Ukrainflation

![]() Russia-China-Iran: Kicking Over the Chessboard

Russia-China-Iran: Kicking Over the Chessboard

Twice today on my morning news cruise I ran across a quotation from a book published a quarter-century ago. I don’t ignore that kind of synchronicity.

Twice today on my morning news cruise I ran across a quotation from a book published a quarter-century ago. I don’t ignore that kind of synchronicity.

It’s from Zbigniew Brzezinski. Maybe you recall the name. The headlines on his obituaries in 2017 usually cast him as “Jimmy Carter’s national security adviser.” But that description grossly underplays the influence he had in America’s power structure over many decades. He wasn’t quite as influential as Henry Kissinger, but he was up there. (One of his progeny, Mika Brzezinski, is part of the obnoxious Morning Joe lineup on MSNBC.)

Among the 30 or so books he wrote, the one that got the most circulation was The Grand Chessboard.

The title of this 1997 tome betrays its agenda — how Washington should strive to remain the “sole superpower” in the post-Cold War era.

In assessing the risks to this agenda he wrote: "Potentially, the most dangerous scenario would be a grand coalition of China, Russia and perhaps Iran, an ‘anti-hegemonic’ coalition, united not by ideology but by complementary grievances."

Zbig assessed that this was a “remote” probability — but one that American leaders should strive to avoid.

A generation later… as the Russia-Ukraine war enters a third year tomorrow… this “remote” probability is now stone-cold reality.

A generation later… as the Russia-Ukraine war enters a third year tomorrow… this “remote” probability is now stone-cold reality.

A few weeks before the invasion, Russia’s Vladimir Putin and China’s Xi Jinping conducted a video conference in which Xi said, “this relationship even exceeds an alliance in its closeness and effectiveness.” Meanwhile, Iran is supplying some of Russia’s ballistic missiles for the war.

All three countries have faced years of sanctions and other forms of American economic warfare. All three held joint naval war games in waters near the Middle East last year. All three now belong to the BRICS configuration that aims to get out from under the U.S. dollar’s thumb.

It didn’t have to be this way.

There’s no time this morning to explore how we got here. Suffice to say that decades of interventions and blunders by successive American presidents — yes, including Donald Trump — brought us to this place.

And the only answer Joe Biden and his advisers can come up with is… more intervening and more blundering.

This morning the Biden administration rolled out what Bloomberg touts as “its biggest one-day sanctions package against Russia” since the invasion.

This morning the Biden administration rolled out what Bloomberg touts as “its biggest one-day sanctions package against Russia” since the invasion.

The announcement has been coming for days. Amid a busy week of writing to his subscribers and appearing on Steve Bannon’s War Room podcast, Paradigm’s macroeconomics maven Jim Rickards posted the following on Xwitter moments ago…

As Jim said the day of the invasion, the initial round of sanctions was doomed to backfire. And in terms of impact, nothing announced today will top what was done two years ago — freezing the dollar- and euro-based assets of Russia’s central bank, some $300 billion worth.

We said it at the time: It was a watershed event. Leaders of every other government in the world that’s not on friendly terms with Washington asked themselves, Could we be next?

According to research from Eurizon SLJ Asset Management that we cited last spring, the dollar’s share of global currency reserves plunged from 55% in 2021 to 47% in 2022 — an unprecedented drop, far beyond the slow-motion erosion that took place during the 2000s and 2010s.

No, you’re not feeling the impact of this shift — not yet.

But in time, enormous quantities of dollars sloshing around overseas that no one wants anymore will come back home in a tsunami — potentially making the 9% inflation of 2022 look like a picnic. You need inflation hedges in your portfolio — be they gold or Bitcoin or mining shares or oil companies.

And that’s the best-case scenario. The worst is a hot war with the United States facing down Russia and China and Iran — a war that our military is ill-equipped to fight, to say the least.

But we’ll have to leave that angle of the saga for another day. We have other economic and business follies to attend to…

![]() How Does a Bank With a Printing Press Lose Money?

How Does a Bank With a Printing Press Lose Money?

Here’s an eye-opening chart…

Here’s an eye-opening chart…

This isn’t exactly news to Jim Rickards’ Strategic Intelligence subscribers. Last month, Jim showed them exactly how a bank with a printing press can lose money.

“Here’s how: in the first place, the printing press prints dollars, but those are not assets; they’re liabilities. If you look at the Fed’s balance sheet (which is publicly available on their website), you’ll see that cash and currency are entered on the liability side of the balance sheet.

“If you pull a $20 bill out of your purse or wallet and read it, you’ll see that it says ‘Federal Reserve Note.’ A note is a form of debt and therefore a liability. It may be an asset to you when you have one but not to the Fed. So the printing press doesn’t help.

“Otherwise, the Fed is like any other bank. They earn interest on their assets (mostly U.S. Treasury securities that pay interest) and they pay interest on their liabilities (mostly excess reserves deposited by banks that are members of the Federal Reserve system).

“The Fed has raised interest on excess reserves (IOER) to around 5.5% in line with the fed funds policy rate. But the interest they receive is often only 2% or 3% because they bought their Treasury securities a few years ago when that was the going rate.

“From there, a sixth grader can see the problem. If you pay more than you receive, you lose money. And that’s the Fed’s situation.

“The next question is: Will the Fed go broke?” Jim continues.

“The next question is: Will the Fed go broke?” Jim continues.

“When you lose money long enough, you have a negative net worth and then you’re technically insolvent. Bankruptcy is just a step away.

“But the Fed is not a normal company (even though it is privately owned). It can always get loans from the Treasury to keep the lights on.

“I had a private dinner in Vail with a Fed governor once and she told me, ‘Central banks don’t need capital.’

“So there you have it. The Fed is losing money, slowly going broke, and nobody notices or cares. Keep that in mind the next time you see some gold for sale. You might want to buy some… just in case.”

As we scan the markets today, gold continues to hold the line on $2,000 an ounce — $2,027, in fact. Silver sits at $22.61.

As we scan the markets today, gold continues to hold the line on $2,000 an ounce — $2,027, in fact. Silver sits at $22.61.

Stocks, you ask? The S&P 500 continues its climb into record territory — past 5,100 now. The Nasdaq is inching higher, indeed this close to eclipsing its late-2021 record of 16,057. The Dow is the strongest performer of the major indexes — at 39,276, it’s up a half percent from yesterday’s record levels.

“I still have my concerns about the market right now,” says Paradigm trading pro Greg Guenthner. No, he’s not loading up on put options — “but I do think we need to look beyond the hotter names on the Nasdaq here and respect that there’s a ton of chop out there.” [For a look inside Greg’s trading strategy — among the most successful in our industry — check this out right away.]

Crude has slipped 2% to $77.04. Bitcoin has lost its grip on $51,000.

![]() Gemini DEI: The Comedy, the Tragedy

Gemini DEI: The Comedy, the Tragedy

Laugh all you want about the Google Gemini fiasco — but don’t think for a moment that it’s a nail in the coffin of the “woke” agenda.

Laugh all you want about the Google Gemini fiasco — but don’t think for a moment that it’s a nail in the coffin of the “woke” agenda.

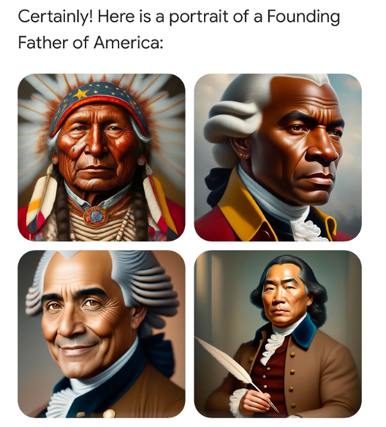

As you’ve likely heard by now, Google’s AI platform called Gemini was programmed to be so politically correct that when asked to spit out images of the United States’ Founders, well…

In terms of the sheer comedy, I can’t hold a candle to colleague Sean Ring’s take in today’s edition of our sister e-letter, TheRude Awakening. And Sean has some serious points about humans’ quest for truth.

But my own take is more foreboding: Google’s gaffe is just a speed bump on the road to a very dark place.

John Robb, author of Brave New War, described this dark place in 2017 — when Facebook started training AI censors to identify and delete information that was deemed “disruptive”:

The REAL danger facing a world interconnected by social networking isn’t disruption… Th[e] danger is an all-encompassing online orthodoxy. A sameness of thought and approach enforced by hundreds of millions of socially internetworked adherents. A global orthodoxy that ruthless[ly] narrows public thought down to a single, barren, ideological framework. A ruling network that prevents dissent and locks us into stagnation and inevitable failure as it runs afoul of reality and human nature.

Robb calls this process “alignment.” In a tweet prompted by the Google Gemini slipup, he elaborates: “Since AIs will have more of an impact on how we collectively perceive reality than all of the information techs we currently use, even small changes in alignment now can have massive impacts on how society works.

“Unfortunately, AI alignment attracts social engineers and authoritarians to it like a moth to a flame. This makes it very dangerous.”

And nothing about what happened with Gemini this week changes that.

Hell, for all we know, Gemini’s comical failures might even be a “limited hangout” — something Google deliberately put out there to distract us from an agenda that’s much more nefarious.

![]() Ted Cruz Is a Garbage Human

Ted Cruz Is a Garbage Human

Now for one of our periodic business-travel alerts: Sen. Ted Cruz (R-Texas) has proposed legislation exempting himself and his fellow congrescritters from getting hassled by the TSA at the airport like the rest of us.

Now for one of our periodic business-travel alerts: Sen. Ted Cruz (R-Texas) has proposed legislation exempting himself and his fellow congrescritters from getting hassled by the TSA at the airport like the rest of us.

Specifically, the bill would provide lawmakers “a dedicated security escort at airports,” according to Politico, “along with expedited screening outside of public view.”

Hmmm… What might have inspired this legislation? Author James Bovard, a perennial thorn in the side of Washington’s control freaks and power trippers, writes in the New York Post…

After missing a flight in Bozeman, Montana, in 2022, Cruz berated airline staff so vehemently that a policeman was summoned to defuse the situation.

The real problem? An airport official later admitted the policeman failed to recognize Cruz.

Does Cruz want a chorus of trumpets to herald the procession of lawmakers through airport terminals?

Or maybe he’d prefer a litter carried by four AmeriCorps members who sing “The Battle Hymn of the Republic” while carting the VIP to his departure gate?

Meanwhile, everyday Americans continue to be subjected to routine humiliation at the hands of the TSA. As Bovard writes, “After an Oklahoma woman sued after being strip-searched due to a menstrual pad, Justice Department lawyers scoffed that the treatment she complained of ‘amount[ed] to no more than … petty oppressions.’”

Bovard reminds us this congressional impunity is bipartisan: Back in 2011, Rep. James Clyburn (D-South Carolina), said, “We’ve had some incidents where TSA authorities think that congresspeople should be treated like everybody else.”

Soon after, the TSA assembled “whitelists” of individuals eligible for expedited screening, including members of Congress.

Evidently that’s still not good enough for Ted Cruz, who was first elected to the Senate in 2012 on a platform that included… abolishing the TSA.

![]() Convenience Stores With a Cult Following

Convenience Stores With a Cult Following

It’s been a load of heavy content today. As promised earlier this week, we’ll wind down with some lighter fare from the mailbag.

It’s been a load of heavy content today. As promised earlier this week, we’ll wind down with some lighter fare from the mailbag.

Tonight’s the night a candlelight vigil is scheduled at the site of a former Hooter’s in Charleston, West Virginia. On Wednesday, I mentioned that next week, the building will be torn down. Soon it will be replaced by a Sheetz convenience store — which according to a local blogger who frequented the long-gone Hooters “is still a win.”

Which brings us to the topic of convenience stores with a cult following. Readers write…

“I once lived in Pennsylvania and recall that Sheetz had a cult-following, but I didn't live close enough to try it more than once or twice.

“I once lived in Pennsylvania and recall that Sheetz had a cult-following, but I didn't live close enough to try it more than once or twice.

“The Pennsylvania/New Jersey area loves their Wawa, which I can appreciate better now that I don't have it anymore.

“Here in Texas, I don't think I've noticed any allegiance to particular convenience stores (despite being the headquarters of 7-Eleven). But when driving on a highway in the Lone Star State, well, Buc-ee's is a rest area experience that's not to be missed!”

Another reader affirms: “Sheetz is huge in our area! Definitely a cult following!”

“I think Buc-ee's is taking over the world… of convenience gas stations,” says a third. “I love Sheetz, but there is nothing that compares to Buc-ee's.”

But the most effusive praise we got is for the Wawa chain…

But the most effusive praise we got is for the Wawa chain…

“The convenience store cult is alive and well for Wawa! I first learned of Wawa when I got stationed in Quantico, Virginia, and a friend asked me, ‘Do you want to go to Wawa?’ as if it was a destination in and of itself. I was very confused but he just said, ‘Trust me.’

“My life was changed forever because Wawa is amazing. Fast service, reasonably priced food, delicious, and usually the cheapest gas in town so it's a bona fide one-stop shop.”

“Almost anyone on the east, or right, coast has heard of Wawa by now,” says another. They are legendary. These company-owned and -operated food and fuel stations started with humble beginnings in suburban Philly during the mid-’60s.

“Almost anyone on the east, or right, coast has heard of Wawa by now,” says another. They are legendary. These company-owned and -operated food and fuel stations started with humble beginnings in suburban Philly during the mid-’60s.

“The dairy-farming Wood family had been delivering its fresh milk around southeastern Pennsylvania for the first half of the 20th century. Seeing mobility and all of us baby boomers needing food, Grahame Wood, the family patriarch, and his team, decided to try retail markets in three Delaware County locations to sell their milk, juice, candy/snacks and tobacco. The first store in Folsom, Pennsylvania, was followed by two more stores, one of which was, and still is, located in Drexel Hill, Pennsylvania. We rode our bikes there all the time for snacks and drinks. Our parents sent us for milk, and they would go for cigarettes, etc.

“If anyone has watched Mare of Easttown on HBO, or lives on the eastern seaboard, you probably have seen or have been to a Wawa food-and-fuel location. Hmm, fuel, you say? Atlantic Richfield (ARCO) decided to sell snacks etc. in ampm markets in the 1970s. Mr. Wood was not pleased and vowed that if they could sell snacks, Wawa would sell fuel.

“Today you can get almost any hot or cold sandwich, pizza, groceries, drinks and tobacco products (if you must) or tap a PNC ATM at Wawa for free. And get gasoline or diesel if your ICE-powered vehicle needs fuel.

“If you go, you might also notice we have a custom at Wawa stores: When entering or exiting a Wawa in southeastern Pennsylvania (not necessarily Philadelphia but I see it there as well), it is customary to hold the door for the person next to you or behind you. Someone leaving a Wawa may hold the door if you are close by, so that the door doesn't slam shut on you before you get there. A brief ‘thank you’ is spoken or a nod of appreciation takes place. Do any of our convivence store cultists have any traditions that include being courteous to others?

“In summary, Wood and Wawa revolutionized the convenience store/retail fuel marketing package. From humble beginnings arose a category-killer company. Kwik Trip, Royal Farms, Sheetz and others have replicated the theme. Convenience was so successful for Sun Oil, who eventually took over ampm from ARCO in consolidation of their gas station sites, Sun Oil sold the refinery and kept the logistics, pipelines and marketing for stores.”

Dave responds: Hmmm… According to Wikipedia, Kwik Trip was founded only a year after Wawa. And we in the Upper Midwest tend to hold doors for others everywhere. Just sayin!

The interesting thing is that almost all of these companies remain owned by their founding families even after several decades. That could be fodder for a pretty good book…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets