“Just Make the Pain Stop”

![]() “Make the Pain Go Away”

“Make the Pain Go Away”

If you’re a normal human who has normal human reactions… it’s hard to be a buy-and-hold investor and hang on for dear life with chart action like this…

If you’re a normal human who has normal human reactions… it’s hard to be a buy-and-hold investor and hang on for dear life with chart action like this…

That’s a screengrab from Yahoo Finance. I’m not going to tell you what company this is just yet. Right now, that’s not the point.

The point is that yes, it’s up 353% in five years — but look at that brutal sell-off from the early 2021 peak and how long the price took to stage a comeback.

For that matter, look at the brutal sell-off from the early 2025 peak. The comeback was much quicker this time, but then look what happened…

Yes, you could have bought this company five years ago… persevered through thick and thin… and you’d be sitting pretty today.

But it would take veins of ice and nerves of steel to hang on through this sort of volatility.

But it would take veins of ice and nerves of steel to hang on through this sort of volatility.

For most of us, the pain of those sell-offs would be so extreme that we’d reach a capitulation moment. I don’t care how much money I’ve lost — just make the pain stop. SELL!

(Have you been there at one time or another during your experience with investing? Be honest…)

Now… imagine if you had a tool that guided you to buy shares of this company at the very moment it was about to make one of those vertical leaps.

OK, hold that thought…

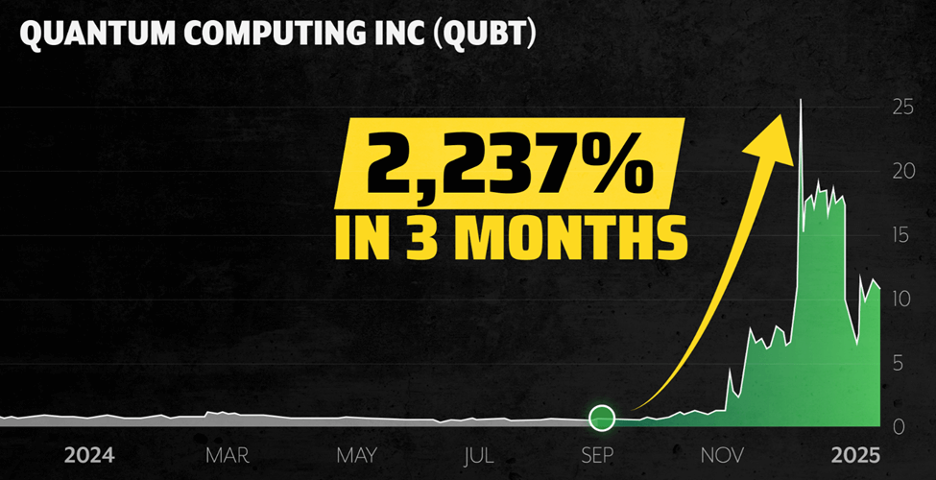

No more suspense. The company in question here is Quantum Computing Inc. (QUBT).

No more suspense. The company in question here is Quantum Computing Inc. (QUBT).

As the name suggests, the company operates in the cutting-edge field of quantum computing — computing so powerful it blows away the most sophisticated supercomputers currently in use.

If quantum physics blows your mind — the idea that, say, a particle can be in two places at once — quantum computing is much the same. Rather than bits of 0s and 1s, the building block of quantum computing is qubits that can be 0 and 1 at the same time.

Paradigm’s AI-and-crypto authority James Altucher described quantum computing like this in our March 31 edition: “These machines aren’t faster. They’re something else entirely. Parallel universes of processing. Trillions of times more powerful than what we’re used to.

Paradigm’s AI-and-crypto authority James Altucher described quantum computing like this in our March 31 edition: “These machines aren’t faster. They’re something else entirely. Parallel universes of processing. Trillions of times more powerful than what we’re used to.

“That kind of power doesn’t just move the needle — it breaks the gauge.

“Suddenly, medicine gets rewritten. Financial systems evolve. Cybersecurity gets disrupted. Disease detection. Protein modeling. Military defense. Material science. All of it.”

But it’s still very early days for quantum computing. It could be years before we hear about someone putting it to use to solve everyday problems on a regular basis.

Until then, quantum stocks are a trading vehicle. Not something you buy and hold and pass on to your grandkids. They’ll soar with hypey headlines and social-media scuttlebutt… only to crash back to earth when the herd moves on to the next shiny object.

Again, the question: What if you had a method to pinpoint the very moment before QUBT shares made one of those vertical leaps?

Again, the question: What if you had a method to pinpoint the very moment before QUBT shares made one of those vertical leaps?

Yesterday during a special Paradigm event, we uncloaked the gentleman we’ve taken to calling “Mr. 10X” around here — because he’s demonstrated an uncanny knack to identify trades that generate 10X gains.

He’s Chris Cimorelli. If you subscribe to James Altucher’s Microcap Millionaire advisory, you’re already familiar with Chris’ role as that publication’s analyst — and his winning ways since the service’s launch in summer 2024.

But as it turns out, he had a side hustle — using his own portfolio as a guinea pig, testing and refining a method to pinpoint consistent 10X winners.

The results were stunning — 18 trades generating “ten bagger” gains or better, all in the space of 12 months.

And that includes the aforementioned QUBT.

“I ended up closing it out for a 2,237% gain in three months,” he recalls. “This was on the share price alone. I didn’t do this with options.

“But I haven’t just done this with stocks like QUBT,” he adds. “I have also closed out more than a dozen options wins of 1,000% or more.

“The point is — I’ve created a strategy that lets me do it with stocks, and options.”

His system — he’s dubbed it “The 10X Code” — is ready for prime time. Ready for folks like you to put to work.

And there’s no better time to get started than right now. Because Chris sees a major market event coming tomorrow that will send three specific trades soaring 1,000% or better.

Watch Chris’ debriefing with Paradigm publisher Matt Insley and VP Doug Hill right here. Do it now… because after tomorrow the profit train will have already left the station.

![]() The Real Story About Gold and 1979

The Real Story About Gold and 1979

Talk about a misleading headline…

Talk about a misleading headline…

“Gold’s value has ballooned by 40% this year,” says this morning’s Wall Street Journal — “putting it on track for a greater annual price jump than during the depths of the COVID-19 pandemic or 2007–09 recession, according to Dow Jones Market Data.

“Futures for the precious metal haven’t surged so much in a year since 1979, when a global energy crisis fueled an inflationary shock that thrashed the world’s economy.”

That’s not wrong… but it doesn’t tell the whole story.

The whole story is that the gold price more than doubled in less than five months.

We’ve recounted the history before, but in brief: When the Iran hostage crisis broke out in November 1979 and Jimmy Carter froze Iranian assets, many wealthy people around the world — particularly in the Middle East — began to wonder if they might be next in line. The panic accelerated the following month when the Soviets invaded Afghanistan and Carter responded with a grain embargo.

Hot money flooded out of the dollar and into Swiss francs, West German marks and especially gold. Gold’s price in dollars more than doubled in four months to a then-record $800 in January 1980.

We’ve seen a similar panic since early 2022 — only this time it’s unfolding in slow motion.

We’ve seen a similar panic since early 2022 — only this time it’s unfolding in slow motion.

After Russia invaded Ukraine and Joe Biden froze the dollar-based assets of Russia’s central bank… the “de-dollarization” movement took off among the BRICS countries and the Global South in general.

Worldwide, central bank purchases of gold set a record in 2022 — and the buying has continued at a furious pace ever since. Not coincidentally, the dollar price of gold has more than doubled from $1,800 at the time of the Russian invasion to record territory this morning at $3,679.

And while this year’s furious price action might be due for a rest soon, we’re nowhere near the top now.

Smart and out-of-the-box thinkers like Paradigm’s own Jim Rickards were first to anticipate the big 2022–2025 jump. Only now are mainstream institutional investors realizing they’re “underweight” the Midas metal relative to other asset classes.

And everyday retail investors? Right now they’re still selling old gold jewelry to raise cash. The top will arrive when those folks start buying gold hand-over-fist and Costco will limit its gold bar purchases to something like one per member every month. (Right now it’s four per member in 24 hours.)

If you already have all the gold you need — Jim Rickards recommends 10% of your investable assets — we’ll remind you silver still hasn’t equaled its 2011 and 1980 peaks.

If you already have all the gold you need — Jim Rickards recommends 10% of your investable assets — we’ll remind you silver still hasn’t equaled its 2011 and 1980 peaks.

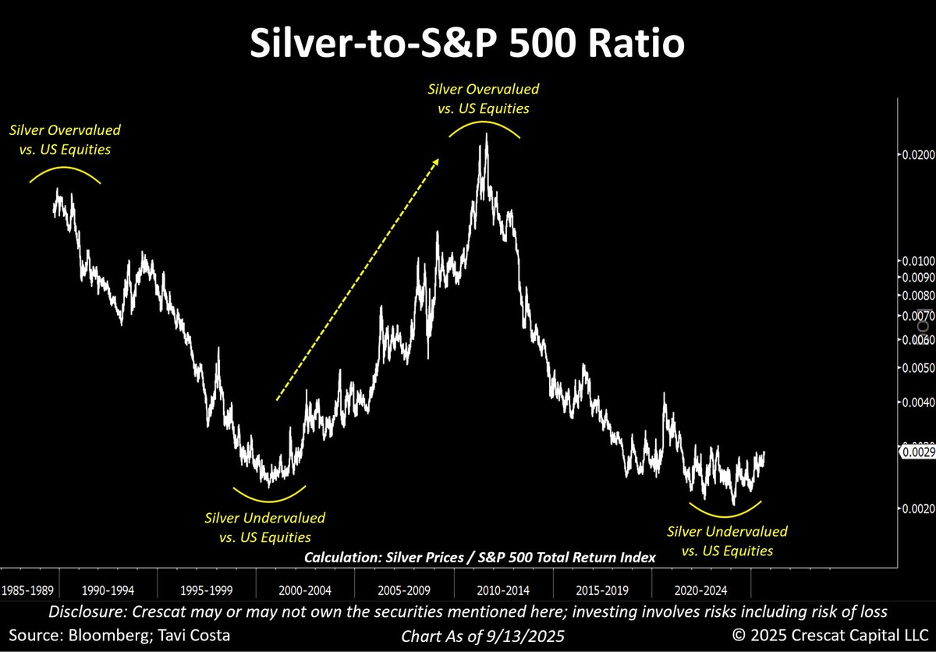

Here’s a chart posted on X from Otavio Costa of Crescat Capital…

Relative to the stock market, silver hasn’t been this cheap since the turn of the century — just as the dot-com bubble was bursting.

From less than $6 an ounce, it soared to $50 in the spring of 2011.

By that standard, today’s price of $42.42 is still dirt-cheap.

Meanwhile, the stock market is catching its breath after both the S&P 500 and the Nasdaq notched record closes yesterday.

Meanwhile, the stock market is catching its breath after both the S&P 500 and the Nasdaq notched record closes yesterday.

The S&P 500 is down marginally but still holding the line on 6,600. Ditto for the Nasdaq, still comfortably above 22,300. Congratulations to Rickards’ Insider Intel readers who bagged 84% gains yesterday playing call options on the copper-mining giant Freeport-McMoRan.

Crude continues to rally this week, up another buck at last check to $64.33.

For once, crypto is like watching paint dry — Bitcoin just over $115,000 and Ethereum at $4,438.

![]() What if Rate Cuts Backfire?

What if Rate Cuts Backfire?

What if rate cuts don’t have the desired effect?

What if rate cuts don’t have the desired effect?

The Federal Reserve is huddling in Washington, D.C. today — about to make its next big call on interest rates tomorrow.

These days, the Fed never drops surprises: Come tomorrow at 2:00 p.m. EDT, the Fed will announce its first cut in the benchmark fed funds rate since last December — from 4.5% to 4.25%.

And in all likelihood, two more cuts are on the way before yearend.

Everyone from Donald Trump to Wall Street bigwigs to CNBC talking heads makes an assumption: When the Fed cuts short-term interest rates, longer-term rates will fall in sympathy. The yield on a 10-year Treasury note will come down first… then mortgage rates… then rates for companies to borrow…

Except that’s not what happened last year.

Except that’s not what happened last year.

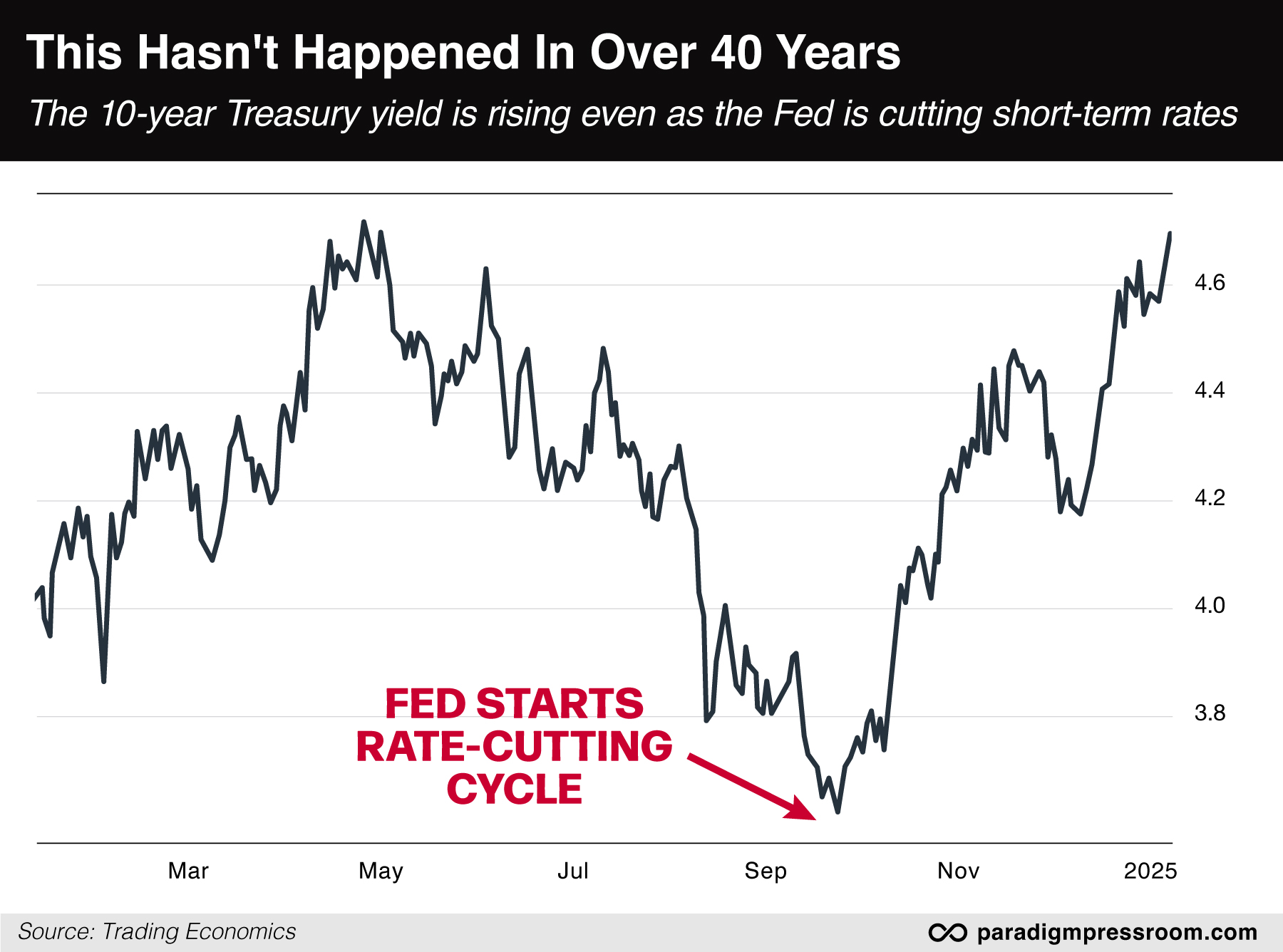

For the first time in over 40 years, longer-term rates rose when the Fed embarked on a rate-cutting cycle.

In fact, the yield on a 10-year U.S. Treasury note started rising the exact day the Fed started cutting rates on Sept. 18, 2024. Here’s a chart we published in our Jan. 7, 2025 edition…

That was the market issuing a no-confidence vote that the federal government would ever get a handle on the national debt, no matter who won the election: “80% of the increase in long rates since September has potentially been driven by worries about fiscal policy,” Apollo Global Management’s Torsten Slok told Bloomberg.

True, the 10-year yield has climbed down since, hovering just over 4.0% today. But that’s still higher than it was a year ago at this time, despite the Fed slashing short-term rates from 5.5% to 4.5% in a short span of three months.

What does it all mean? How does the story end?

In 18th-century France, it ended in bankruptcy and bloodshed — a story colleague Sean Ring recounts well in today’s edition of our sister e-letter The Rude Awakening. Read and think…

![]() Comic Relief

Comic Relief

This one speaks for itself…

This one speaks for itself…

![]() Mailbag: More About DST

Mailbag: More About DST

“I see no ‘compelling case’ for year-round daylight saving time,” a reader writes after seeing the mailbag in yesterday’s edition.

“I see no ‘compelling case’ for year-round daylight saving time,” a reader writes after seeing the mailbag in yesterday’s edition.

“Andy Woodruff’s map proves that getting rid of DST altogether is the least-worst solution. So did all the countries that tried year-round DST and got rid of it as fast as they could.

“Your reader points out a business ‘boom.’ People spend more while it’s light, they think, which is why retail has been behind every DST push. The supposed power savings have been disproved; DST disrupts the normal circadian rhythm, which prefers earlier morning light exposure; and then there are those clinical journal statistics about increased car wrecks and heart attacks, as well as increased depression.

“Anyway, I’m in Arizona. It’s 115 degrees in the summer. Who the heck wants a LONGER day here? As someone would have said, c'mon. man!

“Your reader’s personal data point (based on his increased business) fails in light of the studies and statistics against DST… not to mention the rejection of it each time it’s been tried year-round.

“Thanks for all your hard work.”

Go figure, another Arizonan weighs in — relevant because most of the state ignores DST. It’s in sync with Denver in the winter and LA in the summer.

Go figure, another Arizonan weighs in — relevant because most of the state ignores DST. It’s in sync with Denver in the winter and LA in the summer.

“If you want to get a different view of ‘daylight’ try interviewing American submarine sailors,” he writes. “No sunlight at all, 24/7 for months at a time.

“My experience serving in subs was this. The quartermaster always knew the exact time of local sunset no matter where we were. At that time the lighting in the operations areas was switched to red. The idea was that if the sub had to surface in the dark, the watchstanders' eyes would already be adjusted to night vision. This red light/white light cycle had no relation to the watch rotation, six hours on, 12 hours off.

“To make matters even more strange, all Navy ships at sea are on the same ZULU time (GMT for landlubbers), so local sunrise might be at 0100 (1:00 a.m.). All this became routine for the continuous months submerged. Ask a submariner about DST for their opinion.”

“So why not just follow China's example, and put the whole country in the same time zone?” writes our final correspondent.

“So why not just follow China's example, and put the whole country in the same time zone?” writes our final correspondent.

“Make adjustments locally so that schools start at a reasonable hour, according to local light conditions, and the same for other workplaces. If Eastern time is selected, then on the West Coast they would start their schools around 11:00 a.m. and end them at a corresponding hour.

“Hawaii and Alaska would be even further off from what is considered a normal 8:00 a.m.–5:00 p.m. schedule, but those are just numbers on a clock if we still live in sync with local daylight and dark hours.

“And this would also eliminate the confusion about changing time zones as we move around the country.”

Dave: Hmmm… I’ve been long aware the entirety of mainland China is in the same time zone, but I never really thought through the logistics.

According to Wikipedia, about 94% of the country lives east of something called the “Heihe-Tengchong Line” — as depicted on this public-domain map. So there aren’t a whole lot of people contending with sunrise at 10:30 a.m. anyway…

America’s population isn’t nearly as concentrated — a little fewer than half living in the Eastern time zone and another 30% or so in Central.

All interesting food for thought. Thanks to everyone for keeping the mailbag lively in recent days — and it’s not even time change yet!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets