Year of the Instant Windfall

- The biggest opportunity for the rest of 2023

- Dollar down… (almost) everything else is up

- Money market funds: Third time’s a charm?

- Confidence in higher education tanks to new lows

- Mailbag: Student debt and climate sacrifice

![]() The Biggest Opportunity for the Rest of 2023

The Biggest Opportunity for the Rest of 2023

“I’ve never seen an environment like this,” says Paradigm’s opportunistic James Altucher, presenting a bold forecast for the balance of 2023. “This will be the biggest year for acquisitions of public companies ever.”

“I’ve never seen an environment like this,” says Paradigm’s opportunistic James Altucher, presenting a bold forecast for the balance of 2023. “This will be the biggest year for acquisitions of public companies ever.”

As James knows from personal experience — wheeling and dealing in venture capital and private equity — buyouts can deliver an instant windfall to the owners of the company being acquired.

Some leading examples from the last decade or so…

- 2011: Google acquires Motorola Mobility — handing a 63% windfall to Motorola Mobility shareholders

- 2014: Merck acquires Idenix Pharmaceuticals; Idenix shareholders raked in a 238% premium

- 2018: IBM acquires Red Hat — handing Red Hat shareholders an instant 63% gain

- 2020: Gilead Sciences acquires Immunomedics; owners of the buyout target more than doubled their money, 108%.

So now that you understand the profit potential, you’re logically asking why now? And where are the best opportunities?

So now that you understand the profit potential, you’re logically asking why now? And where are the best opportunities?

To address the first question, James runs down the following list…

- “Companies have more cash than ever. They want to use that cash to grow their business. The best way to grow quickly is to buy other companies.

- “Private equity funds have more cash than ever. Their ONLY job is to buy companies. They have to put their cash to work.

- “Companies are cheaper than normal because the market has not been good. People tend to do irrational selling of both bad and GOOD companies (just like they do irrational buying in bull markets).

- “There are a heavy number of shareholder activists demanding that companies change management because the stocks are so low.

“Management does not like when activists (many of whom are multibillion-dollar hedge funds) want to fire them. So they hire a bank to put the company up for sale and they go to the highest bidder.”

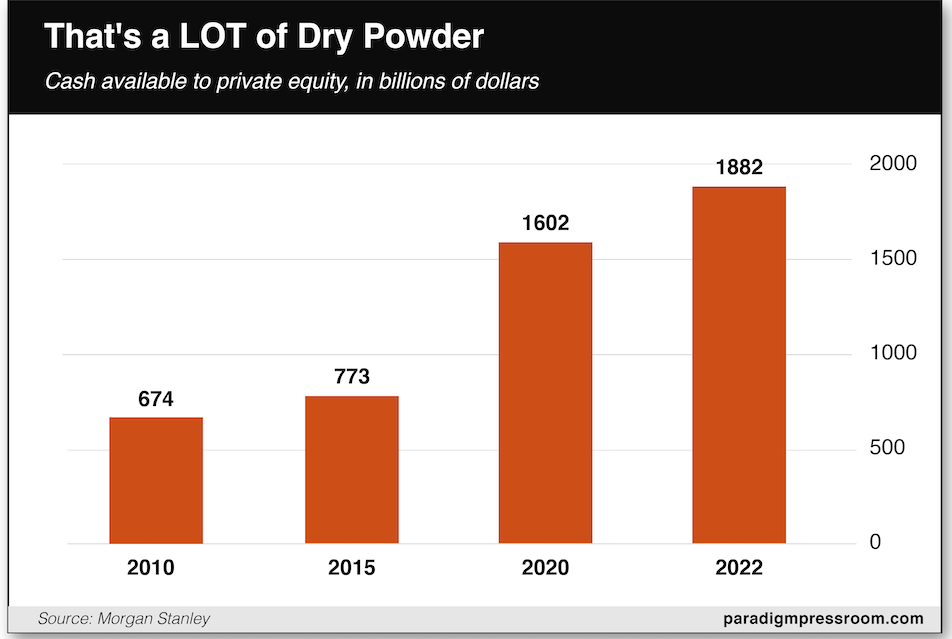

Let’s elaborate on James’ second point with the following chart, courtesy of Morgan Stanley. This is the amount of cash in the bank held by private equity funds…

Let’s elaborate on James’ second point with the following chart, courtesy of Morgan Stanley. This is the amount of cash in the bank held by private equity funds…

Note the doubling between 2015–2020. “The U.S. printed up 4 trillion more dollars in the past few years,” James points out. “That money has to go somewhere. It doesn't go to the schoolteachers and janitors and waiters. It goes to the richest of the rich — the private equity funds.”

Also note the big bump between 2020–2022. That’s because amid the market turmoil last year, private equity bought very few companies. Private equity sat on its hands — especially during the latter half of the year.

“What happens to the people who manage all that cash when they don't put it to work?” James asks rhetorically. “Eventually, they get fired and their dreams of working on Wall Street and getting rich are over.

“Their only job is to buy companies. They have no other job. This is what they do. They have to buy companies and they have not been doing their jobs lately.”

So the setup now is ideal. James sees three sectors where buyouts are especially likely…

So the setup now is ideal. James sees three sectors where buyouts are especially likely…

- Biotech: “Big Pharma patents on top-selling drugs are expiring. They will need to buy smaller biotech firms to keep making profits.”

- Technology: “Companies like Google and Amazon and others often buy a company a week in far worse conditions than this.”

- Energy: “A combination of higher oil prices, more need for alternatives and more focus on things like carbon capture and other environmental initiatives will mean more buyouts.”

In recent months, a select group of James’ readers have already been cashing in on buyout opportunities he and his team have spotted — pocketing gains of 30%, 100%, even 251%.

Just yesterday, they doubled their money on an AI-adjacent play for 100% gains in only three weeks.

And it’s in AI where James sees the next big buyout opportunity. Only this one could be much, much bigger — for reasons James spells out when you follow this link.

![]() Dollar Down, (Almost) Everything Else Up

Dollar Down, (Almost) Everything Else Up

The dollar is tanking… and by extension, nearly everything else is soaring.

The dollar is tanking… and by extension, nearly everything else is soaring.

The U.S. dollar index — a measure of the dollar relative to six other developed-world currencies — broke below 100 this morning for the first time since April of last year.

It’s tumbled 14% since last autumn — a big move in the currency world — and chart-watchers say it’s not over yet.

Chalk up this week’s drop to the easing inflation numbers we mentioned yesterday. Rightly or wrongly, Mr. Market sees the Federal Reserve finally pausing its rate-raising cycle at the end of this month.

It might not be “easy” money from the Fed, but it’s “less hard” money… and that’s enough to send the dollar into a tailspin.

With that, the S&P 500 is less than five points away from 4,500 as we write — another 15-month high.

With that, the S&P 500 is less than five points away from 4,500 as we write — another 15-month high.

Gee, stocks are their strongest since April 2022… while the dollar is its weakest since April 2022. That’s not a coincidence.

The vibe right now feels a lot like the first couple years of the bull market coming out of the 2008 financial crisis. A falling dollar was the fuel that ignited stocks from roughly 2009–2011. It also sent gold to what was then a record high.

As it happens, gold is also rallying this week — back to $1,960 at last check. Silver is only 30 cents away from $25.

The dollar’s drop is aiding crude’s rally; a barrel of West Texas Intermediate is up another half percent today, back above $76 for the first time in 2½ months.

Treasuries are rallying, too, sending yields lower: After cresting 4% last week, the yield on a 10-year Treasury note is back to 3.81%.

“The only piece missing at the moment is crypto,” says Paradigm chart hound Greg Guenthner. “Somehow, Bitcoin has not played along with the stock market and remains stuck in its consolidation range” — over $30,000 but unable to break much higher.

![]() Third Time’s a Charm? (Money Market Funds)

Third Time’s a Charm? (Money Market Funds)

Here we go again with money market funds.

Here we go again with money market funds.

“U.S. regulators rewrote the rules for money market funds for the third time in 15 years in hopes of preventing bailouts in times of turmoil,” reports this morning’s Wall Street Journal.

Money market funds are supposed to be among the safest assets you can hold. But the Federal Reserve had to ride to their rescue during the 2008 financial crisis and again during the 2020 COVID panic.

Allegedly the rules approved yesterday by the Securities and Exchange Commission will prevent another crisis — which begs the question of why the previous rules did not prevent the earlier crises.

In the fullness of time, we might discover the new rules put you at even greater risk. That’s what happened when new rules were implemented in 2016.

As Paradigm’s Jim Rickards reminded us at the time, “Money market funds are now allowed to ‘suspend' redemptions... Not only can they pay back less than you invested, they don't have to pay at all — until they decide to. They can keep your money and get back to you later when conditions ‘normalize.' Whenever that is."

We won’t get into the weeds of these newest regulations. You can read about that anywhere if you like.

Our point today is one that we’ve been making for over a decade, and it’s especially relevant now that you can actually earn a yield once again on money market funds.

Our point today is one that we’ve been making for over a decade, and it’s especially relevant now that you can actually earn a yield once again on money market funds.

It’s this: Avoid money market funds that hold “mystery meat” corporate paper or foreign government debt.

Really, you should also avoid money market funds that hold debt issued by the government mortgage giants Fannie Mae and Freddie Mac — which got into deep trouble in 2008. Usually the giveaway with these funds is that they have the term “U.S. Government” in their name.

You want a money market fund that holds nothing but U.S. Treasury bills. It might require a bit of homework; if they have "Treasury Only" in the name, that's a good sign. But look at the fund's top holdings at Morningstar or a similar website just to be sure. If there's anything other than U.S. Treasuries, move on.

If you don't need the check-writing privileges that come with a money market fund, you can opt for a Treasury-only ETF like the iShares Short Treasury Bond (SHV).

Or better yet, go straight to the source and buy real T-bills. Most online brokerages make it easy now; you can even set it up so they’ll “auto-roll” into new T-bills when they mature. (This is what your editor does with the household emergency fund.)

We give Jim Rickards the final word: "Short-term Treasury bills are a safer alternative. The Treasury still gives you your money back."

![]() Gee, It Couldn’t Happen to a Nicer Bunch of People

Gee, It Couldn’t Happen to a Nicer Bunch of People

Amid a flurry of recent student-debt headlines, public confidence in higher education is plumbing new lows.

Amid a flurry of recent student-debt headlines, public confidence in higher education is plumbing new lows.

Every year, the Gallup pollsters survey roughly 1,000 adults about their confidence level in all manner of public institutions — everything from small business (which usually polls very high) to Congress (lowest of the low, heh).

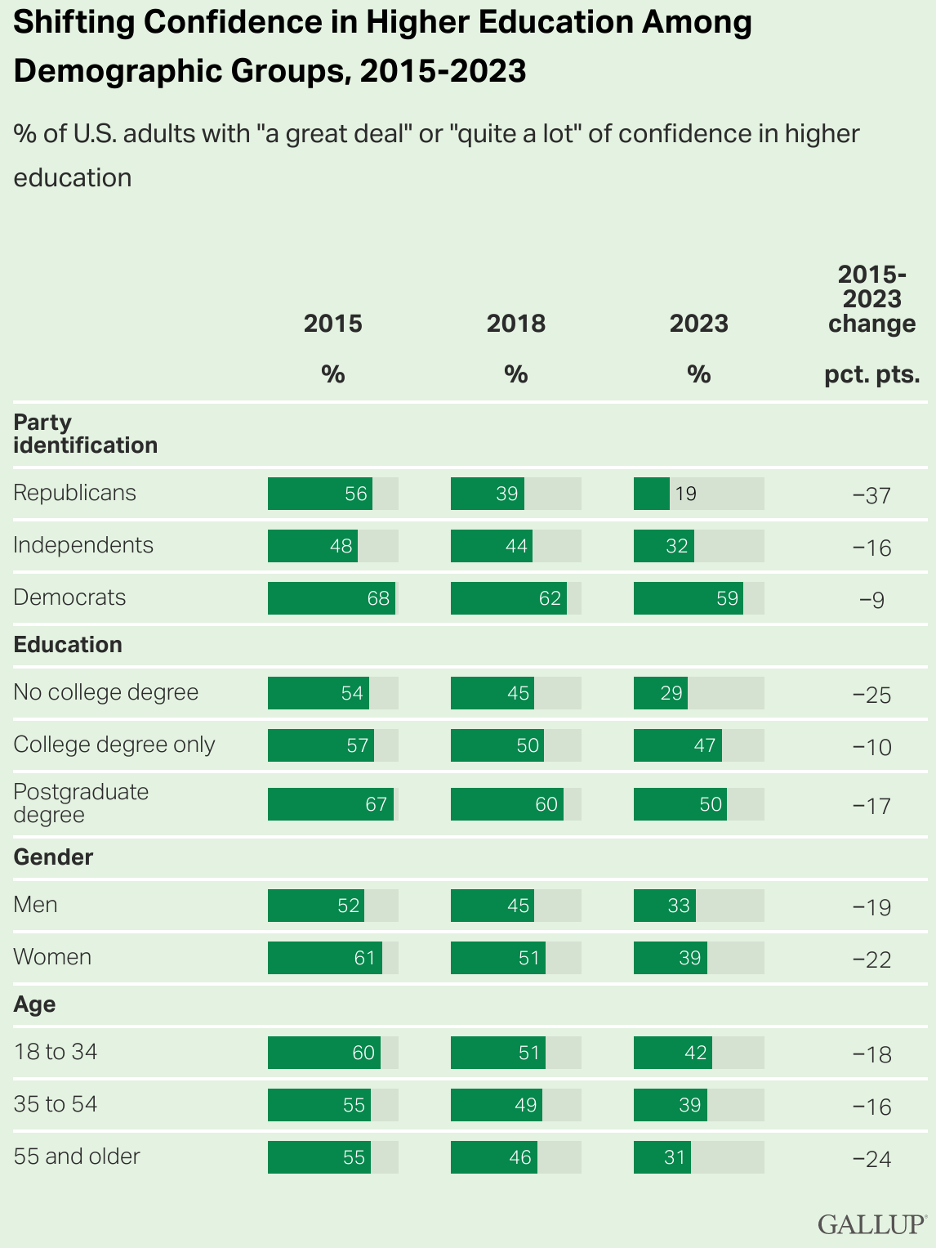

The standout result this year is a huge drop in confidence in higher education between 2015–2023.

Higher ed still ranks fourth among the 16 institutions surveyed — only small business, the military and the police rank higher.

But while 57% of people expressed a “great deal” or “quite a lot” of confidence in higher ed during 2015… that number has tanked to only 36% now. The biggest drop has come among Republicans — from 56% then to 19% now — but the numbers fell among independents and Democrats too.

Actually, the numbers have fallen among every demographic measured — educational attainment, gender and age. Here’s an infographic straight from Gallup…

As we’ve suggested more than once, “peak higher ed” might have come in early 2022 — when many campuses confined students to their dorm rooms taking lousy Zoom classes, even though the whole student body was vaxxed and boosted for COVID. And they were still charged full tuition!

Meanwhile, we’re still getting emails on the topic of student debt, two weeks after the Supreme Court decision…

![]() Mailbag: Student Debt and Climate Sacrifice

Mailbag: Student Debt and Climate Sacrifice

“The fact that students could borrow so much money so easily once they could no longer declare bankruptcy allowed universities to then charge much higher tuition to get an education than it had cost me when in the mid-1960s (even adjusting for inflation).

“The fact that students could borrow so much money so easily once they could no longer declare bankruptcy allowed universities to then charge much higher tuition to get an education than it had cost me when in the mid-1960s (even adjusting for inflation).

“I could work part time and pay for my college education myself and remained debt free. The fact that students could so easily borrow money on their own meant one of my children ran up huge debts without me even knowing about it until later.

“Sort of a win-win for everyone involved except, of course, the students who weren't educated yet in just how that debt they had ignorantly taken on would continue to grow into the future.”

On the topic of the sacrifices everyday people are expected to make for the sake of combating “climate change”...

On the topic of the sacrifices everyday people are expected to make for the sake of combating “climate change”...

“I remember your previous mention of the University of Leeds study,” a reader writes, “in which a typical family of four would be confined to a space of no more than 640 square feet.

“I just did the math on the 1,950-square-foot house my wife and I live in. Imagine cramming three families (12 people) into our modest three-bedroom, two-bath home!”

Dave responds: The number works out to 160 square feet per person — which has a certain resonance for your editor in light of my much older siblings’ experience.

I am — by far — the youngest of four. Before I came along, my dad had built a house of 800 square feet to accommodate a family of five — that is, 160 square feet per person.

That meant my brother and two sisters all shared a bedroom — until my brother, the oldest of the three, set himself up with a cot in the basement somewhere around age 14. (Or so I’m told. By the time I was born, there was a second-story addition.)

The one saving grace was that the house sat on 2½ acres, so there was room to roam outside.

But imagine being confined to such a small indoor space in the high-density “15-minute cities” that the control freaks and power trippers envision for all of us…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets