Elon Throws Nvidia a Lifeline

![]() Elon Throws Nvidia a Lifeline

Elon Throws Nvidia a Lifeline

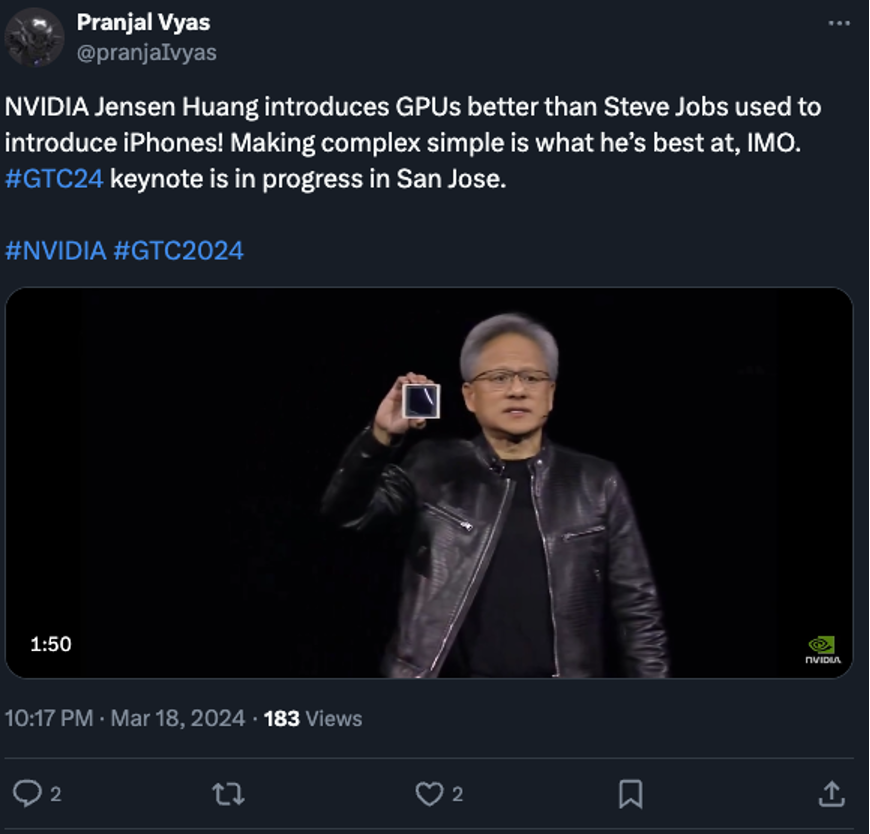

Nvidia CEO Jensen Huang has the tough task of topping himself tomorrow.

Nvidia CEO Jensen Huang has the tough task of topping himself tomorrow.

Amid the euphoria for all things AI the last couple of years, Nvidia’s annual software developer conference has become the forum for Huang to do his best imitation of the late Steve Jobs.

Much as Jobs made the crowd ooh and aah over the latest iPhone release, Huang brought down the house last year with the release of Nvidia’s state-of-the-art Blackwell chip.

Paradigm’s AI authority James Altucher did a masterly job of preparing readers for this moment — anticipating the release of this chip days before Huang’s announcement.

It was great news for Nvidia — and even better news for a handful of related AI players that James recommended. In the space of only three months, three of his best-performing AI trades could have delivered peak returns of 1,650%... 2,178%... and even 2,633%.

By last summer, Huang was quite literally getting the rock-star treatment from adoring fans…

By last summer, Huang was quite literally getting the rock-star treatment from adoring fans…

Your editor listened to a recent podcast interview in which a financial analyst said that moment marked the top for Nvidia’s share price.

Well, not quite. NVDA traded for $122 that day last June. It reached a top of nearly $150 shortly after New Year’s Day.

What is true is that NVDA trades this week for the same $122 that it did at the time of the autograph signing seen ‘round the world.

Thus, the vibe coming into this year’s NVDA event tomorrow is much more muted.

Thus, the vibe coming into this year’s NVDA event tomorrow is much more muted.

“Nvidia’s Next Act Needs to Be Even Bigger,” says a Wall Street Journal headline.

Reuters says Huang will have to “defend his nearly $3 trillion chip company’s dominance as pressure mounts on its biggest customers to rein in the costs of artificial intelligence.”

That pressure is only growing based on the news from Asia this morning. As the South China Morning Post reports, “A new artificial intelligence (AI) framework developed by teams associated with China’s Tsinghua University is said to be able to reduce reliance on Nvidia chips for AI model inference, marking the latest effort by the country to enhance technological self-sufficiency.”

As it happens, our James Altucher says tomorrow Huang is getting a lifeline… from none other than Elon Musk.

As it happens, our James Altucher says tomorrow Huang is getting a lifeline… from none other than Elon Musk.

James calls it “Elon’s Endgame” — in which Musk and Huang are going in together on an AI venture that will redefine the space for years to come.

- It could be up to 9,000% more powerful than current AI systems

- It could disrupt industries from health care to energy to defense

- And it will put extremely powerful AI capabilities in the hands of everyday Americans.

Yes, it could be an enormously lucrative proposition for well-positioned investors. Not because of a bump to NVDA’s share price necessarily… but because James believes that during Huang’s event tomorrow the world will learn about a third player in this venture.

It’s a $1 billion AI company — at least right now. But based on the information from his sources, James says “Elon’s Endgame” has the potential to grow the share price 50X by next year.

Members of the Paradigm Mastermind Group are already in the know about this once-in-a-lifetime opportunity. If you’re not among them, there’s still time before Huang’s address tomorrow to get up to speed. Click here to watch James describe “Elon’s Endgame.”

![]() Here We Go Again

Here We Go Again

The oil price has jumped to its highest in nearly two weeks now that Donald Trump has restarted Joe Biden’s war against the Houthi faction in Yemen.

The oil price has jumped to its highest in nearly two weeks now that Donald Trump has restarted Joe Biden’s war against the Houthi faction in Yemen.

While the markets were closed for the weekend — in recent years that’s how it almost always goes with major U.S. military action — Washington launched airstrikes on Yemen.

On the surface, none of this makes any sense. Yes, the Houthis were harassing U.S.- and Israeli-linked shipping last year — an act of solidarity with the Palestinians of Gaza.

But the Houthis called off those attacks once Israel and Hamas reached a ceasefire in January — you know, the ceasefire that Trump’s own people negotiated shortly before he took office.

A few days ago, the Houthis said they would resume attacks on Israeli ships because Israel was violating the ceasefire with a blockade of humanitarian aid to Gaza. And that, apparently, is the pretext for Washington to start bombing Yemen again.

“The Houthi attack on American vessels will not be tolerated,” Trump bellowed on social media. “We will use overwhelming lethal force until we have achieved our objective.”

But there was no “attack on American vessels” once the ceasefire took effect. And what’s the “objective” of U.S. airstrikes, anyway?

There isn’t even that much American shipping through the Red Sea that’s being disrupted. It’s mostly shipping between Europe and Asia that has to take the long trip around Africa.

Anyway, we’re back where we were last year — U.S. forces firing missiles costing $2 million a pop while the Houthis are targeting U.S. warships with drones costing $2,000. That disparity has not changed with the transition from Biden to Trump.

“Why did we have to do this?” tweets Ann Coulter, channeling skeptics on the right. “Is it part of our constitution that we must be bombing someone at all times?”

Already Washington is looking to escalate — national security adviser Mike Waltz saying the next targets will be Iranian ships funneling intelligence to the Houthis.

Given the tight relationship between Iran and Russia, how’s that going to work? It’ll be interesting to see the readout of the phone call that Trump and Vladimir Putin are having this week that’s supposed to be all about Ukraine.

In any event, crude is back above $68. Not a huge reaction for now — but there’s nothing like a U.S. and/or Israeli attack on Iran to disrupt the global oil trade…

![]() The Fed’s Dilemma

The Fed’s Dilemma

The U.S. stock market is off to a lackluster start for the week as the Federal Reserve’s next move comes into view.

The U.S. stock market is off to a lackluster start for the week as the Federal Reserve’s next move comes into view.

The Fed issues one of its regular proclamations about short-term interest rates on Wednesday. Every indication is that the rate-cutting cycle that began last September and was paused in January will remain on pause. That would leave the benchmark fed funds rate at 4.5%.

“The Fed is between a rock and a hard place,” says Paradigm macroeconomics authority Jim Rickards. “Right now, the Fed is more concerned about inflation. By May, they will be more concerned about jobs. They cannot cut rates to fight unemployment and raise rates to fight inflation at the same time. That’s why they’re basically throwing up their hands and doing nothing.”

Amid that backdrop, the S&P 500 is up a quarter percent to 5,651. Gold is on the cusp of $3,000 again, but silver is losing ground at $33.62.

The day’s major economic number is an eye-of-the-beholder thing.

The day’s major economic number is an eye-of-the-beholder thing.

Retail sales inched up 0.2% from January to February — way less than the 0.7% jump Wall Street economists were counting on.

But the headline number is frequently skewed by auto sales (which are volatile month-to-month) and by gasoline sales (falling gas prices can drag the number down).

If you factor those out you get a 0.5% jump, right in line with Wall Street’s expectations.

All that said, retail sales are up 3.1% year-over-year. This number is not adjusted for inflation. Considering that the official inflation rate is running 2.8%, an objective observer is hard-pressed to say the mighty American consumer is in great shape and spending freely.

![]() “Not Dead Yet”

“Not Dead Yet”

“Yes, Bitcoin is down. Yes, altcoins are bleeding,” acknowledges Paradigm’s senior crypto analyst Chris Campbell.

“Yes, Bitcoin is down. Yes, altcoins are bleeding,” acknowledges Paradigm’s senior crypto analyst Chris Campbell.

Bitcoin sits a little over $83,000 this morning — better than a few days ago but still sucking wind by late 2024-early 2025 standards.

“Every time this happens,” says Chris, “we have two groups of people:

- “The ones who panic, sell at the bottom, swear off crypto forever and then buy back in at the next all-time high like clockwork.

- “The ones who rub their hands together, mutter ‘thank you’ and quietly accumulate at fire-sale prices.”

Yes, Chris is in the latter group.

“The fundamentals of crypto have never been stronger,” he says.

“The fundamentals of crypto have never been stronger,” he says.

Begin with the action in Washington, D.C. “While everyone stares at red charts, the Office of the Comptroller of the Currency just reversed its stance on banks interacting with crypto. (That’s like the Vatican not only admitting Galileo was right but also announcing a space program to colonize Mars.)

“Meanwhile, the SEC just quietly dropped lawsuits against Coinbase, Kraken and Uniswap.

“The Senate just shot down the IRS’ attempt to force DeFi protocols to collect Social Security numbers. Imagine trying to make a vending machine check your ID before dispensing a Snickers bar.

“A year ago, crypto looked like it was gearing up for an extinction-level event. Now? It’s eerily quiet.”

And yet, “Right now, people are buying put options (bets that the market will keep crashing) at record highs,” says Chris.

And yet, “Right now, people are buying put options (bets that the market will keep crashing) at record highs,” says Chris.

“You know when put options were also at record highs?

- “August 2015. Bitcoin went up 87X

- “March 2020. Bitcoin went up 10X

- “November 2022. Bitcoin went up ”

Yes, there could be a further drop from current levels. But Chris urges you to consider this: “In any given year, Bitcoin’s biggest gains come from just 10 days. Miss those and you miss the majority of the upside.

“Every time crypto crashes, people say it’s dead. Every time, it comes roaring back.

- “2013 crash? Dead

- “2017 crash? Dead

- “2020 crash? Dead

- “2022 crash? Dead.

“And yet here we are. Bitcoin is still here. The altcoin market is still here. And the ones who ignored the fear and kept buying are the ones who ended up with life-changing gains.”

![]() Mailbag: Precious Metals, DST

Mailbag: Precious Metals, DST

“Hey Dave, about a week ago you had mentioned looking for silver as well as the miners moving up to confirm the increase of the price of gold,” a reader writes.

“Hey Dave, about a week ago you had mentioned looking for silver as well as the miners moving up to confirm the increase of the price of gold,” a reader writes.

“I want to ask if/when we do get that confirmation, what do you expect the moves in gold to look like? Hundreds of dollars of gains? $1,000? Should we expect the charts to mimic a crypto memecoin's percent gains? Just what sort of future is in the realm of plausibilities?”

Dave responds: Price targets are always dicey things.

But one of the experts we follow outside Paradigm is a fellow named Don Durrett, who’s been investing in mining stocks for 35 years. He says if we can get to $35 silver and 350 on the HUI index of mining stocks — and stay there — that’s likely the signal that a breakout is underway.

Note that I said “and stay there.” The HUI touched 350 for a nanosecond last October. That doesn’t count. Checking our screens, we see the HUI above 348. Another test might be coming this week…

A week past time change, readers still wish to weigh in on daylight saving time…

A week past time change, readers still wish to weigh in on daylight saving time…

Responding to a comment in Friday’s mailbag, a reader writes, “Obviously, the person has no issue reading. Issue appears to be comprehending. (Probably, sleep deprived — like the rest of us).

“Your piece did a great job of outlining the madness of DST yet why it keeps ‘winning.’ Keeps winning because money wins out nearly every time.”

One more comment: “Dave, on the off chance (9%) that someone is interested in novel thoughts: DST (summertime) makes no sense near the equator because the length of days does not vary much. Nor at high latitudes (Edmonton, Edinburgh) because the days are so short in winter and so long in summer that shifting cannot do much.

“It is only at mid-latitudes the temptation arises, mostly to deprive clock-people of morning light and give them more in evenings. These latitudes are also infested with bossy-boots.”

Dave: Yeah, time change is mostly a North American and European thing. You don’t see it much in Asia — although China’s single time zone across the entire country seems bonkers in its own way!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets