaven,” writes a member of our Omega Wealth Circle.

“That Ruby was also dying of cancer, and shortly after shuffled off his mortal coil as well, so that he likewise was unavailable for cross-examination, well, it does give the impression of puppet masters desperately (but so far successfully) covering their tracks.

“I could say more, but I would rather focus on my blessings this week. Gratitude brings much more happiness than dwelling on the evils in the world. I'll save that for next week. Happy Thanksgiving!”

“Another great one!!” says our final correspondent — but he noticed something odd at the very bottom of the issue — where it said, ‘I think this is correct but the info’s a little hazy.’

“Another great one!!” says our final correspondent — but he noticed something odd at the very bottom of the issue — where it said, ‘I think this is correct but the info’s a little hazy.’

“Can you specify what is hazy?” the reader inquires. “I am thinking of assigning this to my class.”

Dave responds: LOL. Somehow a comment appended to the Word doc of yesterday’s issue ended up in the public text of the email. I didn’t catch it. Alas, Emily caught it moments after it was already out in the ether.

The “hazy” comment was from our ace copy editor — a fellow with an old-school journalism background like me. At issue was Jeffrey Epstein’s age at the time he was hired by Donald Barr to teach math at the Dalton School. Was he 19 or 21? Well, the available info is indeed a little “hazy” — we settled on 21.

Anyway, you now have an accidental glimpse into our devotion to accuracy. I have no idea what sort of class you want to share this content with, but have at it!

Happy Thanksgiving,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. “I am requesting permission to share yesterday’s 5 Bullets: From JFK to Jeffrey Epstein on my Facebook page,” writes one of our longtimers. “It was epic and needs to be shared as widely as possible.”

By all means, share away. You’re welcome to do so with any 5 Bullets edition.

P.P.S. We had a couple of other longer responses to yesterday’s edition, but the limitations of space are such that we’ll hang onto them for next Monday.

In the meantime, we’re switching things up for the holiday weekend. Starting tomorrow and continuing through Saturday, we have some never-before-seen video content to share with you.

During our Paradigm Shift Summit in Las Vegas last month, colleague Sean Ring of Rude Awakening fame had cameras rolling as he recorded some “backstage” interviews with all the speakers.

They’re quick and punchy, but still packed with worthwhile information. We’ll share two each day — starting tomorrow with Jim Rickards and James Altucher. The weekday edition of 5 Bullets returns on Monday.