Don’t Give up on Silver Yet

![]() Don’t Give up on Silver Yet

Don’t Give up on Silver Yet

Silver surpassed $120 today. It doubled in less than two months.

Silver surpassed $120 today. It doubled in less than two months.

A picture of silver’s chart right now could easily go next to the word “hyperbolic” in the dictionary.

Yes, it will pull back at some point.

(Checking our screens, “some point” might be starting today — the bid now under $110.)

Precious metals guru Don Durrett — one of the voices outside Paradigm we follow most closely — figures $85 is the new floor.

Which we’ll point out was a record only a month ago.

But after that inevitable pullback, silver is on track to soar even higher.

But after that inevitable pullback, silver is on track to soar even higher.

Within the Paradigm stable, commodities trading veteran Alan Knuckman says based on the charts, he sees a “blow-off top coming — maybe $150 or $200 an ounce.”

Macro maven Jim Rickards — who ignores charts and focuses on fundamentals — arrives at a very similar conclusion: He wouldn’t be surprised to see $200 silver this year.

Even big mainstream Wall Street firms — which typically hate precious metals because the metals don’t generate fat commissions — are giving silver its due.

Even big mainstream Wall Street firms — which typically hate precious metals because the metals don’t generate fat commissions — are giving silver its due.

Bank of America’s chief of metals research Michael Widmer sees a peak anywhere between $135 and… brace yourself… $309.

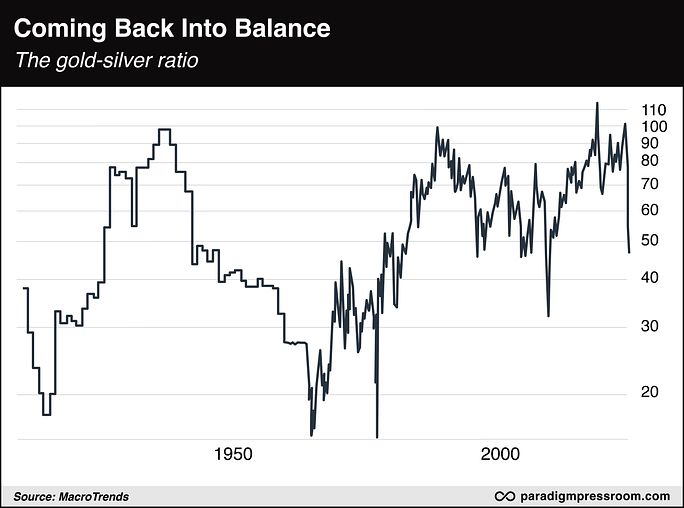

The high end of that range is based on the gold-silver ratio — literally the price of gold divided by the price of silver. Here’s a very long-term chart of the ratio going back a century…

This morning the ratio sits at 46:1 — down dramatically since last fall. But in 1980, the ratio sank as low as 14:1. Based on gold’s price at the start of this year — $4,326 — that’s how Widmer arrives at his $309 outlier.

If you really want to have fun with this ratio, a silver price of $714 an ounce is not out of the question.

If you really want to have fun with this ratio, a silver price of $714 an ounce is not out of the question.

Consider that Jim Rickards is on record projecting a gold price of $10,000 an ounce — perhaps even by late this year. That’s totally plausible when you consider it’s already well over $5,000; it wouldn’t even have to double from here.

Yesterday, colleague Adam Sharp ran the numbers at The Daily Reckoning: Assuming a $10,000 gold price… and a gold-silver ratio of 14:1… well, that’s how you get $714 silver.

Yes, that’s a far-out projection. But even if silver rises to a level only half of that lofty figure… well, that gets you very close to the $309 figure that the mainstream won’t rule out.

![]() Is the TSLA-to-ELON Transition Underway?

Is the TSLA-to-ELON Transition Underway?

For years, critics said Tesla was not a technology company — just a car company with extremely pricey shares. As of today, the claim no longer holds water.

For years, critics said Tesla was not a technology company — just a car company with extremely pricey shares. As of today, the claim no longer holds water.

Tesla issued its quarterly numbers yesterday after the closing bell. The 61% drop in profits was overshadowed by two announcements…

- TSLA will sink $2 billion into Elon Musk’s private artificial-intelligence firm xAI

- The company will wind down production of the Model S and Model X at its Fremont, California plant; the factory floor will be converted to making Optimus robots.

Last Friday, colleague Davis Wilson at our sister e-letter The Million Mission served up a cheeky proposition: Musk would consolidate all of his sundry businesses under the Tesla umbrella, perhaps changing the ticker symbol to ELON.

Hmmm… The Tesla investment in xAI seems like a big step in that direction, no?

In the meantime, Wall Street is reacting badly to the slew of announcements, sending TSLA down over 3% as we write.

Elsewhere, you might call today’s action on Wall Street a Tale of Two Hyperscalers.

Elsewhere, you might call today’s action on Wall Street a Tale of Two Hyperscalers.

Meta and Microsoft also reported their numbers late yesterday. Both companies beat the estimates of the typical Wall Street analyst. Both projected huge increases in spending on AI during 2026.

And that’s where the similarities end. Unlike Meta, Microsoft’s spending projections were higher than Wall Street’s expectations. With that, MSFT shares are getting clobbered — down nearly 12% on the day. META on the other hand is up 7%.

It seems the Microsoft news is weighing more on the major U.S. stock averages than Meta’s: The S&P 500 is down nearly 1.5% on the day, back below 6,900. The Nasdaq is down 2.5%, while the Dow’s losses are about three-quarters of a percent.

Crypto is selling off, too — Bitcoin under $85,000 and Ethereum approaching $2,800.

Crude, however, is up over two bucks — above $65 for the first time since late September. There’s no new news about U.S. strikes on Iran, but traders continue to price in a growing likelihood.

“I’ll admit my mistake,” Jim Rickards says after the Federal Reserve’s latest policy-setting meeting.

“I’ll admit my mistake,” Jim Rickards says after the Federal Reserve’s latest policy-setting meeting.

Jim was anticipating a cut of a quarter-percentage point and a badly split vote among the Fed’s Open Market Committee of 8-4.

In the event, the FOMC kept the fed funds rate steady at 3.75% and there were only two dissenting votes, both by Trump appointees favoring a cut.

“The decision to pause rate cuts had nothing to do with the economy and everything to do with politics,” Jim writes his Crisis Trader readers today.

“Donald Trump wants lower rates. He has practically declared war on the Federal Reserve to get them. Even when the Fed cut rates as they have in recent meetings, Trump complains they did not cut them enough.

“This meeting was Jay Powell’s way of poking a stick in Donald Trump’s eye. In this effort, he was happily joined by almost the entire board.”

![]() Gold, Central Banks and Tether

Gold, Central Banks and Tether

Gold is getting smacked along with silver — tumbling from a peak of $5,575 to below $5,300. As it happens, $5,300 was a record high only yesterday.

Gold is getting smacked along with silver — tumbling from a peak of $5,575 to below $5,300. As it happens, $5,300 was a record high only yesterday.

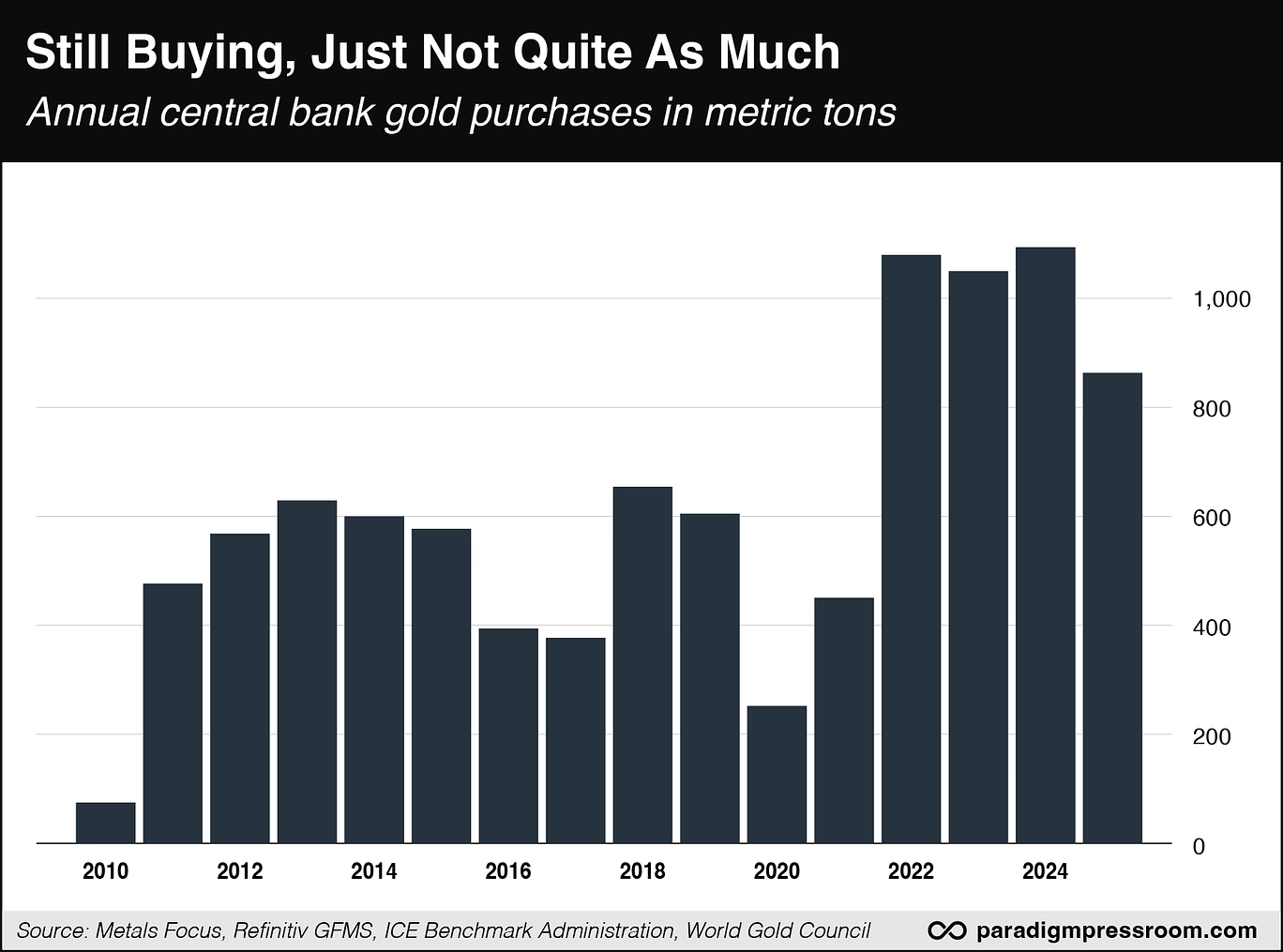

The World Gold Council is out with its final report on central bank gold demand in 2025. It fell 20% from 2024 levels — but is still much higher than at any time before 2022.

As we never tire of pointing out, the buying spree began in 2022 when the Biden administration froze the dollar-based assets of Russia’s central bank. Government leaders around the world started wondering if it would happen to them too if they did something to offend politicians in D.C. Gold can’t be frozen or seized as long as it’s in safe storage.

The buying has eased off, but it continues at a healthy clip. As such, central banks continue to keep a floor under the gold price.

Meanwhile, investor demand for gold soared 84% according to the World Gold Council’s calculations. “The drop in central bank demand was completely overshadowed by the increase we have seen in investment demand,” says WGC market strategist John Reade.

Also doing its part to fuel demand — the stablecoin firm Tether.

Also doing its part to fuel demand — the stablecoin firm Tether.

“We are soon becoming basically one of the biggest, let’s say, gold central banks in the world,” Tether CEO Paolo Ardoino tells Bloomberg.

El Salvador-based Tether has accumulated about 140 metric tons of gold and is adding another one or two every week — most of it held underground in Switzerland. Bloomberg calculates over half its stash was acquired last year. Only one central bank in the world, Poland, acquired more.

Most of it is for the company’s own reserves; the rest supports a gold-backed stablecoin.

Might the firm dial back its purchases? “Maybe we are going to reduce, we don't know yet,” Ardoino says. “We are going to assess on a quarterly basis our demand for gold.”

![]() On Site at SpaceCom

On Site at SpaceCom

“This is the big one. NASA, U.S. Space Force and a who's who list of space companies, from big defense primes to scrappy startups, are all here,” says Paradigm tech investing specialist Ray Blanco.

“This is the big one. NASA, U.S. Space Force and a who's who list of space companies, from big defense primes to scrappy startups, are all here,” says Paradigm tech investing specialist Ray Blanco.

Ray is in Orlando for an event called SpaceCom — which kicked off last night.

“Four thousand attendees,” he reports. “250-plus exhibitors. Three days of boots-on-the-ground intelligence gathering. “My goal is simple: Find the space investment opportunities before they get priced to the moon so we can go along for the ride!”

Of course, Ray has to do his due diligence on readers’ behalf once he gets back home. But here’s something that caught his eye right away.

“An aircraft carrier in space” [Ray Blanco photo]

“An aircraft carrier in space” [Ray Blanco photo]

It’s an orbital carrier. “A startup called Gravitics is building them — think aircraft carriers in space — and funded by a $60 million U.S. Space Force contract. They expect to launch their first test carrier next year.

“If China attacks our satellites in space, we can bypass waiting for launch and deploy from an orbital carrier already in space instead of having to wait on launch from the ground. This enables satellite replacements or defenses in hours instead of weeks. The company is also developing transfer vehicles to move the satellites to their final orbits.

“There are commercial applications for satellite constellations as well and the company is also developing space habitats. Gravitics is a private company today but it could become a future opportunity.”

In-between presentations, Ray is posting regularly to the Daily Feed section of the Paradigm Press mobile app. It’s the only place you can see his regular updates from Orlando today and tomorrow — along with scads of instant insights from our team of experts. Download here.

![]() Mailbag: Pelosi, Gold Gain

Mailbag: Pelosi, Gold Gain

Your editor inadvertently raised a reader’s partisan hackles in yesterday’s edition.

Your editor inadvertently raised a reader’s partisan hackles in yesterday’s edition.

“Where were you when Pelosi was pulling off all her insider trades? Did you profile her like you did Hern? Apologies if I missed it.”

Dave responds: Oh, let’s see — how about right off the top of this edition in 2024? I imagine there are others, but deadline is approaching.

I’d never heard of Kevin Hern until yesterday. I didn’t notice what party he belongs to, nor do I care, nor did I even mention it. I just thought it was interesting on its own…

“With gold going parabolic in the last few days (using a personal modification on one of Jim's Rickards’ recommendations) I've realized gains in excess of what I usually make in a year working my job, and it's still January!” a reader enthuses.

“With gold going parabolic in the last few days (using a personal modification on one of Jim's Rickards’ recommendations) I've realized gains in excess of what I usually make in a year working my job, and it's still January!” a reader enthuses.

“So I've got to be thinking, when the IRS demands I estimate how much I'm going to make this year, what am I going to tell them, and what happens if I am wrong in either direction? I've never made enough to have to pay upfront before. What do other traders and investors usually do?

“I tried seeing a tax accountant and they did not have too much to offer in the way of advice for avoiding giving up the maximum amount possible from short-term gains. But I'm still considering going to see them to help with taxes this year. I've a feeling I'm going to need the help.”

Dave responds: As you’ve probably figured out by now, identifying investment opportunities is our stock in trade — “personal finance,” not so much. And especially not tax planning.

There are just too many permutations to the tax code that affect people in too many different ways.

Please, please consult a tax professional. Especially if you file quarterly estimated taxes. And ideally someone committed to making sure you pay only what you owe and not a cent more!