No “Rug Pulls” for Bitcoin ETFs

![]() Crypto “Rug Pulls”

Crypto “Rug Pulls”

“Rug pulls” have become the scam du jour for fraudsters out to make a quick buck.

“Rug pulls” have become the scam du jour for fraudsters out to make a quick buck.

Cybersecurity expert Brittany Allen explains: “Rug pulls” are “a common type of crypto scam where fraudulent developers lure investors into what appears to be a lucrative new project, then disappear with the funds.”

According to an article at Built In: “Typically, a rug pull begins with the creation of a new cryptocurrency token that gets listed on a decentralized exchange and paired with a coin from a leading platform, such as Ethereum.”

The hype cycle begins — you get the picture — and developers take the money and run, leaving investors with sh*tcoins.

Software engineer Ruadhan O (a pseudonym) adds: “The defining feature of a rug pull is the decision by the developers to abandon the project…

“Sometimes this has been planned from the beginning,” he says, “and sometimes the developers become convinced at a later stage that a project will fail.”

In 2021 alone, for example, scammers made off with a whopping $2.8 billion in rug pulls, robbing investors blind at a clip of $7 million per day.

But crypto’s main event tomorrow will not be a rug pull…

“The first week of the year saw firms looking to launch spot-Bitcoin exchange-traded funds (ETFs) clear a major hurdle,” Bloomberg reports.

“The first week of the year saw firms looking to launch spot-Bitcoin exchange-traded funds (ETFs) clear a major hurdle,” Bloomberg reports.

Securities and Exchange Commission (SEC) officials told several firms to submit final paperwork by Friday, Jan. 5. “The staff had no additional feedback on the paperwork for several of the firms after the latest amendments…

“A flood of these updated documents were posted Friday evening, including for ETFs from BlackRock Inc., Grayscale Investments and others,” Bloomberg notes.

What’s more? “Multiple issuers, including BlackRock and Fidelity, submitted amended S-1 filings to name their authorized participants — broker-dealers responsible for handling the creation and redemption of baskets of shares for ETFs.”

This is a weighty step “because some industry watchers had expressed concerns that Bitcoin funds would have a harder time attracting broker-dealers.”

All of which jibes with what Paradigm's crypto expert Chris Campbell confirmed Friday…

All of which jibes with what Paradigm's crypto expert Chris Campbell confirmed Friday…

- “It looks like the Bitcoin ETF is pretty much a sure thing now,” he said.

- “The SEC’s laid out what they need to see, and the issuers have been scrambling to make it happen.

- “Right now, the SEC’s just taking some time to check everything out and give the official thumbs-up.

“There’s always a teeny-tiny chance the SEC might hit the brakes,” he concedes, “but that seems pretty unlikely.”

[NOTE: BlackRock, Fidelity, VanEck, Invesco and many others are about to launch a new crypto venture as soon as Wednesday, Jan. 10.

“This move by Wall Street will help trigger crypto’s FINAL bull run,” says Paradigm’s millionaire crypto investor James Altucher.

“The biggest gains will NOT come from Bitcoin,” he warns. Instead, James has identified six tiny cryptos that could be 10X or even 100X over the next 12 months.

If you haven’t already, check out James’ interview right away.]

![]() Don’t Be Taken in by Vegas’ Razzle-Dazzle

Don’t Be Taken in by Vegas’ Razzle-Dazzle

“All-sizzle, no-steak stocks may look great at first, but if the companies behind the flashy technology don't make money, they're not likely to be great investments,” says Paradigm’s retirement-and-income specialist Zach Scheidt.

“All-sizzle, no-steak stocks may look great at first, but if the companies behind the flashy technology don't make money, they're not likely to be great investments,” says Paradigm’s retirement-and-income specialist Zach Scheidt.

As we mentioned yesterday, Zach and other members of Team Paradigm are onsite at the Consumer Electronics Show in Las Vegas.

And apropos of sizzle, take a look at an exhibit from 2023’s CES…

Courtesy: Zach Scheidt

Zach: “Cheaper to hire the kid next door to cut your grass?”

After doing some digging on Reddit, Novabot started shipping lawn Roombas to consumers — in limited quantities — sometime last quarter. (See photo: We’d be remiss if we didn’t point out that AI was a hot CES trend last year, too.)

“There was certainly a time and a place for investing in high-growth speculative tech stocks,” Zach notes, “especially when interest rates were low and these [companies] had access to virtually free money.

“The best technology sometimes shows up in unexpected places,” he continues. “Check out one of my favorite displays from last year…

“The best technology sometimes shows up in unexpected places,” he continues. “Check out one of my favorite displays from last year…

Courtesy: Zach Scheidt

“I've visited John Deere's display at CES for years, and I'm always amazed by the satellite imagery, precision planting and tremendous efficiency the company offers to farmers.

“You might not think of the tractor company as a tech powerhouse, but it’s at the cutting edge of designing autonomous equipment that makes a huge difference for customers.

“In a challenging market, there are still plenty of opportunities to invest in tech,” Zach says. “But you have to be able to see beyond the sizzle to find truly worthwhile investments.”

For two years now, American small-business owners have been feeling demoralized.

For two years now, American small-business owners have been feeling demoralized.

The National Federation of Independent Business is out this morning with its Small Business Optimism Index, and the headline number for December sits at 91.9 — stuck for 24 straight months below its 50-year average reading of 98. The survey shows inflation is currently the No. 1 issue preoccupying 23% of survey respondents.

“Small-business owners remain very pessimistic about economic prospects this year,” says NFIB Chief Economist Bill Dunkelberg. “Inflation and labor quality have consistently been a tough complication for small-business owners, and they are not convinced that it will get better in 2024.”

Checking on the market today, the Dow is taking it on the chin. The Big Board is down 155 points to 37,525; meanwhile, the tech-heavy Nasdaq is barely in the green, up 0.10% to 14,860 as the S&P 500 has dropped 0.10% to 4,755.

Turning to the commodities complex, crude is up 2.35% to $72.43 for a barrel of WTI. But precious metals are sending mixed signals: Gold is up about 0.10% to $2,028.30 per ounce; silver is down 0.70%, barely hanging onto $23.

Finally, crypto’s in the red at the moment. Bitcoin’s hovering just under $47,000 and Ethereum is down about 3.7% to $2,260.

![]() Intel Challenges Nvidia for AI Supremacy

Intel Challenges Nvidia for AI Supremacy

“It’s bigger than a bus, weighs 100 tons, contains miles of wiring and is the most complex machine humans have ever made,” says Paradigm’s science-and-tech expert Ray Blanco.

“It’s bigger than a bus, weighs 100 tons, contains miles of wiring and is the most complex machine humans have ever made,” says Paradigm’s science-and-tech expert Ray Blanco.

This machine, designed with thousands of parts sourced from a global network of suppliers, utilizes intense ultraviolet light to etch precise microscopic designs onto silicon chips. And a single unit costs about $300 million.

“It’s ASML Holding’s (ASML) latest chipmaking machine, the EXE:5000,” says Ray, “and the first company to get it is Intel Corp. (INTC).

Courtesy: ASML

“Compared to current EUV systems used by other leading chipmakers, this high-NA EUV machine will be able to etch even smaller transistor features printed on silicon wafers during chip manufacturing,” Ray adds. “That means more powerful computer chips.”

In 2024, ASML plans to manufacture just 10 high-numerical aperture (high-NA) extreme ultraviolet (EUV) lithography systems.

Intel has already secured an order for the first six units that come off the assembly line. “It’s a multibillion-dollar opportunity for Intel,” Ray emphasizes.

Intel has already secured an order for the first six units that come off the assembly line. “It’s a multibillion-dollar opportunity for Intel,” Ray emphasizes.

“In turn, Intel has secured big upfront payments from unnamed future customers eager to access to the company’s upgraded capabilities, which has helped defray part of the enormous expense of retooling manufacturing,” Ray says. “And superior manufacturing isn’t all that’s happening at Intel.

“The company’s upcoming Gaudi3 artificial intelligence accelerator will begin challenging Nvidia’s dominance in the rapidly expanding AI chip market later this year.

“Scheduled to launch in 2024, Gaudi3 will compete with Nvidia’s best AI accelerators. This leapfrogging performance couldn’t come soon enough for data center operators hungry for more powerful AI accelerator chips.

“We’ll see Intel stealing lucrative market share,” Ray notes. “Nvidia currently commands approximately 90% share of the AI training accelerator space. By heavily optimizing Gaudi3 to run AI applications, Intel is taking aim at Nvidia’s current cash cow.”

In fact, since Ray first reported Intel’s “turnaround story” in September 2022, shares are up 56%. “Intel is back in the game now…

“Accelerator shortages are rampant in the AI space, and Nvidia is exerting near monopoly pricing power. This year, Intel will begin providing an alternative to Nvidia’s offerings.”

Ray’s takeaway: “Gaudi3 couldn’t debut at a better time. Intel is lining up a huge growth engine.”

![]() Your Tax Dollars at Work: 23 “Megadeals” in 2023

Your Tax Dollars at Work: 23 “Megadeals” in 2023

U.S. state governments handed out more than $10 billion in taxpayer funds to private corporations last year, according to a new report from nonpartisan watchdog Good Jobs First.

U.S. state governments handed out more than $10 billion in taxpayer funds to private corporations last year, according to a new report from nonpartisan watchdog Good Jobs First.

For instance, the group identified 23 “megadeals” — defined as subsidy packages worth $50 million or more — across 16 states in 2023.

The most egregious example? Michigan offered Ford a staggering $1.7 billion in subsidies for a project initially slated to create 2,500 jobs. That equates to $680,000 per job promised, representing both the largest deal of 2023 and the highest cost-per-job figure on record. (Ford has since scaled back its expansion plans in Michigan, cutting the job target by nearly a third to 1,700. Of course.)

In the Northwest, Amazon secured $1 billion in property-tax exemptions from the state of Oregon for unspecified data center expansions, estimated to require just 10 total jobs to qualify for the state subsidy.

But proponents, including Michigan’s Gov. Gretchen Whitmer, argue multiplier effects lead to further economic growth; however, even optimistic projections of four additional jobs per one subsidized job would fail to justify the immense costs for taxpayers.

All told, states pledged to create 34,928 direct jobs in exchange for $10.2 billion in taxpayer funds last year. That translates to a subsidy of $262,800 per job, calling into question the value generated from these deals.

All told, states pledged to create 34,928 direct jobs in exchange for $10.2 billion in taxpayer funds last year. That translates to a subsidy of $262,800 per job, calling into question the value generated from these deals.

Still, while 2023 saw substantial totals, Good Jobs First notes this represented a slight cooling from 2022’s record figures as states pulled back on some subsidies for corporations. Unfortunately, companies will continue feeding at the taxpayer trough in 2024 — particularly tech companies and automakers.

States may aim for an advantage over their neighbors, but unchecked bidding wars predominantly benefit the VIPs sitting in corporate boardrooms rather than the average taxpayer.

Just in case you’re not thoroughly convinced Joe Six-Pack gets the shaft from these state giveaways, take a moment to review how the Badger State courted Taiwanese company Foxconn… To no avail.

![]() Americans Put Down Roots in Low-Tax States

Americans Put Down Roots in Low-Tax States

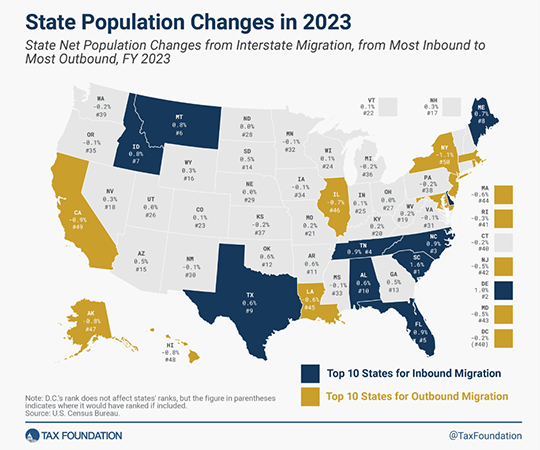

When it comes to interstate migration last year, which U.S. states were population “winners” and “losers”? And why?

When it comes to interstate migration last year, which U.S. states were population “winners” and “losers”? And why?

According to the Tax Foundation, using 2023 data from the Census Bureau, U-Haul and United Van Lines, you can clearly see that state taxes played a decisive role in Americans choosing to relocate from one state to another…

“Though only one component of overall tax burdens, the individual income tax is particularly illustrative here,” Tax Foundation says. “Five jurisdictions — California, Hawaii, New Jersey, New York and the District of Columbia — have double-digit income tax rates.

“States with lower income tax rates — or no income tax at all — have proven highly attractive to interstate movers.”

In 2023, “South Carolina saw the greatest population growth from net domestic inbound migration (1.6%), followed by Delaware (1.0%) and North Carolina, Tennessee and Florida (all 0.9%).

“This population shift paints a clear picture,” the Tax Foundation concludes, “Americans are leaving high-tax, high-cost-of-living states in favor of lower-tax, lower-cost alternatives.”

Emily: Hey, if you’ve bolted from a high-tax state to a tax-friendly jurisdiction, drop us a line. What’s your experience? We welcome your on-the-scene perspective. (And since I’m a Marylander — see map above — I might just live vicariously!)

Take care! Be sure to join us tomorrow for another episode of the 5 Bullets…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets