Trump’s Currency War

![]() Major Trump Priority (You Haven’t Heard About This One)

Major Trump Priority (You Haven’t Heard About This One)

It’s one of the major agenda items of the Trump 47 presidency — even though the White House is saying precious little about it.

It’s one of the major agenda items of the Trump 47 presidency — even though the White House is saying precious little about it.

As Paradigm’s macroeconomics maven sees it, Trump aims to bring an end to the currency war that’s upended markets and economies since 2010.

If you’re scratching your head — What currency war? How does a currency war work? Why does Trump want to end it? — today’s a great day to catch up. Events are moving quickly — and so should you.

It’s easy to lose track, even for someone like me who’s been working with Jim for over a decade: We remain in the midst of a currency war.

It’s easy to lose track, even for someone like me who’s been working with Jim for over a decade: We remain in the midst of a currency war.

Jim literally wrote the book on currency wars — his first book, 2011’s Currency Wars.

“Currency wars,” he wrote in that volume, “are fought globally in all major financial centers at once, 24 hours per day, by bankers, traders, politicians and automated systems — and the fates of economies and their affected citizens hang in the balance.”

The book opens in dramatic fashion — with the Pentagon’s first-ever “financial war game,” held even as the global financial crisis was still raging in early 2009.

Jim walked senior military leaders through a two-day exercise. At the conclusion of the exercise, the Russians and Chinese teamed up on a new gold-backed currency that muscled aside the U.S. dollar as the globe’s main reserve currency.

To say the other participants in the exercise were gobsmacked would be an understatement. Sixteen years later, it’s starting to look eerily prescient.

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

As Jim laid out in the book, the present currency war began in 2010… and marks the third such conflict in a century…

Currency War I (1921–1936): It begins with Germany's epic devaluation of the mark. Soon, everyone is devaluing. By 1933, FDR devalued the dollar against gold, from $20.67 an ounce to $35. The war ends in 1936 with a three-way truce between the United States, Britain and France. Alas, Germany was not a party to the agreement, and a shooting war was underway by 1939

Currency War II (1967–1987): It begins with Great Britain devaluing the pound against the dollar. Soon the dollar is under pressure, and in 1971, Nixon cuts the dollar's last tie to gold — sending the greenback on a roller coaster ride for the next 16 years. The Plaza Accord of 1985 and the Louvre Accord of 1987 lead to a new equilibrium

Currency War III (2010–present): It begins with President Obama announcing plans to double U.S. exports in five years. The only way to make that happen is to cheapen the currency. Months later, Brazil's finance minister declares, "We're in the midst of an international currency war, a general weakening of currency."

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

“The traditional and fastest way to increase exports had always been to cheapen the currency,” Jim explained in Currency Wars.

And everyone around the world in 2010 knew it. Cheapening the currency makes your exports less expensive for foreign buyers.

As it happens, Obama’s National Export Initiative — the act that started this dirty snowball rolling downhill — fell way short of its goals. Instead of doubling by 2015, U.S. exports grew only 50%.

We recount this history, both ancient and recent, to jog your memory if you’re a longtime reader — or clue you in if you’re a newer one.

Maybe you’re a Rickards’ Strategic Intelligence subscriber — but you became familiar with his work only in the last year through his “Election Meltdown” thesis. Maybe you didn’t even know until today that we’re in the midst of a currency war.

But no matter how long you’ve been a Paradigm Press reader, you should know that…

The previous two currency wars lasted 15–20 years. We’re now into Year 16 of the current one. And Jim says Trump aims to wind it down during his second term. Maybe even this year.

The previous two currency wars lasted 15–20 years. We’re now into Year 16 of the current one. And Jim says Trump aims to wind it down during his second term. Maybe even this year.

Tonight Jim is hosting an exclusive streaming event in which he’ll reveal a step Trump has already taken that could end the war once and for all.

He’ll also lay out what it means for your investments — stocks, gold, crypto, even your cash in the bank.

And he’ll reveal a strategy that could generate gains of 1,000% or more over the next year — risking less money and generating much higher profits than most people do trading stocks.

If you’re already a subscriber to Jim’s premium advisory The Situation Report, you’re already familiar with the broad outlines of Jim’s thesis and his approach.

But if not, you really owe it to yourself to check out this event. If you currently subscribe to Rickards’ Strategic Intelligence, we’ll send you a link at 7:00 p.m. EST. If you don’t subscribe to a Rickards publication, you’ll get access to a replay of the event as soon as it’s over. Watch your inbox…

![]() Gold: Central Banks Continue Loading Up

Gold: Central Banks Continue Loading Up

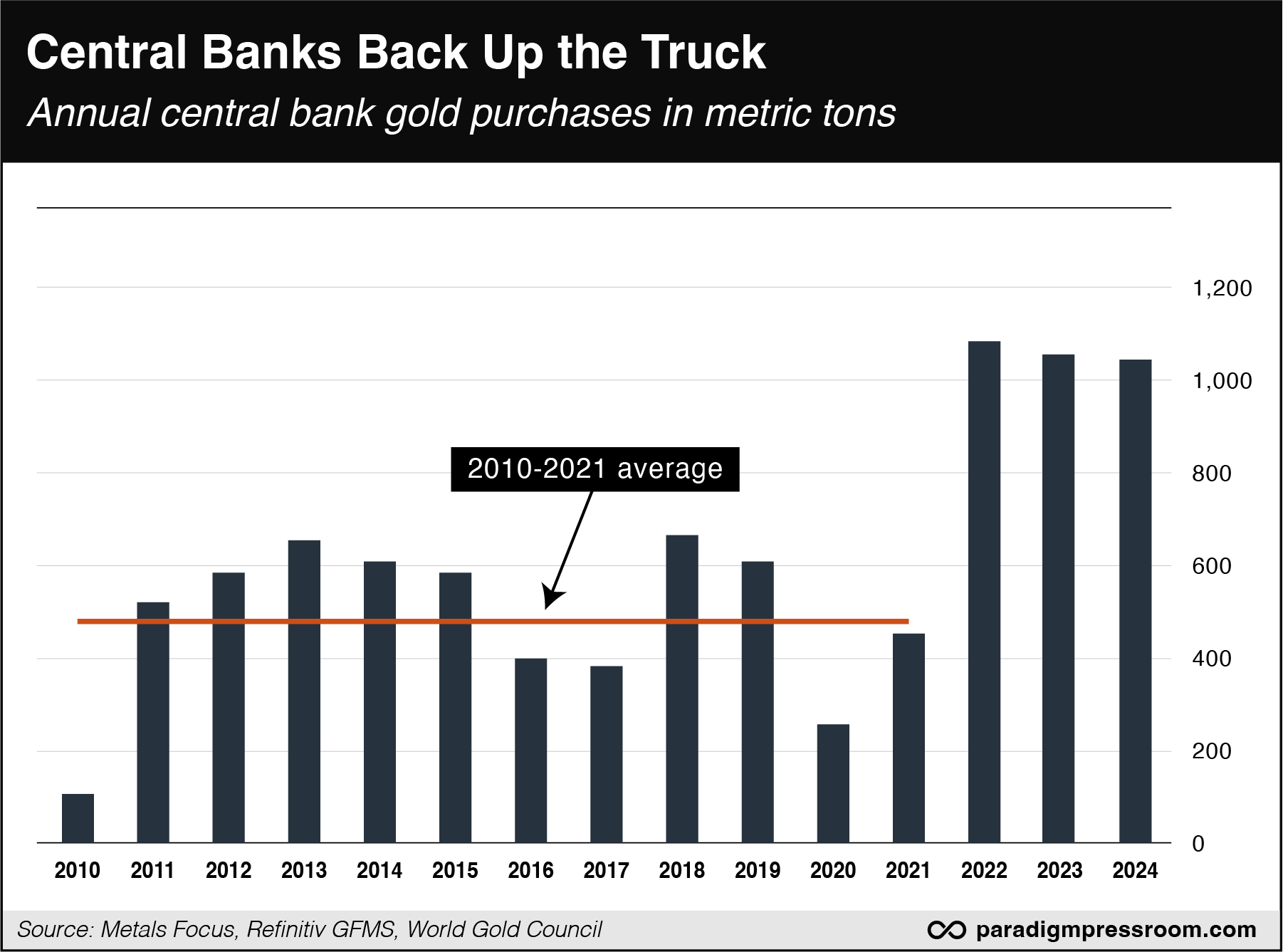

The globe’s central banks continue “backing up the truck” with gold purchases — putting a floor under the gold price.

The globe’s central banks continue “backing up the truck” with gold purchases — putting a floor under the gold price.

The World Gold Council is out with its quarterly and annual assessments of global gold trends. For a third year running, central banks around the world have purchased over 1,000 metric tons — more than doubling the annual average during the 2010s.

At the risk of repeating ourselves, it’s no coincidence the buying spree began in 2022. That’s when Russia invaded Ukraine and the Biden administration responded with unprecedented sanctions — freezing the dollar-based assets of Russia’s central bank.

Leaders throughout the developing world wondered if they might be in for the same treatment if they ran afoul of Washington’s dictates.

So they turned to gold. As our Jim Rickards keeps emphasizing, “Gold is a physical non-digital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

That said, the leading gold purchaser in 2024 is one of Washington’s NATO allies, Poland — adding 90 metric tons to its reserves. Turkey comes in second place with 75 metric tons.

In third and fourth place are two of the BRICS nations — India and China.

Officially, China’s gold stash is sixth largest in the world at 2,264.3 metric tons. (The United States is still No. 1 at 8,133.5.) But unofficially, Jim figures it’s at least twice that size.

Combined with Russia’s stash (fifth largest in the world) and India’s (eighth largest), the BRICS are developing an alternative payments system — bypassing the dollar — with gold as its foundation.

As Jim said in a special 5 Bullets briefing last December, “That’s good news for gold investors because the BRICS and other nations will have to acquire gold themselves (which they are already doing) in order to participate.

“Other investors who buy gold are along for the ride and it’s a ride that will lead to higher dollar prices for gold over time.”

![]() The Markets Today

The Markets Today

The shadowy forces that show up now and then to slam down the gold price made an appearance today — before beating a hasty retreat.

The shadowy forces that show up now and then to slam down the gold price made an appearance today — before beating a hasty retreat.

At one point this morning, gold was down $40 from yesterday’s record levels of $2,870. But at last check, it’s recovered more than half those losses — the bid $2,855. Silver got slammed below $32, but it’s back to $32.15. The HUI index of mining stocks is also hanging tough at 327.

Not much excitement in the stock market — with none of the major indexes moving more than a quarter percent one way or another. At 6,075 the S&P 500 is about 0.7% below its record close set on Jan. 23. Later today another “Magnificent 7” company — Amazon — will report its quarterly numbers.

At $71.22, a barrel of West Texas Intermediate crude is still near its 2025 lows.

No joy in crypto-land, with Bitcoin clinging to the $97,000 level.

About the monthly job numbers, due out tomorrow…

About the monthly job numbers, due out tomorrow…

It being the first Friday of February, the Bureau of Labor Statistics will issue not only the January job figures… but also revisions to the previous 12 months’ figures.

For whatever it’s worth, the buzz we’re hearing is that this year’s revisions will be to the downside — and the biggest since 2009.

If true, that would potentially undercut Wall Street’s “soft landing” narrative — the idea that the Federal Reserve’s cycle of interest rate increases during 2022–23 did not result in any damage to the economy during 2024.

Jim Rickards has been on record for months anticipating a recession early in Trump’s second term. Steep downward revisions to the job numbers tomorrow just might bring the mainstream around to that opinion as well.

Just a heads-up. We’ll dig into the numbers tomorrow…

![]() Comic Relief, DOGE Edition

Comic Relief, DOGE Edition

We concede we haven’t spent much time in recent days on the efforts of DOGE to cut government spending.

We concede we haven’t spent much time in recent days on the efforts of DOGE to cut government spending.

In large part that’s because lots of other people are on the case. That said, there’s also a blizzard of nonsense from people feeding their confirmation biases. For instance, the U.S. Agency for International Development did send money to Jeffrey Epstein — but not that Jeffrey Epstein.

Anyway, a chuckle for the day…

![]() “Has Capitalism Been Repealed?”

“Has Capitalism Been Repealed?”

“Concerning tariffs and illegal drugs: Has capitalism been repealed when it comes to stuff that does us no good?” a reader writes.

“Concerning tariffs and illegal drugs: Has capitalism been repealed when it comes to stuff that does us no good?” a reader writes.

“The wars on drugs, on guns, on alcohol, on fentanyl or whatever have all failed since the country was founded.

“To believe you can win a war against illegal drugs is to believe you can suspend capitalism, where people who really want something will find a way to get it.

“The drug war has been a 100-year failure, and always will be a failure. So will making guns and liquor illegal. Just encourages people to do more work to get them. Wastes of time.”

“I don't get some people's thinking,” counters another — responding directly to the mailbag section in Wednesday’s edition.

“I don't get some people's thinking,” counters another — responding directly to the mailbag section in Wednesday’s edition.

“While it is true that the use of any drug covers up some ill a person is suffering (although many addicts got their first dose by force or were youthfully experimenting and became addicted), each user has to accept responsibility for that. The more people that use drugs, the more it reflects on society and points to societal ills.

“You cited readers (and you apparently agree) that think the U.S. government has no business trying to stop others from making the drugs that come over here. What? That's such a ridiculous notion.

“We are a society. Like it or not, we are. As part of the society, we have a duty — yes, a duty — to work to make that society better, and at least protect it. It does not make our society better or protect it to permit millions of people to die (including those that get killed by people to get their drugs) while we ‘fix’ the ills of society, which are never-ending, especially when we have libertarians that have the perspective that society's ills are not their problem along with a bunch of other people with selfish philosophical worldviews.

“Again, it's not OK to let millions die because ‘it's not my individual problem.’ Rightly constructed government is society's way of acting collectively. Thus, society, i.e., government, has a right and the duty to repel threats to its health. Many say that it's too expensive or it's too hard. So? What difference does that make? Sure we can argue about how we do it, but to suggest that doing it is a problem, while allowing millions of our own people, our kids and neighbors, to die, is the essence of moral nihilism.”

Dave responds: President Nixon declared “war on drugs” in June 1971. It’s worked out about as well as the war on poverty, the war on “terror” and all the other metaphorical wars that politicians have waged in the decades since.

It is largely owing to the war on drugs that the United States imprisons a larger percentage of its population by far than nearly every other country in the world. (We were tops for decades until we were overtaken by El Salvador in recent years.)

And yet illegal drug use and trafficking continue unabated. Amazing how that works.

Maybe it’s time to try another approach?