Bring a Gun to the Knife Show

![]() A Trader’s Secret Weapon

A Trader’s Secret Weapon

“You need to have cash available to seize new opportunities,” says our trading expert Enrique Abeyta. “Without it, you can't ‘buy the dip’ as I've been advising for weeks!”

“You need to have cash available to seize new opportunities,” says our trading expert Enrique Abeyta. “Without it, you can't ‘buy the dip’ as I've been advising for weeks!”

Enrique believes many investors underestimate the crucial role of cash — and trading — when it comes to their portfolios.

He explains: “Trading is about seeking shorter-term opportunities, from six seconds to six months, aiming to profit in every type of stock market” — in contrast with investing, which focuses on longer-term gains over years or decades.

“For most investors,” Enrique warns, “trying to time the market will destroy value.” However, for traders, he advocates a strategy that boils down to “buy low and sell high.” Easier said than done?

Source: Etsy

“The proprietary software system I use for my flagship trading service The Maverick identifies opportunities based on the movement of individual stock prices,” he says.

“At its most basic level, this system looks for companies with strong operational momentum with stocks that have been big winners.

“I then look for entry points where those stocks have sold off to an interesting level — when investors have sold the stock down so far and so fast that it is highly likely to snap back.

“We become more aggressive and expand our recommendations during steep sell-offs or around earnings season. That’s when it’s time to put your cash to work.

“On the flip side, we often get very few ‘buy’ signals when the stock market is at its highs,” he says.

“On the flip side, we often get very few ‘buy’ signals when the stock market is at its highs,” he says.

“This means our number of actionable recommendations falls…

- “To put this into numbers, we average 20 open recommendations at any time in our model trading portfolio — particularly during market sell-offs

- “But the number of open positions can fall to low single digits during stock market highs.

“At this point, we are taking profits on existing positions while building our cash reserves. This cash is the result of our ‘sell high’ discipline,” he notes.

“I don’t run this model on a specified amount of theoretical capital. But I like to think of it as a 100% invested portfolio at its averages (with, say, 20 positions receiving a 5% allocation).

“But if we pulled back to only seven positions, then we would be only 35% invested. This means that we would be holding a 65% cash position.

“We are happy to be in this cash-rich position because it means that when the stock market sells off, we can execute our ‘buy low’ strategy,” Enrique says.

“We are happy to be in this cash-rich position because it means that when the stock market sells off, we can execute our ‘buy low’ strategy,” Enrique says.

“Usually, we will approach the 75–100% invested position via 15–20 positions as the markets test their 50-day and 100-day moving averages.

“If it goes much further, we are willing to apply leverage and go to as much as 150% invested (30 positions) to take advantage of the situation.”

Enrique’s key takeaway? “This is how our cash position is our secret weapon!” he says. It’s like bringing a gun to the knife show. “It gives us the ability to turn the volatility and market risk to our advantage.”

[Imagine building a six-figure nest egg in just weeks… Sounds crazy?

But in 2021, $10K invested in this unique type of trade would have turned into almost $700,000 in just over two weeks.

Paradigm’s legendary trader and former billion-dollar hedge fund manager Enrique Abeyta believes it could happen again this Tuesday, March 25, at 4 p.m. ET.

Click here to get all the details. Before this trade is history.]

![]() Sign of the Times

Sign of the Times

DoorDash and Klarna have decided to join forces to finance late-night pizza cravings. Yes, in a few months, DoorDash customers will be able to choose from Klarna’s buy-now-pay-later (BNPL) options at checkout.

DoorDash and Klarna have decided to join forces to finance late-night pizza cravings. Yes, in a few months, DoorDash customers will be able to choose from Klarna’s buy-now-pay-later (BNPL) options at checkout.

DoorDash representative Anand Subbarayan assures us this is all about “enhancing convenience”... But what about pesky interest rates?

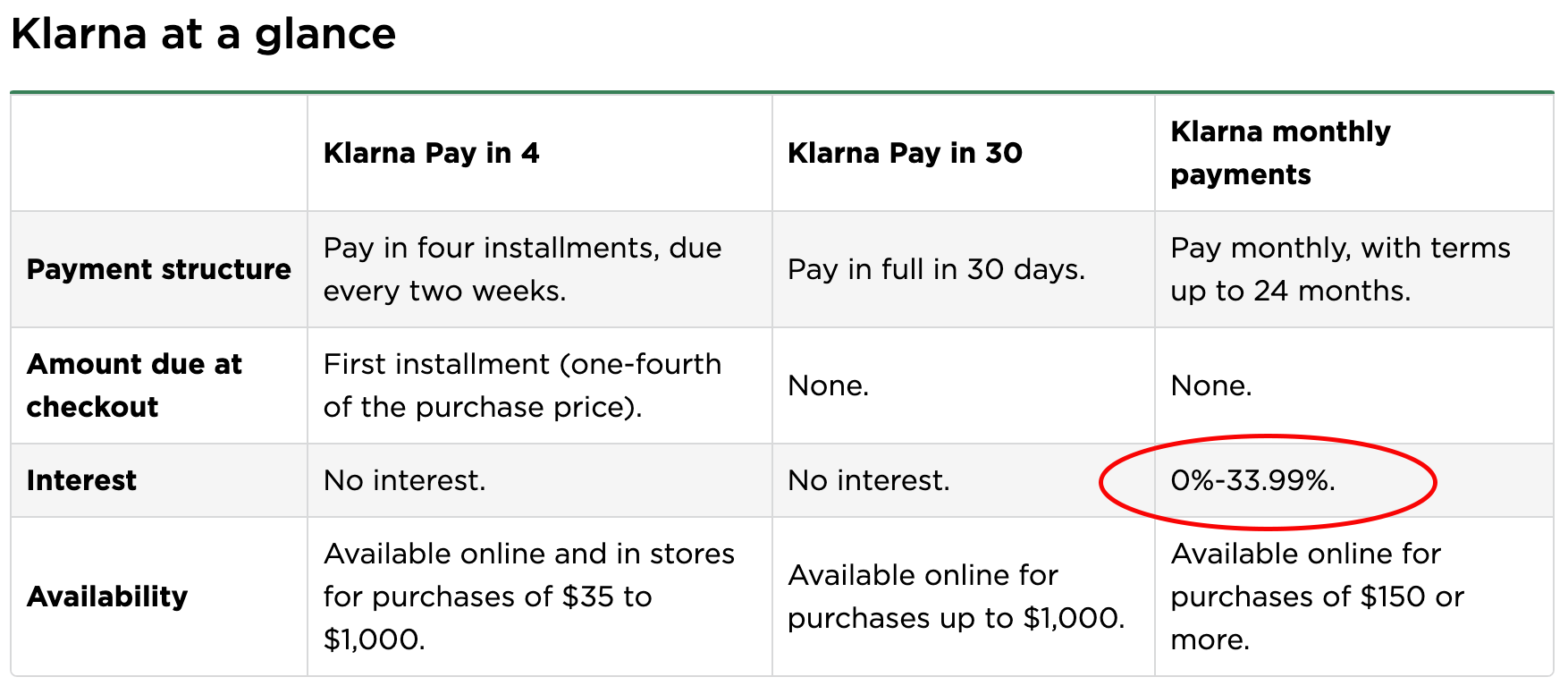

“Klarna works by dividing the total cost of your purchase into smaller installments when you check out in the Klarna app or from an online retailer,” says NerdWallet.

“Payment plans to choose from [include] Klarna Pay in 4, Klarna Pay in 30 and Klarna monthly payments.”

Source: NerdWallet

While Klarna doesn’t explicitly target subprime borrowers with higher rates, those with lower credit scores may be more likely to receive offers with higher interest rates within that 0–33.99% range.

It’s also worth mentioning that Klarna’s business model relies on merchant fees and hopes that — of course! — a certain percentage of users will miss payments, allowing them to charge higher interest rates and/or late fees.

In short: Just don’t.

DoorDash (DASH) shares are down about 2% at the time of writing — which coincides with the whole bloody market today.

DoorDash (DASH) shares are down about 2% at the time of writing — which coincides with the whole bloody market today.

Taking it on the chin, the S&P 500 is faring the worst, down about 0.25% to 5,645. Meanwhile, the Big Board is down about 0.20% to 41,870. The techie Nasdaq? Almost breaking even at 17,685.

Turning to the commodities complex, the price of crude is up 0.20% to $68.20 for a barrel of WTI. But precious metals are getting clobbered. Gold is down 0.80% to $3,018.70 per ounce, and silver’s down 1.55% to 33.47.

As for crypto, Bitcoin’s down 0.30%, just under $84,000; at the same time, Ethereum is down 0.65% or just under $2,000.

![]() AI’s Power Paradox

AI’s Power Paradox

On Thursday, Nvidia announced a partnership with energy R&D company EPRI to address the overworked electrical grid.

On Thursday, Nvidia announced a partnership with energy R&D company EPRI to address the overworked electrical grid.

The power sector is facing a surge in demand from data centers, with electricity consumption projected to increase by 4% annually in the coming years, eventually nearly doubling the consumption levels of 2023.

So Nvidia and EPRI — as well as major players like PG&E, Con Edison, Duke Energy, Microsoft and Oracle — are forming the Open Power AI Consortium, with plans to develop open-source, domain-specific AI models to tackle future power industry issues.

The consortium will develop AI road maps and facilitate knowledge sharing among members. This collaboration aims to address complex challenges such as grid modernization and resilience.

Meanwhile, tech companies are proactively securing power generation capacity. According to TechCrunch, they are focusing especially on renewable energy projects, particularly solar power. (Of course, we know that tech giants including Google, Microsoft and Amazon are exploring nuclear power, too.)

While new power sources are crucial, the consortium may also explore innovative solutions like load shifting. A recent study suggests that optimizing usage during off-peak periods could unlock an additional 76 gigawatts of capacity, representing about 10% of peak demand in the U.S.

This latest development notwithstanding, Paradigm’s science-and-tech specialist Ray Blanco says Nvidia’s CEO Jensen Huang made more big news this week…

![]() “Nvidia Math” Changes Everything

“Nvidia Math” Changes Everything

“The amount of computation we need… is easily 100 times more than we thought we needed this time last year,” according to Huang on Tuesday.

“The amount of computation we need… is easily 100 times more than we thought we needed this time last year,” according to Huang on Tuesday.

“Investors have been worrying that the AI boom might be cooling,” says Ray. “But Nvidia's GTC conference [turned] that fear upside down in spectacular fashion.

“So what’s driving this massive increase in [computational] demand?

“It’s what Jensen calls ‘reasoning AI’ — artificial intelligence that doesn’t just blurt out an answer based on pattern matching, but actually works through problems step by step,” Ray notes.

- “In one demonstration, Nvidia showed how a traditional AI could solve a complex problem using 439 ‘tokens’ (the building blocks of AI responses). The answer came quickly but was wrong

- “The new reasoning AI took nearly 9,000 tokens to solve the same problem. It tested different approaches, checked its answers and arrived at the correct solution…

“But it required 20X more processing power!” Ray notes.

“This shift to reasoning AI is transforming the entire industry: Think of it as the difference between a calculator and a mathematician,” he says. “For investors, this has massive implications.

“This shift to reasoning AI is transforming the entire industry: Think of it as the difference between a calculator and a mathematician,” he says. “For investors, this has massive implications.

“First, remember all the talk about GPU shortages ending? We're entering a new phase of AI that will drive unprecedented demand for computing power.

“Second, Nvidia isn't just upgrading its chips — it’s completely reimagining how AI computing works. Their new Blackwell system delivers 25X more performance than its predecessor using the same amount of power.

“Nvidia has become so dominant that they're literally changing how the industry measures computing power. They're measuring differently, counting differently and building differently — all to support the massive scale needed for this new generation of AI.”

In fact, “Nvidia math changes everything…

“The company unveiled a road map through 2027 showing each generation providing exponentially more power, culminating in systems 900X more powerful than today’s top chips,” says Ray.

“The company unveiled a road map through 2027 showing each generation providing exponentially more power, culminating in systems 900X more powerful than today’s top chips,” says Ray.

“Perhaps most significant for investors: Nvidia is no longer talking about data centers, but ‘AI factories,’” he adds. “From liquid cooling systems to specialized integration services, from new memory technologies to advanced silicon — the entire ecosystem is being transformed.

“This isn't just another chip cycle. It's the beginning of what will likely be the defining wealth-creation opportunity of our lifetime,” Ray concludes.

“When something you want goes on sale, you buy… Right now, AI is on sale.

“Wall Street is still catching up to what this means,” says Ray. “But for those who understand the implications, the opportunity has never been clearer.”

![]() Dumpster-Diving Duo Hits the Motherlode

Dumpster-Diving Duo Hits the Motherlode

A New Jersey couple recently hit the jackpot while rummaging through a Dollar General dumpster, unearthing a haul worth $600.

A New Jersey couple recently hit the jackpot while rummaging through a Dollar General dumpster, unearthing a haul worth $600.

Julia Matthews-Reszler and her husband, Brandon, aren’t your average bargain hunters. They’re carrying on a family tradition of dumpster diving, inspired by Julia’s late grandfather George, who turned trash-picking into an art form.

Their recent score? A veritable cornucopia of goodies…

Source: Reddit, Newsweek

Many items were barely past their “best by” dates, with some good until October 2025…

While the couple was thrilled with their haul, they’re also sobered by the implications. “It’s a rush, but then grief takes over as we realize how much is going to waste,” Julia remarks.

In true Robin Hood fashion, the couple has shared their bounty with friends and even the homeless in their local community.

Who knew dumpster diving could be so profitable?

Heh, at the risk of contracting cholera, I guess it beats DoorDashing (especially if Klarna is involved).

Take care, reader! Have a wonderful weekend…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets