Ground Zero of Tech’s Cold War

![]() Nexperia: Ground Zero of Tech’s Cold War

Nexperia: Ground Zero of Tech’s Cold War

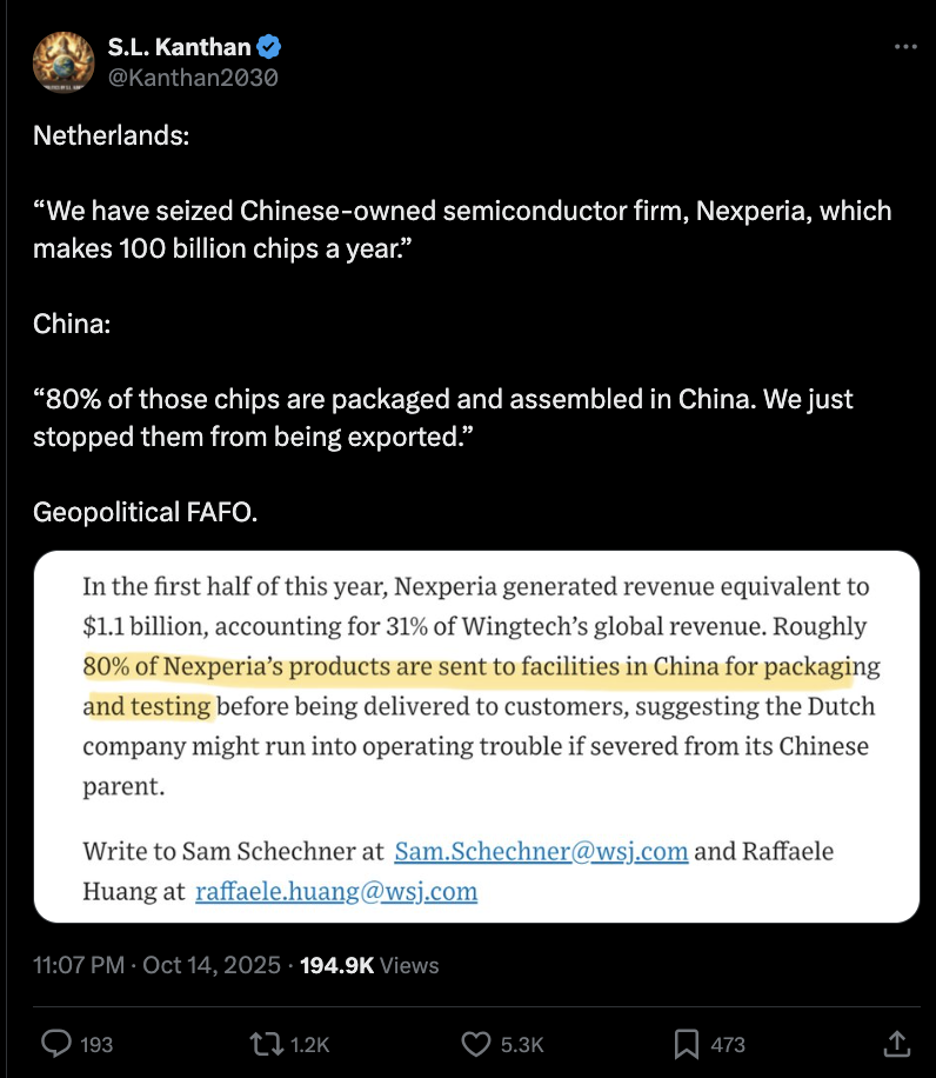

The chipmaker Nexperia, headquartered in the Netherlands, now sits at the center of the escalating U.S.–China trade war — one that’s rippling across the global economy, hitting everything from car production to consumer electronics.

The chipmaker Nexperia, headquartered in the Netherlands, now sits at the center of the escalating U.S.–China trade war — one that’s rippling across the global economy, hitting everything from car production to consumer electronics.

On Sept. 30, the Netherlands’ minister of economic affairs invoked the rarely used Goods Availability Act, a Cold War-era law allowing the state to take control of firms deemed vital to national security.

Officials cited “serious governance shortcomings” and the need to protect critical technology on European soil. The move effectively stripped Nexperia’s Chinese owner, Wingtech Technology, of operational control — though production will continue under Dutch supervision. (Hold that thought.)

Nexperia produces 100 billion chips each year, supplying, for instance, around 35–40% of the automotive industry’s discrete transistors: the inexpensive but essential parts that make cars, phones and appliances function.

A week after the takeover, Dutch courts further suspended Wingtech founder and Nexperia CEO Zhang Xuezheng (“Wing”), appointing a local chief in the interim.

The Hague framed the decision as an emergency measure to “secure supply continuity” and prevent the loss of “vital technological expertise” to foreign powers.

While the Dutch cited domestic legal grounds, Washington clearly played an outsized role.

While the Dutch cited domestic legal grounds, Washington clearly played an outsized role.

On Sept. 29, Washington detonated its new “Affiliates Rule,” extending U.S. export-control restrictions to any foreign subsidiary 50% owned by a listed Chinese entity.

It’s a sweeping shift that potentially ropes in thousands of firms and tightens the noose on Nexperia’s access to U.S. markets.

U.S. officials reportedly told The Hague that replacing Zhang could help Nexperia qualify for exemptions from these new rules.

China, shockingly enough, saw the move as political interference. State media called it an “outright expropriation,” while officials in Beijing accused the Netherlands of acting “under direct U.S. pressure.”

On Oct. 4, China’s commerce ministry retaliated, barring exports of Nexperia products out of China.

On Oct. 4, China’s commerce ministry retaliated, barring exports of Nexperia products out of China.

This was a critical hit because a large share of the company’s output is assembled and tested in China before global shipment.

“Nexperia China, the local unit of the Dutch chipmaker, [told] its employees to follow orders from local management and ignore instructions from the Dutch head office, according to a letter issued to employees,” says the South China Morning Post.

At the same time, Beijing rolled out a fresh round of broad export controls covering rare earth minerals, magnets and battery components — with provisions that extend Chinese jurisdiction to some items produced abroad using Chinese tech.

In the last 48 hours, China has now agreed to urgent talks in Brussels with the European Union. The agreement followed a two-hour call between the EU’s trade commissioner and China’s commerce minister, during which Brussels pressed for “immediate solutions” to China’s new licensing rules.

The EU argues restrictions threaten Europe’s high-tech industries, while Beijing insists they’re lawful and aimed at securing supply chains.

Although the low-end chips Nexperia produces might lack the sophistication of AI chips from Nvidia or AMD, they form the foundation of global electronics manufacturing.

Although the low-end chips Nexperia produces might lack the sophistication of AI chips from Nvidia or AMD, they form the foundation of global electronics manufacturing.

A prolonged disruption could idle auto plants, inflate consumer prices and strain alliances in Europe. Simply put, you can’t run an advanced economy without the cheap chips that make everything work.

What began as a seemingly technical trade dispute has become a test of how far the U.S. and EU are willing to go to contain China. But they might have irreparably overplayed their hand.

- This just in: Volvo and Volkswagen warn of possible factory shutdowns in Europe, and Japan’s auto association urges a diplomatic fix as Mercedes-Benz and GM monitor the fallout. Meanwhile, Nexperia’s Dutch and Chinese divisions trade accusations over product quality and control.

“The damage China is capable of spans far beyond the automotive sector,” says an article at Substack account Doomberg. “A scan of market-cap rankings in the S&P 500 reveals dozens of similar vulnerabilities: Apple, Qualcomm, Starbucks, Coca-Cola, Honeywell, Caterpillar, Walt Disney — the tally of firms with high concentration risk in China is a long one.

“[The] U.S. cannot decouple from China in the short- or even medium term,” the article emphasizes, “without collapsing its own economy and stock market.” And the more Washington pressures its partners to “decouple” likewise, the more it risks fracturing the very supply chains the West depends on.

Ultimately, this episode isn’t just about one Dutch chipmaker; it’s about who controls the infrastructure of the global economy. In this fight, even the smallest chips could carry the biggest consequences.

![]() Seasonality Says “Game On!”

Seasonality Says “Game On!”

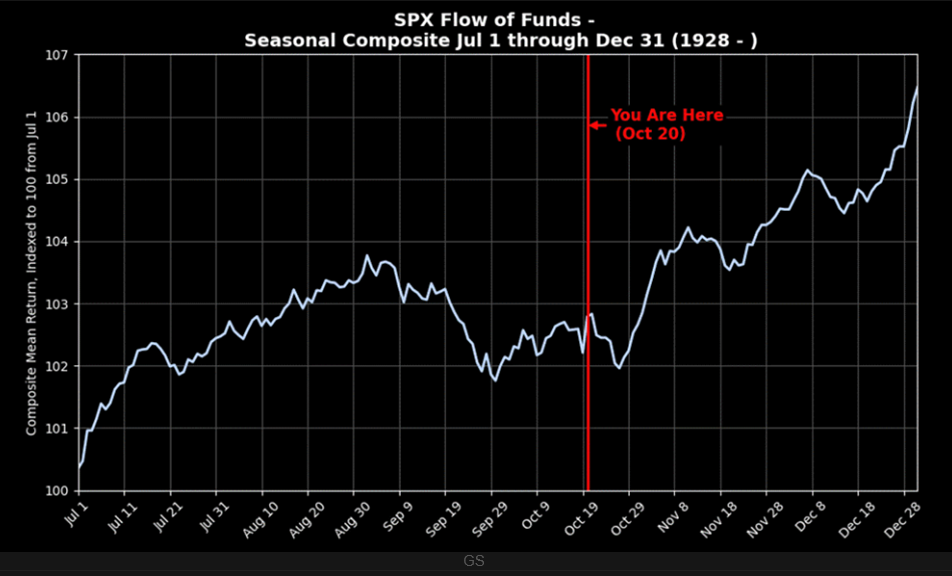

“Oct. 20 is the OFFICIAL start of the best seasonality period for the stock market,” notes pro trader Enrique Abeyta at the Paradigm Press app’s Daily Feed feature.

“Oct. 20 is the OFFICIAL start of the best seasonality period for the stock market,” notes pro trader Enrique Abeyta at the Paradigm Press app’s Daily Feed feature.

“Goldman Sachs points out this morning that from Oct. 20–Dec. 31, the S&P 500 and Nasdaq Composite have averaged respective returns of +4.16% (since 1928) and +8.48% (since 1985). Game On!”

Enrique adds: “Looking back over the last 25 years, there have been FOUR times when the S&P 500 was at least +14% at this point of the year: 2013, 2019, 2021 and 2024.

“The market was higher the rest of the year ALL four times,” he says, “an average of +8.5%.”

![]() The Crude Ultimatum

The Crude Ultimatum

The standoff between the U.S. and India over Russian oil may finally ease, but not because of diplomacy.

The standoff between the U.S. and India over Russian oil may finally ease, but not because of diplomacy.

For months, President Trump has claimed that India was about to stop purchasing Russian crude, even though imports have remained steady — about 1.5–1.8 million barrels per day, according to Kpler. Those shipments have saved India billions and helped keep Moscow’s war economy afloat.

Now new U.S. Treasury sanctions targeting Rosneft and Lukoil — the two biggest Russian oil producers — could force India’s private and state-run refiners to reevaluate. Reliance Industries, India’s biggest private refiner, for instance, says it’s already “recalibrating” purchases.

While Washington frames this as pressure on Russia, the reality is blunter: The U.S. is using financial leverage to strong-arm India into line. For India, the discounts on Russian oil had already shrunk, so the economics may no longer justify the risk.

India may decide the better deal now is with Washington instead of Moscow. But it won’t be out of friendship.

With that, the price of crude is up 5% to $61.40 for a barrel of West Texas Intermediate. Other commodities, including precious metals are rallying: Gold’s up 2.45% to $4,165.30 per ounce, and silver is up 2.70%, pennies under $48.

With that, the price of crude is up 5% to $61.40 for a barrel of West Texas Intermediate. Other commodities, including precious metals are rallying: Gold’s up 2.45% to $4,165.30 per ounce, and silver is up 2.70%, pennies under $48.

Tesla (TSLA) posted strong Q3 revenue of $28.1 billion yesterday afternoon, up about 12% year-over-year, helped by a surge in vehicle deliveries as buyers rushed to claim expiring U.S. EV tax credits.

However, the company’s operating profit fell roughly 40% from a year ago amid higher costs, lower regulatory-credit income (money Tesla earns by selling carbon/emission credits to other automakers) and tariff headwinds.

Elon Musk used the earnings call to draw attention to self-driving “robotaxi” plans to expand testing without safety drivers into several metro areas by year-end.

At the time of writing, TSLA shares are down almost 2%. As for the overall stock market, the three major indexes are clawing back some of yesterday’s losses. The Nasdaq is up 0.60% to 22,875 while the S&P 500 and Dow are 0.35% and 0.10% — to 6,720 and 46,635 respectively.

Meanwhile, the crypto market is flashing green. Flagship crypto Bitcoin is up 1.60% to $109,880; Ethereum’s up 1.40% to $3,865.

![]() The “Two-Speed Economy”

The “Two-Speed Economy”

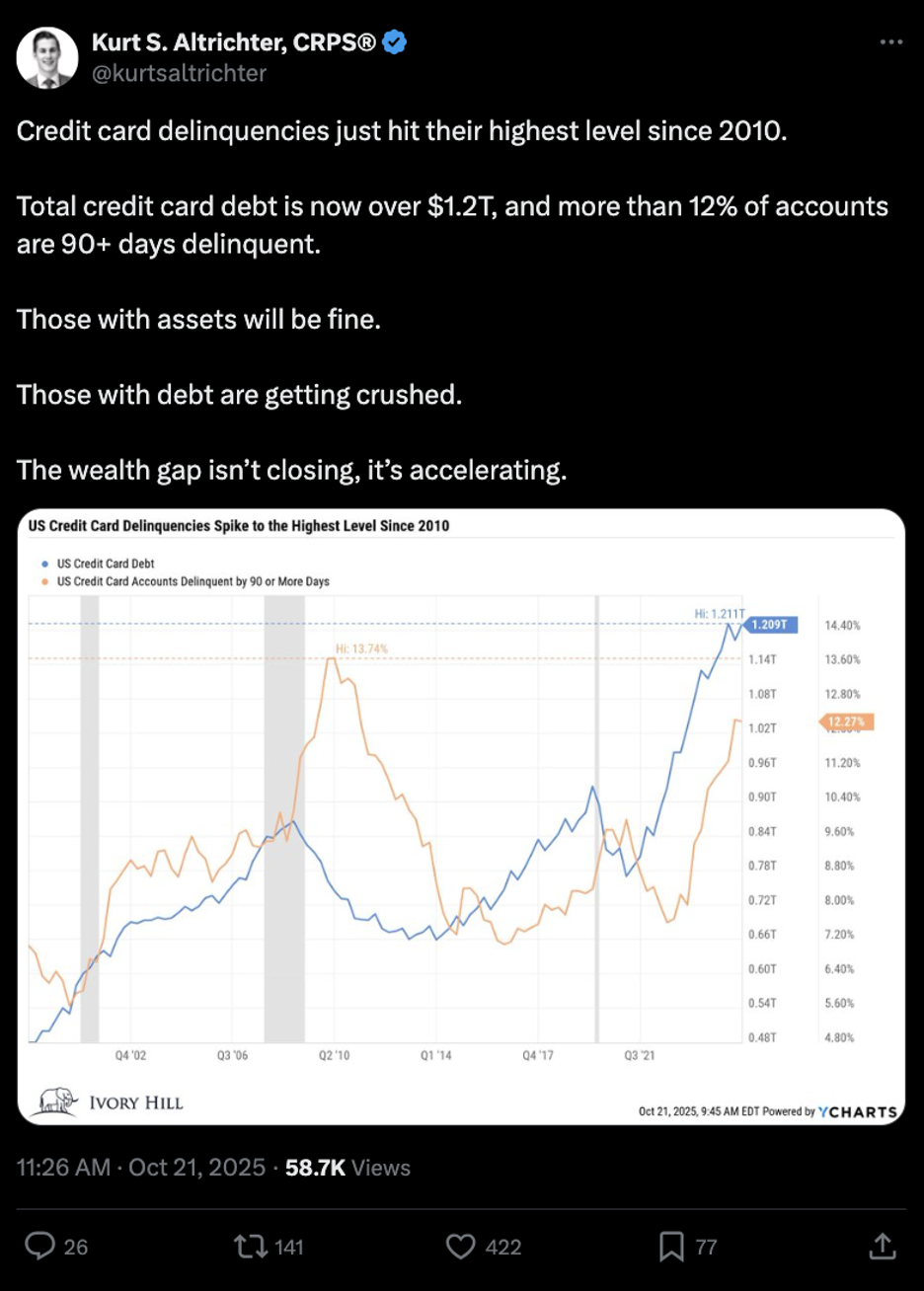

U.S. auto loans are now flashing red: A study by VantageScore shows delinquencies have surged 50% over the past 15 years.

U.S. auto loans are now flashing red: A study by VantageScore shows delinquencies have surged 50% over the past 15 years.

According to Fitch Ratings, 6.43% of subprime auto borrowers were at least 60 days behind on payments in August — matching January’s record and far above the 2008 crisis peak of 5.04%. When Fitch began tracking the data in 1993, for instance, that figure was just 0.12%.

Last year, 1.73 million vehicles were repossessed. That’s the highest number since 2009, says Cox Automotive. And America’s total auto debt has climbed to $1.66 trillion, roughly double what it was a decade ago.

Much of that debt has been sliced into asset-backed securities, or ABS, and sold to investors. That structure — eerily similar to the subprime mortgage market before 2008 — is now showing strain.

Wall Street is already on edge after the collapses of subprime lender Tricolor and car-parts supplier First Brands in September. “When you see one cockroach, there’s probably more,” warned JPMorgan CEO Jamie Dimon.

Goldman Sachs President John Waldron adds: “We may, we probably will, have some defaults — and it’s not going to be pretty.”

Waldron cautions that the credit boom has created a “two-speed economy,” where corporate borrowers and households on the lower rungs are beginning to buckle under the same pressures.

Waldron cautions that the credit boom has created a “two-speed economy,” where corporate borrowers and households on the lower rungs are beginning to buckle under the same pressures.

The pain is showing up first in consumers’ garages. The average new car in America now costs more than $50,000, up 35% since 2019. And monthly payments average $761 for new vehicles and $570 for used ones, according to Edmunds.

“Consumers are buying the same car they owned before, but their payments are $300 more a month,” said Jessica Caldwell, Edmunds’ head of insights.

Debt counselors are overwhelmed. The nonprofit American Consumer Credit Counseling (ACCC) reports 53,900 calls this year— up 63% from 2019. “People are using their credit cards for basic living expenses,” says Kenneth Mohammed of ACCC.

ACCC’s average client debt has jumped 60% in five years to $30,000, and many clients earn $75,000 or more annually — evidence the crisis has climbed the income ladder.

Meanwhile, about 30% of traded-in car loans are now underwater, with buyers rolling almost $7,000 in old debt into new loans.

“That should send off alarm bells,” warns Mark Zandi, chief economist at Moody’s Analytics. “You’re seeing all this stress while everyone still has a job — so what happens if people start losing them?”

Waldron is more straightforward: Private credit and bank lending “belong to the same system,” he says, and if defaults continue to cascade, “all participants will be affected.”

![]() “Where We’re Going, We Don’t Need Roads”

“Where We’re Going, We Don’t Need Roads”

Aerospace startup Inversion has an intrepid new pitch: Drop emergency supplies from space — anywhere on Earth, in under an hour.

Aerospace startup Inversion has an intrepid new pitch: Drop emergency supplies from space — anywhere on Earth, in under an hour.

The company’s plan centers on its Arc orbital reentry vehicle, a reusable capsule that can carry about 500 pounds of cargo.

The Arc sits parked in low-Earth orbit until needed. When called upon, it detaches from its service module, blazes through the atmosphere at Mach 20-plus and glides to a landing by steerable parachute.

Source: Inversion

“They paved paradise and put up a parking lot.”

Unlike traditional supply chains — hampered by distance, politics or bad infrastructure — the Arc could reach remote or hostile areas that no plane or truck could.

“With massive cross-range to cover great distances during reentry, and high maneuverability throughout every phase of flight, Arc delivers a transportation capability that has never existed before,” says Justin Fiaschetti, Inversion’s co-founder and CEO.

Inversion imagines thousands of these orbiting couriers forming a global logistics web for military, humanitarian and disaster-relief operations.

While everyone else is figuring out drone delivery… Inversion just decided to skip a step?

Take care, reader! Join us tomorrow for a fresh 5 Bullets…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets