The 1-2-3 Investing Secret

![]() A Successful (But Not Easy) Strategy

A Successful (But Not Easy) Strategy

“All I care about is doing things the right way. When it comes to the markets, that means one thing: making money,” says Paradigm’s newest team member Enrique Abeyta.

“All I care about is doing things the right way. When it comes to the markets, that means one thing: making money,” says Paradigm’s newest team member Enrique Abeyta.

Also known as “The Maverick” — a moniker he earned at the Wharton School — Enrique adds: “My independent approach to the markets is the key to my trading strategy.”

To wit, Enrique pores over data which, by and large, is not accessible to everyday investors. “Most large companies have dozens of analysts at banks and brokerages that cover the stock,” he says, “basically writing research and analysis about it.

“As time goes on, these analysts update their predictions. If a company is doing well then, they raise their estimates.

- “Rising estimates (or earnings revisions) as they are called are the single most powerful predictor of near-term (and long-term) stock prices,” Enrique says, reaffirming his thesis featured in yesterday’s 5 Bullets.

“It’s not just about having the data, though,” he says. “You need to know how to use it.

“There are only a few [earnings metrics] that really matter. Most of the time, earnings per share (EPS) is the only one you really need to focus on when analyzing a stock.” (Hold that thought.)

“Over three decades, I’ve refined a unique approach that relies on the ‘1-2-3’ stock pattern, which can help you identify BIG profit potential.

“If a company goes from negative or flat revisions to three consecutive positive ones, then I’m interested,” says Enrique.

“If a company goes from negative or flat revisions to three consecutive positive ones, then I’m interested,” says Enrique.

“It’s rare for a company to see rising estimates for that long and not see follow-through in operations. And the follow-through can be massive,” he emphasizes.

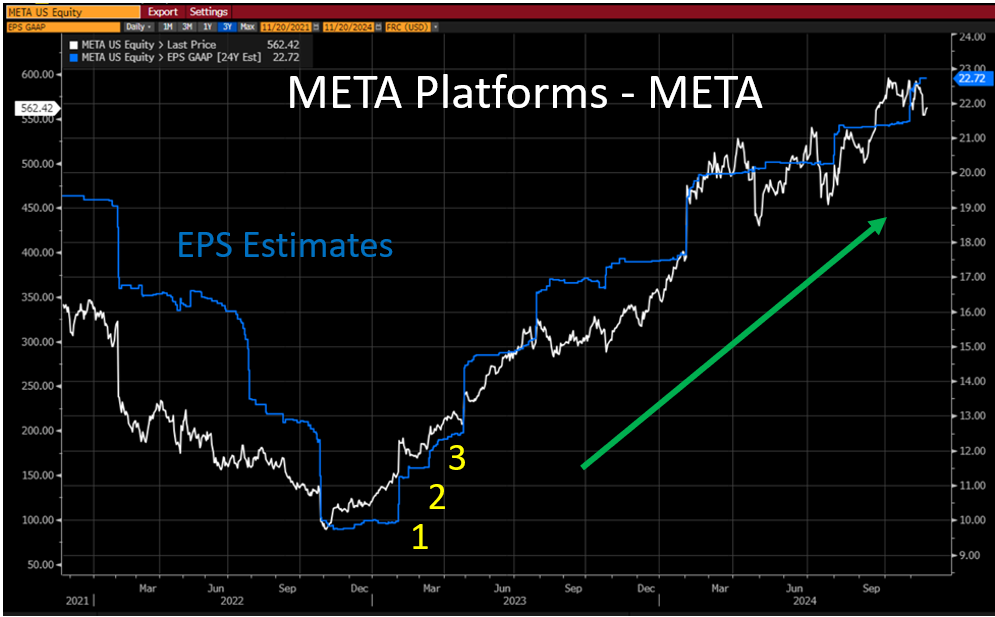

“One of the best examples of the success of the ‘1-2-3’ stock pattern I’ve seen in recent years is Meta Platforms Inc. (META), parent of Facebook.

“Here’s a chart showing the stock price,” Enrique says, “and the analysts' estimate for 2024 EPS going back a few years…

“As META worked off the post-COVID digital hangover, you can see that the estimates for 2024 EPS were consistently going down back in 2022.

“Estimates went down and the stock followed them,” Enrique notes. “Now, look at the chart where negative revisions stopped. That was the bottom of the stock price.

“From December 2022 to February 2023, we saw multiple positive earnings revisions, triggering the ‘1-2-3’ pattern… Meta took off immediately after.

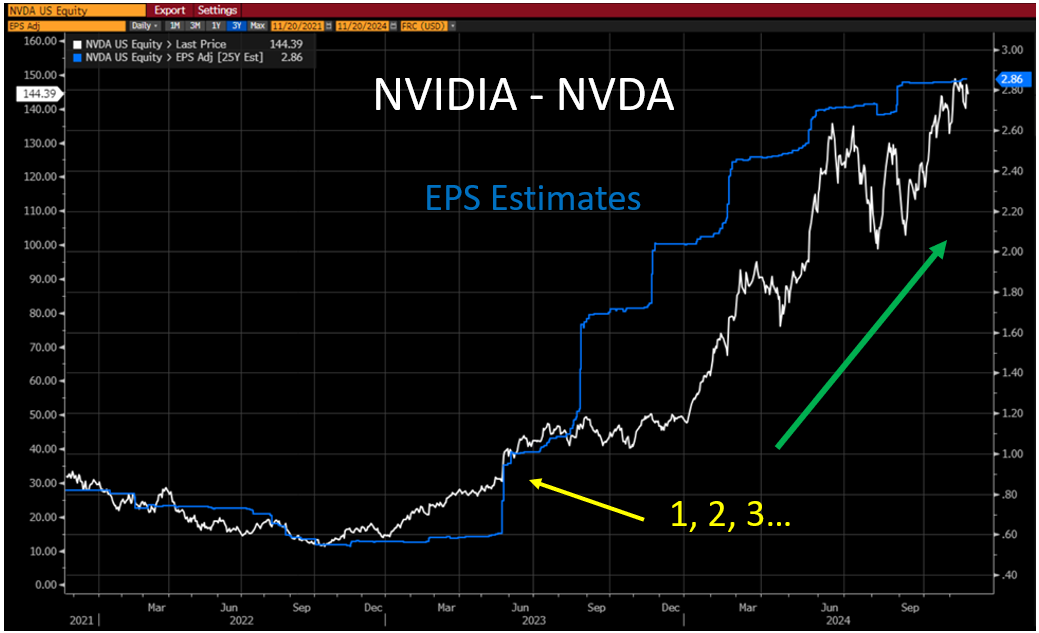

“The same thing happens to almost all of the best stocks after the ‘1-2-3’ pattern is in,” Enrique says. “Let’s talk about the most popular stock in the last few years, Nvidia Corp. (NVDA).

“The same thing happens to almost all of the best stocks after the ‘1-2-3’ pattern is in,” Enrique says. “Let’s talk about the most popular stock in the last few years, Nvidia Corp. (NVDA).

“Here’s a chart with the stock price and the analyst estimates for 2024 EPS…

“Numbers moved down through 2022 as NVDA faced a slowdown in consumption of their chips from their technology customers,” he says.

“NVDA’s estimates bottom a little bit after META, and we see the first positive revision in February 2023.

“From there, the stock triggered our ‘1-2-3’ signal by May 2023. “If you had waited for that signal, you could have bought the stock at around $25 per share.

“Today, NVDA is trading SIX TIMES higher!

“That’s the power of the ‘1-2-3’ stock pattern that can propel you toward life-changing returns,” Enrique says. “And I’m here to help you find these opportunities.”

![]() “AI 2.0” (The Fed? Not So Much)

“AI 2.0” (The Fed? Not So Much)

Paradigm's AI expert, James Altucher, emphasizes the significance of this moment: “AI 2.0 represents the premier investment opportunity of our era.”

Paradigm's AI expert, James Altucher, emphasizes the significance of this moment: “AI 2.0 represents the premier investment opportunity of our era.”

To wit, Nvidia's latest earnings report showcased the company's dominance in the AI chip market, with revenue nearly doubling to $35 billion — a 94% year-over-year increase. Meanwhile, the company’s data center business, which produces specialized AI chips, grew by an impressive 112%

Nvidia's next-generation Blackwell chip is already in high demand, with CEO Jensen Huang noting that demand outstrips production capacity. And this chip is at the forefront of what Huang calls “the industrial revolution of AI.”

Likewise, other Big Tech companies are investing heavily in AI, with Meta training large-scale models, Elon Musk's xAI building a massive supercomputer — using 100,000 Nvidia chips — and Amazon pouring billions into AI company Anthropic.

James likens this AI revolution to early investments in Amazon and Bitcoin, suggesting it could create more millionaires than any recent investment avenue.

“Smart investors are paying attention,” he adds, “because this might be the biggest wealth-creation opportunity of our lifetimes.”

Apparently, Mr. Market is experiencing a pre-holiday malaise. At the time of writing, two of the major U.S. stock indexes are floundering in the red.

Apparently, Mr. Market is experiencing a pre-holiday malaise. At the time of writing, two of the major U.S. stock indexes are floundering in the red.

The techie Nasdaq is notably down about 1%, a few points under 19,000. Nvidia is taking much of the blame; NVDA shares are down 3.25%. Of course, all is not lost (see above).

In the meantime, the S&P 500 index is down about 0.50%, a few points away from 6,000, in fact. The Dow just flipped into red territory, stalled at 44,850.

Checking on commodities, crude is down to $68.75 for a barrel of WTI. And although the price of gold is up 0.80% to $2,667 per ounce, silver’s down about 0.85%, but still hanging out above $30.

The crypto market is in rally mode today: Bitcoin is up over 5%, approaching $96K, while Ethereum is up 7.5% to $3,560. “Markets have a funny way of gravitating toward round numbers,” Paradigm’s crypto evangelist James Altucher reminded us Friday. “In [Bitcoin’s] case, that's $100,000.” Just sayin’...

Shortly after we went to virtual press yesterday, the Federal Reserve released the minutes from its early-November FOMC meeting.

Shortly after we went to virtual press yesterday, the Federal Reserve released the minutes from its early-November FOMC meeting.

Disclaimer: Fed “minutes” are unlike the minutes from your local school board meeting. No, they’re not an impartial record of attendees and who said what. Instead, the minutes are a thoroughly political document; in essence, a financial-markets obfuscation.

According to The Wall Street Journal: “Fed officials [discussed] potentially slowing or pausing interest-rate cuts if progress on lowering inflation stalled, minutes show.”

- In terms of inflation, the Commerce Department released October’s core PCE price index number this morning. The Fed’s favorite inflation yardstick, which excludes food and energy, rose by 2.8% year-over-year, matching economists' expectations. But it’s also the highest reading since April.

“The Fed does not turn on a dime,” Paradigm’s macro expert Jim Rickards assures. “They will need to see more [contrary] data before they stop the rate cuts, let alone consider raising rates.

“The Fed will continue rate cuts in December with a 0.25% rate cut to follow the 0.25% cut in November,” he says. “Steady as she goes.”

![]() Smell-O-Vision

Smell-O-Vision

Early estimates suggest that 6G could be 100X faster than its predecessor, according to Paradigm’s science-and-tech expert Ray Blanco.

Early estimates suggest that 6G could be 100X faster than its predecessor, according to Paradigm’s science-and-tech expert Ray Blanco.

At the heart of 6G will be advanced artificial intelligence which will optimize network performance and open doors to transformative applications.

“At its core, quantum computing integration will provide unbreakable security through quantum encryption and advanced protection protocols,” says Ray. Plus, the architecture of these networks will be revolutionized by blockchain technology.

“Perhaps most exciting,” he says, “6G will usher in the ‘internet of senses’ — a breakthrough that will allow users to experience touch, taste and even smell through digital communications, transforming everything from online shopping to remote medicine.

“Science-fiction dreams of holographic communications could also become reality,” says Ray. “Imagine 6G enabling Star Wars-style projections that will make today's Zoom calls feel as outdated as fax messages.”

Ray’s takeaway? “Most investors haven't caught on to [6G’s] potential yet. The market is still focused on 5G players,” he says. “New 6G technology will create a perfect opportunity to get positioned before the hype cycle kicks into high gear.”

Ray is eyeing some of the most promising companies in the 6G space; he’ll let readers know when the risk-reward is in the sweet spot.

![]() Trump’s NEC Director: OMG

Trump’s NEC Director: OMG

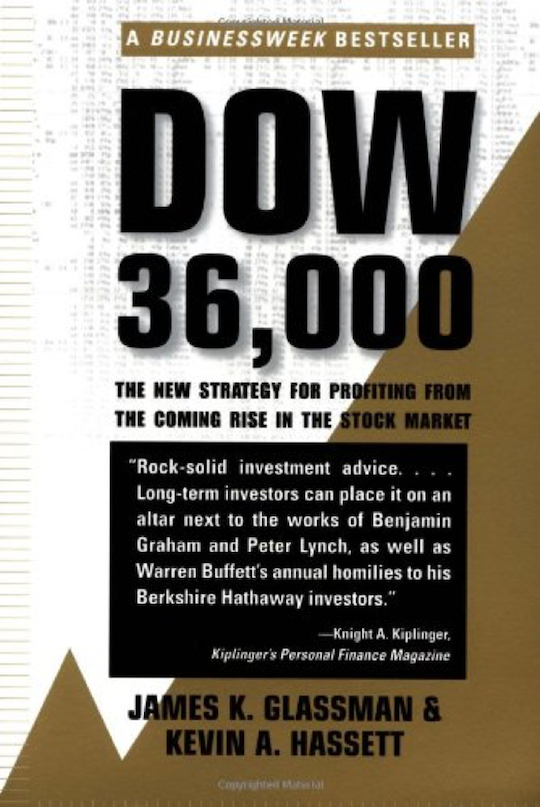

“Oh God, Trump’s putting the Dow 36,000 guy on the National Economic Council,” said the 5 Bullets’ managing editor Dave Gonigam via Paradigm’s editorial Slack channel yesterday.

“Oh God, Trump’s putting the Dow 36,000 guy on the National Economic Council,” said the 5 Bullets’ managing editor Dave Gonigam via Paradigm’s editorial Slack channel yesterday.

The “guy” in question is Kevin Hassett who co-authored the aforementioned 1999 bestseller which predicted the Dow would crest 36,000 market cap by 2004. A market cap which the Dow didn’t achieve until 2021.

So Hassett’s forecast missed the mark by, err, 17 years. “Jim could write Gold $36,000 next and be right much sooner than Hassett was,” quipped Jim Rickards’ chief analyst Dan Amoss.

No matter. Hassett has a way of failing up — up, in fact, to Trump’s first-term chairman of the Council of Economic Advisers.

Hassett’s new directorship gig would be another leap forward. “The National Economic Council is the more hands-on policymaking team,” says Bloomberg. “President Bill Clinton created the position in 1993, after a campaign based on the premise that the most important job of the president is ‘the economy, stupid.’”

Assuming he accepts, Hassett will sail into NEC leadership. No messy confirmation hearings required.

As Biden’s former WH economist Ernie Tedeschi posts at X-Twitter, Hassett “is a very traditional and conventional” choice for NEC.

As Biden’s former WH economist Ernie Tedeschi posts at X-Twitter, Hassett “is a very traditional and conventional” choice for NEC.

To give you an idea of Hassett’s forerunners, the NEC job is currently held by former vice chair of the Fed, the “last card-carrying liberal” Lael Brainard.

Before Brainard, there was Team Biden’s Brian “liberal world order” Deese (who demanded wartime sacrifices from Americans to guarantee victory in Ukraine).

Then there was Trump’s pick, Larry Kudlow, who — during the height of the pandemic in April 2020 — wanted American taxpayers to “pay the moving costs of American companies” to repatriate in order to unsnarl supply chains.

Perhaps the swampiest creature of all? Former NEC director and ex-Goldman Sachs exec Gary Cohn, once called small-business owners “morons” — for not loopholing estate taxes like Cohn and the rest of his ilk.

So if Hassett’s a “traditional and conventional” choice, he’s just another in a long line of out-of-touch elites. God help us.

![]() Turkey Jive

Turkey Jive

If the American Farm Bureau’s annual Thanksgiving grocery bill seems absurd to you, we’re in total agreement.

If the American Farm Bureau’s annual Thanksgiving grocery bill seems absurd to you, we’re in total agreement.

Since 1986, the folks at the American Farm Bureau Federation (AFBF) have published stats on the annual cost of Thanksgiving dinner.

This year, allegedly, the founder of the feast needs to budget $58.08 to feed a party of 10, down $3.09 from last year. (The stat for 2022 was a record high, by the way. The record low? In 1987, according to the AFBF, the same meal cost just $24.51.)

Courtesy: American Farm Bureau Federation

The AFBF’s menu includes “turkey, stuffing, sweet potatoes, rolls with butter, peas, cranberries, a veggie tray and pumpkin pie with whipped cream, all in quantities sufficient to serve a family of 10 with plenty of leftovers.”

Leftovers? Really? Oh, and what about liquor?

Perhaps now more than ever, a little “social lubricant” could go a long way towards keeping the peace around the dinner table.

That said, your party of 10 might be diminished by 2.3 in light of a recent Spruce survey which finds 23% of respondents considering boycotting family Thanksgiving this year. To avoid cantankerous post-election conversation.

C’mon! Remember what our mothers told us about polite dinner conversation? And whatever the actual cost of Thanksgiving dinner, spending time with loved ones… Priceless.