Swissie Spanks the Dollar

![]() U.S. Debt Is a “Time Bomb”

U.S. Debt Is a “Time Bomb”

“Take a look at America. That's a time bomb,” says Swiss Finance Minister Karin Keller-Sutter in a recent interview with Swiss newspaper Blick.

“Take a look at America. That's a time bomb,” says Swiss Finance Minister Karin Keller-Sutter in a recent interview with Swiss newspaper Blick.

“Debt levels in the U.S. [are] a risk to international financial stability,” she elaborates.

Courtesy: X

Keller-Sutter further notes the stark contrast between Switzerland's prudent fiscal management and the precarious financial situation in the U.S. (More on that in a moment.)

As proof, she points to U.S. stock-market volatility in early August as a harbinger of potential economic troubles, describing it as “an expression of investors’ fear of a recession.”

A reality which isn’t lost on Paradigm’s currency expert Jim Rickards…

The Swiss franc's strength as a safe haven is well established and rooted in history, Jim highlights.

The Swiss franc's strength as a safe haven is well established and rooted in history, Jim highlights.

Considered a safe-haven currency since World War I, this long-standing reputation attracts investors during times of economic uncertainty or market turbulence.

And even when global markets are performing well, the Swiss franc often maintains its strength due to several key factors:

Debt-to-GDP Ratios

- Switzerland: The debt-to-GDP ratio is reported at 38.3%, with a total debt of around $316 billion against a GDP of approximately $822 billion as of 2023

- United States: In stark contrast, the U.S. has a significantly higher debt-to-GDP ratio of 134%, reflecting an “out-of-control” national debt burden, says Jim.

Trade Balances

- Swiss Trade Surplus: Switzerland maintains a trade surplus, bolstered by strong exports in precision equipment, luxury goods and a thriving tourism sector. “Switzerland has a $1.15 billion trade surplus,” Jim says

- U.S. Trade Deficit: On the other hand, the U.S. is facing a substantial trade deficit which contributes to the depreciation of the dollar relative to the franc. “The U.S. has a $238 billion trade deficit,” he adds. “There’s really no comparison there.”

Interest Rates and Inflation

- Interest Rates: Switzerland's short-term policy interest rate stands at 1.25% while the U.S. rate is a much higher 5.50% — which helps savings accounts, sure, but hinders borrowing

- Inflation: “These rates should be put in the context of inflation, which is 1.3% in Switzerland versus 2.9% in the U.S.,” says Jim. “But when adjusted for inflation, the real rate in Switzerland is -0.05% compared with 2.6% in the U.S.”

Adding to Switzerland’s economic strength…

Switzerland holds a significantly higher amount of gold relative to its GDP compared with the U.S. — nearly four times more gold, in fact.

Switzerland holds a significantly higher amount of gold relative to its GDP compared with the U.S. — nearly four times more gold, in fact.

“The United States (No. 1) has 8,133 metric tonnes of gold (worth $654 billion) in its reserves while Switzerland (No. 7) has 1,040 metric tonnes (worth $83.6 billion),” Jim says.

“When those reserve holdings are put in the context of GDP, Switzerland has an 8.90% ratio of gold-to-GDP while the U.S. has a 2.27% ratio of gold-to-GDP.

“The U.S. has more gold by weight but Switzerland has a much higher amount of gold relative to the size of its economy,” he says. “This arguably makes Switzerland the better safe haven.”

This substantial gold backing enhances the franc's appeal, especially when gold prices rise in U.S. dollar terms. And Switzerland's robust and well-regulated financial sector only adds to the franc's appeal.

“Given the economic, social and geopolitical uncertainty in the world today,” Jim concludes, “Switzerland ranks highly as a safe haven and, in many ways, the franc is more of a ‘go to’ currency than the U.S. dollar.

“That situation,” he says, “is likely to become more pronounced in the months ahead.”

![]() Perpetual Inflation

Perpetual Inflation

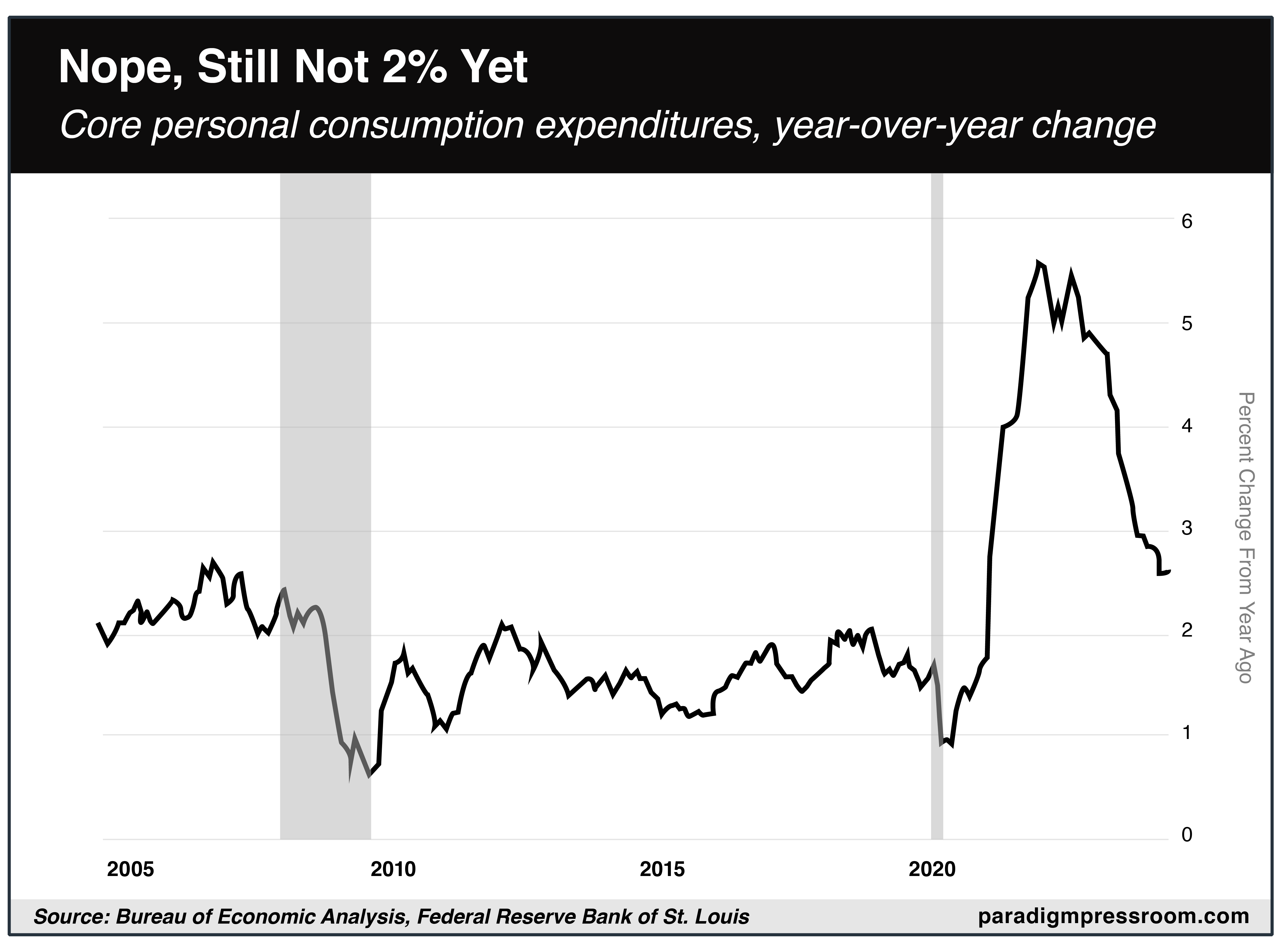

With 19 days until the next FOMC meeting, inflation is still stuck closer to 3% than the Federal Reserve’s preferred 2% target.

With 19 days until the next FOMC meeting, inflation is still stuck closer to 3% than the Federal Reserve’s preferred 2% target.

The Commerce Department issued its read on “core PCE” this morning. By this yardstick, consumer prices rose 0.2% in July — in line with expectations. Meanwhile, the year-over-year inflation rate is stuck at 2.6% versus the 2.7% economists anticipated.

Will July’s “cooling” inflation measure — if you can call it that — “give the Fed some leeway to be more aggressive with rate cuts,” Barron’s speculates. “Only if the labor market shows a steep deterioration.

“In his speech at the Fed’s annual Jackson Hole economics conference, Chairman Jerome Powell said policymakers didn’t want to see further deterioration in the labor market. That makes the jobs report for August, to be released on Sept. 6, more pivotal in determining what happens next for rate policy,” says Barron’s.

Taking a look at stocks today, the S&P 500 index and tech-heavy Nasdaq are barely in the green this Friday afternoon, at 5,595 and 17,540 respectively. The staid DJIA, on the other hand, is down 0.25% to 41,235.

Taking a look at stocks today, the S&P 500 index and tech-heavy Nasdaq are barely in the green this Friday afternoon, at 5,595 and 17,540 respectively. The staid DJIA, on the other hand, is down 0.25% to 41,235.

Commodities? A sea of red. Crude is down almost 3% to $73.70 for a barrel of West Texas Intermediate. As for precious metals, gold is down over 1% to $2,530.90 per ounce while silver is down almost 3% to $29.25.

Finally, turning to the crypto market, Bitcoin is down 1.5% to $58,540; Ethereum’s chopped down 2.6%, just under $2,500.

![]() Central Banks and Gold: Follow the Leader

Central Banks and Gold: Follow the Leader

In a report last week, Bank of America analysts pointed out that “gold is the only asset that's outperforming U.S. tech shares.”

In a report last week, Bank of America analysts pointed out that “gold is the only asset that's outperforming U.S. tech shares.”

Indeed, gold has seen impressive gains this year, rising about 20%, and outperforming the S&P 500 Index, U.S. Treasuries, crypto and more.

- “In comparison, [cryptocurrencies] have risen 17.7%, stocks have rallied 15.4%, the overall commodity sector is up only 1.9%, government bonds have increased by 0.6%, and the U.S. dollar has gained 0.2% year-to-date,” says an article at Kitco.

Interestingly, despite gold's strong performance, individual investors aren't driving this rally. In fact, gold investments have seen $2.5 billion in net outflows this year, suggesting that many investors are selling to lock in profits.

This unusual situation — rising prices coupled with investor outflows — indicates that a different group is behind the increased demand for gold.

BoA suggests: “Do what central banks are doing... buy gold.”

BoA suggests: “Do what central banks are doing... buy gold.”

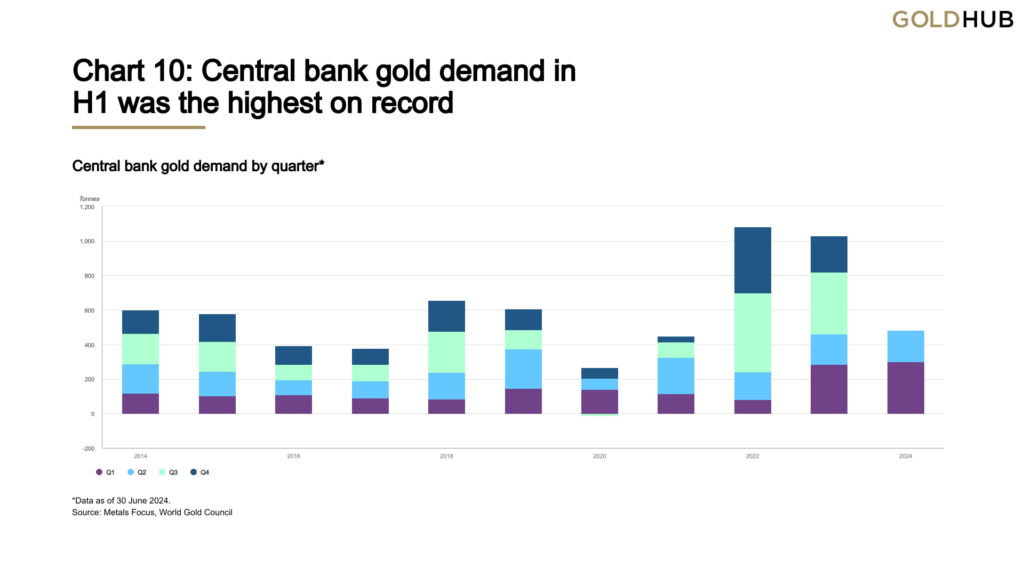

Central banks purchased a record 483 tons of gold in the first half of 2024, which is 5% higher than the 460 tons purchased in the first half of 2023.

Source: Metals Focus, World Gold Council, Gold Hub

“Gold is now the second-largest reserve asset (16.1% versus 15.6% for the euro) and has one of the lowest correlations to stocks across asset classes,” BoA analysts note.

“Gold could see more investor inflows as downside risks continue to grow in equity markets,” Kitco adds.

Namely, analysts believe potential interest rate cuts by the Federal Reserve could lead to increased inflation, a scenario where gold typically performs well.

“Bank of America doesn’t expect the S&P 500 to benefit as the Federal Reserve looks to kick off its new easing cycle,” the article continues. “The analysts note that an equity sell-off could happen sooner rather than later.”

“Investors should buy gold,” Markets Insider concludes, “even as the metal hovers around record-high prices.”

![]() You’re Going to Need a Bigger Vault

You’re Going to Need a Bigger Vault

A massive vault for precious metals recently opened near Singapore's Changi Airport, reflecting a growing trend to own physical gold and silver.

A massive vault for precious metals recently opened near Singapore's Changi Airport, reflecting a growing trend to own physical gold and silver.

It’s called The Reserve — a sleek six-story facility built by Silver Bullion Pte Ltd. and capable of holding 10,000 tons of silver and 500 tons of gold.

Courtesy: thereserve.sg

This surge in demand for physical bullion storage comes even as gold prices hit record highs this year, surpassing $2,500 an ounce. According to Silver Bullion’s founder Gregor Gregersen: “The feedback we've got from those conversations is that basically we need more vaults.”

The preference for physical bullion over exchange-traded funds (ETFs) — “paper gold,” Jim Rickards calls them — is worth mentioning..

Philip Klapwijk of Precious Metals Insights Ltd. explains: “People are taking a long view and they're not happy with the way the world is going on both the economic and political fronts, and are therefore increasing their allocations [to] gold.”

While storing physical gold has its drawbacks, including storage fees, physical gold (and silver) offer advantages in terms of privacy and when-the-SHTF security.

And the trend has led to an increased demand for secure storage solutions — particularly in stable jurisdictions like Singapore.

![]() A Butter Baron Spreads the Wealth

A Butter Baron Spreads the Wealth

After the passing of Danish butter magnate Lars Emil Bruun in 1923, his will contained an unusual stipulation: His extensive collection of coins, notes and medals — accumulated over some 60 years — was to be held as an emergency reserve for Denmark’s national collection.

After the passing of Danish butter magnate Lars Emil Bruun in 1923, his will contained an unusual stipulation: His extensive collection of coins, notes and medals — accumulated over some 60 years — was to be held as an emergency reserve for Denmark’s national collection.

If everything remained intact after one century, his collection could be sold to benefit his descendants. Now, 101 years later, the first set of coins from Bruun’s impressive 20,000-piece collection is set to go up for auction.

Hosted by Stack’s Bowers, the auction will feature over 280 lots, including gold and silver coins from Denmark, Norway and Sweden, dating from the late 15th century to the end of Bruun’s life.

The entire collection is valued at around $72.5 million, making it the most valuable collection of world coins to ever hit the market.

Among the highlights is a rare 1496 gold noble of King Hans, which could sell for up to $1 million.

Courtesy: Stack’s Bowers Galleries

1496 “King Hans” gold noble

“Hands-down my favorite piece in the sale is the 1496 gold noble of King Hans, who was king of Denmark and Norway under the Kalmar Union, as well as Sweden for a brief time,” says Matt Orsini of Stack’s Bowers Galleries.

“It is important on so many levels — it’s the very first gold coin struck by Denmark, it’s the very first dated coin struck by the Danish kingdom and it’s unique in private hands,” he says.

“The good thing about collecting coins,” Bruun once told a Danish magazine, “is that when you are upset about something or you feel unsettled, then you go and look at your coins, and then you calm down…

“People who are exclusively devoted to their business make a great mistake. I, for one, could never imagine thinking about nothing but butter until my dying days.”

Heh, indeed… In terms of enjoying a reasonable work-life balance, it sounds as if Bruun didn’t spread himself too thin.

Speaking of which, Happy Labor Day from the 5 Bullets team!

Of course, the markets will be closed that day. But check your inbox for Monday’s edition…