Privacy Alert

![]() If You Care About Your Privacy, Read This

If You Care About Your Privacy, Read This

We begin the new week with a public service announcement.

We begin the new week with a public service announcement.

If you have an iPhone, and you’ve recently upgraded to iOS 17, there’s a crucial step you might consider taking to protect your privacy.

There’s a new feature called NameDrop… and it’s set to default “on.” Simply by bringing your phone in proximity to someone else’s phone, you can end up sharing all your contact info.

The financial and tech media are taking an oddly devil-may-care approach to this development.

The financial and tech media are taking an oddly devil-may-care approach to this development.

Forbes has a long story pooh-poohing the whole thing: “The NameDrop feature isn’t just going to throw your contact details at any passing person with an iPhone. Not only do the iOS 17 smartphones need to be close to each other, but they need to be so close as to be actually touching, but touching in the right place. Which means the very top of the phone so that near field communication can work.”

And if the feature ends up working by accident, a series of NameDrop options will show up on the screens of both phones before the data is shared. Which is good, but still problematic.

Meanwhile, various law enforcement agencies are going overboard the other way — playing off the whole “stranger danger” thing.

For instance: The Oakland County Sheriff’s Office in suburban Detroit warns, “PARENTS: Don’t forget to change these settings after the update on your children’s phones as well.”

Anyway, discretion is the better part of valor — and privacy.

Anyway, discretion is the better part of valor — and privacy.

The fix here is simple. Go to Settings > General > AirDrop > Bringing Devices Together. Slide the toggle switch off — like this.

![]() If the Recession Is Finally Here, Do This

If the Recession Is Finally Here, Do This

Hmmm…

Hmmm…

The spot price of gold crept further over the $2,000 level this morning, the bid $2,011 at last check. Silver is up nearly 50 cents to $24.80.

The thinking goes like this: If the economy is slipping into recession, that means the Federal Reserve would start mashing the monetary gas pedal by cutting interest rates sooner than previously thought. Inflation would accelerate, and that would benefit gold.

But is the underlying assumption valid? After all, there’s been recession chatter for nearly two years now… and scads of federal stimulus have managed to prop up the economy, kinda sorta, so far.

While many Wall Street types were scurrying to their holiday destinations last Wednesday, an obscure economic measure signaled that the much-anticipated recession is finally nigh.

While many Wall Street types were scurrying to their holiday destinations last Wednesday, an obscure economic measure signaled that the much-anticipated recession is finally nigh.

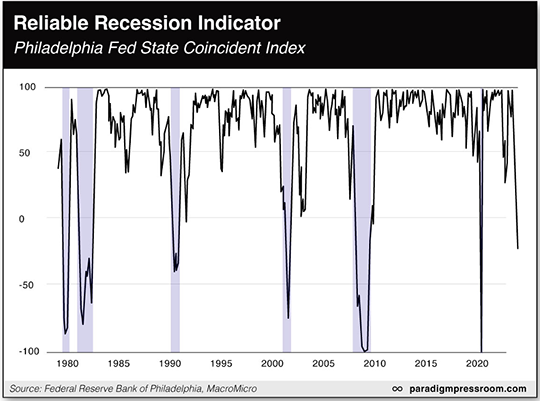

The Federal Reserve Bank of Philadelphia issued its “State Coincident Index.” This index compiles four employment indicators from all 50 states and mashes them up into a composite figure on a scale from plus 100 to minus 100.

Since the index’s inception in the late 1970s, a reading of plus 50 or lower has usually heralded the onset of recession. In September the index fell to plus 26… and in October it fell even further to minus 22.

To be sure, if a recession is imminent, it would be early by recent standards.

To be sure, if a recession is imminent, it would be early by recent standards.

Since 1980, the average economic “expansion” — that is, the period in-between recessions — has lasted 78 months — 6½ years. The current expansion that began with the post-lockdown recovery in the spring of 2020 is only 38 months along.

“But 78 months is an average,” points out Paradigm’s macroeconomics authority Jim Rickards. “Economies don’t operate on averages; that’s a statistical abstract.

“Economies take their own course based on a large number of business cycle factors and exogenous shocks. From 1974–1982, the U.S. suffered through three recessions of which two (1974 and 1982) were the worst recessions since the Great Depression. That’s one recession every 32 months. So much for averages.”

Jim has seen approaching signs of a recession for nearly a year now. “Most of these signs have been highly technical including inverted yield curves, negative swap spreads, a strong dollar and yields on short-term Treasury bills that are lower than those that can be attained with a phone call to the Fed under their RRP program.

“These are all powerful and reliable signs, but they have long lead times, and they cannot pinpoint exactly when a recession will start. In short, they can tell us a recession is coming but are not especially useful on the precise timing.

“Now we are seeing evidence of a recession through indicators that are concurrent with a recession,” Jim warns. “These signs are more obvious, less technical, and suggest that a recession may have already begun.”

“Now we are seeing evidence of a recession through indicators that are concurrent with a recession,” Jim warns. “These signs are more obvious, less technical, and suggest that a recession may have already begun.”

They include…

- A stock market struggling to reclaim its record highs from late 2021 and early 2022. As Jim sees it, that’s indicative of “a market that is running on fumes”

- Falling longer-term interest rates — with the 10-year Treasury note dropping from 5% last month to less than 4.5% now. “Rates actually go up at the start of a recession,” Jim explains, “because businesses have weaker cash flow and turn to borrowing to maintain working capital. Then the recession gets even worse, and banks turn off new lending because they are worried about credit losses. At that point, rates start to go down. But the decline in rates happens after the recession has already started”

- Several economic indicators that are suggestive of a recession — including “falling industrial production, rising initial claims for unemployment and a rising rate of continuing claims (which means employers are not hiring).

“In short, we have moved from highly technical long-term recession indicators to more widely understood immediate recession indicators. The combination of the two should give investors pause.”

So… how bad will it be? Here, we look for historical analogues.

So… how bad will it be? Here, we look for historical analogues.

“The 1974 recession might be the best guide to today’s situation,” says Jim — “because it was triggered by a supply shock similar to the supply chain breakdown in 2021–2022.”

The Arab oil embargo of late 1973 — a response to U.S. support for Israel in the Yom Kippur War — sent oil prices quadrupling from roughly $3 a barrel to $12.

“The oil price shock was accompanied by supply shortages due to government regulation,” Jim goes on. “The combination sent the U.S. economy into a tailspin.

“The stock market fell 45% from January 1973 to December 1974. That percentage decline would translate into a 15,725 point drop in the Dow Jones Industrial Average index using today’s levels. That’s what a real oil shock and steep recession look like in stock market terms.”

And yes, that would be very positive for gold: While the stock market tumbled 45% during 1973–1974, the gold price tripled — from $64 to $184.

Beyond gold, there’s another approach Jim urges you to consider. While the stock market tumbled nearly 20% last year — you remember that, right? — this strategy generated 190% gains.

Follow this link and Jim will tell you all about how it works.

![]() Biggest Beneficiary of the Year-End Rally

Biggest Beneficiary of the Year-End Rally

The U.S. stock market is treading water as the new week begins — with none of the major averages moving more than 0.15%.

The U.S. stock market is treading water as the new week begins — with none of the major averages moving more than 0.15%.

The S&P 500 rests at 4,551. Recession indicators notwithstanding, there’s nothing to stop a run toward 4,600 — or even the early-2022 highs near 4,800 — before year-end. (It’s beyond year-end where things could get dicey.)

“The path of least resistance is higher,” Greg Guenthner affirms to his Trading Desk readers.

One economic number of note: New home sales came in much weaker than expected, down 5.6% in October. The highest mortgage rates in over 20 years are starting to have an impact. The price of single-family new construction is now $409,000 — down 17.6% from a year ago.

“I’m starting to notice investors returning to smaller tech companies after taking safe harbor over the last few months in the mega-caps like Microsoft and Apple,” says Paradigm tech specialist Ray Blanco.

“I’m starting to notice investors returning to smaller tech companies after taking safe harbor over the last few months in the mega-caps like Microsoft and Apple,” says Paradigm tech specialist Ray Blanco.

“It may be your last opportunity to get into our picks,” he tells his Technology Profits Confidential readers, “before they start taking off over the rest of 2023 and into 2024.

“Biotech is historically undervalued across the board right now, something that simply can’t continue for much longer. Even a lot of AI picks are surprisingly cheap, despite the ever increasing hype surrounding artificial intelligence.

“It’s an exciting time in tech, with new technologies taking huge leaps forward, but yet the markets haven’t reflected it yet.”

Like the stock market, crude is little moved this morning at $75.33 — despite a worrisome geopolitical development.

Like the stock market, crude is little moved this morning at $75.33 — despite a worrisome geopolitical development.

Overnight the USS Eisenhower entered the Persian Gulf — the first time an American aircraft carrier has done so in two years. Of course, the tension level in the Middle East is much higher now than it was then — and as we warned last week, the Iranian government could easily view the Eisenhower’s move as a provocation.

![]() How the Power Elite Spent Their Holiday

How the Power Elite Spent Their Holiday

We present the following with no further comment…

We present the following with no further comment…

![]() From JFK to Jeffrey Epstein: “Hard to Read”

From JFK to Jeffrey Epstein: “Hard to Read”

As promised, we saved a couple of longer reactions to last Tuesday’s edition for today…

As promised, we saved a couple of longer reactions to last Tuesday’s edition for today…

“Tuesday’s 5 Bullets was a difficult read not because what was said was hard but as a freedom-loving American I can’t stand how far our government has fallen.

“What shocked me though was the statement you made in Bullet 1 regarding the Biden administration nullifying an act of Congress through an executive order.

“I suppose this is normal but still, it is frustrating to see. With Congress having given so much of its power to the president and the administrative state it makes me wonder why we even have a Congress. I follow a few of them on X and all they do is complain about everything. They’re all talk and no action, not a one. Never do they say that they’re going to rein in our imperial president.

“I keep hoping that the American people will say enough but all we do is take it on the chin and keep voting the two parties who are basically two sides of the same coin — authoritarian socialism/corporatism. At this point I don’t know what it will take to bring any real change.

“I also want to touch on points 3 and 4. As a former member of the Navy and someone who refused the jab and could have lost his job I completely am in the camp that I would never encourage anyone to serve in the military.

“The vast majority of the senior officers are self-serving people. The Navy says that honor, courage and commitment are its core values. I would say that during COVID the officers practiced dishonor, cowardice and a commitment to do evil to those they led. There was no ability to reason or think things through. Only blind obedience to the order to take the jab. And the military wonders why they can’t recruit enough people!

“Thank you for always keeping it real and have a Happy Thanksgiving!”

“Dave, this easily is one of the most concise and honest commentaries on the sorry state of our nation and how it came to be that way, including precisely where we took the major turn for the worse — other than the formation of the Federal Reserve, the original sin that spawned so many others and enabled the worst among us to, as our Founders warned, undo all the gains of the Revolution.

“Dave, this easily is one of the most concise and honest commentaries on the sorry state of our nation and how it came to be that way, including precisely where we took the major turn for the worse — other than the formation of the Federal Reserve, the original sin that spawned so many others and enabled the worst among us to, as our Founders warned, undo all the gains of the Revolution.

“Nov. 22, 1963, most definitely is a day that always will live in infamy. I believe without a doubt elements within the CIA murdered President Kennedy, with the blessing of and sanctioning by their 'superiors' all the way up to that disgraceful piece of **** Dulles — likely even above him, and I dare anyone to prove me wrong.

“It is lamentable, and a further reflection of how deep their roots extend, that no one in Congress (emphasis on 'con,' as always) even bothered to second Sen. Moynihan's proposal back in the ’90s to bring an end to that blight upon our republic, and all of humanity, known as the CIA. Then again, that would be but a first step, although a necessary one.

“I only can hope that one of these days, enough of us wake up and are pissed off enough over how we've been lied to, used and abused for so long that we exercise the most important clause in the Declaration of Independence: 'That whenever any Form of Government becomes destructive of those ends, it is the Right of the People to alter or to abolish it.'

“How much more evidence do we need that the current form of government has indeed been destructive of Life, Liberty and the pursuit of Happiness for anyone other than themselves, for decades?

“Take care, Brother, and be well.”

Dave responds: I’d forgotten all about it, but yes: More than once after the Cold War was over, Sen. Daniel Patrick Moynihan (D-New York) submitted bills to abolish the Central Intelligence Agency.

Both before and after his death in 2003, writers have disagreed about how serious he really was. After all, there are more than a dozen other intelligence agencies with a foothold in the Beltway.

But if it would have done away with the CIA’s paramilitary arm, it surely would have been a step forward…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. On a less-serious topic that generated a high volume of reader mail recently: Is cursive writing making a comeback?

Today’s Wall Street Journal devotes its quirky A-hed front-page story to the fact that California has mandated cursive instruction in the elementary schools effective Jan. 1. “About half the states now have a law or state standard requiring cursive instruction, many of them passed in recent years.”

*Sigh*

Is there nothing beyond the purview of the control freaks and power trippers and their everything-not-prohibited-is-mandatory mentality?