Rocket Fuel for Tiny Stocks

![]() Rocket Fuel For Tiny Stocks

Rocket Fuel For Tiny Stocks

The Federal Reserve begins two days of meetings today — at the conclusion of which it will set the stage for the next phase of the stock market’s “rotation.”

The Federal Reserve begins two days of meetings today — at the conclusion of which it will set the stage for the next phase of the stock market’s “rotation.”

Of course, Fed chair Jerome Powell won’t say it like that during his press conference tomorrow. But that’s what’s in store.

The Fed is conducting one of its eight-times-a-year policy meetings. Barring an immense shock, the Fed will declare tomorrow at 2:00 p.m. EDT that it’s leaving the benchmark fed funds rate alone.

The rate will stay at 5.5% — where the Fed has held it for the last year after the steepest rate-raising cycle since the early 1980s.

The written statement accompanying this decision — and Powell’s press conference after the statement is issued — will in all likelihood signal an impending “pivot” to rate cuts starting at the next meeting in mid-September. The trade in the futures market is pricing in a 100% probability of this outcome.

All else being equal, lower interest rates benefit smaller companies more than bigger ones.

All else being equal, lower interest rates benefit smaller companies more than bigger ones.

Smaller companies tend to borrow from banks when they need money to expand their operations or pursue new avenues of research and development.

Bigger companies also benefit from lower rates, but not as much. When they need money for expansion or R&D, they can issue their own debt in the corporate bond market.

This is the reality that underlies the “rotation” we’ve seen in the stock market the last three weeks or so. In anticipation of lower rates, money is flowing out of the megacap tech-adjacent companies like the “Magnificent 7” names… and flowing into the smaller fry.

Result: Last week, the Russell 2000 index of small-cap stocks jumped 3.5%. The tech-heavy Nasdaq registered a 2% drop.

With the benefit of hindsight, we can say the rotation began 19 days ago.

With the benefit of hindsight, we can say the rotation began 19 days ago.

On Thursday, July 11, the Labor Department issued a cooler-than-expected inflation number. Suddenly the narrative took off: The Fed won’t cut rates in July, but a September cut is in the bag.

With that, the rotation was underway. The Nasdaq notched a record close the day before that inflation number. It’s down 7% since.

The Russell, meanwhile, leaped 11.4% in the week after the inflation number and has held onto those gains since.

Paradigm Press editors were onto this rotation right away. In these 5 Bullets, income pro Zach Scheidt was anticipating it even before the release of the inflation report on July 11. Soon after, chart hound Greg Guenthner saw the Russell breaking out of a long sideways grind that began in early 2022.

But it’s our AI and crypto authority James Altucher who sees the most potential coming out of this rotation — indeed, what he thinks is the biggest investment setup in 50 years.

That’s why he moved heaven and earth to convene his Superstock Summit last Thursday — to alert as many people as possible to the opportunity. Long story short, he’s got his eye on five tiny stocks — one with 1,000% profit potential in the next 12 months.

![]() The $35 Trillion Ball and Chain

The $35 Trillion Ball and Chain

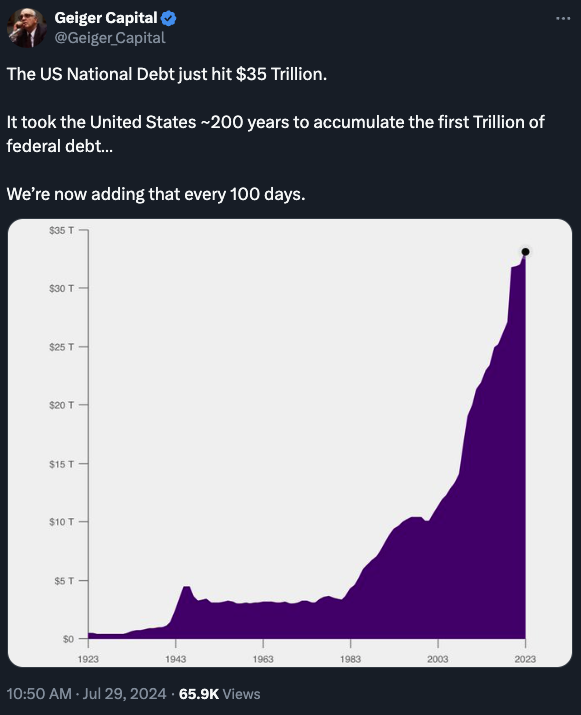

Not that anyone in the political class cares, but the national debt has now crossed the $35 trillion threshold.

Not that anyone in the political class cares, but the national debt has now crossed the $35 trillion threshold.

For perspective, the total was “only” $23 trillion in early 2020 — before Donald Trump locked down the country and went on a mad spending spree that Joe Biden then put on steroids.

That’s a 59% increase in five years…

The United States is approaching a debt crisis that the Treasury and the Fed can only print their way out of. You think inflation is bad now?

There was a time in this country when politicians at least gave lip service to the problem. But this year, no one is talking about it on the campaign trail. That’s because it’s not the sort of thing that gins up culture-war outrage and generates campaign contributions.

Likewise, neither political party wants to step on the toes of the two industries most responsible for this alarming increase in debt — the military-industrial complex and the crony-capitalist health care system.

And the beat goes on…

Going into the release of Microsoft earnings later today and the Fed announcement tomorrow, the U.S. stock market is pulling back.

Going into the release of Microsoft earnings later today and the Fed announcement tomorrow, the U.S. stock market is pulling back.

After a flat day yesterday, the S&P 500 is down more than three quarters of a percent at last check to 5,420.

Gold is quietly rallying and back within $10 of $2,400. Silver has nosed its way past $28 again. Bitcoin sits a little over $66,000, on the low end of its trading range the last few days.

Oil is in danger of dropping below $75 for the first time since early June. And speaking of black gold…

![]() If It’s Tuesday, It Must Be Regime Change in Venezuela

If It’s Tuesday, It Must Be Regime Change in Venezuela

Here we go with what seems like Washington’s 206th attempt at regime change in the country that’s home to the world’s biggest oil reserves.

Here we go with what seems like Washington’s 206th attempt at regime change in the country that’s home to the world’s biggest oil reserves.

Not that you’ll see it framed that way in either corporate or conservative media…

Venezuela held an election on Sunday. The country’s election authority says President Nicolas Maduro won a third term with 51% of the vote. The opposition says its candidate Edmundo Gonzalez won by a wide margin.

Washington is siding with the opposition: Secretary of State Antony Blinken says Washington has “serious concerns that the result announced does not reflect the will or the votes of the Venezuelan people.” Other U.S. officials say even more economic sanctions targeting Venezuela are in the offing.

Context: The U.S. government has been trying to overthrow Venezuelan leaders for a quarter-century now.

Context: The U.S. government has been trying to overthrow Venezuelan leaders for a quarter-century now.

Washington was apoplectic when the socialist firebrand Hugo Chavez came to power in 1999, threatening the gravy train that U.S. multinationals had gotten used to in previous decades.

The Dubya Bush administration instigated a coup in 2002 that lasted all of three days before Chavez stormed back to power. Washington then embarked on sanctions.

Chavez died in 2013, with power passing to his protege Maduro. The sanctions escalated. As a result, the country’s crude exports were slashed by 75% between 2015–2020.

➢ Statistic of the day: Venezuela is home to the biggest crude reserves in the world, 18.2% of the global total — and it’s the thick, sulfurous kind of crude that’s perfect for American refineries.

The Trump administration tried to pull off another coup in 2019 with even less success than the 2002 effort. For a while, both the Trump and Biden administrations recognized a guy who exercised no power and who’d never been elected to anything as the “interim president.”

Eventually Biden’s team acknowledged Maduro really was still in charge — but a disputed election presents a new opportunity to alter the reality.

To be sure, there’s no smoking-gun proof that the CIA is “funding thugs to fuel violent riots against President Maduro,” as the podcaster S.L. Kanthan tweeted this morning.

To be sure, there’s no smoking-gun proof that the CIA is “funding thugs to fuel violent riots against President Maduro,” as the podcaster S.L. Kanthan tweeted this morning.

But after 25 years of efforts to get rid of Chavez and Maduro, it’s not hard to believe. Meanwhile, everyday Americans are deprived of the benefits from buying abundant Venezuelan crude.

By the way, you can draw a direct link from U.S. sanctions against Venezuela… to the economic misery they impose on everyday Venezuelans (but not the regime)... to a substantial share of the crisis at the U.S.-Mexico border.

The official numbers alone show 262,633 Venezuelans crossing the border during 2023. In December, the Border Patrol reported nearly 47,000 “migrant encounters” with Venezuelans — the second-highest total after Mexicans.

Last September the Biden administration extended temporary legal status to an estimated 472,000 Venezuelans living in the United States. Homeland Security Secretary Alejandro Mayorkas said “conditions in their home country prevent their safe return.”

And what brought those conditions about? Yes, socialist mismanagement under Maduro and Chavez bears some of the blame. But let’s not overlook the hardship made possible by four U.S. presidents and their failed sanctions aimed at regime change.

![]() Great Moments In Taxation

Great Moments In Taxation

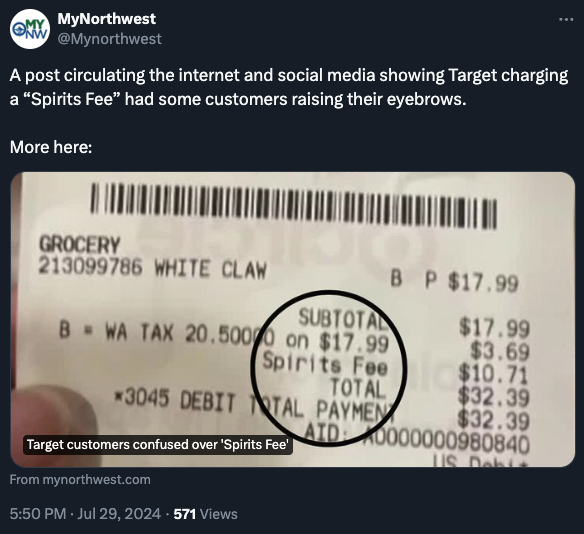

Stories abound these days about odd surcharges being tacked onto people’s retail and restaurant receipts, but this one is truly novel…

Stories abound these days about odd surcharges being tacked onto people’s retail and restaurant receipts, but this one is truly novel…

A “spirits fee” on a pack of White Claw? (That stuff is vile, by the way, but we digress…) And a “spirits fee” that’s almost 60% of the purchase price!?

So it would seem if you buy it from a Target in Washington state.

A viewer of KIRO-TV in Seattle wondered what on Earth was going on. A reporter showed it to someone from the Washington State Liquor and Cannabis Board — who replied in bureaucratese…

That particular White Claw product is considered a distilled spirit so it’s subject to two wholesale excise taxes, the 17% ‘Spirits Fee’ a retail sales tax and Target’s markup. Our auditors have actually reviewed Target receipts such as this. Where it says ‘Spirits Fee’ it really contains another excise tax (collected by Department of Revenue), the 17% (collected by LCB) and the markup. A more accurate reading would have said “Spirits Tax, excise and sales tax and Markup.”

Clear as mud, right?

“Saying it’s a fee gets us to question it,” Target customer Thomas Hulm tells the TV station. “It’s poorly labeled. It should be labeled a tax, a state liquor tax if that’s what it is.”

A Target spokesperson confirmed it’s a tax.

So why didn’t anyone in the company have the presence of mind to label it such on the receipt?

No answer.

The mind boggles…

![]() Mailbag: Readers Rise Up

Mailbag: Readers Rise Up

As I anticipated, I got some pushback after a calling-balls-and-strikes examination of Donald Trump’s Bitcoin speech over the weekend. One reader even invoked the term “Trump derangement syndrome”

As I anticipated, I got some pushback after a calling-balls-and-strikes examination of Donald Trump’s Bitcoin speech over the weekend. One reader even invoked the term “Trump derangement syndrome”

“Maybe DT has a plan. I mean the art of the deal is his forte. What if the deal involves putting the crypto miners next to hydro plants and nuclear plants. Possible win-win? Just sayin’. Have a nice day.”

“So what part of all this do you not understand?” says another.

“As someone that has followed Trump for the past eight years it is consistent he hates when China leads the way in anything. So why not just go with what he said and take it as supporting crypto? Sounds like to be that you are majoring in minors.

“Even if the ONLY reason for a change of heart is that Trump hates China to dominate anything, that would be good enough for me and should be for you. Just saying.”

Dave responds: You’ll have to excuse me for treating Donald Trump with the same skepticism I accord to every other politician.

A disturbing new article co-authored by Bitcoin Magazine editor-in-chief Mark Goodwin and muckraker Whitney Webb suggests that Trump’s minions are scheming on a CBDC without calling it a CBDC.

They key in on Trump’s promise in the speech to “create a framework to enable the safe, responsible expansion of stablecoins… allowing us to extend the dominance of the U.S. dollar to new frontiers all around the world.”

As Goodwin and Webb see it, stablecoins could fulfill many of the tasks of a CBDC — especially the surveillance and programmability. Many of the private issuers of stablecoins already work hand-in-hand with the FBI and the Secret Service — freezing wallets at the agencies’ request.

Meanwhile, it appears the “strategic Bitcoin reserve” would be the linchpin of a plan “making Bitcoin a reserve asset and, as a consequence, a sink for the inflation caused by the government’s perpetual expansion of the money supply,” write Goodwin and Webb..

“Ironically, Bitcoin would then become the enabler of the very problem it had long been heralded as solving.”