911,000 Jobs Erased ✏️

![]() 911,000 Jobs Erased

911,000 Jobs Erased

Another year, another massive reset to the government job numbers.

Another year, another massive reset to the government job numbers.

This morning the wonks at the Bureau of Labor Statistics issued their annual “benchmark” revisions to the market-moving job numbers it releases on the first Friday of each month.

No one gave a hoot about these revisions until last year — when the BLS subtracted 818,000 jobs for the period April 2023–March 2024. In other words, “job creation” that had been advertised at a blistering pace of 242,000 per month was actually more like 174,000.

The timing of the revisions last year was just as consequential as the numbers themselves.

The timing of the revisions last year was just as consequential as the numbers themselves.

For one thing, a presidential election was only months away. Republicans accused the Biden administration of cooking the books to generate sunny headlines every month — only to quietly release the “real” numbers later in hopes that Democrats would hold onto the White House.

(Plausible? Absolutely. Evidence? None yet.)

For another thing, a Federal Reserve meeting was only weeks away. Arguably, the extreme revisions gave the Fed cover to cut the fed funds rate by a half percentage point — a super-sized cut that, once again, Republicans argued was being done to shore up the Democrats’ election prospects.

So here we are today with this year’s model of the revisions.

So here we are today with this year’s model of the revisions.

The BLS subtracted an even bigger number of jobs — 911,000 for the period April 2024–March 2025.

In other words, “job creation” that had been advertised at a meager pace of 147,000 a month was actually a pitiful 71,000.

The Trump White House cast doubt on the numbers even before their release: “I’m not sure what these people who collect the data have been doing,” said Treasury Secretary Scott Bessent.

Why is the administration so defensive? The revisions cover only the first 10 weeks or so of the Trump 47 presidency. Besides, Trump fired the head of the BLS last month after the July job numbers were disappointing. (The new head of the BLS awaits Senate confirmation.)

Part of the problem is for whatever reason, businesses don’t respond to BLS surveys in the numbers they did pre-pandemic. Or they respond weeks or months after the fact, and then the statisticians have to go back and adjust.

In any event, next year’s revisions will be especially interesting. As mentioned in yesterday’s edition, the U.S. border has been effectively closed since spring — on the heels of an enormous influx of migrants starting in 2021. The U.S. economy might not need as many “new jobs” each month as previously thought.

Anyway, this year’s revisions come only eight days before the Federal Reserve makes its next call on interest rates.

Anyway, this year’s revisions come only eight days before the Federal Reserve makes its next call on interest rates.

Looking at the futures markets this morning, traders are not pricing in a super-sized cut this time. There’s only an 8% probability.

But a quarter-percentage point cut is in the bag: There’s a 92% probability the Fed will trim the fed funds rate from 4.5% to 4.25%.

Conceivably those odds will change again before the end of the week: Thursday brings the official inflation numbers — also from the BLS.

One more note about the job market before we move on: In small-business America, good help is still hard to find.

One more note about the job market before we move on: In small-business America, good help is still hard to find.

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. The headline optimism number for August rings in at 100.8. That’s four-straight months above the index’s long-term average — and we do mean long term because the NFIB has conducted this survey since 1973.

“Optimism increased slightly in August,” says NFIB chief economist Bill Dunkelberg — “with more owners reporting stronger sales expectations and improved earnings. While owners have cited an improvement in overall business health, labor quality remained the top issue on Main Street.”

Yes. The NFIB survey includes a section where owners are asked to identify their single most important problem. “Quality of labor” came out on top, cited by 21% of respondents. Good help is still hard to find even though the “Great Resignation” of 2021–22 is now a distant memory. Unfilled openings were especially plentiful last month in construction, manufacturing and transportation.

Taxes came in second place, cited by 17% of respondents as their single most important problem. Inflation was cited by 11% and poor sales by 10%. By recent standards, “poor sales” has been elevated for four straight months.

![]() The Newest and Best Backdoor to SpaceX

The Newest and Best Backdoor to SpaceX

The down-on-its-heels company best known for launching the Dish Network satellite TV service in the 1990s is suddenly “the most exciting stock in the market,” says colleague Davis Wilson at our sister e-letter The Million Mission.

The down-on-its-heels company best known for launching the Dish Network satellite TV service in the 1990s is suddenly “the most exciting stock in the market,” says colleague Davis Wilson at our sister e-letter The Million Mission.

EchoStar Corp. (SATS) announced a massive deal yesterday: SpaceX will pay the company $17 billion for valuable wireless spectrum that SpaceX needs to build out its Starlink satellite broadband service.

SATS will collect $8.5 billion in cash… and $8.5 billion in SpaceX equity.

That’s $8.5 billion in SpaceX ownership… for a company whose market cap before this announcement was $22 billion.

Are you putting two and two together?

This announcement “instantly makes EchoStar the newest — and arguably the best — way for investors to get exposure to SpaceX stock without waiting for an IPO,” says Davis.

This announcement “instantly makes EchoStar the newest — and arguably the best — way for investors to get exposure to SpaceX stock without waiting for an IPO,” says Davis.

“With EchoStar’s market cap sitting around $22 billion, nearly 40% of its value could soon be tied directly to Elon Musk’s rocket company.”

SATS stock is a way better means to get exposure to SpaceX than the ETFs that include SpaceX in their holdings. (One trades at a ridiculous 4x multiple to net asset value; the other holds only 7% of its assets in SpaceX.)

EchoStar’s deal with SpaceX comes on the heels of another deal with AT&T — which is paying the company $23 billion for another slice of wireless spectrum.

“For a company with roughly $27 billion in debt, these back-to-back deals are transformative,” Davis writes. “The cash infusion helps clean up EchoStar’s balance sheet while the SpaceX equity gives it a long-term growth engine.

“In one stroke, management took EchoStar from a heavily leveraged satellite operator with big question marks to a company holding one of the most coveted private assets in the world.”

Yes, EchoStar still has much to prove. Its core business “has struggled with declining growth and stiff competition,” Davis acknowledges.

But if SpaceX continues to deliver, “EchoStar’s position could multiply in value.

“That’s why I view EchoStar as the most exciting stock in the market right now.”

As for the broad market today, there’s little reaction to the job revisions.

As for the broad market today, there’s little reaction to the job revisions.

At 6,493 the S&P 500 has barely budged from yesterday’s close. Likewise the Dow and the Nasdaq haven’t moved more than a tenth of a percent. But there’s no joy in small-cap land, the Russell 2000 down 1%.

Crude popped over a buck to $63.34 amid new tensions in the Middle East: Israel fired missiles on the Gulf sheikdom of Qatar — where Hamas negotiators were staying amid on-again, off-again ceasefire talks. (Guess they’re off again…)

Not much action among the major cryptos — Bitcoin under $112,000 and Ethereum at $4,300.

Meanwhile, gold is consolidating yesterday’s big gain at $3,643 — but silver has slipped back under $41. Once more, precious metals have delivered profits to a slice of our readership: Pro-level subscribers to Rickards’ Strategic Intelligence bagged 260% gains yesterday playing calls on GDX, the big gold-miner ETF.

We’ll stay with precious metals for Bullet No. 3…

![]() The Gold Tax

The Gold Tax

“The government doesn’t want you invested in gold, because that ties up your money,” writes author and former investment banker Carol Roth at Fox Business.

“The government doesn’t want you invested in gold, because that ties up your money,” writes author and former investment banker Carol Roth at Fox Business.

“It means you don’t loan it to the government. It means you don’t invest in stocks that you may trade in and out of and generate more taxable profits to add to government revenues. They want your money flowing through the economy in a way where they can extract benefits for themselves. Choosing gold over the long-term means they don’t benefit.”

And so the government imposes a powerful disincentive to own precious metals. Longtime owners of precious metals already know about it; neophytes are only now starting to learn about it.

“Precious metals, including gold, are characterized by the IRS as collectibles,” Roth writes. “The same goes for exchange-traded funds (ETFs) that are physically backed by gold or other precious metals.”

Capital gains on collectibles face a top tax rate of 28% — substantially more than the 20% rate you pay on the gains from stocks held longer than one year.

“The U.S. government and the Federal Reserve have been cavalier about your money — derelict in their duty to protect the value of the dollar, which means protecting the purchasing power of the money you have earned,” Ms. Roth reminds us.

“If you want to try to neutralize that impact by holding some gold or silver, you shouldn’t be punished when you want to use that alternative money for a purchase, for example. You certainly should not receive a penalty that exceeds that of stock gains.”

Alas, there’s no movement on Capitol Hill to equalize the tax treatment — and no push from the direction of the White House, either. Nonetheless, it’s “bad policy whose time has come for an update.”

There’s an important proviso that Roth does not mention: The collectibles tax does not apply if you hold gold in a tax-advantaged retirement account like an IRA or 401(k). All your gains accrue tax-free until withdrawal.

That’s the good news. The bad news is that no matter what you’re invested in, your withdrawals are taxed as ordinary income!

![]() Comic Relief: Workplace Edition

Comic Relief: Workplace Edition

We can’t vouch for the authenticity of this signage, but we share it anyway…

We can’t vouch for the authenticity of this signage, but we share it anyway…

![]() Mailbag: About That White House Dinner…

Mailbag: About That White House Dinner…

We got a lengthy if heartfelt plea from a reader. We have to truncate it for space.

We got a lengthy if heartfelt plea from a reader. We have to truncate it for space.

“America’s slide into dystopia is accelerating. Watching the wealthiest and most powerful tech leaders groveling before Trump and Melania at last week’s White House dinner floored me.

“We’re not surprised when sycophantic cabinet members line up to heap praise and court favor — that’s sadly become expected. But when the titans of industry, people with unimaginable resources and influence, do the same?”

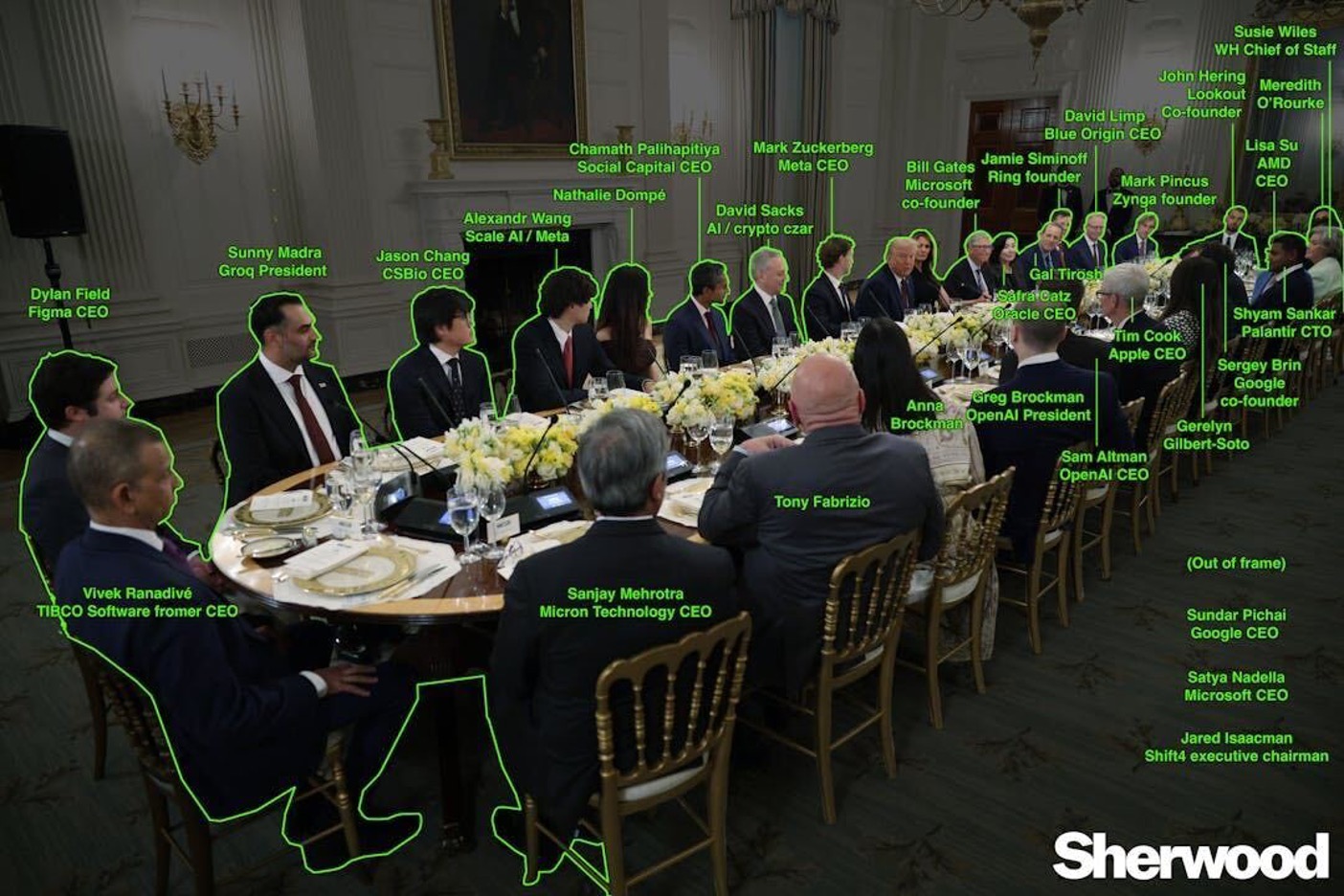

The reader refers to this gathering with Trump and his wife flanked on one side by Mark Zuckerberg and on the other by Bill Gates. The Sherwood news site — an arm of the Robinhood brokerage — put out this helpful annotated guide to who was at the table.

“The signal was clear,” the reader goes on: “profits and access matter more than principle, even for those who can afford to stand on principle.

“I see the same sentiment echoed in the investment advisories I monitor. The consistent refrain is: ‘Never let politics get in the way of profit.’ No matter what Trump does — tariffs, deficits, spending sprees, even dismantling institutions and destroying industries — the advice is always the same: Don’t fight it, profit from it. In other words, get on board, even if the ship is sinking.”

“If integrity is alive anywhere, the story isn’t finished. And the future doesn’t belong to the sycophants and profiteers — it belongs to those with the courage to stand when standing costs the most.

“Please continue to stand.”

Dave responds: Your plea presumes that the people at the table had an ounce of integrity before Trump won a second term.

I refer you to an edition published barely a month into the Trump 47 administration — in which I hit out at OpenAI CEO Sam Altman and Palantir CEO Alex Karp. Both of them aligned with/kowtowed to Democrats when they were in power — only to turn on a dime after Trump’s reelection.

Zuckerberg flip-flopped as well although as I said at the time, I’m willing to give him the benefit of the doubt.

As for the ethics of investing… the problem for us as publishers is that no matter what company or asset class comes under our editors’ microscope, someone will likely have an objection.

If we screen for everyone’s potential objections, we’ll be left with precious little to recommend. So we leave it to readers — and let their consciences be their guide.

Investing is a dicey affair amid any Fourth Turning, such as we’re experiencing now. As long as you recognize no one’s coming to save us, you’re off to a good start!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets