NVDA and GOOG: Smart Moves

![]() The “Lag 7”

The “Lag 7”

If recent history is any guide, this week should be the biggest week of earnings season.

If recent history is any guide, this week should be the biggest week of earnings season.

In mid-2023, Bank of America analyst Michael Hartnett coined the term “Magnificent 7” — applying it to a select group of tech-adjacent megacap stocks.

In alphabetical order they’re Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

The Mag 7 were the engine powering the broad stock market during 2023 and 2024. Typically, five of the seven would report their quarterly earnings in the same week. Wall Street waited breathlessly for the numbers and conference calls. Financial media devoted as much hype to these weeks as they did to Federal Reserve meetings.

And then came 2025.

And then came 2025.

Wall Street still waited breathlessly and the media still devoted oodles of airtime and bandwidth.

But the juice was gone. The S&P 500 rose 16.4% for the year… and only two of the Mag 7 outdelivered the broad market.

Alphabet (GOOG) sailed 65% higher, while Nvidia (NVDA) rose 39%. The rest underperformed an S&P 500 index fund. Jokes started to abound about the “Lag 7.”

This week, four of those underperformers report their numbers — Apple, Meta, Microsoft and Tesla.

Alphabet used to be part of this frenzy every January, April, July and September. This time, however, it’s sitting out — waiting to report its numbers until next week. Nvidia, for its part, has always reported several weeks after its Mag 7 brethren.

Smart move in both cases. If you’re crushing it, best to report your numbers when they won’t get lost in the shuffle of everyone else’s numbers.

And so the “biggest week of earnings season” no longer has the razzle-dazzle it once did. Heck, CNBC thought it was worthy of “Breaking News” this morning when old-economy stalwarts Boeing and General Motors reported their numbers.

Times change…

![]() Health Care: Crack in the System

Health Care: Crack in the System

The big story on Wall Street today is the first obvious crack in an unsustainably costly U.S. health care system — not that the media are framing it in those terms.

The big story on Wall Street today is the first obvious crack in an unsustainably costly U.S. health care system — not that the media are framing it in those terms.

“The Trump administration is proposing roughly flat rates for Medicare insurers next year,” reports The Wall Street Journal.

Oops — Wall Street analysts were counting on an increase between 4–6%.

With that, Mr. Market is mercilessly punishing the big providers of Medicare Advantage plans: CVS Health (CVS) is down 10.8% at last check... UnitedHealth (UNH) down 18.5%… Humana (HUM) down 19.3%.

Your editor has been writing about the staggering costs of the American health care system for over a decade — most recently over the holidays.

Health care took up barely 6% of all federal spending in 1970. Today that share has swelled to over 35%.

Something’s got to give.

Perhaps Wall Street is starting to wake up to that reality, given the price action in the insurance stocks today. The Trump administration will make a final call on the compensation those companies get in April.

If you’re on a Medicare Advantage plan right now — more than half of Medicare beneficiaries are — it’s not too early to start thinking about what your world would look like if the system can no longer sustain these plans and your only option is a more costly Medicare supplement or “Medigap” plan.

At present one major health care provider — Mayo Clinic — already turns away patients who have only Medicare Advantage coverage.

Many others are likely to join Mayo’s ranks if events continue on their current trajectory…

As for the broader stock market, it’s a mixed bag: The S&P 500 is up a half percent as we write to 6,984.

As for the broader stock market, it’s a mixed bag: The S&P 500 is up a half percent as we write to 6,984.

If that number holds by day’s end, it would be a record close. The Nasdaq, meanwhile, is up nearly 1%. But the Dow is down three-quarters of a percent, dragged down by the aforementioned UNH.

The action in precious metals so far this week has been dizzying — up huge Sunday night, down huge last night, up substantially (but not huge) today. Checking our screens gold is about 12 bucks shy of $5,100 while silver is over $108.

“Volatility is likely to stick around,” colleague Sean Ring writes in today’s Rude Awakening. “Scalpers will sell overbought rallies. Those sell-offs may overshoot. Price may spend time carving out a messy range while positioning resets.” (If you want the play-by-play of everything behind the whipsaw moves of the last 48 hours, Sean’s your guy.)

Crypto is gamely trying to stage a comeback, Bitcoin back over $88,000 and Ethereum at $2,967.

Crude is up 1.7% as the war drums beat louder in the Middle East again.

Crude is up 1.7% as the war drums beat louder in the Middle East again.

“The U.S. is weighing precision strikes on ‘high-value’ Iranian officials and commanders who it deems responsible for the deaths of protesters,” reports Middle East Eye, citing “a Gulf official familiar with the discussions.”

Judging by the U.S. bombing of Iran last year and the kidnapping of Venezuelan strongman Nicolás Maduro this year, Donald Trump is keen for lightning-quick action — and no U.S. casualties.

If that’s not a viable option this time, The Jerusalem Post reports that Washington is considering a blockade on Iranian oil shipments, similar to the one imposed on Venezuela late last year.

But that too comes with considerable risk, as the military analyst Will Schryver tweets…

Amid these cross-currents, a barrel of West Texas Intermediate fetches $61.66 — on the high end of its trading range this month.

![]() Division and Dissension at the Fed

Division and Dissension at the Fed

Paradigm macro maven Jim Rickards is sticking his neck out.

Paradigm macro maven Jim Rickards is sticking his neck out.

This morning the Federal Reserve began one of its policy-setting meetings held eight times a year. At the conclusion of that meeting tomorrow afternoon, Jim expects the Fed will cut the benchmark fed funds rate another quarter percentage point to 3.5%. (It was 4.5% as recently as last summer.)

This expectation is far outside the consensus. Looking at the action in fed funds futures this morning, traders assign a 97% probability the Fed will “pause” its recent rate-cutting cycle and hold the rate steady at 3.75%.

Note well: Jim has had a near-perfect record calling both the direction and magnitude of Fed rate moves for the last four years.

At issue this time is “Powell’s loss of control of his own board,” says Jim. Powell favors a quarter percentage point cut, and so do some of his colleagues. But other members of the Fed’s Open Market Committee favor a steeper cut of a half percentage point, while others favor leaving the rate where it is now.

“The result,” says Jim, “may be an 8-4 vote in favor of the 0.25% rate cut where the four dissenters are of two different minds — some supporting a larger cut and some supporting no cut at all.

“This nuance will be lost on everyday Americans and the media. All they will see is a large dissenting vote.”

Fed chairs have long exercised an iron grip over the other committee members. But now the level of division and dissension is its highest since the 1980s.

The fact Powell is a lame duck only adds to the sense of things flying apart. He’s running only three more meetings until his term as chair is up in May — and that’s assuming he doesn’t quit early under pressure from Donald Trump.

“That can only unsettle markets more than they already are,” Jim concludes.

![]() “New and Improved” TikTok (Continued…)

“New and Improved” TikTok (Continued…)

When we left you yesterday… we took note that under the platform’s new U.S.-based majority owners, users were complaining about both an intrusive new terms of service (collecting data on everything from precise location to the user’s mental health) and the suppression of news from the “For You” tab.

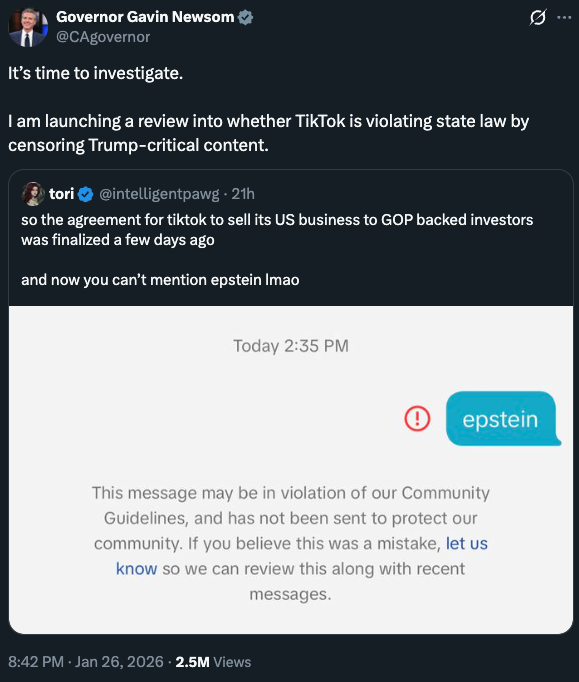

Now come accusations that posts about the late financier and sexual predator Jeffrey Epstein are being censored — which, of course, California Gov. Gavin Newsom glommed onto for partisan advantage…

Elsewhere we see widespread complaints that the platform simply isn’t available. The Downdetector site tells the BBC it got over 663,000 reports of issues from U.S. users of TikTok starting on Saturday and continuing through yesterday. Other users noticed the videos they uploaded had less visibility than before or were even “stuck at zero views.”

For its part, TikTok’s new U.S. management said yesterday that users might notice "multiple bugs, slower load times or timed-out requests" that it blamed on a power outage at a data center owned by Oracle (which now owns 15% of TikTok).

"While the network has been recovered, the outage caused a cascading systems failure that we've been working to resolve together with our data center partner." it said.

And yet, TikTok seems to be working just fine in the rest of the world, where China-based Bytedance retains majority ownership. Go figure…

![]() Mailbag: $1.5 Trillion

Mailbag: $1.5 Trillion

“Wow Dave, this issue was exceptional,” a reader writes after last Friday’s edition exploring the underbelly of the military-industrial complex.

“Wow Dave, this issue was exceptional,” a reader writes after last Friday’s edition exploring the underbelly of the military-industrial complex.

“You have addressed most of these points in past issues but this was an extremely well-done piece. It ought to be used as a primer for any class on recent history. No buts. Surely there will be some simpletons who read it as an attack on some of their heroes — ignore them. You're doing good work, keep it up.”

“Outstanding 5 Bullets on Jan 23, Dave — one of your best over the past year,” says another. “Great to see a little bit of Bill Bonner and libertarian philosophy carried over from Agora into Paradigm Press. Now if you could just convince Jim Rickards and Buck Sexton to read it!”

“Excellent commentary!” enthuses a third. “Needed to be spelled out — you did that very neatly. As good as Chris Campbell — only different. Thank you.”

Dave responds: Love Chris, so that’s high praise indeed!

Not everyone is in accord: “Maybe Dave Gonigam is a good managing editor, but he is an awful columnist.

Not everyone is in accord: “Maybe Dave Gonigam is a good managing editor, but he is an awful columnist.

“I think I made it to Bullet No. 3 this time — and that was a struggle.”

Dave: I appreciate the very specific feedback, laying out your objections so systematically. It will undoubtedly enable me to do a better job in the future.

“Really good post — spot-on regarding the assertions,” writes our final correspondent — a longtimer who’s not afraid to rake me over the coals now and then.

“Really good post — spot-on regarding the assertions,” writes our final correspondent — a longtimer who’s not afraid to rake me over the coals now and then.

“AND... one thing caught my eye. You presume al-Qaida was responsible for the attacks. Is that so?

“Gotta call bull*** on that one, and I imagine you would too if you didn't fear being cast as... god forbid... conspiracy theorists.

“Well, I'm an unapologetic conspiracy theorist and conspiracy factist... the Wuhan shots... the rigging of multiple financial markets, especially silver... the Maidan shenanigans... the ballot fraud in the 2020 election. The list goes on for quite a while. My track record of correct calls is pretty much unblemished.

“Later you say, correctly: ‘Sept. 11, 2001, was also the day many conservatives abandoned their suspicions of Big Government.’

“YEAH... THAT WAS THE PRECISE DESIRED EFFECT. Mission accomplished.

“Cheney's dead now and I guess it's unseemly to continue my cheering, but what an interesting story he might have been loose enough to tell under the influence of truth serum.

“It was an inside job, and only the willfully ignorant or those with an interest in perpetuating the con could possibly disagree, given the overwhelming mountain of evidence.

“Most can't admit the truth re: 9/11. It would set their worldview on tilt. I get that and I sympathize, but the truth is the truth, no matter how uncomfortable or inconvenient it is... to coin a phrase.

“Again, your analysis is dead on.”

Dave: Thank you. I think the already-known and widely acknowledged facts about 9/11 are damning enough — particularly the involvement of high-level Saudi Arabian officials, about which we continue to learn more 24 years later.

And yet the whole time, U.S. presidents have bowed and scraped before King Fahd, King Abdullah, King Salman and now Crown Prince Mohammed bin Salman.

Obama and Trump aided and abetted a Saudi Arabian genocide in Yemen — for which someone in Yemen might, one day, decide to hold the American people at large responsible and carry out a large-scale attack on U.S. territory. And the whole cycle would begin anew…

But on one point I’m in full agreement: Every new crisis, whatever its origins, is an excuse for a new power grab. And so it goes.