Elon’s Long Game

![]() Elon’s Long Game

Elon’s Long Game

At the very least, Elon Musk is getting serious about putting data centers in space. It’s also possible he’s looking to consolidate most of his businesses within publicly traded Tesla.

At the very least, Elon Musk is getting serious about putting data centers in space. It’s also possible he’s looking to consolidate most of his businesses within publicly traded Tesla.

We went into some detail last fall about the advantages of orbiting data centers — namely, 24/7 solar power that doesn’t compete with homeowners and businesses for scarce electricity back on Earth.

The science behind the concept is still a work in progress. But if anyone’s got the will and the funds to make it work, it’s Musk.

Yesterday afternoon, the rumors started rippling among the 5,000 attendees at the SpaceCom event in Orlando — including our own Ray Blanco, who posted the following on the Paradigm Press mobile app…

Yesterday afternoon, the rumors started rippling among the 5,000 attendees at the SpaceCom event in Orlando — including our own Ray Blanco, who posted the following on the Paradigm Press mobile app…

Musk has been touting the potential of space-based data centers for months — most recently last week at the World Economic Forum in Davos, Switzerland: “The lowest-cost place to put AI will be in space. And that will be true within two years, maybe three at the latest.”

“This isn't looking like much of a prediction anymore,” Ray wrote yesterday to readers of Altucher’s Investment Network.

“This isn't looking like much of a prediction anymore,” Ray wrote yesterday to readers of Altucher’s Investment Network.

“And that means that the universe of players I am seeing here at SpaceCom, like launchers, nuclear power systems, manufacturing platforms and space logistics infrastructure — just became essential to the biggest industrial shift since the internet.

“Under the proposed deal, xAI shares will be exchanged for SpaceX shares.

“The corporate structure is already in motion — entities were set up in Nevada on Jan. 21 to facilitate the transaction.

“The merger combines SpaceX's launch capabilities and Starlink’s satellite network with xAI's Grok AI platform, supercomputing infrastructure and the X social media platform's vast data resources.

“It also consolidates defense contracts, including xAI's $200 million Pentagon deal to integrate Grok into military networks. The result: the world's most valuable private company, preparing for what will be the largest IPO in history.”

Or will Musk instead bring the whole shebang underneath the Tesla umbrella?

Or will Musk instead bring the whole shebang underneath the Tesla umbrella?

That’s the tantalizing possibility raised by Bloomberg’s version of the story…

SpaceX is considering a potential merger with Tesla Inc., as well as an alternative combination with artificial intelligence firm xAI, according to people familiar with the matter, a sign billionaire Elon Musk is weighing how to consolidate his empire.

The firm has discussed the feasibility of a tie-up between SpaceX and Tesla, an idea that some investors are pushing, the people said, asking not to be identified as the information isn’t public. Separately, they are also exploring a tie-up between SpaceX and xAI ahead of an IPO, some of the people said.

A week ago today at our sister e-letter The Million Mission, colleague Davis Wilson advanced an out-there proposition: “What if Elon Musk eventually consolidates all of his companies into one mega-entity? Maybe even with one single ticker: ELON.”

Only a week later, that sure looks like the trajectory. Especially after the announcement that Tesla is sinking $2 billion into xAI.

TSLA shares ended yesterday down 3.2%. Today they’ve recovered all those losses and then some, up nearly 5%.

Meanwhile, the major indexes are in the red as the week winds down.

Meanwhile, the major indexes are in the red as the week winds down.

➢ Congratulations are in order for Rickards’ Insider Intel readers — who yesterday bagged enormous 803% gains playing call options on the mining giant Rio Tinto Group

➢ For the record: Another Magnificent 7 name reported its quarterly numbers late yesterday. Apple generated record profit on the back of blowout iPhone sales; it seems everyone who upgraded their phone during lockdown in 2020 could no longer hold off on their next upgrade, even if they’re strapped for cash. As always, however, it’s not about the news but rather the reaction to the news: AAPL is down 1.3% on the day.

Elsewhere, the Labor Department reported a red-hot inflation number this morning — wholesale prices leaping 0.5% during December, which translates to a 3% year-over-year jump.

Numbers like these will do nothing to persuade the Federal Reserve — under current management anyway — to resume cutting interest rates after its “pause” earlier this week.

But speaking of Fed management…

![]() Gold… and the Fed

Gold… and the Fed

The financial media just can’t help themselves…

The financial media just can’t help themselves…

That’s what greeted your editor upon waking this morning.

The media are always looking for “reasons” behind every move in the markets, big or small. Of course, they can never prove cause and effect, so they resort to use of the word “after” — inducing you, the news consumer, to make the causal connection on your own.

As Paradigm trading pro Enrique Abeyta would tell you, the nomination of a new Fed chair is not the reason for the sell-off in precious metals.

Rather it’s the excuse for a sell-off in an asset class that was incredibly overstretched and due for a reset.

Checking our screens, gold is down over $350 — but still clinging to a $5,000 handle. If that holds by day’s end, the Midas metal will still register an all-time weekly high. That’s how volatile the price action has been this week.

Silver, on the other hand, is down $18 to $97.51 and will end the week in the red. That said, $97 silver was an all-time high only eight days ago.

If you want to explore some other proximate events (not necessarily reasons) for the correction in the metals today, Sean Ring has an excellent rundown at The Rude Awakening.

In the meantime, another Wall Street giant is stepping forward with a bold precious metals prediction.

In the meantime, another Wall Street giant is stepping forward with a bold precious metals prediction.

We’ll reinforce what we said yesterday: Wall Street hates precious metals because they don’t generate juicy fees the way stocks and bonds and options do. So when the big banks start talking up metals, it’s worth paying attention.

Yesterday, we mentioned that Bank of America sees silver rising to anywhere between $135–309 long term. Now JPMorgan Chase is looking for gold to reach $8,000–8,500 by the end of the decade.

The reasoning of JPM’s Nikolaos Panigirtzoglou is startlingly similar to that of our own Jim Rickards: All it takes is for private investors to increase the gold allocations in their portfolios from the current 3% to 4.6%.

➢ Elsewhere in the commodity complex, oil prices remain near four-month highs over $65. Traders don’t want to be “short” crude going into a weekend when the likelihood of a U.S. attack on Iran is elevated.As for the Fed… read on.

![]() The Fed… and Housing Costs

The Fed… and Housing Costs

So yes, the president did nominate a new Federal Reserve chair. As we’ve done with Jerome Powell in the past, and Janet Yellen before him, we introduce you to this individual via a trio of photos…

So yes, the president did nominate a new Federal Reserve chair. As we’ve done with Jerome Powell in the past, and Janet Yellen before him, we introduce you to this individual via a trio of photos…

Intense Kevin Warsh

Intense Kevin Warsh  Too cool for school Kevin Warsh

Too cool for school Kevin Warsh  “I’m the captain now” Kevin Warsh

“I’m the captain now” Kevin Warsh

Kevin Warsh, 55, is a Harvard Law product who spent a few years at Morgan Stanley before joining the Dubya Bush administration. Bush later appointed him to the Fed’s Board of Governors for a five-year stint before he took a teaching job at Stanford and a board position at UPS.

So he checks all the elite boxes. The Wall Street Journal tells us Warsh “played behind-the-scenes roles during Washington’s rescue of Wall Street in the 2008-09 financial crisis.” Wikipedia says he “acted as the central bank’s primary liaison to Wall Street.”

In other words, Wall Street is counting on him to once again save their bacon at taxpayer expense during the next banking crisis — which likely as not will unfold before the end of Trump’s term.

Warsh was in the running for Fed chair eight years ago during Trump’s first term — and didn’t make the cut.

Warsh was in the running for Fed chair eight years ago during Trump’s first term — and didn’t make the cut.

It’s all there in our voluminous archives: Warsh was a candidate during The Apprentice: Fed Chairman Edition in 2018.

He described his Oval Office interview during a Politico podcast — saying the president badgered him about keeping interest rates low. (Sound familiar?)

“If you think it was a subject upon which he delicately danced around, then you’d be mistaken,” said Warsh. “It was certainly top of mind to the president. The president has a view about asset prices and stock markets. He has a view based on his long history in his prior life as a developer and real estate mogul of the role of interest rates.”

Warsh wasn’t about to blow it this time. Like OpenAI’s Sam Altman and Palantir’s Alex Karp (among many others), he deftly played the insider game, shape-shifting from Establishment twit into MAGA bomb-thrower without missing a beat.

Earlier this month, the buzz around Washington was that no matter who Trump nominated, centrist Republicans in the Senate would look upon him with suspicion because Trump threatens the Fed’s alleged “independence.” But Warsh has built up enough elite cred across his career that he’ll likely sail through…

One more thing before we move on: It’s possible Trump didn’t intend to name someone so soon.

One more thing before we move on: It’s possible Trump didn’t intend to name someone so soon.

Out of nowhere, he said last night he would nominate a candidate today.

In the relentless media cycle of the 2020s, that served as a shiny-object distraction from something else he said a few hours earlier…

That remark set off a wave of white-hot generational resentment on social media…

Hmmm… Wonder how soon the president intends to trot out his 50-year mortgage proposal again?

![]() Stat of the Day

Stat of the Day

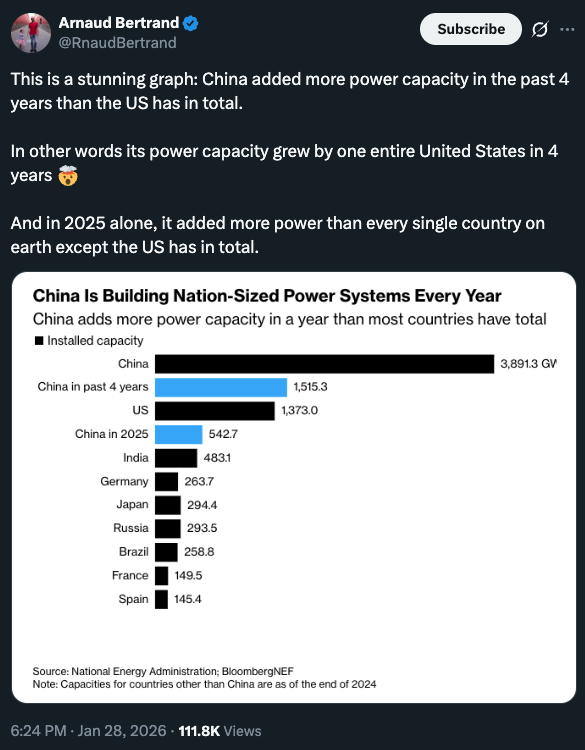

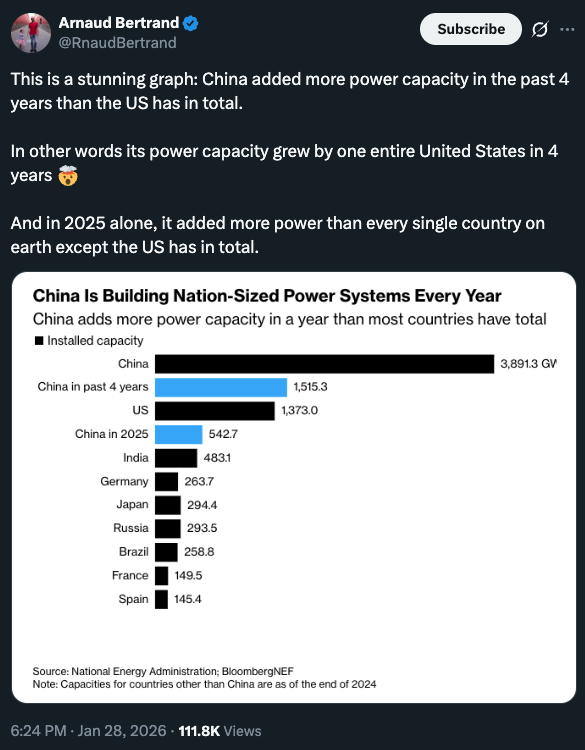

Here’s an eye-opener — especially in light of the heavy demands that data centers are placing on the U.S. power grid…

Here’s an eye-opener — especially in light of the heavy demands that data centers are placing on the U.S. power grid…

![]() Mailbag: Newcomer and Longtimer Edition

Mailbag: Newcomer and Longtimer Edition

Here’s an eye-opener — especially in light of the heavy demands that data centers are placing on the U.S. power grid…

Here’s an eye-opener — especially in light of the heavy demands that data centers are placing on the U.S. power grid…

Mailbag: Newcomer and Longtimer Edition

Mailbag: Newcomer and Longtimer Edition

We have mail from readers new and old to wind down the week. First, a newcomer’s inquiry…

We have mail from readers new and old to wind down the week. First, a newcomer’s inquiry…

“I'm a brand-new investor, and a new Paradigm and James Altucher follower and subscriber. I've enjoyed the information so far, sharing my excitement, and looking forward to more. BTW, all the stocks I've purchased based on your recommendations are doing well. They're smaller quantities, it's a start. I've also purchased both of Scott Adams’ books on James’ recommendation..

“My question is this: When there are emails and texts about exciting opportunities, I listen to the videos and then am completely disappointed when I get to the end and realize I have to pay $1,495 or $2,495 to get the information each time. (I'd love to get in on Matt Badiali's info, wow!)

“I don't have enough saved (yet) to be able to pay those fees and still have money left to invest and pay my bills. As seasoned professionals, do you have any suggestions? Thank you in advance.”

Dave responds: First of all, welcome aboard. We’re delighted you’re here.

Very briefly: We have two basic tiers of subscriptions. One of them is far more costly than the other. The higher cost reflects a higher level of both risk and complexity in the recommendations.

Our hope is that the profits you generate from your entry-level subscription will over time allow you to step up to a higher level of service. If you want to know more about our business model at Paradigm Press, we invite you to give this back issue of 5 Bullets a look. And good luck with your journey!

Meanwhile, a longtimer weighs in on a couple of precious metals items in yesterday’s edition…

Meanwhile, a longtimer weighs in on a couple of precious metals items in yesterday’s edition…

“Dave, the chart showing gold purchases by central banks is denominated in tonnes, which is the proper way to do it, but if you had shown it in the cost of the gold, 2025 would have been around 20% higher than 2024, since the average price in 2024 was around $2,350 per ounce, while in 2025 it was around $3,450 per ounce.

“As for the tax question, it is worth noting that taxes are only owed after the trade is closed out. If you hold for less than 12 months, then you are taxed at the short-term capital gains rate for your bracket, and if longer than 12 months, then you are taxed at the long-term (lower) rate.

“I will note that I own a gold miner recommended by Byron King seven or eight years ago that is up over 30X, and I'm still holding. Someday I'll sell and pay the tax, but meanwhile I'm hodling!”

“Dave Gonigam’s observations in last Friday’s 5 Bullets are par for the Gonigam course,” writes our last correspondent — “well informed, insightful and highly entertaining.

“Dave Gonigam’s observations in last Friday’s 5 Bullets are par for the Gonigam course,” writes our last correspondent — “well informed, insightful and highly entertaining.

“He missed his calling. He should have been a college professor.”

Dave: Huh? What?!

Actually in my early teen years I did think about pursuing an econ degree. I fancied going to the University of Chicago to study under Milton Friedman — who at the time had achieved celebrity status with his book and companion PBS series Free to Choose.

But I was a media creature at heart and so I pursued a broadcast news career. It’s just as well; I wouldn’t have lasted long at all in academe!