Was It Powell? Was It Hackers?

- Everything is connected (or is it?)

- Miserable milestone: $1 trillion in interest

- Ukraine and the big drop in oil prices

- Jerome Powell channels his inner Bill Belichick

- Mailbag: Oil, nukes and DST

![]() Everything Is Connected (Or Is It?)

Everything Is Connected (Or Is It?)

Things got weird in the financial world after we hit “send” on yesterday’s edition at 1:30 p.m. EST…

Things got weird in the financial world after we hit “send” on yesterday’s edition at 1:30 p.m. EST…

Not that you’d know anything was out of sorts scanning the front page of today’s Wall Street Journal.

“Fed Chairman Jerome Powell indicated that the central bank wouldn’t declare an end to its historic interest-rate increases until it had more evidence that inflation was cooling. Major U.S. stock indexes declined after Powell’s remarks, with the S&P 500, Nasdaq and Dow losing 0.8%, 0.9% and 0.7%, respectively.”

More hawkish remarks from Powell, and the market sells off — there’ve been a couple dozen such days like that this year. Move along, nothing to see here, right?

[There was an amusing moment during Powell’s speech — but that will have to wait for Bullet No. 4 today…]

The real news was buried on Page B9. The U.S. Treasury held one of its regular auctions yesterday — and it bombed.

The real news was buried on Page B9. The U.S. Treasury held one of its regular auctions yesterday — and it bombed.

Uncle Sam sold $24 billion in 30-year bonds. The Journal said the auction “didn’t entice as many buyers as anticipated. Benchmark 10-year yields, which offer practically risk-free returns, settled higher at 4.629%.”

It was worse than the Journal let on — even if it wasn’t the “complete disaster” being hyped on everyone’s favorite alt-financial site.

Foreign buyers didn’t show up anywhere near the numbers expected. Thus, the buying had to be done by the “primary dealers” — the two dozen big banks and trading firms that underwrite Treasury auctions. In exchange for a host of special privileges with the government and the Federal Reserve, the primary dealers are obligated to buy Treasuries when no one else steps up.

Like anything else, the bond market is subject to the laws of supply and demand: Lower demand translates to lower prices — and in the bond market, that translates to higher interest rates. The yield on a 30-year bond jumped yesterday from 4.66% to 4.78% — a substantial one-day move.

Compared with a Jay Powell speech that should have surprised no one… the Treasury auction’s flop seems like a far more likely candidate to spook the stock market and break an eight-day winning streak.

Nowhere in the print edition of the Journal did we find the news that the Treasury market was disrupted by… a ransomware attack on a Chinese bank.

Nowhere in the print edition of the Journal did we find the news that the Treasury market was disrupted by… a ransomware attack on a Chinese bank.

To be fair, it was the Financial Times that had the scoop. But still…

The Industrial and Commercial Bank of China is the biggest bank in the world as measured by assets — with $6.1 trillion. One of its New York-based subsidiaries — ICBC Financial Services — has become “a key player on Wall Street for Treasury clearance,” says the FT.

Sometime Wednesday, hackers began to access ICBC Financial Services’ systems.

“The attack prevented ICBC FS from settling Treasury trades on behalf of other market participants, according to traders and banks. Hedge funds and asset managers rerouted trades because of the disruption and the attack had some effect on Treasury market liquidity, according to trading sources.”

Bloomberg added some color to the FT’s coverage: To complete settlement of trades, ICBC FS dispatched a courier with a thumb drive around Manhattan. Bloomberg also says the suspected perps are “a prolific criminal gang with ties to Russia.”

And with that, you know what we know. Anyone who claims to know more had better, as the kids say, bring the receipts.

And with that, you know what we know. Anyone who claims to know more had better, as the kids say, bring the receipts.

At this point, it’s a stretch to say the hack is somehow serving as “cover” for a Treasury auction that went badly. Nor is it apparent whether the hack somehow contributed to the Treasury auction going badly.

But it’s safe to say we’re likely to see more weirdness like this going into 2024 — eyebrow-raising, market-moving events that don’t always have obvious explanations and may or may not be connected.

As always we’ll do our best here to separate the news from the noise. For now, we take on a related matter…

![]() Miserable Milestone: $1 Trillion in Interest Expense

Miserable Milestone: $1 Trillion in Interest Expense

Of course, there’s the lingering question of why demand for Treasuries yesterday was so feeble. The answer might lie in some news from earlier in the week…

Of course, there’s the lingering question of why demand for Treasuries yesterday was so feeble. The answer might lie in some news from earlier in the week…

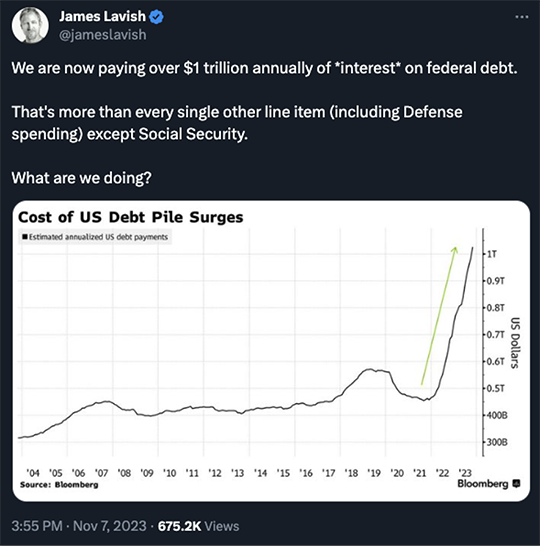

“Estimated annualized interest payments on the U.S. government debt pile climbed past $1 trillion at the end of last month,” according to an analysis performed by Bloomberg. “That projected amount has doubled in the past 19 months from the equivalent figure forecast around the time.”

As it is, Uncle Sam ended fiscal year 2023 in September shelling out $879.3 billion in interest expense — fully 14% of the federal budget.

That’s what rising interest rates will do. Gone are the near-zero rates of the Obama years — when the national debt could rise relentlessly but the government’s interest expense actually fell slightly.

➢ By the way, assuming Congress can’t come to terms, we’re staring down another “partial government shutdown” a week from tomorrow. That’s not exactly instilling confidence in the buyers of U.S. debt either…

![]() Ukraine and the Big Drop In Oil Prices

Ukraine and the Big Drop In Oil Prices

On second thought, maybe the swoon in oil prices isn’t as irrational as it seems.

On second thought, maybe the swoon in oil prices isn’t as irrational as it seems.

For several days running we’ve been gobsmacked by the complacency in the energy markets — the oil price cratering 17% in three weeks despite abundant evidence that the Israel-Hamas conflict could send much of the Middle East up in flames.

Then again, maybe it’s the realization that the Russia-Ukraine war is about to wind down.

As we mentioned on Tuesday, NBC News is reporting that U.S. and European leaders are quietly pressuring the government of Ukraine to start thinking about what it’s willing to give up in exchange for peace with Russia.

That’s a whale of a climb-down from Washington’s official stance since Russia invaded 21 months ago — to “drive Russians back to pre-invasion lines,” as Secretary of State Blinken put it.

But the reality is that Ukraine is running out of men and Ukraine’s Western backers are running out of weapons and ammo.

But the reality is that Ukraine is running out of men and Ukraine’s Western backers are running out of weapons and ammo.

As NBC summed up the position of U.S. officials, “Ukraine likely only has until the end of the year or shortly thereafter before more urgent discussions about peace negotiations should begin.”

The news came on the heels of a remarkable Time magazine article filed from Kyiv. It featured an interview with a defiant President Zelenskyy. But there were also interviews with Zelenskyy aides who warn that the war is stalemated, and the president has lost his grip on reality. “We’re out of options,” said one. “We’re not winning. But try telling him that.”

Perhaps it’s taken a few days for the reality to settle in for energy traders: Washington is giving up on its effort to “weaken” Russia — or at least on this phase of the effort.

Who knows, before it’s all over Zelenskyy might find himself meeting the same fate as other stooges, proxies and partners of the United States like Gen. Noriega and Saddam Hussein…

We forget now how much Russia’s invasion scrambled the global oil trade — briefly pushing crude up to $130 a barrel in the spring of last year. But much of that chaos has sorted itself out now, with Russian oil that used to go to Europe now going to China and India instead.

And thus, a huge portion of the “risk premium” that’s figured into energy prices since early 2022 is coming back out of the markets.

That’s as plausible an explanation as any for the fact that crude trades this morning just under $77 a barrel — lower than it traded before Russia’s invasion.

As for the rest of the markets, the week is winding down quietly.

As for the rest of the markets, the week is winding down quietly.

As mentioned earlier, the S&P 500’s winning streak was snapped after eight days with yesterday’s losses. Today, the index is up about a quarter percent at 4,357. Paradigm trading pro Alan Knuckman says the same dynamics are in play now as they’ve been the last several days: If the index can push its way past 4,400 again, that clears the way for a rally to 4,600.

Treasury yields are inching back down after yesterday’s shock, the 10-year note back below 4.6%.

Precious metals are on track to put in a miserable weekly close — gold at $1,942 and silver at $22.35. But crypto is looking stout, Bitcoin back above $37,000 and Ethereum approaching $2,100.

![]() Jerome Powell Channels His Inner Bill Belichick

Jerome Powell Channels His Inner Bill Belichick

Suddenly, legions of people online who have no use for Federal Reserve chair Jerome Powell have a new measure of respect for the guy.

Suddenly, legions of people online who have no use for Federal Reserve chair Jerome Powell have a new measure of respect for the guy.

For the second time in three weeks, “climate change” activists crashed a Powell speech — this one delivered yesterday during an International Monetary Fund conference in Washington.

He kept his cool even as his irritation was obvious — and his mic was still open. The whole thing unfolded in just 45 seconds; don’t watch if you don’t want to hear an f-bomb.

Heh — Powell’s energy here is reminiscent of Bill Belichick, the legendary New England Patriots coach. You know, when reporters ask the same question a half-dozen different ways and every time he answers, “We’re on to Cincinnati.” No wonder people like Powell more now…

![]() Mailbag: Oil, Nukes and DST

Mailbag: Oil, Nukes and DST

A member of our Omega Wealth Circle writes in to riff on my assertion yesterday that the biggest risk in the Middle East for everyday Americans is a disruption to the region’s oil supply.

A member of our Omega Wealth Circle writes in to riff on my assertion yesterday that the biggest risk in the Middle East for everyday Americans is a disruption to the region’s oil supply.

“I respectfully suggest that the greatest threat is that this all escalates to a nuclear exchange,” he asserts.

“The Russians have been very restrained thus far in response to U.S. provocations, but Iran is a close ally of theirs, not to mention the tens of thousands of Russian soldiers who have been killed by U.S. munitions in Ukraine.

“There is a limit to how long and hard you can poke a bear with a sharp stick before it uses its claws. And as you noted, there is a massive lack of diplomatic skill and understanding in our capital.”

Dave responds: Word.

If in fact the Biden administration is giving up on “weakening” Russia in Ukraine because Iran and its proxies seem like an easier target for American military might… well, don’t forget Russia has bases in Syria. (Which Russia did not have before Barack Obama foolishly tried to engineer regime change in Syria, but we digress…)

One more note about daylight saving time as the week winds down…

One more note about daylight saving time as the week winds down…

“During the 20-plus years I lived in Arizona,” a reader writes, “I never heard anyone complain about being on standard time all year.

“During the summer you want the sun to go down quicker and start cooling off.”

Dave responds: Yeah, I can imagine.

As it happens, your editor lived in Indiana for a while in the 1980s and ’90s — when most of the state still observed year-round standard time.

But because I worked in broadcast news, I didn’t really notice the advantages: My life revolved around the fact that the late news was on at 11:00 p.m. in the winter and 10:00 p.m. in the summer — while the morning newscasts were on at the same time year-round. Ugh!

Have a good weekend (and Happy Armistice Day tomorrow),

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets