“Magic Money Computers”

![]() Why Is Today, March 20, So Important?

Why Is Today, March 20, So Important?

We begin with an acknowledgment of the obvious.

We begin with an acknowledgment of the obvious.

So yes, I’m fully aware that yesterday’s edition — plus the promotional email I sent yesterday — is classic Oooh, a crash is coming on THIS SPECIFIC DATE marketing.

Considering that the specific date is today, you deserve a follow-up — and some transparency.

Just to back up a bit: Starting late last year, Paradigm editor Mason Sexton, editor of The Map, said today — March 20, 2025 — is a potential pivot point both for the markets and society at large.

“I believe March 20 is an important date where we could see a very important trend change,” he said in our exclusive video called The Prophecy.

To be absolutely clear, we’re talking on or about March 20. It’s the date his one-of-a-kind methodology points to. The exact date is not crucial to the success of the trades he recommends.

Case in point: Way back when, Mr. Sexton called the Black Monday crash of 1987 — still the biggest one-day percentage drop in stock market history.

Case in point: Way back when, Mr. Sexton called the Black Monday crash of 1987 — still the biggest one-day percentage drop in stock market history.

“If I had to guess the final top,” he said in advance, “I’d say first or second week of October… that would precede a correction of 15–20% minimum.”

it turned out to be the third week — the Dow industrials plunging 22.7% on Oct. 19. No matter: Anyone who followed his seven specific recommendations leading up to that day fared very well indeed.

I won’t get into the weeds about his methodology today. If you subscribe to The Map, you’re already up to speed. And if you’re not, he can explain it in his own words way better than I can.

For our purposes here, I want to explore two possibilities that could make today — or the coming days — a make-or-break moment.

![]() “Magic Money Computers”

“Magic Money Computers”

For starters, there’s Elon Musk’s claim that “magic money computers” exist within key federal agencies.

For starters, there’s Elon Musk’s claim that “magic money computers” exist within key federal agencies.

Musk says his DOGE boys have found 14 so far — most of them at the Treasury, some at the State Department, one at Health and Human Services and one at the Pentagon.

“They just send money out of nothing,” he said on Sen. Ted Cruz’s (R-Texas) podcast.

(In other news, Sen. Ted Cruz has a podcast.)

“Any computer which can just make money out of thin air,” Musk said, “that’s magic money.”

Exactly what Musk means here is squishy. In one sense, the U.S. government has been “making money out of thin air” since 1971 — when President Richard Nixon killed off the last vestiges of the gold standard.

Nothing new about that — we’ve been dealing with the diminishing purchasing power of fiat currency ever since.

But Musk suggests the “money out of thin air” in question amounts to 5–10% above and beyond what shows up in the official statements of the U.S. Treasury.

Musk seems to imply that the funds disbursed by these computers are not drawn on Uncle Sam’s accounts at the Treasury. The funds are pure counterfeit.

Musk seems to imply that the funds disbursed by these computers are not drawn on Uncle Sam’s accounts at the Treasury. The funds are pure counterfeit.

At least one sharp-eyed observer is latching onto this dire interpretation: “This is the biggest news of the century,” tweets Chris Martenson of the long-running Peak Prosperity website. ”If money is being spent without it coming from a message-settled banking account, it means the entire system of banking is an overt fraud.”

If true, what can Musk and the DOGE boys do about it?

Well, if the payments were out-and-out fraudulent, then the government could attempt to claw them back from the recipients, assuming the recipients can be tracked down.

But that might have the effect of cleaning out the recipients’ bank accounts. That could have all sorts of nasty knock-on effects — not least for the banks.

In a worst-case scenario the Trump administration would have to decide whether to…

- Let the chips fall where they may and cleanse the system of the underlying rot or

- Pursue another series of massive bank bailouts on top of the ones that took place in 2020 and 2008.

By the way, Mason Sexton accurately called both the COVID crisis of 2020 and the subprime crisis of 2008 — to the benefit of his wealthy hedge fund clients. This time, everyday folks like you stand to benefit. Give his presentation The Prophecy a look right away — and learn why today and the following days could be so significant.

![]() Will Trump Nuke Iran?

Will Trump Nuke Iran?

Or maybe the impending crisis will be Donald Trump unleashing a nuclear attack on Iran.

Or maybe the impending crisis will be Donald Trump unleashing a nuclear attack on Iran.

This week, independent journalist Ken Klippenstein — formerly with The Intercept — has reported a series of, for lack of a better term, bombshells.

“President Trump’s menu of options for dealing with Tehran now includes one he didn’t have in his first term,” he writes: “full-scale war.

“Pentagon and company contracting documents I’ve obtained describe ‘a unique joint staff planning’ effort underway in Washington and in the Middle East to refine the next generation of ‘a major regional conflict’ with Iran…

“While a range of military options are often provided to presidents in a passive-aggressive attempt on the part of the Pentagon to steer them to the one favored by the brass, Trump already has shown his proclivity to select the most provocative option. Trump reportedly ‘stunned’ Pentagon officials in 2020 when he chose to assassinate Iran’s top general Qassim Suleimani from his menu of choices…

“What Trump can now do, which is right out of the Israeli playbook, is attack Iran's command and control, including Iran’s leadership, if for no other reason than to emphasize the new boss isn’t the same as the old one.”

And yes, nukes are on the table.

And yes, nukes are on the table.

The plans were in the works last year, even before Trump returned to the presidency. Klippenstein’s source on the nuclear angle is “a retired senior military officer who has been briefed on the planning.”

“Escalating an Iran conflict to the use of nuclear options can originate in two ways,” writes Klippenstein: “One, with the CENTCOM commander ‘requesting’ the use of nuclear weapons, mostly to stave off Iranian conventional military success; and two, in a ‘top down’ order, that is, by the president, mostly as a ‘demonstration’ to ‘signal’ to Iran.”

During his roughly 10 years as a journalist, Klippenstein says he can’t recall writing about nukes once. “Now, the nuclear threat seems very much a live issue with this latest generation of detailed military planning that could be put in motion at any time and by a single person who has already shown himself to have a much bigger appetite for risk, even than in his first time.”

One might wish there’d be an opportunity for vigorous public debate about how much of a threat Tehran poses to Americans in America (as opposed to Americans in the Middle East or Israelis)... and whether that threat justifies the first use of nuclear weapons since 1945… but evidently that’s not in the cards.

As far as the markets, a U.S. nuclear attack targeting Iran would be the mother of all geopolitical shocks — more than Russia invading Ukraine in 2022, more than 9/11 in 2001, more than Iraq invading Kuwait in 1990.

To be sure, it’s only one of many possibilities that could make today or the days to come a memorable moment in the history of this century. It could also be the fallout from the “magic money computers.” Or it could be something else entirely.

Whatever it turns out to be, you want your portfolio to be ready. Mason Sexton has you covered. Follow this link to start watching The Prophecy right away.

![]() The Fed’s “Backdoor Rate Cut”

The Fed’s “Backdoor Rate Cut”

Gee, a collapse of the banking system and nuclear warfare sorta make the latest Federal Reserve decision look like a nothingburger, no?

Gee, a collapse of the banking system and nuclear warfare sorta make the latest Federal Reserve decision look like a nothingburger, no?

To no one’s surprise, the Fed left its benchmark fed funds rate alone; it’s been sitting at 4.5% for three months now.

But there was one unexpected development: The Fed decided to slow the pace at which it’s reducing its still-bloated balance sheet. Paradigm’s macro maven Jim Rickards calls it a backdoor rate cut.

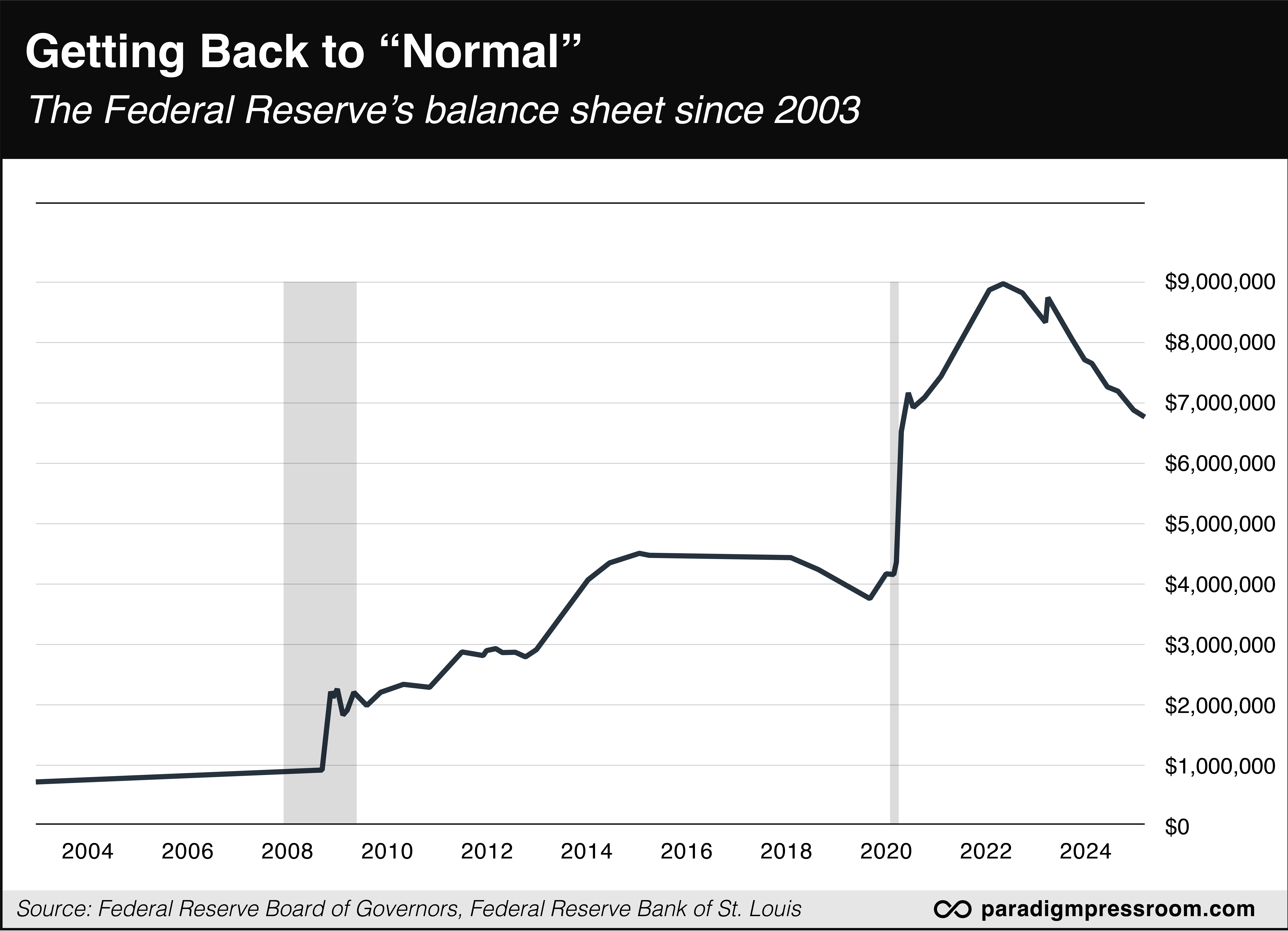

When the COVID crisis hit, the Fed started buying Treasuries and mortgage-backed securities at a furious pace to stabilize financial markets. As a result, the Fed’s balance sheet exploded from a little over $4 trillion in early 2020 to nearly $9 trillion by early 2022.

The Fed has been trying to get back to some semblance of “normal” for the last three years and indeed the balance sheet is now back below $7 trillion.

However… yesterday the Fed decided to slow the pace of this “runoff” from $25 billion a month to only $5 billion. All else being equal, that’s a stealth form of monetary easing.

As for when the Fed might resume its rate-cut cycle, the futures markets are saying another three months. But Jim Rickards won’t rule out a cut as soon as the next meeting on May 7 — especially if the inflation rate continues to climb down. (It fell from 3.0% to 2.8% in February, but one month is not a trend.)

“Fed Chair Jay Powell will focus on the dual mandate of low unemployment and price stability as required by law,” Jim tells his Crisis Trader readers. “But the Fed can juggle which part of the mandate (jobs or inflation) takes precedence at any point in time.”

The major U.S. stock indexes held onto their morning gains after the Fed issued its proclamation yesterday — and they’re adding to those gains today.

The major U.S. stock indexes held onto their morning gains after the Fed issued its proclamation yesterday — and they’re adding to those gains today.

At last check, the S&P 500 is up a fifth of a percent to 5,686. The Dow and the Nasdaq are both up about a third of a percent.

“The big question right now is follow-through,” says Paradigm’s Greg Guenthner at The Trading Desk. “Can buyers continue to step in here now that the aggressive selling seems to have slowed? And can traders shake off any bad news that might otherwise interrupt a relief rally?”

Gold is taking a rest, down nine bucks to $3,038. Silver can’t catch a break, now $33.37. Bitcoin sits a hair over $85,000, near its 200-day moving average.

Crude is up over a buck to $68.35 — the highest in nearly three weeks. But in no way does it look ready to break out to, say, $70 or higher.

The big economic number of the day might deceive you into believing the tight housing market is finally starting to loosen up.

The big economic number of the day might deceive you into believing the tight housing market is finally starting to loosen up.

Existing home sales clocked in way higher than expected — a 4.2% jump from January to February.

But that jump was concentrated in the South (hurricanes) and the West (wildfires). “Displaced households may be anxious to buy whatever the market conditions,” says a summary from Econoday. Even with that, existing home sales are down 1.2% year-over-year.

The median price of an existing home sits at $398,400 — up 1.3% for the month and up 3.8% compared with a year ago. That’s nearly five times median household income, calculated by the Census Bureau in 2023 at $80,610.

![]() Grim Chuckle

Grim Chuckle

To the best of our knowledge there’ve been no new major releases of JFK files since our dispatch yesterday.

To the best of our knowledge there’ve been no new major releases of JFK files since our dispatch yesterday.

We did, however, encounter the following…

It doesn’t help armchair researchers that the files released this week aren’t searchable. (Maybe Musk and the DOGE boys can introduce the National Archives to OCR software?)

But the good folks at the Mary Ferrell Foundation — which has been suing the feds for years to get access — promises to convert the documents soon as searchable PDFs.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets