The $27,533 Gold Solution

![]() What If “Command” Currencies Collapse?

What If “Command” Currencies Collapse?

In a world where fiat currencies face increasing pressure, Paradigm’s macro authority Jim Rickards has consistently emphasized the importance of gold. And his latest gold forecast is nothing short of jaw-dropping…

In a world where fiat currencies face increasing pressure, Paradigm’s macro authority Jim Rickards has consistently emphasized the importance of gold. And his latest gold forecast is nothing short of jaw-dropping…

But before we get to that, Jim’s prediction is not based on speculation; instead, it’s the result of detailed modeling and historical precedents.

First, Jim explains that during financial crises, gold prices often follow a predictable pattern. Initially, the price of gold drops alongside stocks as investors liquidate assets to cover margin calls or meet liquidity needs.

“You sell what you can,” Jim notes, highlighting the panic-driven behavior that dominates markets during such times.

However, this initial sell-off is typically followed by a sharp rebound as “strong hands” step in to buy gold at discounted prices.

It’s important to point out that even if stocks moderate this week — providing some relief from recent downturns — Jim’s fundamental thesis supporting gold’s rise remains unchanged.

And as you’ll see below, Jim has evidence that this cycle is playing out as we speak…

“What if confidence in command currencies collapses due to some combination of excessive money creation, extreme levels of dollar debt, a new financial crisis, war or natural disaster?” Jim posits.

“What if confidence in command currencies collapses due to some combination of excessive money creation, extreme levels of dollar debt, a new financial crisis, war or natural disaster?” Jim posits.

If confidence in fiat currencies collapses, central banks may have no choice, he says, but to return to a gold standard.

In such a scenario, the “implied non-deflationary price of gold” would need to be recalibrated to maintain equilibrium between gold reserves and the money supply.

To wit, M1 is the most liquid part of the U.S. money supply, meaning it’s the easiest to convert into cash.

It includes physical cash (bills and coins), bank reserves held in vaults and deposits like checking accounts.

Currently, the U.S. M1 money supply totals $17.9 trillion.

As for gold, “the U.S. Treasury reserves [total] 8,100 metric tonnes (261.5 million troy ounces),” says Jim.

If the government were to return to a gold standard today, according to Federal Reserve rules from 1913–1946, the legal requirement would be that 40% of M1 money supply be backed by gold.

All to say, $7.2 trillion worth of gold would be necessary. “Applying the $7.2 trillion valuation to 261.5 million troy ounces yields a gold price of $27,533 per ounce,” Jim notes.

All to say, $7.2 trillion worth of gold would be necessary. “Applying the $7.2 trillion valuation to 261.5 million troy ounces yields a gold price of $27,533 per ounce,” Jim notes.

Although no forecast is guaranteed, Jim believes this scenario is well within the realm of possibility given current macroeconomic trends. “This isn’t a guess,” he adds.

Beyond the Fed’s 20th Century model, Jim highlights real-world factors driving gold prices higher.

- On the supply side, global gold production has been declining steadily since 2017, with miners struggling to find high-quality ore deposits. This stagnation in supply creates upward pressure on prices when demand increases

- On the demand side, central banks have been significant buyers of gold, with purchases surging by 1,000% between 2010–2022. This trend shows no signs of slowing down; central banks acquired 800 metric tonnes of gold in 2023 alone. Jim notes that much of this demand stems from concerns about the stability of fiat currencies as well as geopolitical risks.

For individual investors, Jim’s advice is straightforward: act now. Gold’s price trajectory follows an exponential pattern where percentage gains become easier as the base price rises.

For instance, moving from $2,000 to $3,000 per ounce represents a 50% gain, but moving from $14,000 to $15,000 per ounce is only a 7% increase.

“Those $1,000 pops get even easier as we approach my calculated gold price of $27,533,” he explains.

The implication is clear: gold buyers today stand to benefit most as they accumulate more gold at lower prices and enjoy higher percentage returns during the early stages of a rally.

Jim’s analysis paints a compelling picture for gold’s future. For investors, the message is clear: moments of market panic often present opportunities to buy gold before the price resumes its upward trajectory.

Whether driven by geopolitical crises or fundamental supply-demand dynamics, gold remains an essential asset for preserving wealth during uncertain times.

As Jim summarizes: “Get your gold while you can.”

[You have an unclaimed package from Jim Rickards: It’s valued at $400 and waiting for you… but supplies are limited and may soon run out.

To secure your package — an assortment of items Jim has hand-selected to protect you from the all-out financial trade war — watch this short video message for instructions.

And submit your claim before the deadline at 11:59 p.m. EDT on FRIDAY. Act quickly, or you may lose this exclusive offer for good.]

![]() Be Careful What You Wish For

Be Careful What You Wish For

In a speech at the Economic Club of Chicago on Wednesday, Fed Chair Jay Powell hinted at no further rate cuts.

In a speech at the Economic Club of Chicago on Wednesday, Fed Chair Jay Powell hinted at no further rate cuts.

Conversely, President Trump has been pounding the table (via social media), demanding rate cuts — on the assumption that once the Fed cuts short-term rates, long-term rates will follow in sympathy.

But as we mentioned in December and January, the Fed did three cuts last fall and long-term rates ROSE — something that hadn’t happened in 40 years — likely because the bond market sniffed out that federal spending and the national debt were spiraling out of control.

And here we are again this month, with long-term rates rising at a time they “should” be falling. Here’s the thing: Trump is wishing for something that won’t necessarily get him what he wants.

Also not getting what it wants? Wall Street…

Taking a look at stocks today, the Big Board is down 1.10% to 39,225. But the tech-heavy Nasdaq is only slightly in the red, down 0.10%,and clawing its way to 16,285. Meanwhile, the only major U.S. index in the green, the S&P 500, is up 0.35% to 5,295.

Taking a look at stocks today, the Big Board is down 1.10% to 39,225. But the tech-heavy Nasdaq is only slightly in the red, down 0.10%,and clawing its way to 16,285. Meanwhile, the only major U.S. index in the green, the S&P 500, is up 0.35% to 5,295.

Treasury yields are climbing higher again after a few days’ retreat, the 10-year note at 4.32%.

Turning to commodities, the price of crude is up 2.70% to $64.15 for a barrel of WTI. Precious metals, however, are taking a hit. The yellow metal is down 1% to $3,310 per ounce, and silver is down 2.15% to $32.25.

And Bitcoin and Ethereum, at the time of writing, are at $84,650 and $1,585 respectively.

![]() Tariffs Supercharge AI Innovation

Tariffs Supercharge AI Innovation

“The tariff shock is forcing companies to rediscover what made American manufacturing great in the first place: technological superiority,” says Paradigm’s science-and-technology investor Ray Blanco.

“The tariff shock is forcing companies to rediscover what made American manufacturing great in the first place: technological superiority,” says Paradigm’s science-and-technology investor Ray Blanco.

“For decades, American companies were addicted to cheap foreign labor — chasing ever-cheaper labor around the globe instead of investing in technological innovation at home.

“Now, it will be addicted to domestic AI,” he adds. “For reshoring to make economic sense, companies must embrace automation on an unprecedented scale.

“[Companies] won’t just recreate their overseas labor-intensive processes,” he says. “Instead, they’ll invest in cutting-edge AI vision systems for quality control.

“We’re talking about AI-powered factories that require minimal human intervention — manufacturing that can operate 24/7 with a fraction of the labor costs.

“They’ll also deploy autonomous robots for materials handling and implement machine learning for predictive maintenance. They’ll use AI for just-in-time inventory optimization.

“The companies providing these technologies stand to see explosive growth as reshoring accelerates,” notes Ray.

“The companies providing these technologies stand to see explosive growth as reshoring accelerates,” notes Ray.

“While everyone fixates on tariffs, they're missing the real story: AI is still on track to add more than $15 trillion to the global economy over the next few years.

“While tariffs may reshape where physical goods are made, they have little impact on software, cloud services and intellectual property — precisely the areas where American AI dominance is strongest.

“Even more promising are the AI innovators building platforms that can be exported globally – the digital infrastructure that will power not just American factories, but the world’s transition to intelligent automation.”

Ray concludes: “Trump’s tariffs might be the best thing that’s EVER happened to AI.

“For now, remember that periods of maximum pessimism often coincide with the greatest investment opportunities. We’re looking for specific recommendations to play this trend.”

Read on…

![]() Stealth Energy Dynasty

Stealth Energy Dynasty

“Tesla is an AI energy empire in disguise,” says Paradigm’s AI expert James Altucher.

“Tesla is an AI energy empire in disguise,” says Paradigm’s AI expert James Altucher.

“Here’s what everyone misses: By 2027, Tesla will make more money from AI energy than from cars,” he says. “The real money is in AI energy infrastructure. And Tesla is already way ahead…

- “DOJO: Tesla’s supercomputer. This isn’t ChatGPT for Teslas. It’s the brain. It trains itself. It powers autonomy in cars, robots, energy systems. It’s building its own intelligence, every day

- OPTICASTER: It’s Tesla’s AI that manages energy distribution in real time. It knows when to store energy, when to use it and when to trade it. It’s like having a hedge fund manager for your electricity bill

- AUTOBIDDER: Imagine AI trading electricity the way Wall Street trades stocks — except with 100% uptime and no emotion. It’s already being used by energy companies and even Supercharger networks to buy and sell stored energy in real-time markets

- POWERHUB: Think of it as the command center. It’s an AI dashboard that tells you where your power is going, where it should go and how to make your grid smarter

- OPTIMUS: The AI-trained humanoid robot that will literally install the future. Picture this: Optimus building solar farms in the desert. Optimus repairing wind turbines in a storm. Optimus cleaning and maintaining your entire energy infrastructure without sleep or pay raises.

“So what’s the bottom line?” asks James. “In 2023, Tesla’s energy profits were 6.5% of gross. In 2024? 25%... Energy revenue up 67%. Auto revenue down 7%.

“At this growth rate, Tesla will become the Amazon Web Services of energy by 2027,” James forecasts. “Except instead of selling server time, they’re selling electricity... AI... autonomous tech... and maybe even the keys to Mars,” he adds.

“At this growth rate, Tesla will become the Amazon Web Services of energy by 2027,” James forecasts. “Except instead of selling server time, they’re selling electricity... AI... autonomous tech... and maybe even the keys to Mars,” he adds.

“None of this includes the upside from…

- Selling AI chips: the A15 chip

- Offering AI-as-a-service from Dojo

- Scaling Optimus

“If you’re still thinking about Teslas as cars, you’re using a flip phone in the iPhone era,” he emphasizes.

“My guess? At today’s price, TSLA is trading at more than 20x projected 2029 earnings — and that’s without factoring in any potential upside from Tesla’s robot army.

“I’ll say it again: Tesla is not a car company,” James summarizes. “It’s the foundation of the next civilization.”

![]() Mini-Me Mania

Mini-Me Mania

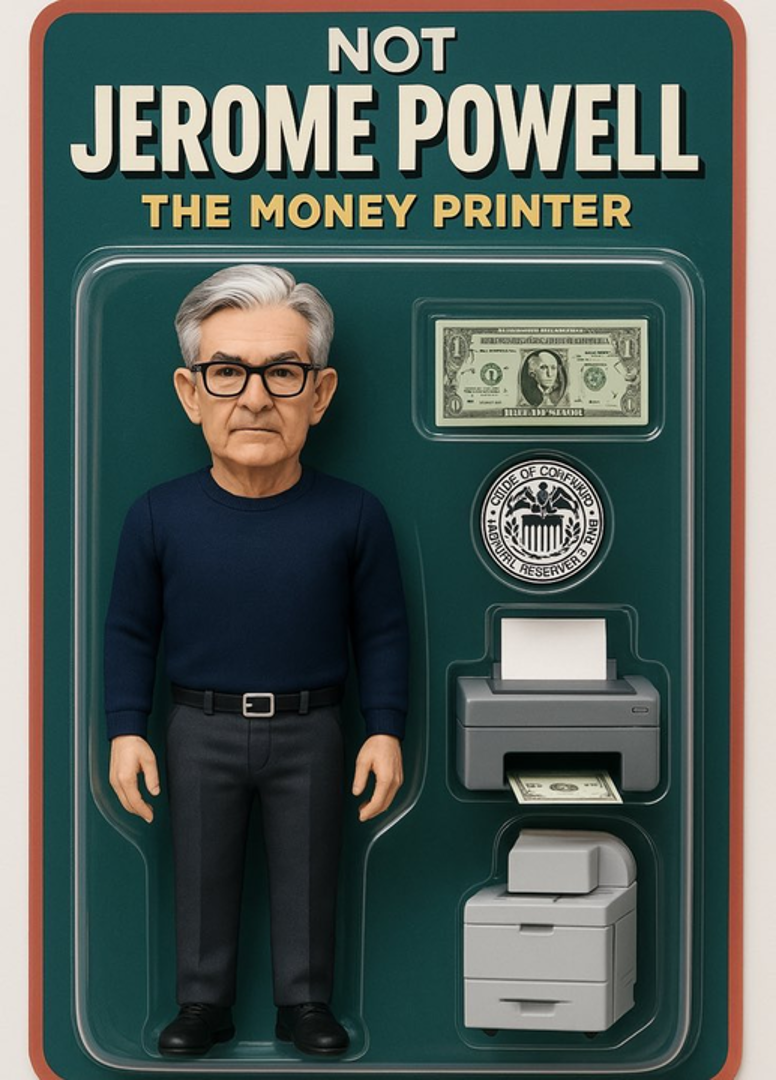

Social media’s newest obsession: Turning yourself into a plastic-wrapped, AI-generated action figure.

Social media’s newest obsession: Turning yourself into a plastic-wrapped, AI-generated action figure.

Just upload a photo, feed ChatGPT some prompts about your ideal packaging and voilà — you’re now a collectible doll with accessories of your choosing.

First exhibit?

What’s missing? A scroll with a Trump nastygram…

But let’s not pretend AI runs on good vibes and unicorn dust… No, as we’ve spotlighted for years now, AI requires a tremendous amount of energy.

Cambridge University Professor Gina Neff points out, for instance, that ChatGPT alone guzzles more electricity annually than 117 countries.

Then there’s the “slop” factor. These AI tools blend designs, references and especially letters into a monster mashup.

Exhibit B: Take a closer look at the dollar bill. Gadzooks, it’s George Washington(ish) sans wooden teeth!

Meanwhile, the Federal “Reserver” seal is absolute gibberish. Is that cyrillic lettering? And a spider instead of an eagle?

According to my Gen Z daughter, this AI doll trend seems to be most popular among Millennials. As the top age range of this group approaches middle age, this could be the digital equivalent of a midlife crisis.

When a sports car might be more energy-efficient.

Have a wonderful Thursday! Dave will be back with more fresh takes tomorrow…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets