Not Since COVID Has This Happened

![]() Not Since COVID Has This Happened

Not Since COVID Has This Happened

It doesn’t show up on Bloomberg’s homepage or the front page of The Wall Street Journal. But the signs are everywhere, beneath the surface.

It doesn’t show up on Bloomberg’s homepage or the front page of The Wall Street Journal. But the signs are everywhere, beneath the surface.

Whether it’s tariff uncertainty or a recession that’s been brewing for months or both… the movement of goods cross-border is slowing dramatically.

Result: Trucking activity at the hubs that process goods from the ports of Los Angeles and Long Beach has slowed to pandemic-era levels.

Or consider this: Effective today, DHL has suspended all shipments of goods worth over $800 to U.S. consumers “until further notice.”

This one is definitely tariff-related. The company cites a “significant increase” in red tape at U.S Customs.

Business-to-business shipments will carry on, “though they may also face delays.”

What changed? Since April 5, goods worth over $800 have been subject to additional processing at customs; previously the threshold was $2,500.

The company says the change “has caused a surge in formal customs clearances, which we are handling around the clock.”

Again, none of this is front-page stuff — yet. But we figured it was worth a heads-up.

“What if I told you I know exactly how Trump’s tariffs are going to play out?” asks Paradigm’s AI-and-crypto authority James Altucher.

“What if I told you I know exactly how Trump’s tariffs are going to play out?” asks Paradigm’s AI-and-crypto authority James Altucher.

“The exact stocks that will crumble… and the exact ones that will lead the market higher.”

Bold claim, we know. But this week, “a single market event (one that’s 100% guaranteed to happen) could send a massive shock through the market,” he says.

“Bigger than anything we have seen so far this year. If I’m right, this will be a transformative moneymaking moment.”

We’re talking about the potential for life-changing wealth when most people have no idea what to expect next. “And I do not want you to be left behind,” says James.

Again, we’re talking about something that’s going down this week, guaranteed. If you don’t want to miss out, follow this link and James will start to clue you in on what he calls 2025’s Ultimate Money Move.

![]() The Weaker Dollar — Just As Trump Wants It

The Weaker Dollar — Just As Trump Wants It

“History shows that when the dollar is too strong, the U.S. will set out to weaken it,” says Paradigm’s macroeconomics maven Jim Rickards.

“History shows that when the dollar is too strong, the U.S. will set out to weaken it,” says Paradigm’s macroeconomics maven Jim Rickards.

Jim spent much of last week in Japan to — among other things — deliver a keynote speech at a private investors conference about the role of gold in the global monetary system.

Over the years Japan’s currency, the yen, has gone through many ups and downs relative to the dollar. Right now, Donald Trump wants a weaker dollar — in hopes of making U.S. exports more affordable for foreigners, including the Japanese.

For all the turmoil in the stock and bond markets since Trump’s big tariff announcement on April 2, the dollar is doing what Trump wants. The U.S. dollar index, measuring the dollar against a basket of six major currencies including the yen — has sunk from 104.25 to 98.27.

“History shows that the Japanese are willing to accommodate such efforts at dollar devaluation for a variety of reasons,” Jim says — “which include geopolitical considerations as much as economic ones.”

“History shows that the Japanese are willing to accommodate such efforts at dollar devaluation for a variety of reasons,” Jim says — “which include geopolitical considerations as much as economic ones.”

While Jim was in Japan last week, Japanese officials ventured to the White House to see if they could strike a deal after Trump’s “Liberation Day” announcement.

No deal yet, but as Jim sees it, “they will not object to plans to revalue the yen against the U.S. dollar.”

This week, Jim is headed to Jekyll Island, Georgia — birthplace of the Federal Reserve — for a comprehensive debriefing with his research team. And you’ll have the chance to be a fly on the wall.

We’re hosting an exclusive livestream event this coming Wednesday at 2:00 p.m. EDT.

The Final Secret of Jekyll Island, this event is called. It’ll cover everything you ever wanted to know about how the markets got here so far in 2025… and where they’re going for the rest of the year.

We won’t try to sell you one of Jim’s premium services during this event; this is strictly for your enlightenment.

We’ll email you a link to the livestream shortly before we get underway Wednesday afternoon. In the meantime, you can review the agenda at this link.

![]() Who’s Afraid of a Google Breakup?

Who’s Afraid of a Google Breakup?

“If Meta or Alphabet get broken up by regulators, it’s not the end of the world,” writes Davis Wilson at our sister e-letter The Million Mission.

“If Meta or Alphabet get broken up by regulators, it’s not the end of the world,” writes Davis Wilson at our sister e-letter The Million Mission.

A week ago today, the Federal Trade Commission’s antitrust case against Facebook parent Meta went to trial — Mark Zuckerberg’s attempts to ingratiate himself with the Trump administration coming to naught.

Then on Thursday, a federal judge labeled Google an illegal monopolist when it comes to online advertising — the second time that’s happened in eight months.

Both cases might well end with the firms forced to spin off or divest core businesses. “While nothing is imminent,” says Davis, “the potential is real, and investors need to start thinking about the upside.”

You read that right. Upside.

You read that right. Upside.

“If Meta or Alphabet were forced to divest Instagram, WhatsApp, YouTube or parts of their ad businesses, here’s what would likely happen,” says Davis…

“Shareholders wouldn’t lose value. They’d receive shares in the new entities. Just like a stock split or spinoff, existing shareholders would retain ownership in each piece of the business.

“The total value of your investment would initially stay the same.

“For example, if Meta is worth $500 per share and Instagram is spun off as a $100 per share entity, Meta’s stock might drop to $400. But you now own both Meta ($400) and Instagram ($100). You haven’t lost value… it’s just split.

“Same with Alphabet. If it spun off YouTube or its ad exchange business, shareholders would receive stakes in those standalone companies.

“And here’s the kicker: Breakups often unlock value,” Davis adds.

“And here’s the kicker: Breakups often unlock value,” Davis adds.

Case in point: eBay spinning off PayPal a decade ago. “At the time, analysts thought the standalone PayPal would struggle. Instead, it crushed expectations and more than doubled in the years that followed.”

Or if you want to go way back in technological history, how about the breakup of AT&T in the 1980s? “It created multiple ‘Baby Bells,’” Davis reminds us — “and long-term investors made a killing as each company found its own way to grow.”

Back in the present, Davis is keen on the prospects of both Meta (META) and Alphabet (GOOG).

“Their core businesses are growing,” he says. “They dominate their respective markets. And they’re pouring money into AI and next-gen technologies.”

And the breakup risk? “To me, it’s not really a risk. It’s a potential reward.”

In the meantime, the fear trade is back in play today – stocks down, gold up.

In the meantime, the fear trade is back in play today – stocks down, gold up.

Gold has roared another 2.5% higher, over $3,400 for the first time. Silver’s up too, but not nearly as much – less than 1% to $32.81.

The S&P 500 is down over 2% to 5,169. That’s still better than the April 8 low under 5,000 – but right now the index is on track for its fourth-straight losing session. The losses in the Dow are over 2% and the Nasdaq nearly 3%.

Crude is selling off in sympathy with stocks, a barrel of West Texas Intermediate down 2.7% and back below $63.

Bonds are selling off, though not as much as stocks. The 10-year Treasury yield sits at 4.36%.

![]() “A Tool for Control of Americans”

“A Tool for Control of Americans”

And now a 5 Bullets business travel alert: It took the better part of 20 years, but the “Real ID” requirements to board an airplane are about to come into force.

And now a 5 Bullets business travel alert: It took the better part of 20 years, but the “Real ID” requirements to board an airplane are about to come into force.

When last we visited the matter in late 2022, the feds had once again pushed back the enforcement deadline of the Real ID Act — a post-9/11 law requiring that you have a driver’s license or other form of ID compliant with the law’s requirements to board a domestic flight.

That is, the photo must be compatible with facial-recognition software and the feds must be allowed access to state driver’s license databases.

The first deadline to comply was 2008. In all, the deadline was pushed back seven times. It wasn’t until 2020 that all 50 states began issuing compliant IDs.

In December 2022, the feds set a deadline of May 7, 2025 — about 2½ weeks from now.

It appears this time, the deadline will stick — a de facto national ID card being ushered in by the supposedly pro-freedom Trump administration.

It appears this time, the deadline will stick — a de facto national ID card being ushered in by the supposedly pro-freedom Trump administration.

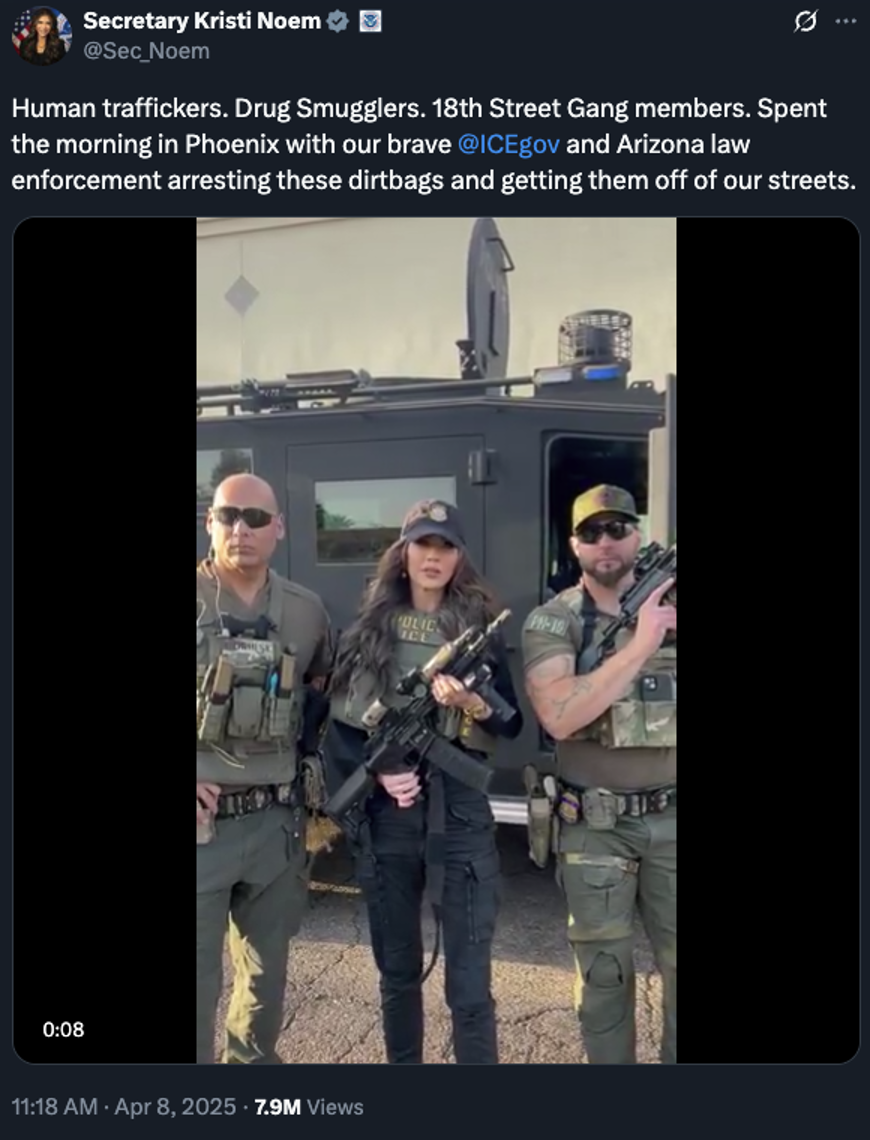

Homeland Security Secretary Kristi Noem made it official a few days ago…

Noem is a real piece of work, roasted on social media as “Commando Barbie” for foolish photo ops in which she displays a wanton disregard for NRA gun-safety rules (“Always keep the gun pointed in a safe direction”)...

… because it’s more important that she cultivate her “badass MILF” chic.

“Real ID isn’t needed and won’t stop terrorists from hijacking planes,” tweets Rep. Thomas Massie (R-Kentucky.)

“Real ID isn’t needed and won’t stop terrorists from hijacking planes,” tweets Rep. Thomas Massie (R-Kentucky.)

“Most of the 9/11 hijackers held Saudi, UAE, Egyptian or Lebanese passports. Real ID is a national standard and database of IDs that is primarily a tool for control of Americans.”

Perhaps it could be worse: “Section 202 of the Real ID Act (which was written by the sponsor of the Patriot Act) gives unfettered discretion to the secretary of Homeland Security to require ANYTHING as a condition for you to get a driver’s license,” tweets Kentucky State Rep. T.J. Roberts.

“Imagine if Kamala Harris won. She surely would have reappointed [Alejandro] Mayorkas. He surely would have required you disclose your political affiliations, the church you attend, your biometric data or any other thing you’d prefer to keep private.”

Anyway, it looks as if the deadline’s gonna stick this time — May 7.

➢ It pains me to write about this knowing that Saturday was not only Patriots’ Day but indeed the 250th anniversary of Lexington and Concord and “the shot heard round the world.” What would Paul Revere think?

![]() Mailbag: Yes, It’s More Than Tariffs

Mailbag: Yes, It’s More Than Tariffs

“Dave, I agree,” a reader writes after our most recent assessment of the tumult in the bond market.

“Dave, I agree,” a reader writes after our most recent assessment of the tumult in the bond market.

“While Trump gleefully demolishes trust in America, relying on that calamitous factor alone is an oversimplification of why international actors are selling off U.S. treasuries. Our elected representatives have mismanaged the federal budget for decades. It's more than not understanding math; they don't care. Have you ever considered why?

“The ballooning federal debt isn't just a symptom of fiscal irresponsibility; it's a calculated tool enabling the well-connected to privatize gains and socialize losses. Do you think Trump and his cabal of cronies are going to get their snouts out of the trough? That's not going to happen.

“Each round of deficit spending pumps billions into private hands — contracts, subsidies, bailouts — all benefiting the powerful insiders. Remember the parade of corporate elites kissing the ring and paying tribute after the king's coronation? Corporate and government parasites deftly convert public funds into private assets, effectively laundering taxpayer money into personal wealth. Meanwhile, we peasants are left footing an ever-increasing bill.

“This gravy train persists — and the debt grows — precisely because those who benefit most want it to. Trump and his puppets in Congress show no genuine interest in reducing debt because they and their key patrons — the wealthiest Americans — are profiting immensely from the status quo. Why do you think Senate Minority Leader Chuck Schumer sided with the Republicans and their spend-a-palooza continuing resolution?

“Until we confront the fundamental issue — the concentration of wealth and power — any discussion of debt reduction remains merely rhetorical. So I expect I'll continue to see more.”

Dave responds: Well said. And if it’s specific targets you’re looking for… nothing changes until the health care cartel is smashed and the military-industrial complex is brought to heel.

I’m not holding my breath.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets