Russia’s Gold “Stimulus”

![]() Russia’s “Loss” = Gold’s Gain

Russia’s “Loss” = Gold’s Gain

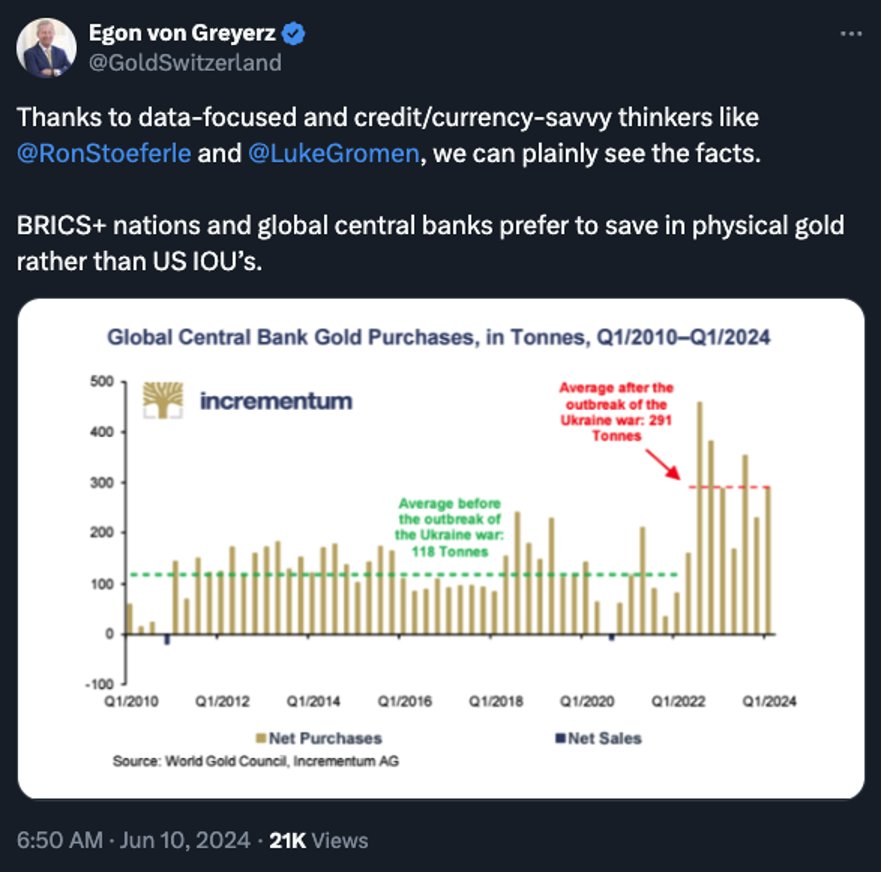

We’d already known how Western sanctions against Russia prompted an international gold grab. But sometimes you need a chart to make it plain.

We’d already known how Western sanctions against Russia prompted an international gold grab. But sometimes you need a chart to make it plain.

This chart depicts the quarter-by-quarter accumulation of gold by the world’s central banks going back to 2010…

To be sure, central banks around the world had been net buyers of gold for more than a decade. But the buying really took off after Russia invaded Ukraine in 2022 and Washington slapped unprecedented economic sanctions on Russia.

Specifically, U.S. Treasuries held by the Central Bank of Russia were frozen. Leaders of other governments around the world — especially those not in Washington’s orbit — naturally wondered Could we be next?

Thus they started loading up on the Midas metal. Not coincidentally, gold has rallied from $1,800 before the invasion to over $2,300 now.

After what’s going down in Apulia, Italy this week, the stage will be set for gold to rocket much higher — perhaps $15,000 by 2026.

After what’s going down in Apulia, Italy this week, the stage will be set for gold to rocket much higher — perhaps $15,000 by 2026.

So says Paradigm’s macroeconomics maven Jim Rickards — who’s keeping a close eye on events leading up to a summit of G7 leaders starting Thursday.

The essential backdrop: In April, when Congress squandered another $95 billion on aid for Ukraine, Israel and Taiwan, it also passed something called the REPO Act.

“This act authorizes the president to steal any Russian assets, including U.S. Treasury securities, that come under U.S. jurisdiction.”

In other words, not just freezing them as they’ve been since 2022 — but seizing them.

“The impact of the REPO Act is limited by the fact that only about $10 billion of Russian sovereign assets are actually under U.S. jurisdiction,” Jim goes on. “Yet the act contemplates this theft will be a down payment on a much larger theft to be conducted by NATO allies in Europe.

“The U.S. goal is to use the G7 summit as a platform for getting the other G7 members to go along with this theft of Russian assets under their jurisdiction,” says Jim.

“The U.S. goal is to use the G7 summit as a platform for getting the other G7 members to go along with this theft of Russian assets under their jurisdiction,” says Jim.

See, a much larger total of Russia’s U.S. Treasuries — about $290 billion worth — is under the jurisdiction of European banks. Washington needs the cooperation of other G7 leaders to confiscate those Treasuries. That’s going to be the major agenda item at G7 starting Thursday.

“The consequences of this theft in the international monetary system would be momentous and highly adverse for the United States,” Jim asserts.

“One immediate impact would be the decline of trust in the U.S. Treasury market and an aversion to holding U.S. Treasury securities in sovereign reserves. Major holders of U.S. Treasuries such as China, Japan, Taiwan, Saudi Arabia, Brazil and others would gradually reallocate reserves away from Treasuries toward assets that cannot be frozen or seized such as gold bullion.”

Again, this is already happening. See the chart above. But the move to confiscate Russia’s Treasuries and not just freeze them? That would put this flight into gold on steroids.

“In an ironic twist, the mere talk about stealing Russian assets has caused the price of gold to increase by $600 per ounce in a matter of months,” Jim points out.

“In an ironic twist, the mere talk about stealing Russian assets has caused the price of gold to increase by $600 per ounce in a matter of months,” Jim points out.

“Russia has approximately 3,000 metric tonnes of gold in its reserves, which cannot be touched by Western sanctions or the REPO Act. The rally in gold prices has increased Russia’s reserve position by $50 billion without Russia lifting a finger.

“If the U.S. and its NATO allies work together to steal 100% of the Russian assets located in the West, it will be the greatest theft in the history of the world. The G7 summit could be a disaster for the global monetary system.”

But it will be great for gold. That’s why Jim is so keen to spotlight a specific type of gold investment this week — one that over time could return at least 10X your money, double his expected performance of gold bullion.

You owe it to yourself to watch his latest presentation now — ahead of the G7 summit starting Thursday. Just a few calculated moves, Jim says, and you could be set for life.

![]() Apple Disappointment Doesn’t Last Long

Apple Disappointment Doesn’t Last Long

At its annual Worldwide Developers Conference yesterday, Apple did exactly what we said it would do. Mr. Market was underwhelmed.

At its annual Worldwide Developers Conference yesterday, Apple did exactly what we said it would do. Mr. Market was underwhelmed.

During his keynote speech, CEO Tim Cook demonstrated his resolve to make Apple a meaningful player in AI.

The Siri voice assistant will get an AI upgrade — and what the upgrade can’t do, OpenAI’s ChatGPT will do. Yes, the much-rumored partnership between AAPL and OpenAI is for real.

Still, competitors were quick to scorn…

… and of course Elon Musk had to make it all about him.

Apple ended the trading day yesterday down 1.9%. But that was just a knee-jerk reaction. As we write today, it’s up 4.8% and trading at all-time highs.

That’s a more-than-respectable start toward the forecast of Paradigm AI authority James Altucher’s — that AAPL will be up by a third at year-end.

Of course, James is much more enthusiastic about a tiny company that’s key to Apple’s AI ambitions. Paradigm Mastermind Group members know exactly who we’re talking about; if you’re among them, you’ll want to stay in touch with your weekly updates.

As for the major U.S. stock indexes today, it’s a mixed bag. The Dow is in the red, the Nasdaq in the green. At 5,353, the S&P 500 is down seven points from yesterday’s record close.

As for the major U.S. stock indexes today, it’s a mixed bag. The Dow is in the red, the Nasdaq in the green. At 5,353, the S&P 500 is down seven points from yesterday’s record close.

Gold is likewise little moved, the bid $2,311. But silver? Ouch — down 2% and about to break below $29 for the first time in a month. Bitcoin is also getting creamed, below $67,000 after nearly touching $70,000 yesterday.

Crude is up slightly and back within sight of $78. The dip below $73 earlier this month had zero staying power.

![]() The “Data Dependent” Fed

The “Data Dependent” Fed

As mentioned here yesterday, tomorrow promises to be an interesting day in the markets.

As mentioned here yesterday, tomorrow promises to be an interesting day in the markets.

The Labor Department will issue the official inflation numbers at 8:30 a.m. EDT. Hours later, the Federal Reserve will issue its latest proclamation on interest rates.

As the aforementioned Jim Rickards sees it, the Fed is in no mood to cut rates now, and probably not at the next meeting seven weeks from now. Even if the inflation rate ticks down tomorrow, Jim says, “The Fed needs to see two or three months of solid progress before reaching a level of confidence that inflation is declining enough to permit rate cuts.”

To be sure, there’s no shortage of economic data that says rate cuts would be appropriate now. Jim laid out this laundry list to his Crisis Trader readers earlier today…

- Atlanta Fed GDP Nowcast = 3.1% (down from recent estimate of 4.2% on May 14)

- The unemployment rate ticked up to 4.0% in the May employment report

- Oil prices have trended down from $86.90 to $78.85 over the last nine weeks

- Regular gas at the pump has trended down from $3.64/gal to $3.47/gal in the past month

- Consumer savings are largely depleted, and credit cards are maxed out

- Higher rates for credit cards are headwinds to consumption

- Higher rates for mortgages are a headwind to home purchases and consumer durables

- Inverted yield curve continues to signal a coming recession

- Most job creation is in part-time jobs

- Labor force participation moved down from 62.7% to 62.5% in May employment report

- Jobs are going largely to illegal aliens.

But on the other side of the ledger…

- ISM index in services was strong

- Job creation remains solid, up by 272,000 jobs in the May employment report.

- Unemployment rate remains low despite recent increases

- Inflation is sticky with a central tendency around 3.3% over 11 months.

For all the talk about the Fed being data-dependent, “This data is not given equal weighting by the Fed,” says Jim. “The inflation rate is the dominant factor in a world where job growth remains strong.”

At least the headline job number remains strong, anyway. More about that shortly in the mailbag…

![]() “Uncertainty Is the Enemy of Progress”

“Uncertainty Is the Enemy of Progress”

Small-business owners are more jittery about the future than at any time in the last 3½ years.

Small-business owners are more jittery about the future than at any time in the last 3½ years.

That’s the big takeaway from the monthly Small Business Optimism Index issued by the National Federation of Independent Business.

The headline optimism number for May is 90.5, the highest since December. Higher numbers are good, but this isn’t saying much — the index has now spent 29 straight months below its 50-year average.

Digging into the report, the standout number is the uncertainty index. Here, higher numbers are bad — and at 85, this number is the highest since the second wave of COVID lockdowns in November 2020.

“The news is now dominated by political events rather than economic news and analysis,” says the monthly report from NFIB economists Bill Dunkelberg and Holly Wade. “The election promises to bring major changes in the tax and regulatory environment, regardless of who wins. All of this presents a very uncertain outlook for small-business owners and uncertainty is the enemy of progress.”

In the portion of the survey where respondents are asked to identify their single most important problem, inflation remains tops — cited by 22%. Close behind is “quality of labor,” cited by 20% — suggesting good help is still hard to find. Taxes were cited by 13%, labor costs by 10%. Everything else is in single digits.

For the record: The Port of Baltimore is once again open, nearly 11 weeks after a cargo ship struck the Francis Scott Key Bridge.

For the record: The Port of Baltimore is once again open, nearly 11 weeks after a cargo ship struck the Francis Scott Key Bridge.

The wreckage of the bridge has now been cleared; the channel is restored to its original dimensions, 700 feet wide and 50 feet deep. That’s good for ship traffic — but truck traffic going around Baltimore will likely be rerouted for years to come.

Meanwhile, dockworkers throughout the Eastern Seaboard and Gulf Coast could go on strike this fall.

Meanwhile, dockworkers throughout the Eastern Seaboard and Gulf Coast could go on strike this fall.

“The International Longshoremen’s Association canceled talks set for Tuesday in Newark, N.J.,” reports The Wall Street Journal, “to protest the use of automated machinery at some ports, which the union says violates prior labor agreements.”

The current contract expires Sept. 30.

Missing from the Journal’s coverage is this: If past is prologue, the Biden administration will move heaven and earth to prevent a strike and keep supply chains intact — as it did with West Coast ports in 2023 and the freight railroads in 2022.

![]() Mailbag: Tortured Economic Statistics

Mailbag: Tortured Economic Statistics

In light of Sean Ring’s quip about the inflation figures due tomorrow — “Who knows how they’re going to engineer that number,” he said — a reader writes…

In light of Sean Ring’s quip about the inflation figures due tomorrow — “Who knows how they’re going to engineer that number,” he said — a reader writes…

“Government statistics: If you torture the numbers long and hard enough, you can get them to tell you anything.”

Dave responds: We’re not at liberty to identify him by name, but there’s an out-of-the-box economist telling his many well-heeled clients that something stinks to high heaven about Friday’s job report.

He readily acknowledges that past presidents have seen fit to tinker with economic numbers — but it seems more extreme now.

Seems plausible from where we sit — given how past presidents have monkeyed around with the Strategic Petroleum Reserve, but Joe Biden took it to a whole new level.

Of course, no one can paper over a weakening labor market indefinitely. Sooner or later that translates to less consumer spending and plunging corporate profits.

The question now is whether that becomes evident before or after the election…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets