Russia Prospers as the West Blunders

![]() The G7 and a First-Order Blunder

The G7 and a First-Order Blunder

Whaa? Western sanctions against Russia aren’t working?!

Whaa? Western sanctions against Russia aren’t working?!

In what must be entry number 362,461 in mainstream articles, BBC’s Russia editor Steve Rosenberg outlines how breathtakingly sanctions have backfired.

“I can remember Western officials and commentators describing the sanctions as ‘crippling,’ ‘debilitating’ and ‘unprecedented,’” Rosenberg says.

“With adjectives like these filling the airwaves, the situation seemed clear. There was surely no way that Russia’s economy would withstand the pressures,” he says.

“Faced with the prospect of economic collapse, the Kremlin would be forced to back down and withdraw its troops.

“Wouldn’t it?”

(It’s here we wonder if Mr. Rosenberg is at all familiar with Betteridge’s law of headlines: Any headline that ends in a question mark can be answered by the word no.

While not exactly the same in this instance, it still seems applicable.)

“After more than two years of fighting, Russia’s economy has adapted to the pressures of war and sanctions,” Rosenberg confirms.

“After more than two years of fighting, Russia’s economy has adapted to the pressures of war and sanctions,” Rosenberg confirms.

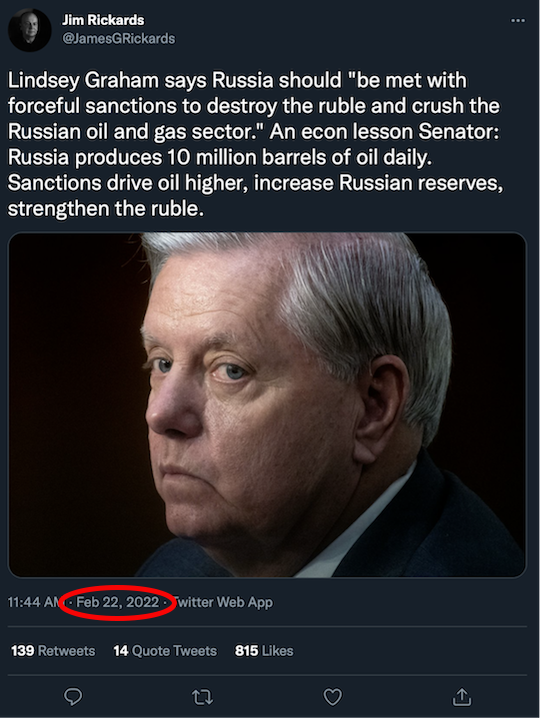

Indeed, it’s a phenomenon Paradigm’s macro expert Jim Rickards predicted from the very onset of the war.

Exhibit A?

And twenty-seven months later, Jim has the receipts: “Russian growth now exceeds U.S. growth…

- “Russia is growing at 5.4% (annualized) while U.S. growth in the most recent quarter was only 1.3%

- The Russian debt-to-GDP ratio is a comfortable 17.2% while the U.S. debt-to-GDP ratio is a dangerous 122%

- Unemployment in Russia is only 2.7% while the unemployment rate in the U.S. is 3.9%

- The Russian ruble has held steady at about 90:1 for months

- The value of Russia’s gold reserves has increased $50 billion on the rise of gold’s price

- And Russia is now the largest exporter of oil to China.

“With that track record,” Jim says, “one would think the U.S. would reevaluate the impact of economic sanctions…

“Instead, the West now plans to double-down by stealing over $300 billion of Russian assets held in the form of U.S. Treasury securities,” Jim says. “This plan” — aka “a first-order blunder” — “will formally be unveiled at the G7 meeting.

“Instead, the West now plans to double-down by stealing over $300 billion of Russian assets held in the form of U.S. Treasury securities,” Jim says. “This plan” — aka “a first-order blunder” — “will formally be unveiled at the G7 meeting.

“About $200 billion of the $300 billion in total Russia assets are held in Euroclear, the largest custodian in Europe with over $40 trillion in assets held in custody,” he says.

“Russia will not take this theft lying down. Russia will retaliate by seizing over $300 billion in Western assets located in Russia, including energy infrastructure, telecommunications assets and retail outlets.

“Russia will also sue Euroclear for wrongful conversion of assets in one of several Russia-friendly jurisdictions where Euroclear has offices, including Dubai and Hong Kong,” Jim says.

“Once Russia wins a judgment, it can go anywhere in the world to enforce it.

“This could throw Euroclear’s $40 trillion custody business into chaos and create a global financial catastrophe,” Jim forecasts.

“The U.S. has not learned its lesson about financial sanctions yet,” Jim concludes. “It may have an even harder lesson to learn if it moves ahead with stealing the Treasury securities legally owned by Russia.”

Starting tomorrow — Thursday, June 13 — Jim says: “The G7 summit could be a disaster for the global monetary system.” (And a disaster for your personal savings.)

Jim fears millions of Americans will be blindsided, watching their savings dwindle away.

Fortunately, those who prepare before Biden’s pivotal meeting with the G7 on June 13 will have the opportunity to build an entire nest egg with just a few calculated moves.

Jim spotlights a specific type of gold hedge — one that over time could return 10X your money, double his projected performance of gold bullion.

Click to watch Jim’s emergency briefing… It’ll be too late tomorrow.

![]() Market: Talk “Fed Speak” to Me!

Market: Talk “Fed Speak” to Me!

The Labor Department is out today with the May inflation number.

The Labor Department is out today with the May inflation number.

Down a slight 0.1% from April’s CPI reading, the official year-over-year inflation rate in May, at 3.3%, is still miles away from the Federal Reserve’s 2% target.

But contradicting the guess of the typical Wall Street economist, May’s CPI is the third “cooler than expected” inflation figure we’ve seen in weeks.

Major contributors to inflation during May include housing, health care and auto insurance. On the other side of the ledger, gasoline and energy prices were down significantly, and groceries only increased 0.1%.

Quick reminder: The FOMC’s meeting concludes this afternoon. At the last FOMC meeting on May 1, the Fed observed the “lack of further progress” in subduing inflation.

“Chair Jerome Powell is likely to underscore [that] the policymakers will need to see several more months of low inflation readings before they would consider reducing their key rate,” says the AP. “It would be an encouraging sign that the policymakers may cut their benchmark rate within a few months.”

Another reminder? At Paradigm’s latest Whiskey Bar event at The Watergate Hotel, Rude Awakening editor Sean Ring made an out-of-the-box prediction that the Fed would cut rates just once this year in June. According to the CME's FedWatch Tool, the likelihood of that scenario stands at 10%.

But by the time you read this, the market will be reacting — or overreacting —- to whatever Powell says during his press conference.

Taking the market’s current temperature, stocks are in fine fettle…

Taking the market’s current temperature, stocks are in fine fettle…

The techie Nasdaq is leading the way — up 1.75% to 17,654. Simultaneously, the S&P 500 has gained 1.10% to 5,345 while the Big Board’s added 110 points (0.30%) to its market cap at 38,860.

- Apple has regained its footing as the world’s most valuable company. (AI?) With a market cap of $3.24 trillion, the company has surpassed Microsoft and Nvidia. AAPL shares, by the way, are up almost 5% at the time of writing.

Turning to the commodities complex, crude is up 0.20% to $78.08 for a barrel of WTI. And gold and silver are catching bids: The yellow metal is up 1% to $2,350 per ounce while its silver cousin is up 3.25%, just over $30.

Meanwhile, the crypto market’s flashing green. Bitcoin is up 3.65% to $69,775, and Ethereum is up 3.75% to $3,600.

![]() Number Go Up (NVDA)

Number Go Up (NVDA)

“The paint isn’t even dry on the freshly split Nvidia shares and the financial media is already crowning it as the next big addition to the Dow,” says Paradigm’s pro trader Greg “Gunner” Guenthner.

“The paint isn’t even dry on the freshly split Nvidia shares and the financial media is already crowning it as the next big addition to the Dow,” says Paradigm’s pro trader Greg “Gunner” Guenthner.

“It’s all just speculation at this point. But if NVDA keeps pace with its historic run, it would certainly be a welcome addition to the DJIA.

“After all, NVDA just casually added another trillion bucks to its market cap as it stacks up a gain of nearly 40% over the past four weeks,” Gunner says. “As the crypto kids like to say, number go up.

“Speculators have no problem chasing NVDA higher as summer approaches,” Gunner says.

“I’m sick of all the NVDA talk, too,” he adds. “But it’s the main driver of this year’s market gains — and it’s managed to fuel the averages with a virtually parabolic rally that refuses to die.

“As always, I don’t think it’s wise to attempt to quick-call a major crash in NVDA shares (or any other semiconductor stock, for that matter). Stay on the lookout for downside action — but don’t load up on the short side without confirmation that a move lower has started.

“You can sit around wishing you put 100% of your trading capital in NVDA on Jan. 1,” says Gunner. “Or, you can focus on doing the work and following your trading process to help find the consistent winners that will lead to long-term trading success.”

![]() 57,000 Tonnes

57,000 Tonnes

“New gold deposits are becoming harder to find around the world as many prospective areas have already been explored,” CNBC says.

“New gold deposits are becoming harder to find around the world as many prospective areas have already been explored,” CNBC says.

The World Gold Council reminds us that mining is a cash-intensive process that can take, on average, 10–20 years for a mine to come online.

CNBC adds: “Securing licenses and permits needed before mining companies can start operations can take several years.”

From the get-go, the odds are deeply stacked against a gold discovery turning into an operational mine — a mere 10% contain enough precious metal reserves to justify establishing a mining operation.

Moreover, numerous mining ventures in remote regions often lack essential infrastructure like roads, electricity and water, all of which require additional cash.

“I think the overwhelming story there is after 10 years of rapid growth from around 2008, the mining industry is struggling to report sustained growth in production,” says WGC Chief Market Strategist John Reade.

“It’s getting harder to find gold, permit it, finance it and operate it,” Reade concludes.

To date, about 187,000 metric tons of gold have been mined… The kicker?

Estimates from the United States Geological Survey suggest only around 57,000 tonnes of gold reserves remain for excavation.

![]() Yo, Beer Me!

Yo, Beer Me!

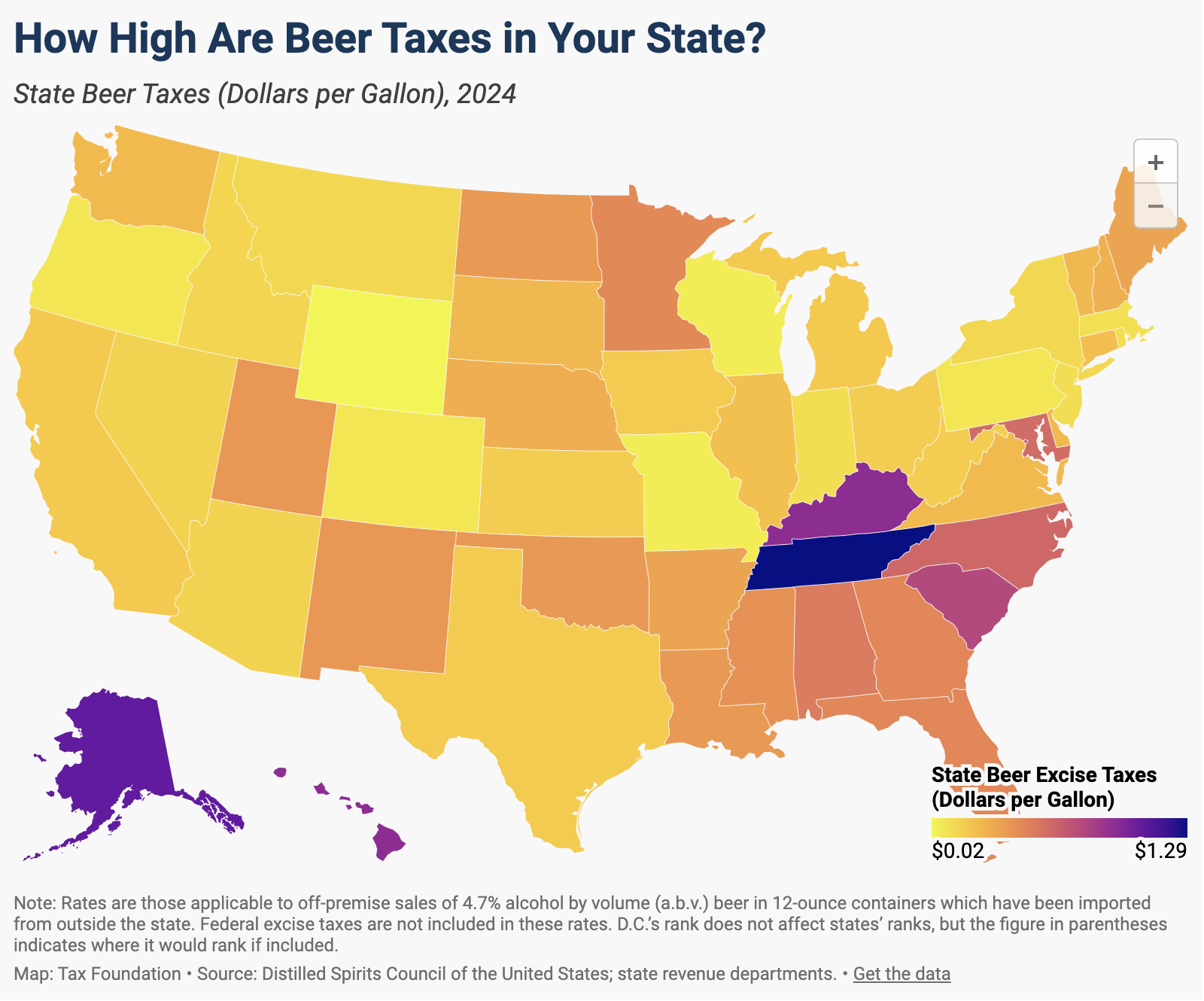

Ahead of Father’s Day festivities, you might be curious to know what state excise tax is levied against your favorite beer.

Ahead of Father’s Day festivities, you might be curious to know what state excise tax is levied against your favorite beer.

“Although you can’t see [these] taxes on your receipt, vendors pass along those costs to consumers in the form of higher prices,” says a Tax Foundation article.

Mind you, at the federal level, the USG “collects an excise tax on fermented malt beverages” somewhere in the range of $0.11 to $0.58 per gallon, based on a few factors.

But wait…

All 50 states — plus the District of Columbia — levy their own excise tax on beer. For reference, here’s the lay of the land this year…

“Sixteen states have beer excise tax rates that vary based on alcohol content, place of production, size of container or place purchased,” the article adds.

For example? Idaho considers any beer with a 5% ABV or higher a “strong beer.” So beer is taxed like wine at $0.45 per gallon in the Gem State.

“Rates vary widely: as low as $0.02 per gallon in Wyoming, and as high as $1.29 per gallon in Tennessee.”

In fact, Maryland — where Paradigm Press is headquartered — has the seventh-highest beer tax at $0.60 per gallon.

Regardless, we highly doubt you’ll eighty-six beer from your Father’s Day menu. On the other hand, inflation? Nah! Dad’s worth it.

Take care! We’ll be back again tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets