Trump’s Ticking Time Bomb

![]() Trump’s Ticking Time Bomb

Trump’s Ticking Time Bomb

It was an ominous development that got lost in the shuffle on New Year’s Day — amid the car-ramming in New Orleans and the truck bombing in Las Vegas.

It was an ominous development that got lost in the shuffle on New Year’s Day — amid the car-ramming in New Orleans and the truck bombing in Las Vegas.

The U.S. government once again bumped up against the debt ceiling.

Uncle Sam is unable to borrow anything more than the $36.2 trillion he has already — and won’t be able to until Congress acts.

The Treasury Department has implemented “extraordinary measures” to make sure Uncle Sam doesn’t blow past his credit limit — borrowing from government pension funds and the like.

All new issuance of Treasury debt is suspended until March 14.

The new Treasury Secretary Scott Bessent promised during his confirmation hearings that “the United States is not going to default on its debt if I’m confirmed.”

Well, no it’s not. It never has. But that’s not the problem.

The real problem comes once Congress acts and lifts the debt ceiling again — as it always does.

“What’s different now,” says Paradigm’s newest editor Mason Sexton, “is that because interest rates are now so high — it’s really starting to snowball.”

“What’s different now,” says Paradigm’s newest editor Mason Sexton, “is that because interest rates are now so high — it’s really starting to snowball.”

In his exclusive blockbuster interview this week called The Prophecy — you can watch right here if you’ve not seen it already — Mason reminded us that interest rates are now four times higher than they were during Donald Trump’s first term.

Which means the national debt starts growing that much faster.

“To give an analogy,” he said, “it’s like if you have a credit card that’s maxed out. But now, instead of paying 18% in interest, you’re paying closer to 70% a year.”

Maybe you’ve heard how interest on the national debt is now a bigger line item in the federal budget than the Pentagon. That’s the reason.

But please, don’t get the wrong idea. Mason isn’t just another Cassandra harping on the national debt.

The debt is “just one part of the ticking time bomb Trump is now facing,” Mason said in the interview.

The debt is “just one part of the ticking time bomb Trump is now facing,” Mason said in the interview.

It’s the confluence of the national debt with inflation (about which more below)... record-low savings rates… record-high credit card debt… housing prices out of reach for the middle class… and the list goes on.

And while the Treasury says its drop-dead date is March 14… Mason says the real date to watch for a convergence of these crises is March 20.

That’s 48 days away.

If you’ve already watched the interview, you already know why he’s so confident about that date. And if you haven’t, we encourage you to watch and find out.

If you’re still on the fence about whether to make the time commitment to watch, let me remind you of the uncanny calls he’s made over a 45-year career in the markets…

- He called the start of an 18-year bull market in 1982

- He called the crash of 1987, still the biggest one-day drop in stock market history

- He anticipated the 2008 financial crisis and the time to get back in the market

- He called the top and bottom in the COVID year of 2020.

Note well that Mason has a knack for timing major turning points in the market — both up and down. And he expects many such turning points in the months beyond March 20.

“There will be many tradeable rallies and dips along the way,” he says. “This is going to be a period of maximum volatility. It will almost be like the Olympic moguls in skiing. Up and down and back.”

It’s a period when many of your friends and neighbors will be in a panic — watching their account balances shrink, wondering what’s really going on. But you’ll already know. And you’ll prosper. Because you’ll be armed with the knowledge you gained the moment you started watching The Prophecy.

![]() Friday Market Miscellany

Friday Market Miscellany

As far as the S&P 500 is concerned, the DeepSeek panic is over.

As far as the S&P 500 is concerned, the DeepSeek panic is over.

At last check, the index was up three-quarters of a percent on the day to 6,115 — only three points off its record close a week ago yesterday.

The Nasdaq is up even stronger as the week winds down — rallying 1.25% as we write to 19,928. That’s 1.1% below its record close in mid-December.

Helping fuel the rally today is Magnificent 7 behemoth Apple — up nearly 1.5% despite reporting a drop in iPhone sales.

Helping fuel the rally today is Magnificent 7 behemoth Apple — up nearly 1.5% despite reporting a drop in iPhone sales.

Mr. Market seems to put more importance on the fact that — as CNBC puts it — “services, which includes App Store purchases, payments and advertising, are becoming a bigger part of the overall business, lifting Apple’s profit margin.”

Well, that might be news to CNBC, but as far as Paradigm’s income investing pro Zach Scheidt is concerned, that’s been key to Apple’s appeal for many years now. Way back In 2017, he called that steady stream of recurring revenue Apple’s “secret profit center.”

Elsewhere, the big market story today is gold — which is on track to notch its first weekly and monthly close over $2,800.

Elsewhere, the big market story today is gold — which is on track to notch its first weekly and monthly close over $2,800.

At last check, the bid is up to $2,813. The action in silver and the mining stocks suggests the current gold rally might have some legs. Silver broke through $31 this week for the first time since mid-December and the HUI index of mining stocks likewise burst past the 300 level.

Crude continues its slide of recent days, now $72.67. After a furious run-up past $79, all the gains of this month have vanished.

Uncertainty hangs over the oil market amid Donald Trump’s threatened tariffs against Canada and Mexico. Supposedly they kick in tomorrow — or maybe they won’t. Perhaps oil imports will be exempted — or maybe not. Gee, it’s not as if businesspeople have to make plans around any of this, right?

Bitcoin hovers over $105,000 amid news that the SEC has given its blessing to a new ETF that allows you to buy exposure to both Bitcoin and Ethereum with a single ticker. The Bitwise Bitcoin and Ethereum ETF still needs to clear a couple of more paperwork hurdles before it starts trading.

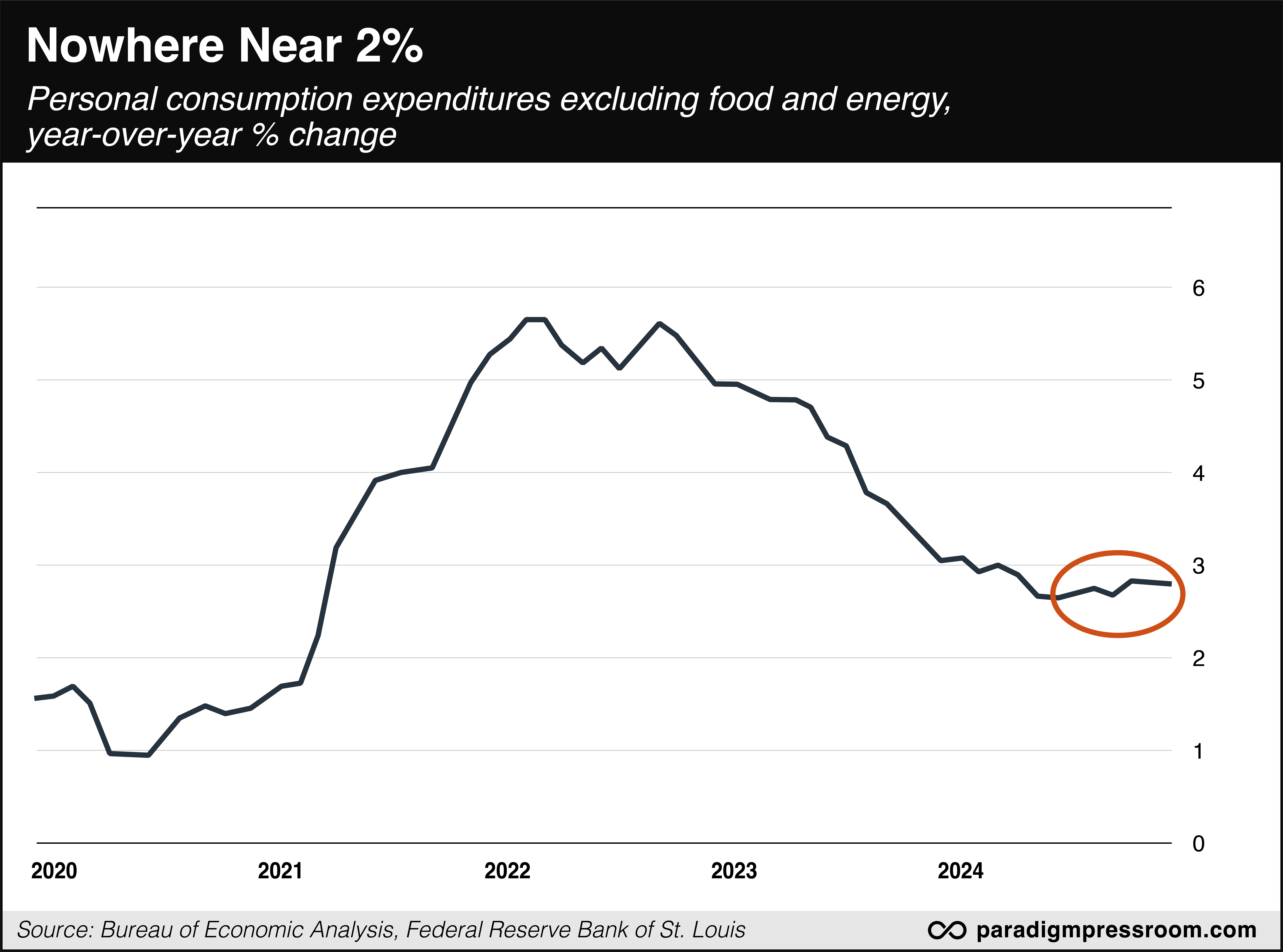

The Federal Reserve’s preferred measure of inflation shows… no progress against inflation for months now.

The Federal Reserve’s preferred measure of inflation shows… no progress against inflation for months now.

When Fed officials talk about their 2% inflation target, the number they have in mind is something called “core PCE” issued by the Commerce Department.

The latest reading on core PCE is out this morning and it shows year-over-year growth of 2.8%. Worse, that’s up from 2.6% six months ago.

After the Fed paused its rate-cutting cycle this week, Bloomberg’s spin on today’s number is that “underlying inflation remained muted in December, which should support further rate cuts.” Hope springs eternal!

![]() Too Good to Be True? (DeepSeek, Continued…)

Too Good to Be True? (DeepSeek, Continued…)

Count Paradigm tech specialist Ray Blanco among the DeepSeek skeptics.

Count Paradigm tech specialist Ray Blanco among the DeepSeek skeptics.

From the get-go, he thought it seemed too good to be true — a Chinese-made AI model competitive with ChatGPT, developed with a fraction of the processor power and 1/20th of the budget?

The headlines today are bearing out something that had been rumored since at least Tuesday — that perhaps DeepSeek pulled off its feat with “gray market” Nvidia chips imported via Singapore.

“It’s true that DeepSeek actually used new methods to improve efficiency, and they do,” Ray concedes. “But it isn't the efficiency breakthrough it was cracked up to be.”

Rather it’s just one more example of incremental efficiency improvements: “On the hardware side, compute gets cheaper and faster with every new chip generation. On the software side, engineers keep coming up with new ways to optimize and run faster on the hardware.

“This innovation is great for U.S. AI companies on both the hardware side like Nvidia and the software side like Microsoft. Improved efficiency in training and running AI models actually expands the market for companies like Nvidia. It also allows companies like Microsoft to offer AI services for cheaper.”

But even if DeepSeek’s claims pan out, Ray says it doesn’t mean the U.S. tech giants have wasted billions of dollars on the buildout of data centers.

But even if DeepSeek’s claims pan out, Ray says it doesn’t mean the U.S. tech giants have wasted billions of dollars on the buildout of data centers.

To whatever extent AI becomes more efficient, Ray believes it will be another example of the “Jevons Paradox,” named after the 19th-century English economist who noticed that more efficient methods of burning coal resulted in total coal consumption rising.

“When technology improves, we don't end up using less of it, we find more ways to use it,” Ray says.

“Cheaper personal computers didn't kill the computing industry, they created an explosion in demand. Cloud storage getting cheaper didn't reduce storage needs, it enabled companies to store everything.

“The same principle applies to AI. More efficient AI doesn't mean less demand for AI chips, it means AI everywhere, in more applications, running more models, solving more problems.

“That's why DeepSeek's efficiency gains, to the extent they are real, don't threaten Nvidia's future — they could actually strengthen it.”

For whatever it’s worth, NVDA is on track to end the week over $125 — about where it was trading four months ago.

![]() Stupid Corporate Logo Infringement Tricks

Stupid Corporate Logo Infringement Tricks

We’re a bit late to take notice, but there’s been an amusing development in Canadian politics…

We’re a bit late to take notice, but there’s been an amusing development in Canadian politics…

As you might be aware, Prime Minister Justin Trudeau is stepping down as leader of the Liberal Party ahead of parliamentary elections later this year.

A new leader will be chosen on March 9. Among the people looking to take over party leadership are central banker Mark Carney — who previously ran the Bank of Canada and the Bank of England.

But whoever designed his “M” logo didn’t realize it bore a close resemblance to that of a firm called MetCredit, which bills itself as “Canada’s debt recovery professionals.”

“That’s a beautiful logo, Mark,” said a tweet from CEO Brian Summerfelt — “but we’re apolitical.”

Carney’s people quickly got to work…

As someone posted in the replies, “Brian, you may as well get to know Mark. You will probably be calling him sometime after March 9 when the unpaid bills need collecting.”

![]() “Unnecessary Political Potshots”?

“Unnecessary Political Potshots”?

“Sadly, you still can’t help yourselves from taking unnecessary political potshots at the Democrats,” writes one of our regular correspondents/critics after Wednesday’s edition.

“Sadly, you still can’t help yourselves from taking unnecessary political potshots at the Democrats,” writes one of our regular correspondents/critics after Wednesday’s edition.

“In this case you created a well-written, informative article about the new AI debacle in your first bullet point.

“BUT you just couldn’t leave it there and had to take a shot at Kamala Harris who, in case you missed it, already lost the election. What possible benefit do your readers gain about the subject matter by referencing her? Go back and read the article again and ask yourself why you chose to deride her administration.

“Once you realize how unnecessary her mention was, you can then seek therapy to find out why you are still haunted by the Biden (not Harris) administration. It’s almost pathologic, best of wishes for your recovery. Perhaps in the future you can stick to the facts without obvious political bias.”

Dave responds: Aw c’mon, lighten up.

Apprehensive as I might be about the Trump administration’s policies, I am relieved that for the next four years I won’t have to listen to the likes of Antony Blinken or Jake Sullivan hectoring China or Russia or anyone else about the “rules-based international order.”

Earlier this week the loathsome Sen. Tom Cotton (R-Arkansas) — he’s a perfect representation of the warmongering UniParty — described how the “rules-based international order” really works.

“What matters, in the end,” he said, “is less whether a country is democratic or non-democratic, and more whether the country is pro-American or anti-American.”

Quite the mask-off moment. Is it any wonder so much of the Global South wants to get as far away from the U.S. dollar as humanly possible?

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets