Manic Monday: The Fed Fouled Up

![]() The Fed Broke Something

The Fed Broke Something

There’s a saying about how “The Federal Reserve keeps raising interest rates until they break something” — in the economy, the markets or both.

There’s a saying about how “The Federal Reserve keeps raising interest rates until they break something” — in the economy, the markets or both.

We’ll get to today’s market mayhem soon enough. But to make sense of it, let’s back up just a bit.

For almost all of 2024, the jibber-jabber on Wall Street about how the Fed was going to pull off a “soft landing” — raising rates without wrecking the economy.

The odds the Fed would pull this off were never very high. The Fed has accomplished a soft landing only three times in the post-WWII era, most recently in the mid-1990s.

But the jibber-jabber persisted, well into July. The Nasdaq notched a record close on Wednesday, July 10 and the S&P 500 on Tuesday, July 16.

Last Thursday, August 1, as we chronicled in real time, it’s as if a switch was flipped. Soft landing was out. IMMINENT RECESSION was in.

Last Thursday, August 1, as we chronicled in real time, it’s as if a switch was flipped. Soft landing was out. IMMINENT RECESSION was in.

Of course, “the r-word” has been a thing on social media for a while now…

…but sometimes it takes Wall Street a while to catch up.

Thus began a wicked sell-off, still in progress today. As mentioned on Thursday, the proximate event for the start of this whoosh downward was a pair of punk economic numbers – weekly first-time unemployment claims and the monthly ISM manufacturing index.

The monthly job numbers the next day, Friday, did not help matters — and it’s worth unpacking them in a bit more detail today.

The monthly job numbers the next day, Friday, did not help matters — and it’s worth unpacking them in a bit more detail today.

It’s not just the headline number of only 114,000 new jobs — and the fact it takes 150,000-200,000 each month just to keep up with population growth.

It’s also that the wonks at the Bureau of Labor Statistics created 246,000 jobs out of thin air via a statistical invention called the “birth-death” model.

As we mentioned last month, the BLS relies on surveys of businesses to generate its monthly headline number.

But new businesses are coming into existence all the time; the wonks at the Bureau of Labor Statistics don’t necessarily know how many or where they are. Likewise, if a business doesn’t respond to the survey, it’s possible that’s because the business has gone out of existence.

So the analysts resort to statistical inference via the “birth-death model.”

Alas, the model has an unfortunate habit of underestimating the number of new jobs whenever the economy is coming out of recession… and overestimating the number of new jobs whenever the economy is going into recession.

And the economy is definitely going into recession based on the official unemployment rate rising to 4.3% — triggering something called “the Sahm rule.”

And the economy is definitely going into recession based on the official unemployment rate rising to 4.3% — triggering something called “the Sahm rule.”

Coined by economist Claudia Sahm in 2019, the rule is a little convoluted, but here goes: Take a look at the three-month moving average of the unemployment rate. Any time this number is more than a half percentage point above the lowest three-month moving average from the previous year, a recession soon follows.

Or at least, a recession has followed every time going back to 1970.

We’re there now: The three-month average is 4.13%. The lowest three-month average over the last year was 3.63%.

There’s a variant on the Sahm Rule that’s a little more straightforward: Any time the unemployment rate exceeds its moving average during the previous two years, a recession follows. This too has a flawless record going back to 1970.

And there are still more recessionary vibes from the job numbers, as Paradigm’s Jim Rickards noted for his Situation Report readers on Friday.

And there are still more recessionary vibes from the job numbers, as Paradigm’s Jim Rickards noted for his Situation Report readers on Friday.

“It continues to be the case that many of the ‘jobs’ reported are part-time jobs,” says Jim.

Indeed, the number of people classified by the BLS as “part-time for economic reasons” — that is, they’d like a full-time job but can’t find one — is the highest so far of the post-pandemic recovery.

Meanwhile, “wages rose by 3.4% (annualized and adjusted for reduced hours worked). With headline inflation at 3.0% for the most recent month, real wages scarcely rose at all over the past year.

“With real wages flat and job increases declining, consumers will react by cutting spending, increasing savings, and paying down credit card balances when possible.”

That’s no good for the bulk of companies that depend on the mighty American consumer to spend, spend, spend — even out of an empty pocket.

Long story short, it’s now obvious to everyone the Fed broke something.

Long story short, it’s now obvious to everyone the Fed broke something.

This is what Jim Rickards has been warning about all year even as the Wall Street happy talk fixated on a soft landing.

Now, the Fed is poised to start lowering interest rates, but for all the wrong reasons — not because inflation and the economy are slowing to some sort of happy equilibrium but because the economy is flirting with recession. That will be bad for corporate earnings and bad for stock prices.

This morning, the buzz from both the mainstream and within the Paradigm team’s internal e-chat is that the Fed won’t wait to cut rates until its next regular meeting in mid-September. There will be an “emergency” cut sooner and it won’t be a piddly quarter-percentage point cut either — more likely half, from 5.5% to 5.0%.

But when? Imagine if the Fed cuts this week and then the official inflation numbers out next week run hotter than expected. That’s the worst of all worlds. Then we’re talking 1970s-style “stagflation” in which the economy hits a wall even while the inflation rate stays elevated.

The tell for the Fed’s intentions won’t be in the stock market but rather the credit markets.

The tell for the Fed’s intentions won’t be in the stock market but rather the credit markets.

So says Jim Rickards’ senior analyst Dan Amoss. “The sooner high-yield credit spreads surge, the more urgently Fed Chair Jay Powell will do an emergency cut.”

That is, watch for when the yields blow out on junk bonds — bonds issued by companies whose debt isn’t considered investment-grade. With Powell’s background in private equity, “he still pays close attention to provision of credit to weaker companies getting cut off,” says Dan — “leading to a feedback loop of layoffs and surges in the savings rate.”

For the moment, those yields are still suppressed; fear is not running rampant through the credit markets yet. But there’s an indicator we’ll be watching closely in the days ahead, and we’ll keep you abreast.

And when the time does come for a rate cut, the reaction in the stock market could be violent – to the upside. “A face-ripping rally,” as Sean Ring says in this morning’s Rude Awakening.

All that said, the prospect of recession isn’t the only thing weighing on the markets now. Stand by for Bullet No. 2…

![]() Four More Reasons Mr. Market Is Panicking

Four More Reasons Mr. Market Is Panicking

For one thing, there are events in Japan.

For one thing, there are events in Japan.

Last Thursday, the Bank of Japan delivered a shock by raising its benchmark interest rate from near-zero to 0.25% — in an effort to goose the yen’s value amid rising inflation.

Suddenly, global markets have to adjust to the reality that the “yen carry trade” — borrowing dirt-cheap in Japan and using the proceeds to invest in other countries for a higher return — is no longer a sure thing.

Money has flowed out of Japan to other countries for so long, it seems like an iron law of the universe — as certain as gravity. But no more. Soon, the flows might reverse — with Japan finally attracting capital from other countries.

When so many people position their funds one way… and events start moving another way… things can get hairy, and not always in a predictable way.

This much, however, is certain: Japan’s benchmark Nikkei stock index slid 12.3% today, the biggest one-day drop since 1987.

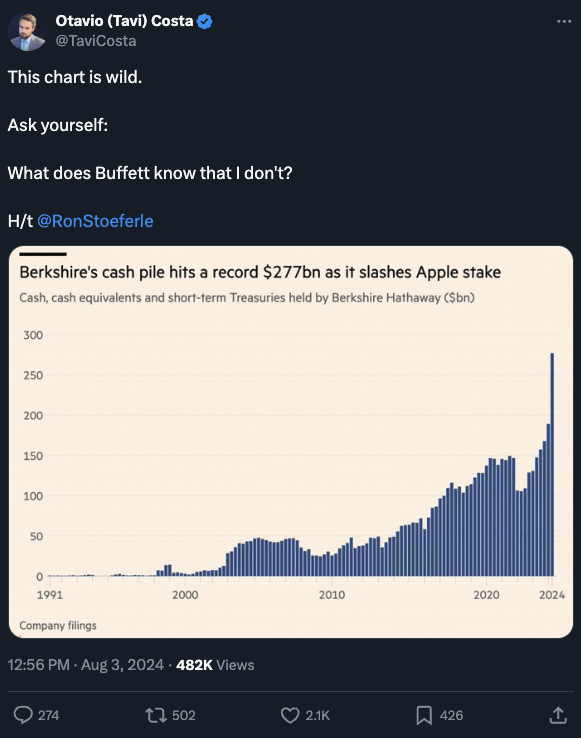

Back home, there’s “the Buffett effect” to consider.

Back home, there’s “the Buffett effect” to consider.

While markets were closed Saturday, Warren Buffett’s Berkshire Hathaway disclosed that it sold off big slugs of stock in the last quarter — including nearly half of its stake in Apple.

To be sure, Buffett has been unloading stocks for nearly two years now. But Berkshire’s cash pile swelled nearly 47% in a single quarter — from $189 billion to $277 billion.

Then there’s the election: If as the saying goes, “markets hate uncertainty,” then markets hate the fact that Donald Trump’s sure-thing victory looks less sure now.

Then there’s the election: If as the saying goes, “markets hate uncertainty,” then markets hate the fact that Donald Trump’s sure-thing victory looks less sure now.

We won’t dwell on this angle today. Jim Rickards says Trump still has the upper hand — but an electoral college landslide is less likely than it was before the Democrats pulled their Biden-Harris switcheroo last month.

The race is tightening in swing states like Wisconsin and North Carolina. “Trump still has a clear path to victory,” Jim says, “but he’ll have to work harder to keep that path open.”

Nor will we dwell on the possibility of the Middle East conflict blowing up into something much bigger than it is now — except to note a glaring disconnect within Washington, D.C.

Nor will we dwell on the possibility of the Middle East conflict blowing up into something much bigger than it is now — except to note a glaring disconnect within Washington, D.C.

After Israel’s twin assassinations last week in Lebanon and Iran, the next move is Iran’s.

![]() Damage Assessment

Damage Assessment

The “face-ripping rally” we mentioned earlier? It’s still days or weeks in the future. For now, it’s the third straight trading day of whoosh.

The “face-ripping rally” we mentioned earlier? It’s still days or weeks in the future. For now, it’s the third straight trading day of whoosh.

We get an earful from readers now and then for our mention of the day’s market numbers, however cursory, when they can be easily looked up on any financial website and be up-to-the-minute.

But a treatment of the numbers is hard to avoid on days like these – and as always we aim to put them in context even if they’re constantly on the move. Here goes…

- At last check, all the major U.S. stock indexes are down at least another 2% on the day. But in the case of the S&P 500, it’s still over 5,200 — a threshold never crossed until this past March. On Friday, the Nasdaq hit “correction” territory — a 10% drop from its most recent peak — and it’s down another 2.75% as we write. As for Dow 40,000? That was so last week…

- Volatility as measured by the VIX — which spent much of this year in the mellow 12-13 range — blew out over 60 this morning. It’s since pulled back to 36

- Bonds are rallying modestly, adding to last week’s gains and pushing yields still lower. The yield on a 10-year Treasury note sits at 3.78%, the lowest since the last week of 2023

- Gold isn’t rallying amid the turbulence but it’s hanging tough — back above $2,400 after a brief dip below that level this morning. Unfortunately, on the cusp of recession silver is acting more like an industrial metal than a precious metal, down $1.32 to $27.24. Speaking of industrial metals, copper is under $4 a pound for the first time since March

- Crude is testing two-month lows at $73.22. For the moment, “global economic slowdown” is trumping “elevated Middle East tensions”

- Bitcoin held its own on Thursday and Friday — comfortably over $60,000 — but it fell gradually over the weekend and suddenly today. For a brief moment it traded below $50,000 for the first time in nearly six months — but it’s since recovered over $54,000.

The one economic number of the day came in as expected — the ISM Services Index suggesting the U.S. services sector is back in growth mode at 51.4. (Any number over 50 suggests expansion.) But the average of the last three months is the weakest since the onset of COVID lockdowns.

![]() Copper and Traffic Cams

Copper and Traffic Cams

From the social media universe, here’s a new one for our ongoing chronicle of copper thefts…

From the social media universe, here’s a new one for our ongoing chronicle of copper thefts…

Near as we can tell, this number isn’t too far off the mark. By one calculation, a speed or red-light camera contains about 4.4 pounds of copper. At $4 a pound, give or take, you’re looking at a modest haul of a little under $18.

But if history is any guide, the real money to be made is from the wiring connecting one camera to another.

In 2006, a Las Vegas TV station reported that copper thieves stole two miles of wires along U.S. 95 – a nearly $1,200 haul. A similar amount was stolen a decade ago along Interstate 95 in Florida near West Palm Beach.

For the record both of those thefts involved traffic-monitoring cameras — the kind that keep an eye on traffic flow and accidents, not moving violations. I mean, if that makes a difference to “who needs to hear this.” Heh…

![]() Two Roads to the Same Outcome

Two Roads to the Same Outcome

After sifting through the reaction to last Thursday’s edition, I got downright depressed.

After sifting through the reaction to last Thursday’s edition, I got downright depressed.

I had hoped to use J.D. Vance’s remarks about “childless cat ladies” as a jumping-off point to explore punitive tax policies… a disturbing control-freak view of government’s role in people’s lives that doesn’t usually come from the right side of the aisle… and what it would take to encourage higher birth rates, which is an issue Vance professes concern about.

Instead, I was treated to a barrage of Why are you beating up on the Republicans?!

A more sophisticated version amounted to Why are you letting the perfect be the enemy of the good?!

The subtext through much of it was Don’t you know what’s at stake in this election?!

Well, yes, I do know what’s at stake. It was encapsulated beautifully over the weekend in a new piece by William Schryver – the military analyst whose pithy tweet about U.S. Middle East policy I shared above.

It’s not a long read, but here are the three key paragraphs…

Donald J. Trump is not destined to be the savior of the American Republic. In the first place, there is no American Republic to save. There is only a rapidly crumbling empire led by clueless fools who cannot see the writing on the wall, and who could not interpret it even if they could.

Trump, if elected, will twist in the ever-changing winds of perceived exigency, and will ultimately be persuaded by his hand-picked entourage of imbeciles to make a series of ill-advised decisions that will lead to a shocking American military defeat and an unprecedented devaluation of the US dollar that will collapse the purchasing power of the overwhelming majority of Americans…

A Kamala Harris presidency will lead to all the same places a Trump presidency would lead, just with more drag queens, rainbow flags, and social upheaval.

No one is coming to save you.

You might wish to organize your life accordingly.

We’re here to help with the investment aspect of that. In light of the current market turbulence, stay tuned to your paid Paradigm Press publication(s) for guidance on specific recommendations. And we’ll be here with these 5 Bullets to try to make sense of the madness…