Data Centers in Space

![]() Data Centers in Space

Data Centers in Space

If people are getting sick and tired of data centers being built in their neighborhood and driving up their electric bills… where will AI get the juice it needs to function?

If people are getting sick and tired of data centers being built in their neighborhood and driving up their electric bills… where will AI get the juice it needs to function?

Increasingly the answer appears to be in outer space.

A handful of startups are already pursuing the concept of orbital data centers powered by solar. So is former Google CEO Eric Schmidt. Last month, Amazon founder Jeff Bezos said he envisioned gigawatt-scale data centers built in space over the next 10–20 years.

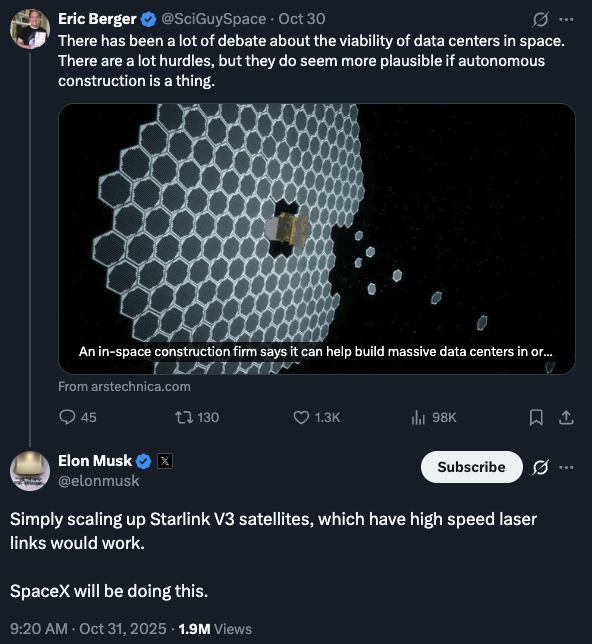

Then came a story published last week by Ars Technica about the logistics of building data centers in space… and Elon Musk weighed in.

“Musk’s interest in space-based data centers significantly raises the profile of the nascent industry,” Ars Technica’s Eric Berger writes in a follow-up article.

“Musk’s interest in space-based data centers significantly raises the profile of the nascent industry,” Ars Technica’s Eric Berger writes in a follow-up article.

“Proponents of the idea say the advantages are clear: free, limitless power from the sun and none of the messy environmental costs of building these facilities on Earth (where opposition is starting to grow).”

It’s not that novel a concept: After all, telecommunications satellites have been transmitting data ever since the launch of Telstar 1 in 1962, supporting analog TV and telephone communications. It’s just a matter of scale — and SpaceX just might be able to pull it off.

At present, SpaceX’s network of Starlink V2 mini satellites supports a maximum download capacity of about 100 gigabits per second. But Musk and crew have a V3 generation of satellites in the works that will grow this capacity tenfold.

As early as the first half of next year, SpaceX will launch dozens of these satellites on every Starship rocket launch.

Caleb Henry, research director at the firm Quilty Space, figures about 60 satellites per launch. And there’ve been four launches so far in 2025. “Nothing else in the rest of the satellite industry… comes close to that amount of capacity,” he tells Ars Technica.

Critics point out that space-based data centers require vast solar arrays, never mind the logistics of constructing them in space.

But “SpaceX’s Starlink constellation has already defied some of this conventional wisdom by delivering high-speed broadband to millions of customers around the world while making a profit,” Berger points out.

“So if Musk believes the Starlink architecture can be applied to data centers, it will be difficult for the industry to ignore.”

![]() Gold Reaches a Milestone (No, Really)

Gold Reaches a Milestone (No, Really)

Not that many people noticed, but gold and silver notched record monthly closes on Friday.

Not that many people noticed, but gold and silver notched record monthly closes on Friday.

At $3,997.10, the Midas metal ended October 3.3% higher than the September close of $3,869. But in-between came the insane ramp to nearly $4,400 — and the steep drop.

Silver’s story is similar, ending October at $48.65 — higher than a month earlier but down big from the $54.46 peak.

“These blow-off rallies can resolve in two ways: by price or by time,” colleague Sean Ring writes in today’s Rude Awakening. “If by price, we’ll see $3,600 [gold]. If by time, it may take a month or two before we reclaim the intramonth high of $4,381.”

As for silver, “give it a few weeks before we finally surmount that $54.50 level.”

The story for the mining stocks isn’t quite as sanguine. The HUI index ended October at 581 — down from 611 at the start of the month. Not surprising given the ongoing rally in tech stocks; look for the miners to consolidate until hot money starts rotating out of the Magnificent 7 names and into other sectors.

As for today, gold has inched back over $4,000 but silver is losing ground at $48.38. The HUI has drifted down 1.4% to 572, in part because the Street doesn’t like an acquisition just announced by Coeur Mining (CDE).

As for the broad stock market, “It’s melt-up season, so I wouldn’t be surprised to see stocks float higher this month,” observes Greg Guenthner at The Trading Desk.

As for the broad stock market, “It’s melt-up season, so I wouldn’t be surprised to see stocks float higher this month,” observes Greg Guenthner at The Trading Desk.

“Just where the potential melt-up will take us remains to be seen. But earnings have been strong so far, and reactions are equally positive. Just a few potential roadblocks remain. Some are technical, others are event-driven.

“Can the speculative tech names catch and start to run here? We’ve seen plenty of positive momentum from the mega-caps and other household names. But many of the speculative tech groups are still consolidating their September and early October rallies…

“Then there’s the shutdown. We’re on the cusp of what could be the longest government shutdown of all time as the new week begins. But so far, traders have brushed it off.”

As the new month begins, the S&P 500 is up slightly on the day to 6,852 — about 40 points off last Tuesday’s record close. The Nasdaq’s gain is stronger, while the Dow is in the red.

Crude begins a new week at $61.35. No joy in crypto-land, with Bitcoin below $107,000 and Ethereum just over $3,600.

The main economic number of the day is the ISM manufacturing index — which rang in lower than expected at 48.7. Any number under 50 suggests a shrinking factory sector, and with the exception of two months in early 2025 the index has been stuck under 50 for the last three years.

The main economic number of the day is the ISM manufacturing index — which rang in lower than expected at 48.7. Any number under 50 suggests a shrinking factory sector, and with the exception of two months in early 2025 the index has been stuck under 50 for the last three years.

The ISM survey team blames the current punk number on tariff uncertainty: Executives are too gun-shy about spending on new plant and equipment until they have a better idea of what the future holds.

Which tees up today’s Bullet No. 3…

![]() China: Nothing Is Ever Settled

China: Nothing Is Ever Settled

Perspective: A week ago at this time, Wall Street was staging a big rally on news that U.S. and Chinese negotiators had reached a “framework” agreement ahead of the Trump-Xi summit.

Perspective: A week ago at this time, Wall Street was staging a big rally on news that U.S. and Chinese negotiators had reached a “framework” agreement ahead of the Trump-Xi summit.

Treasury Secretary Scott Bessent made big promises: “The tariffs will be averted.” There’d be a final deal on the sale of TikTok to U.S. investors. And progress on everything from fentanyl to U.S. soybeans to Chinese rare earths.

But as we cautioned in this space, there was no similar big talk from the Chinese side — just generalities about “a basic consensus on arrangements to address their respective concerns.”

We bruited the very real possibility that one side might walk away in a huff — which would tank the stock market in short order.

In the event, the Trump-Xi summit went ahead — but did not result in a broad, sweeping agreement. It was essentially an agreement to kick the can.

In the event, the Trump-Xi summit went ahead — but did not result in a broad, sweeping agreement. It was essentially an agreement to kick the can.

- Beijing promised to crack down on fentanyl chemicals; in exchange, Washington cut the overall tariff level on Chinese goods from 57% to 47% (although there seem to be many exceptions and carve-outs that bring the level down further)

- Beijing also promised to ease some of its export controls on rare earth elements for 12 months

- China will buy more American soybeans, the amount to be announced later.

That’s it. They couldn’t even come to final terms on a TikTok deal, for crying out loud!

Over the weekend it emerged there might also be agreement on the fate of the Chinese-owned chip maker Nexperia.

Over the weekend it emerged there might also be agreement on the fate of the Chinese-owned chip maker Nexperia.

As we chronicled last month, the Dutch government nationalized Nexperia’s operations there. But because 80% of Nexperia’s Dutch product is sent to China for packaging and testing, Beijing had ample leverage — which it exercised by barring exports of the firm’s product from China. Volkswagen and Volvo, among others, were at risk of shutting down their assembly lines for lack of chips.

Now a statement from Washington says Beijing will “take appropriate measures to ensure the resumption of trade from Nexperia's facilities in China, allowing production of critical legacy chips to flow to the rest of the world.” In practice, that means the Chinese government will exempt certain firms from the ban.

The meager details dripping out from the meeting were enough to keep Mr. Market happy — the S&P 500 flat on Thursday, down modestly on Friday.

The meager details dripping out from the meeting were enough to keep Mr. Market happy — the S&P 500 flat on Thursday, down modestly on Friday.

But this isn’t the broad, sweeping deal Bessent suggested was on offer a week ago today. There’s a not-insignificant risk that one side will do something to raise the hackles of the other.

And then we’re looking at the prospect of something like what happened on Friday, Oct. 10 — the S&P 500 taking a 2.7% spill after Beijing tightened its rare-earth export controls and Donald Trump threatened 100% tariffs on China.

Yes, the scare was momentary. But at some point reality is going to settle in: There might never be a “deal” with China in the sense of a written document constituting a final settlement with terms that everyone can understand and that afford businesses the opportunity to make long-term plans based on clear rules of the road.

What happens then?

➢ One other wild card: The Supreme Court hears arguments on Wednesday in the challenge to the Trump tariff regime that we told you about six months ago. Stay tuned…

![]() The Golden Toilet, Continued

The Golden Toilet, Continued

So as it turns out, there were two solid-gold toilets. This saga is the gift that keeps on giving.

So as it turns out, there were two solid-gold toilets. This saga is the gift that keeps on giving.

Way back in 2016, we related the debut of an artwork at the Guggenheim in New York — a fully functional toilet made of 18-karat gold, installed in one of the museum’s public restrooms.

The work was the brainchild of the Italian artist and sculptor Maurizio Cattelan, who titled it America. The Guggenheim described the exhibit’s objective as “making available to the public an extravagant luxury product seemingly intended for the 1%.”

[Cattelan went on to further renown for his duct-taped banana.]

In 2019, the luxe loo was installed for display at Blenheim Palace, birthplace of Winston Churchill and now a museum. A few weeks later… thieves managed to rip the toilet from its plumbing and make off with it.

Four suspects were caught in 2023 and two were convicted earlier this year. But the purloined potty was never recovered — not surprising given its $4 million melt value at the time of the break-in.

In that context, imagine your editor’s surprise upon seeing the following…

In that context, imagine your editor’s surprise upon seeing the following…

As it happens, Cattelan intends to make a set of five gold toilets. To date, he’s cast two — including the missing one.

The other was bought from a gallery by a private collector in 2017. And this second one goes on auction later this month at Sotheby’s in New York.

Of course, gold prices have risen steadily over the years. As such, the starting bid will be $10 million — or whatever is the metal value of the toilet’s 101.2 kilogram mass on the day of the sale, Nov. 18. Presumably it will fetch a considerable premium over the spot price.

In the meantime, it will be installed in a restroom at Sotheby’s Manhattan headquarters. But unlike the other toilet’s stint at the Guggenheim a decade ago, Sotheby’s David Galperin tells The Wall Street Journal, “We don’t want people sitting on the art.”

![]() Mailbag: Mamdani

Mailbag: Mamdani

“I would quibble with several aspects of your Mamdani article,” a reader writes after last Tuesday’s edition — “such as the gushing praise of Mamdani that you quote from your former colleague, and the gratuitous insults of Rogan O’Handley, a fine American and thought leader for a significant segment of Americans tired of the Uniparty nonsense.

“I would quibble with several aspects of your Mamdani article,” a reader writes after last Tuesday’s edition — “such as the gushing praise of Mamdani that you quote from your former colleague, and the gratuitous insults of Rogan O’Handley, a fine American and thought leader for a significant segment of Americans tired of the Uniparty nonsense.

“However, leaving those objections aside, I especially encourage you and your readership to critically question the notion that an experiment in communism in the country’s financial capital would be fine because it would be easily eradicated in the next election if it failed on the merits, which is highly likely. Communists are particularly adept at crushing opposition using undemocratic and often brutal tactics. Why would we expect anything different here?

“I’m afraid we’re down to holding our noses and rooting for Cuomo, whose only positive is that he isn’t Mamdani. His campaign slogan ought to be: ‘Vote for the nursing home murderer. It’s important.’”

“That was a lot of word-smithing but little new information. What's your point?” writes another.

“That was a lot of word-smithing but little new information. What's your point?” writes another.

“Yes, it’s expensive to live in NYC, with expensive residences, restaurants and clientele and who own them. Commuting is no bargain to live outside the city either. Regular folk who work in the city can’t afford to live there. What’s new about that? The same can be said of Monaco. But what’s the point? Don’t live there.

“Many in this class of voters who come from depressed countries or worse socialistic failures want the bright lights of New York City only to realize they can’t afford it and want handouts, government subsistence and a change into the very living conditions they left and why they came in the first place. This isn’t new either. Along comes a pied piper, like comrade Mamdani, who offers a song and dance to uneducated people (lifelong takers) and the promises of free stuff?

“Because his message is delivered with a wink and a smile, it makes you pause?”

Dave responds: Maybe you’re familiar with how NYC’s middle and working classes were dispossessed over the span of decades, but I suspect most readers learned a thing or two that they didn’t know before. That was my only aim. Sorry if it fell short for you.

The reaction from conservatives with Mamdani is eerily similar to the reaction liberals had a decade ago with Trump. Someone like me comes along, trying to objectively assess why this politician is getting traction, suggesting that it’s economic privation resulting from the misdeeds of connected elites…

… and the response in both cases is, Nuu-uhhh, it’s simple! His supporters are awful people! How dare you try to justify them!

Oh well…

“Posting political statements on a forum that is designed to gain customers interested in financial matters, and making money in the financial markets, probably isn’t a good practice,” writes our final correspondent.

“Posting political statements on a forum that is designed to gain customers interested in financial matters, and making money in the financial markets, probably isn’t a good practice,” writes our final correspondent.

“You’re going to piss off half of your customer base by practicing your First Amendment rights. It is definitely your right to do so, but consider another soapbox.”

Dave: You’re new to these parts? I’ve been at this for 15 years and I’ve pissed off just about everyone along the way. Comes with the territory.

Believe me, I’d rather live in a world where politics and public policy never intersect with commerce — but as investors we have to deal with the world as it is and not as we’d wish it to be.

If Mamdami is a portent of things to come… isn’t that something you’d want to know?