The Only Safe Haven Left

![]() Trump, the Dollar and “Safe Havens”

Trump, the Dollar and “Safe Havens”

When it comes to the value of the U.S. dollar, Donald Trump is channeling Alfred E. Neuman, the mascot of the old MAD magazine: “What, me worry?”

When it comes to the value of the U.S. dollar, Donald Trump is channeling Alfred E. Neuman, the mascot of the old MAD magazine: “What, me worry?”

Asked yesterday in Iowa whether he was worried about the dollar’s recent drop relative to other major currencies, he said, “No, I think it’s great.

“I mean, the value of the dollar, look at the business we are doing. No, the dollar is — the dollar is doing great.”

And just like that, what had already been a precipitous slide in the U.S. dollar Index since mid-January turned into a rout — as seen in this candlestick chart from the good folks at StockCharts…

And gold sailed to crazy new heights. Again. At last check the bid is up another $96 to $5,275.

Even before Trump piped up yesterday, the International Monetary Fund said it was making contingency plans for a global run on the dollar.

Even before Trump piped up yesterday, the International Monetary Fund said it was making contingency plans for a global run on the dollar.

On Monday, IMF managing director Kristalina Georgieva said her organization is bracing for a rapid sell-off of U.S. dollar-denominated assets.

“At the fund, one muscle that we are building is our ability to hypothetically present scenarios of unthinkable events and then figure out what to do,” she said during an event in Belgium. Asked if one of those unthinkable events is a run on dollar assets she said the IMF runs “all kinds of scenarios.”

Unfortunately, when it comes to insulating the global financial system from such a shock, the IMF has no “muscle.” It’s the proverbial 98-pound weakling.

Unfortunately, when it comes to insulating the global financial system from such a shock, the IMF has no “muscle.” It’s the proverbial 98-pound weakling.

Georgieva’s proposed solution is for the European Union to issue its own bonds, on top of those issued by individual EU member states. Because the EU is such a big market, EU bonds would supposedly provide investors an alternative to traditional “safe haven” assets like U.S. Treasuries and gold.

The idea is a nonstarter. For one thing, leaders of major EU nations like Germany and the Netherlands are dead-set against it.

And even if someone in EU leadership could herd cats and rally everyone around the notion… who’d want to invest in the bonds of a region whose best economic days are behind it?

Which leaves us all with the existing safe havens for scary moments — U.S. Treasuries and gold. But one of those safe havens is not like the other.

Which leaves us all with the existing safe havens for scary moments — U.S. Treasuries and gold. But one of those safe havens is not like the other.

U.S. Treasuries were an outstanding safe haven from the 1980s all the way until 2020. Interest rates were falling steadily — which pushes bond prices higher. Treasuries were the ideal “40” component of a 60/40 portfolio: When the 60% of the portfolio devoted to stocks underperformed, the 40% devoted to bonds acted as a shock absorber.

But long-term Treasury rates bottomed in 2020. They’ve been climbing steadily since. They don’t even respond to moves by the Federal Reserve.

Over the last 40 years, every time the Fed has cut short-term interest rates, long-term rates have fallen in sympathy.

No longer: Since September 2024 the Fed has cut short-term rates from 5.5% to 3.75%. But the yield on a 10-year Treasury note has risen from 3.6% then to 4.25% today.

Higher bond yields, lower bond prices. The whole world knows that no one in Washington, D.C., either Republican or Democrat, will do anything about Uncle Sam’s gargantuan $38.5 trillion debt. Medium- and long-term Treasuries are a loser now.

Which leaves gold. Yes, it’s setting records day after day. Yes, it’s up a nosebleed 23.2% year-to-date already. Yes, it’s bound to correct sooner or later before the next leg up.

All we can say at this point is that if you don’t have your full gold allocation yet — Jim Rickards recommends 10% of your investable assets — that you dollar-cost average. Buy a little bit every week or every month until you get to your 10%. That way you’re sure to “buy the dip” now and then without trying to guess exactly when the gold price will turn up or down.

![]() Market Miscellany

Market Miscellany

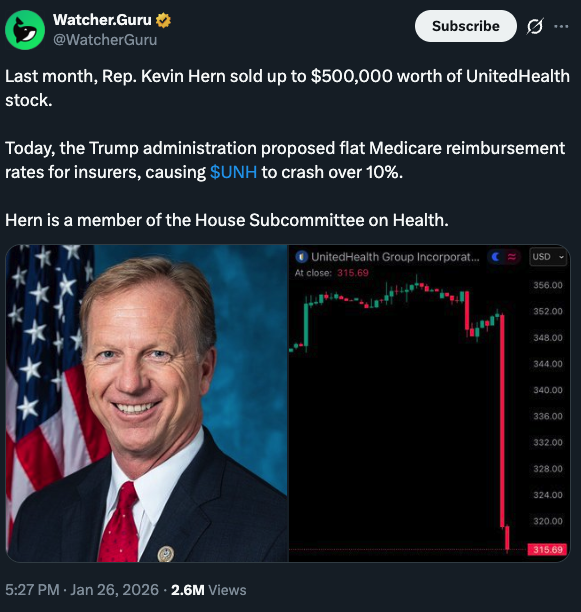

Next, a quick follow-up to Bullet No. 2 in yesterday’s edition…

Next, a quick follow-up to Bullet No. 2 in yesterday’s edition…

After yesterday’s vicious sell-off in the major health insurers — UnitedHealth tumbled 20% by day’s end — they’re enjoying a very modest oversold bounce, UNH up 2.5% as we write.

As for the broad stock market, the major U.S. indexes are doing what they usually do ahead of a Federal Reserve policy announcement — treading water.

As for the broad stock market, the major U.S. indexes are doing what they usually do ahead of a Federal Reserve policy announcement — treading water.

The S&P 500 poked its nose over 7,000 briefly this morning but has since pulled back to 6,990 — up less than 0.2% on the day. The Nasdaq is up over a third of a percent while the Dow is flat.

Among the big newsmakers are Amazon — which just announced its second round of job cuts in the last three months, 16,000 positions this time. AMZN shares are flat on the day ahead of the company’s earnings release next week.

“Big day for chip stocks,” says Davis Wilson of our sister e-letter The Million Mission.

“Big day for chip stocks,” says Davis Wilson of our sister e-letter The Million Mission.

“Semiconductor heavyweights ASML and SK Hynix jumped Wednesday after delivering strong earnings, reinforcing that demand across the chip supply chain remains red-hot.

“Adding fuel to the rally, China approved sales of Nvidia’s H200, pushing NVDA shares higher early in the session and easing fears around export restrictions.

“Between ongoing memory chip shortages and relentless AI-driven demand, the semiconductor trade is back in the spotlight — and investors are paying attention.”

Davis posted this nugget on the “Daily Feed” section of the Paradigm Press mobile app — where you can get all-day access to instant insights like these. In addition, you get buy and sell alerts for all your paid publications without having to sift through gobs of email. If you haven’t already downloaded the app, you can do so right now at this link.

We touched on gold earlier. Silver’s gain is not as strong today — up $1.25 at last check to $113.33.

We touched on gold earlier. Silver’s gain is not as strong today — up $1.25 at last check to $113.33.

While silver is in territory that seemed unthinkable only a few weeks ago… it’s been consolidating this week in a volatile range between $102–117. It’s gold that’s been playing catch-up — ending last week just shy of $5,000 and now within sight of $5,300.

As for digital assets, not much to say: Bitcoin is a little under $90,000, Ethereum a little over $3,000.

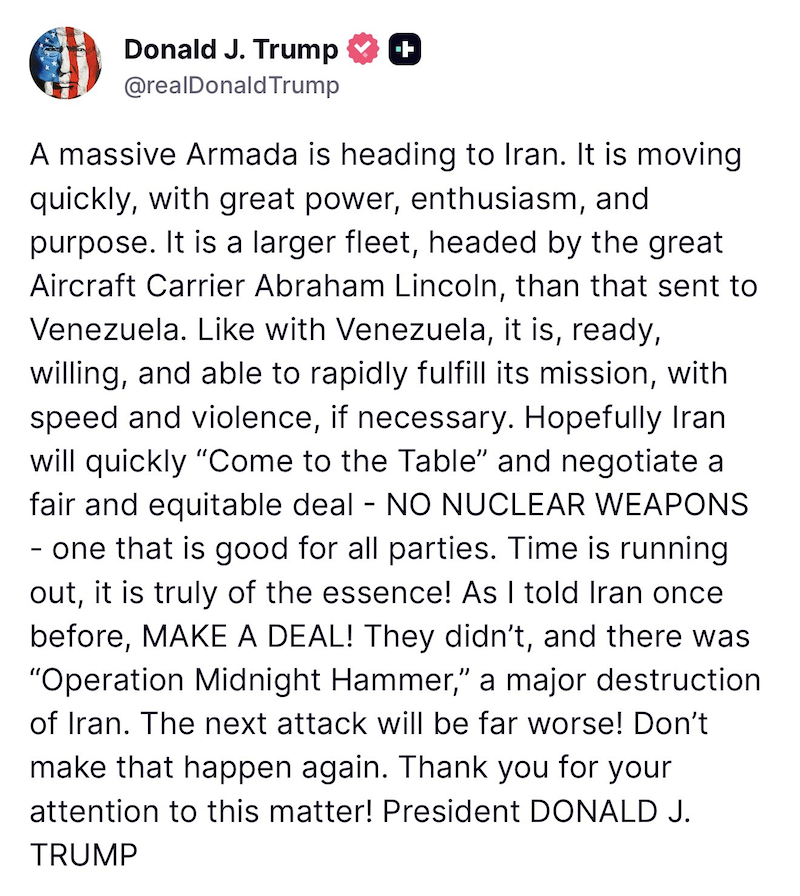

Crude is over $63 for the first time in four months as Donald Trump issues new threats against Iran.

Crude is over $63 for the first time in four months as Donald Trump issues new threats against Iran.

Why any of this is necessary when he told us last summer that U.S. bombing had “completely obliterated” Iran’s nuclear sites, he did not say.

![]() 85 Seconds to Midnight

85 Seconds to Midnight

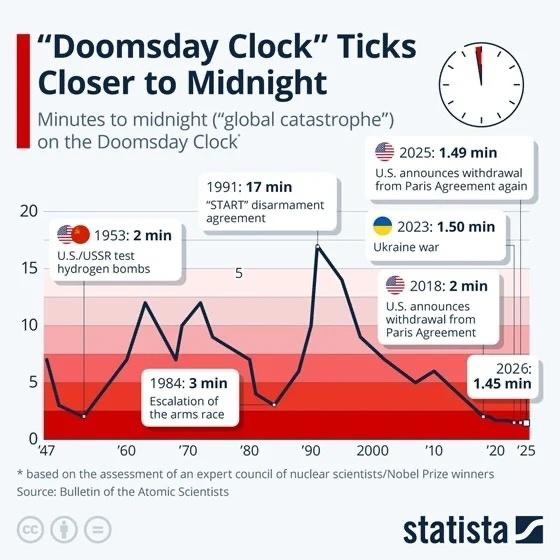

The “Doomsday Clock” is closer to midnight than it’s ever been.

The “Doomsday Clock” is closer to midnight than it’s ever been.

Regularly since 1947, the Bulletin of the Atomic Scientists has published a clock symbolizing the risk of nuclear Armageddon.

Throughout the Cold War, the clock never got closer than two minutes to midnight. Since the Russian invasion of Ukraine, it’s been 90 seconds or less, as seen on this infographic from Statista…

In recent years, the editors of the Bulletin have updated the clock every year during January. This week, they inched the clock forward from 89 seconds to 85.

Among their reasons: The last remaining nuclear arms treaty between the United States and Russia is set to expire one week from today. The “New START” treaty of 2011 kept a cap on the two sides’ nuclear arsenals — each country allowed 1,550 deployed strategic warheads and launchers.

New START will be the second major arms agreement junked under President Trump; during his first term he walked away from Ronald Reagan’s Intermediate-Range Nuclear Forces Treaty, which eliminated an entire class of nuclear weapons from the continent of Europe.

And so next week will mark the first time in over 50 years that there will be no bilateral treaty limiting the U.S. and Russian nuclear arsenals.

The relevance to the markets and the economy, you ask? None — except there won’t be any markets or economy for us to talk about if the Earth is pockmarked with smoldering radioactive craters.

![]() Ditching TikTok

Ditching TikTok

The new “Made in America” TikTok is so awful, hordes of users are walking away.

The new “Made in America” TikTok is so awful, hordes of users are walking away.

The market research firm Sensor Tower tells CNBC that the daily average number of users deleting the app has spiked 150% since the platform came under U.S. control last Thursday.

We’ve chronicled the complaints in recent days: An intrusive new privacy policy… top users reporting zero views of their videos… claims of censorship… or the app just being either slow or unavailable.

And it seems users are seeking out alternatives…

“This is a textbook case of the Streisand effect,” says an observer on X. “When platforms tighten censorship, users don’t disappear — they migrate. TikTok’s trust problem is becoming a growth engine for competitors, and UpScrolled is capitalizing on that moment perfectly.”

“I was one of the few Republicans that voted NO against the TikTok Ban,“ says a tweet from former Rep. Marjorie Taylor Greene (R-Georgia).

“I was one of the few Republicans that voted NO against the TikTok Ban,“ says a tweet from former Rep. Marjorie Taylor Greene (R-Georgia).

[She was one of the few in either party to vote no, as a matter of fact…]

“And now that it’s been sold apparently people are getting censored for posting about Epstein and other things. People loved TikTok but they are leaving in droves because banning people’s speech is worse than spying on them.”

For its part, TikTok’s new U.S. management says there are no rules against sharing the name “Epstein” in direct messages — a not-very-clever dodge that fails to address the claim that posts are being restricted.

This fiasco is a fitting conclusion to a sorry saga that was years in the making.

Two final observations, originally shared in an issue-length exploration of TikTok a year ago…

- No one in either party tried to sell the American people on the urgency of either banning TikTok or bringing it under U.S. control. The politicos just did what they wanted, the people be damned

- There will be more TikToks in the future: The law that forced the TikTok sale gives the president the authority to ban any website or app at his discretion if it is owned by a person or company in a “foreign adversary country.”

![]() Mailbag: 1968… and 2026

Mailbag: 1968… and 2026

“This was a fantastic report,” says a very late-arriving reader email responding to our Dec. 18 edition — exploring a weird historical pattern that suggested that the tumultuous events of 1968 might reverberate during 2026.

“This was a fantastic report,” says a very late-arriving reader email responding to our Dec. 18 edition — exploring a weird historical pattern that suggested that the tumultuous events of 1968 might reverberate during 2026.

(I suppose they already are?)

“I remember very well all these events and you are spot-on. You missed the Newark riots, that I must admit was well done in the movie The Many Saints of Newark.

“Dave, you are very good at this and you are one of the only nonpartisan reporters left. Thank you very much for sharing these insights.”

Dave responds: After publishing that issue, I ran across a startling but credible claim: At the 1968 Democratic National Convention in Chicago, “an estimated one in six protesters was an undercover agent for the police, the Army or Navy or the FBI.”

Doing some further digging, it turns out the estimate originates with a former Army intelligence offier-turned-whistleblower named Christopher Pyle, who turned his Ph.D. dissertation into a book called Military Surveillance of Civilian Politics, 1967–1970.

A 1978 CBS News broadcast also arrived at the one-in-six figure, citing Army sources.

Obviously not all of those faux “protesters” were agitators or provocateurs… but it doesn’t take very many to stir up trouble.

Something to think about in light of events unfolding on our screens this month…