Wall Street’s (Risky) Tariff Bet

![]() Mr. Market’s Daring Bet

Mr. Market’s Daring Bet

Mr. Market is laying down a daring bet today.

Mr. Market is laying down a daring bet today.

In case you weren’t glued to the news over the weekend, Customs and Border Protection posted a notice late Friday saying that many electronics would be exempt from the new tariffs – including electronics from China.

But on the Sunday talk show circuit, Commerce Secretary Howard Lutnick said those goods would nonetheless face separate tariffs in another month or two.

Then the president himself weighed in. “There was no tariff ‘exception’ announced on Friday,” he posted on his Truth Social site. Instead, those goods will be subjected to a different tariff regime involving semiconductors.

Clear as mud, right?

And yet, Wall Street is on the rally tracks today. At last check, the S&P 500 is up nearly 1.5%. Between today’s action as well as Friday’s, all of Thursday’s 3.4% loss has been recovered.

No, that’s not an all-clear signal.

For the moment, Wall Street is betting on “less tariff action” — and potentially setting itself up for another severe downdraft when that bet doesn’t pay off.

“While everyone is worried about a market crash, what is worse than a crash and quick recovery is a long, slow grind down,” says Paradigm’s macro maven Jim Rickards.

“While everyone is worried about a market crash, what is worse than a crash and quick recovery is a long, slow grind down,” says Paradigm’s macro maven Jim Rickards.

“That does not mean a one-day crash of 10% or more. It could mean a slow grind down perhaps 20% or 30% over six months or even longer.

“A quick crash can recover quickly. With a slow grind, many investors tell themselves it will come back or ‘buy the dips’ or hang in there. Then it will grind down some more until the retail investor finally capitulates with large losses.”

Jim’s guidance: “Investors should lighten up on equity exposure to reduce losses during this stock market decline” — because as he sees it, “the next 12 months could be a rough ride for those who aren’t prepared.”

Jim’s been expecting chaos just like this ever since Trump’s election. And he’s been crafting a detailed strategy to play the trade war.

Like it or not, “Trump is igniting an economic power shift that will trigger one of the biggest money-making opportunities of our lifetime,” Jim says.

We’re talking about the potential for 1,000% gains before the end of this year. Follow this link to learn more – because Jim says “I’m here to ensure you do not become a victim.”

![]() It’s Not All About Tariffs

It’s Not All About Tariffs

Now for a vivid reminder from Paradigm trading pro Greg Guenthner: “The market’s foundation was cracking even before Trump’s tariff announcement.

Now for a vivid reminder from Paradigm trading pro Greg Guenthner: “The market’s foundation was cracking even before Trump’s tariff announcement.

“Yet most traders are still clinging to the idea that we’re in a temporary pullback, believing the bull will get back up and start charging again. It won’t.”

The problem didn’t start with “Liberation Day” on April 2. It started more than a week earlier on March 25 — at the very moment the S&P 500 bumped up against its 200-day moving average. It was a crucial test for the index — and it failed that test.

That’s why the monster rally last Wednesday… and the uptick Friday and today… are not an all-clear signal. Greg reminds us of a saying among chart watchers: Nothing good happens below the 200-day moving average.

“That’s certainly been the case this month,” he adds. “The new lows list is miles longer than the new highs. And we haven’t experienced a trading day with an intraday move less than 1% since the S&P was rejected at its 200-day moving average back on March 25th.

“Prognosis: expect bear market action to continue, complete with failed rallies and larger-than-average intraday swings.”

What can you do? For one thing, “Use big relief rallies like we saw last Wednesday as an opportunity to ‘get right’ with any broken plays that might be weighing you down,” Greg advises. “Sell longs into strength and aggressively take profits on these big upside days…

“If you can preserve your capital now, you’ll have an excellent shot at winning big when stocks retest their lows, or when the averages are able to break through resistance and mount a sustainable rally.”

As the day wears on, the Monday-morning rally is losing a little of its oomph. The S&P’s earlier 1.5% gain is looking more like 1% now. The Nasdaq is likewise up 1%; the Dow’s gain is a tad weaker.

As the day wears on, the Monday-morning rally is losing a little of its oomph. The S&P’s earlier 1.5% gain is looking more like 1% now. The Nasdaq is likewise up 1%; the Dow’s gain is a tad weaker.

Among today’s big gainers are MP Materials Corp (MP) — up 22% as China has further tightened its controls on exports of rare-earth elements. Meanwhile, the big banks continue to kick off earnings season — Goldman Sachs up nearly 2% after handily beating analyst expectations.

The tension in the bond market remains elevated, with the yield on a 10-year Treasury note still over 4.4% for reasons we explored in-depth last Thursday. (And there’s another disturbing wrinkle to the story; hopefully we can get to it tomorrow.)

Precious metals are selling off, but gold is still holding the line on $3,200 and silver on $32. The gold-silver ratio continues to hover around 100, a historically high figure that makes silver a true bargain relative to gold. Mining stocks are moving up, the HUI index at another best-since-2013 reading of 395.

Crude rallied after we hit “send” on Friday, and it’s hanging on to most of those gains today at $61.32.

Bitcoin is on the high end of its recent trading range at $84,613.

![]() Trump’s Quagmire

Trump’s Quagmire

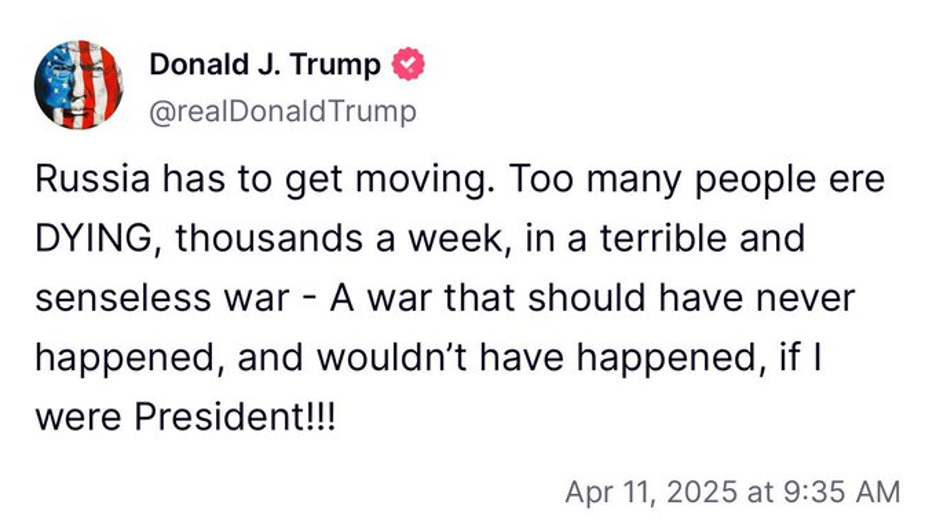

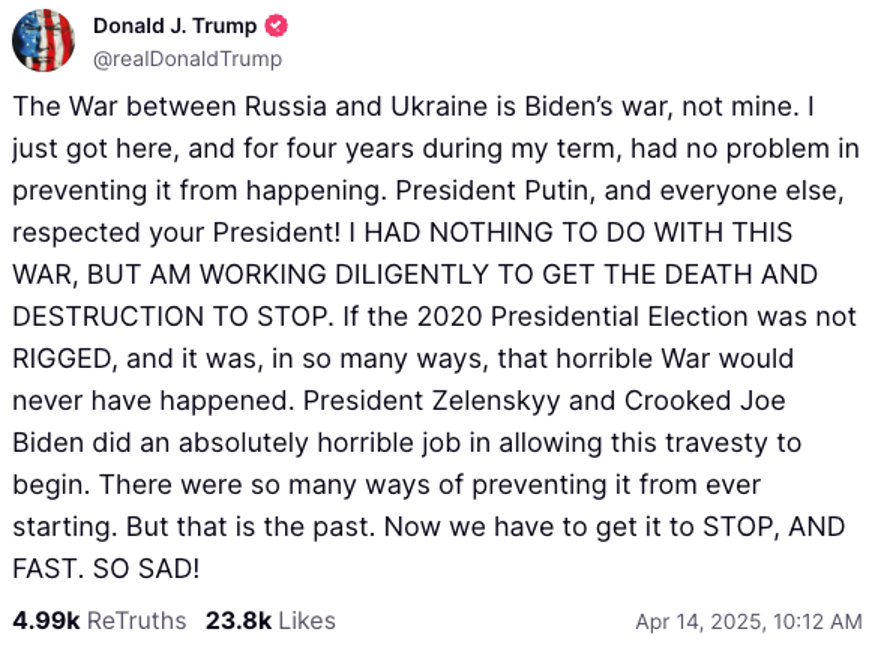

Donald Trump continues to fail what Jim Rickards calls his “Vietnam moment.”

Donald Trump continues to fail what Jim Rickards calls his “Vietnam moment.”

Jim generally gives the president high marks for his first three months. “Trump’s one blind spot,” he says, “is Ukraine.”

Recall it was Democrat Lyndon Johnson who dramatically escalated Washington’s involvement in Vietnam — but it became Republican Richard Nixon’s war for five more years. Jim says Trump risks something similar in Ukraine. Especially with posts like this on Friday…

Trump very much wants a cease-fire, publicly saying last month he’s “pissed off” with Russian President Vladimir Putin.

But as Jim told his Strategic Intelligence readers last week, Putin feels no pressure to agree to a cease-fire as long as Moscow continues winning the war.

The problem is that Trump is “being misled by neocon warmongers in his own Cabinet,” says Jim — “such as National Security Advisor Mike Waltz and his subordinates.

“Putin’s terms for Ukraine have been clear since before the war began — demilitarization, de-Nazification, neutrality, and no NATO membership. The only changes have been the amount of territory that Russia will add to the Russian Federation…

“Trump should just agree with Putin, sign a treaty and go home… What began as Biden’s War will soon become Trump’s War if he doesn’t get some good advice and end it now.”

This just in: Trump still isn’t getting good advice. The following is not the statement of someone who “has the cards.”

![]() Tick-Tock: Time Change Flip-Flop

Tick-Tock: Time Change Flip-Flop

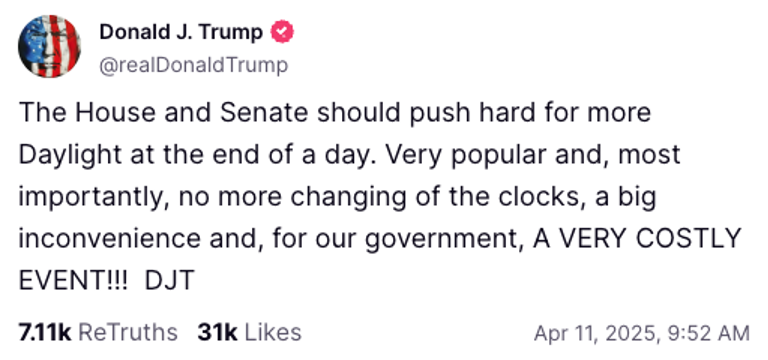

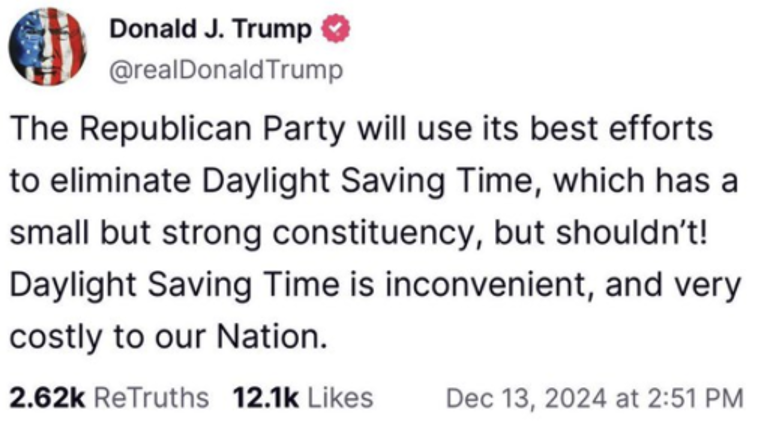

The good news is that the president is using his bully pulpit to try to do away with time change. The bad news is he now wants year-round daylight saving time.

The good news is that the president is using his bully pulpit to try to do away with time change. The bad news is he now wants year-round daylight saving time.

He posted the following on Friday…

Longtime readers know by now that most every March and November I lament the changing of the clocks.

It’s not just the personal toll it takes on my aging carcass. It’s also the leap in workplace accidents, car crashes and heart attacks the week after time change – and the persuasive evidence that DST does nothing to conserve energy, as it was once touted.

In 2020, the American Academy of Sleep Medicine, along with several other groups, published a position paper in the Journal of Clinical Sleep Medicine.

Its recommendation — year-round standard time, because that’s what would be “best aligned with human circadian biology and has the potential to produce beneficial effects for public health and safety.”

Which happens to be what the president advocated for in a post late last year.

Note the 100% flip-flop he’s now performed. What changed?

Well, as we noted in our most recent DST writeup last month, there’s a host of special interests that love the longer evenings — oil producers and refiners, convenience stores, golf courses, outdoor-equipment makers and so on.

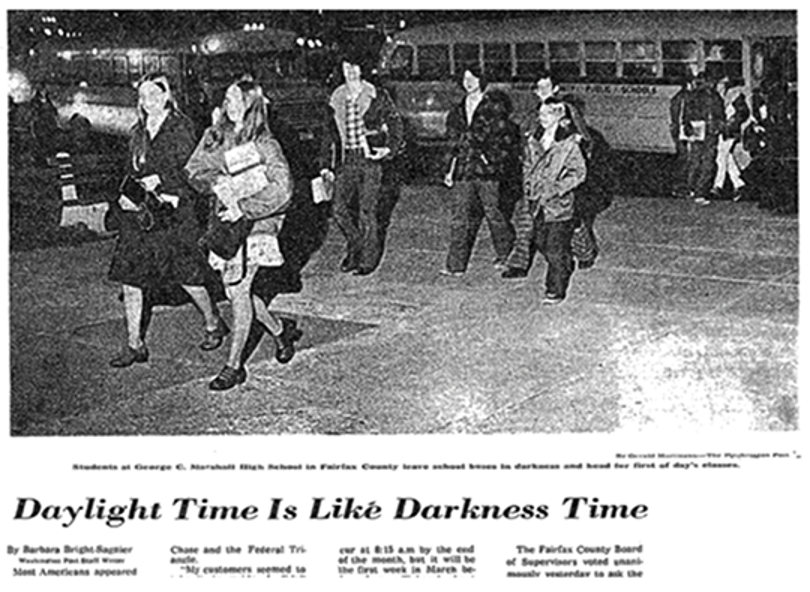

The president is old enough that he should remember the failed experiment with year-round DST conducted amid the Arab oil embargo in 1974.

The president is old enough that he should remember the failed experiment with year-round DST conducted amid the Arab oil embargo in 1974.

Everyone hated it because kids were going to school in the dark. Here’s a clipping from The Washington Post in early January of that year…

The Senate Commerce Committee held a hearing on the issue last Thursday. According to Politico, “Chair Ted Cruz (R-Texas) said there’s general consensus that the twice-annual changing of the clocks should end, but there’s disagreement on whether to switch to daylight saving time or standard time.”

To be continued…

![]() Mailbag: Trump’s Third Term

Mailbag: Trump’s Third Term

“Please stop promoting the video by Jim Rickards about sovereign wealth funds as explaining how Trump can have a third term,” a reader implores.

“Please stop promoting the video by Jim Rickards about sovereign wealth funds as explaining how Trump can have a third term,” a reader implores.

“I’ve seen this before a few times. The video makes no effort to explain the connection. A third term is not even addressed in the video … unless someone on your staff is cynical enough to think all it would take is enormous popularity of Trump, and presenting the sovereign wealth case is all you need to say.

“Let that person know, please, that y’all can’t assume most folks to be in agreement with that airy dismissal of our constitution or its intent. The 12th and 22nd amendments don’t allow a third term, and a constitutional amendment, even with the wind of enormous popularity behind it, is unlikely to be ratified by 2028.

“To be fair, what about an extra-constitutional presidency? It might be possible in a civil war environment. If that’s the line of thought, then let’s get your predictions in the right order, and state them clearly so we don’t have to puzzle over what you might have in mind.”

Dave responds: I confess I’m not altogether certain which video you’re talking about.

What I can tell you is that Jim recently performed a deep dive about an American sovereign wealth fund for readers of Rickards’ Insider Intel. It’s important enough that it deserves a wider hearing — perhaps in the form of a special guest essay next week. Stay tuned.

As for a third Trump term, Jim has said for the last week in at least two of his publications that the 22nd Amendment specifies no one can be elected president more than twice.

Thus, the most likely path to a Trump third term would be J.D. Vance at the top of the ticket in 2028 and Trump as the running mate. Once inaugurated as president, Vance would resign and Trump would begin his third term.

Now here’s a real mind-bender: Barack Obama could conceivably do the same thing.

Jim even broached that possibility in this space last summer when it became apparent Kamala Harris would be at the top of the 2024 ticket. Obviously it didn’t play out that way — but who’s to say it couldn’t next time around?

A Trump-Obama 2028 showdown?

I’ll cast my vote for the giant meteor…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets