Your Amazon Package Has Arrived

![]() Your Amazon Package Has Arrived

Your Amazon Package Has Arrived

“Drones you can buy on Amazon — that’s how Hamas got through one of the most sophisticated surveillance systems on Earth,” says Paradigm’s AI authority James Altucher.

“Drones you can buy on Amazon — that’s how Hamas got through one of the most sophisticated surveillance systems on Earth,” says Paradigm’s AI authority James Altucher.

“These were cheap drones, not military-grade drones,” reiterates Chris Kirchhoff — author of Unit X: How the Pentagon and Silicon Valley Are Transforming the Future of War — during a recent podcast interview.

“Drones that you and I would use to film ourselves skateboarding or skiing.”

Courtesy: Israel Defense Forces, The Times of Israel

Hamas drone found by Israeli troops

James asks: “If Israel, with all its cutting-edge defense tech, can get caught off-guard like this, what does that say about us? I [wanted] to know if the U.S. is prepared to face the new era of low-cost, high-impact warfare.”

Which jibes with similar musings from Paradigm editor and former U.S. Navy officer Byron King…

“What’s the way ahead for America, in a world where the old ways of waging war have changed so dramatically?” Byron questions.

“What’s the way ahead for America, in a world where the old ways of waging war have changed so dramatically?” Byron questions.

“Based on public comments by senior U.S. military and civilian officials,” he says, “analysts are shocked at what's happening on the front lines:

- “For Ukraine, war has become a Battle of the Somme, except [with] drones,” he says. “I’ve seen videos and read accounts of Russian drone swarms at the scale of hundreds and even thousands at a time, whizzing across the sky like a flock of passenger pigeons of old

- “Meanwhile, don’t overlook recent engagements with the Houthis in Yemen, who proved that they could block the southern entrance of the Red Sea when and how they chose to do so,” says Byron.

To wit, Rude Awakening editor Sean Ring quipped in December: “A bunch of goatherders have just stopped world trade.”

This after Byron mentioned that Houthis were using $100,000 drones — clearly, more sophisticated than anything listed on Amazon — to attack commercial shipping in the Red Sea, while the U.S. Navy used $1–4 million rockets to shoot down said drones.

Now that’s asymmetric warfare…

“Our adversaries are now able to buy a lot of the same technology the U.S. military is buying,” Kirchoff notes.

“Our adversaries are now able to buy a lot of the same technology the U.S. military is buying,” Kirchoff notes.

“In 2016, if you had gone to any four-star general in the U.S. military and said, I would bet you a steak dinner that in 10 years drones are going to be able to defeat tanks, they would say, You're on… I'll bet you 10 steak dinners.”

In 2024? “No four-star general would take that bet,” he says.

The F-35, for instance, represents the pinnacle of traditional fighter jet design with impressive capabilities — “flying supercomputers,” James calls them.

But Kirchoff counters: “The iPhones that we carry around in our pockets are actually far more advanced than the processor in the F-35 because the consumer technology ecosystem has grown so much larger.”

For context, James adds: “Back during the Cold War this wasn’t true. The Defense Advanced Research Projects Agency (DARPA) had [technology] that was six or seven generations more advanced than what people used on a daily basis.

“That’s where Chris and his work at the Defense Innovation Unit (DIU) comes in…

“The DIU is a Pentagon organization created to bridge the gap between the U.S. military and Silicon Valley's fast-paced tech industry,” James says.

“The DIU is a Pentagon organization created to bridge the gap between the U.S. military and Silicon Valley's fast-paced tech industry,” James says.

“Its primary role is to scout, vet and bring commercial technology into the military’s operations,” he says, “to create a large number of inexpensive, yet effective, systems that can be produced rapidly and in large quantities to overwhelm adversaries.

“But the question remains: Is it enough?

- The future of warfare won’t be about who has the most tanks or the fastest jets. It will be about who can innovate the quickest, who can adapt to new threats and who can integrate new technologies most effectively.

“We’ve got the talent, the resources and the will,” James concludes, “but we need to align them with the realities of modern warfare.”

As for the financial angle to this story: “Everyone saw what $300 RPGs and $5,000 drones did to Israel’s $1 billion wall and $5 million tanks,” says nanotechnologist and entrepreneur Moshik Cohen.

“This could be a chance for true disruption by innovative defense startups.”

![]() [Update] The “R” Word

[Update] The “R” Word

“Are we, or aren’t we, in a recession?” asks editor Sean Ring this morning at the Morning Reckoning. Sean’s answer: “Yes, since March.” And here’s why…

“Are we, or aren’t we, in a recession?” asks editor Sean Ring this morning at the Morning Reckoning. Sean’s answer: “Yes, since March.” And here’s why…

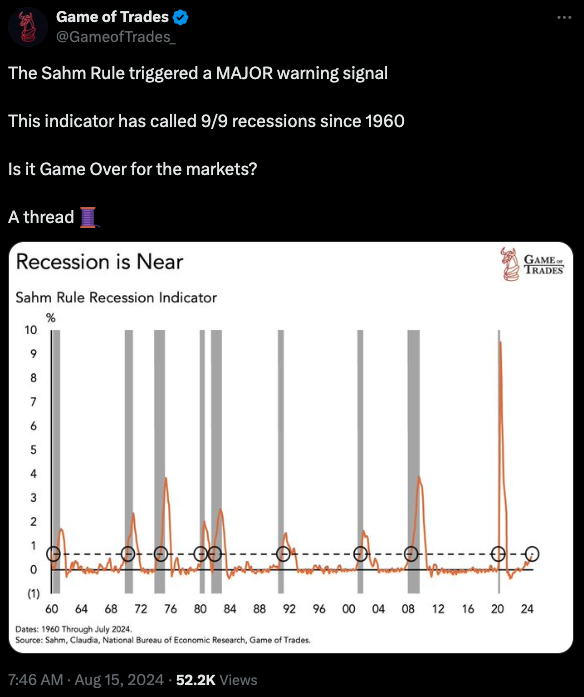

It all goes back to the Sahm Rule Recession Indicator. As Dave explained it in layman’s terms in our Aug. 5 “manic Monday” issue:

“Take a look at the three-month moving average of the unemployment rate. Anytime this number is more than a half percentage point above the lowest three-month moving average from the previous year, a recession soon follows,” says Dave.

“Or at least, a recession has followed every time going back to 1970.” Or 1960?

“Right now,” Sean says, “the unemployment rate is above Sahm’s 0.50 threshold” — by one measure, it has been since March 2024. “Either way, the indicator says we’re in a recession.”

What does this mean for the stock market? “Generally, we need three things to happen for the market to crash,” Sean says:

What does this mean for the stock market? “Generally, we need three things to happen for the market to crash,” Sean says:

- Initial jobless claims rising over time

- The inverted yield curve (short rates > long rates) steepens but then returns to normal

- And rising oil prices.

“Only two of those three are happening right now,” says Sean. “If we have increasing initial claims” — check — “a yield curve ‘un-inversion’” — check — “and an oil price rally” — uncheck — “we will be smacked in the head with a market crash.

“The recession has already begun. Most people can feel it. Some ignore it,” says Sean. “As for the market crash, it’s not imminent, and we may never get it.

“Unless and until oil prices start to rise, we should be reasonably fine in equities for the time being.”

In light of which, oil is up 1.80% — or a little over $78 for a barrel of WTI. As for the other commodities we track, gold is up 0.50% to $2,493.60 per ounce while silver is up 4%... but still well under $30.

In light of which, oil is up 1.80% — or a little over $78 for a barrel of WTI. As for the other commodities we track, gold is up 0.50% to $2,493.60 per ounce while silver is up 4%... but still well under $30.

Turning our attention to stocks, the tech-loving Nasdaq has gained 2% to 17,550. At the same time, the S&P 500 and Dow are both up over 1% to 5,530 and 40,475 respectively.

- Walmart beat quarterly earnings, reporting $169.3 billion in revenue, surpassing the consensus forecast of $168.6 billion. It’s a strong performance for the first half of the year, but the report cautions about the second half. Of course, as the largest U.S. retailer, all eyes are on Walmart to track consumer trends. “Americans are still shopping,” says CNN. “They’re just going to Walmart.”

The crypto market is of two minds today. Flagship crypto Bitcoin is up about 0.50%, but still under $60K. Meanwhile, Ethereum’s down 0.50% to $2,650.

![]() Gimme a Break

Gimme a Break

“The Myth of August,”is that “the whole world takes a break,” says Paradigm’s macro expert Jim Rickards.

“The Myth of August,”is that “the whole world takes a break,” says Paradigm’s macro expert Jim Rickards.

“Part of the myth is true,” he says. “August really is a popular time for vacation… From there, it’s a short stretch to say that if everyone’s on vacation, then nothing important can happen.

“The idea that nothing happens when everyone’s on break is not true,” Jim says. “August has always been a history-making month with or without vacations,” he notes. “August 2024 is no exception…

“We’ve already had our share of big-ticket surprises, including [the] digital nomination of Harris/Walz for the Democratic ticket [before] the benefit of an actual convention. The Democratic National Committee simply changed their rules to allow a digital roll call vote.

“Of course, the wars in Ukraine and Gaza continue to escalate toward a nuclear confrontation without much attention from the U.S. press,” Jim says. Of less significance than all-out nuclear conflict, but still worth mentioning, the market’s “manic Monday” on Aug. 5.

“The fact is August is a month full of wars, terrorism, market crashes, natural disasters and other earth-shaking events. The Myth of August is not about people taking vacations (they do), but about history taking a time out,” Jim warns.

“August is not a time to let down your guard.” Word. We’ll have more on the topic tomorrow…

![]() Renewable Energy Hits a Milestone*

Renewable Energy Hits a Milestone*

“Wind and solar generated more power than coal through the first seven months of the year, federal data shows, in a first for renewable resources,” says an article at E&E News.

“Wind and solar generated more power than coal through the first seven months of the year, federal data shows, in a first for renewable resources,” says an article at E&E News.

While coal typically experiences a seasonal dip in spring and rebounds during summer's peak demand, recent data indicates wind and solar maintained their lead even through July's high temperatures

Utility-scale solar facilities experienced significant growth, generating 118 terawatt-hours through July, marking a 36% increase compared to last year. Wind energy also saw an uptick, producing 275 TWh, an 8% increase from 2023.

“The pair accounted for 16% of U.S. power generation through July, slightly more than coal’s share of the power generation market,” the article adds.

But there’s a major asterisk in the discussion regarding the role renewable energy plays in U.S. power generation.

But there’s a major asterisk in the discussion regarding the role renewable energy plays in U.S. power generation.

“Mark Repsher, an analyst who tracks the power industry at PA Consulting Group, said the figures point to larger challenges facing the power grid.

“Additional power plants that can be turned on at the flip of a switch will be needed to meet demand, he said. The question is whether it will come from natural gas or zero-carbon resources, such as nuclear or geothermal.” [Emphasis mine.]

Which is where the term “baseload power” is going to come into popular usage — that's the infrastructure that always needs to be on so the grid doesn’t collapse.

Renewables, for instance, don’t qualify. Fossil fuels and nuclear power do.

Which is why this conclusion to the article is more than just an afterthought: “[Coal] plant retirements are on track to hit their lowest level in 13 years.”

![]() License to… Work?

License to… Work?

“One in Every Five Jobs Requires Government Permission,” says a Reason headline.

“One in Every Five Jobs Requires Government Permission,” says a Reason headline.

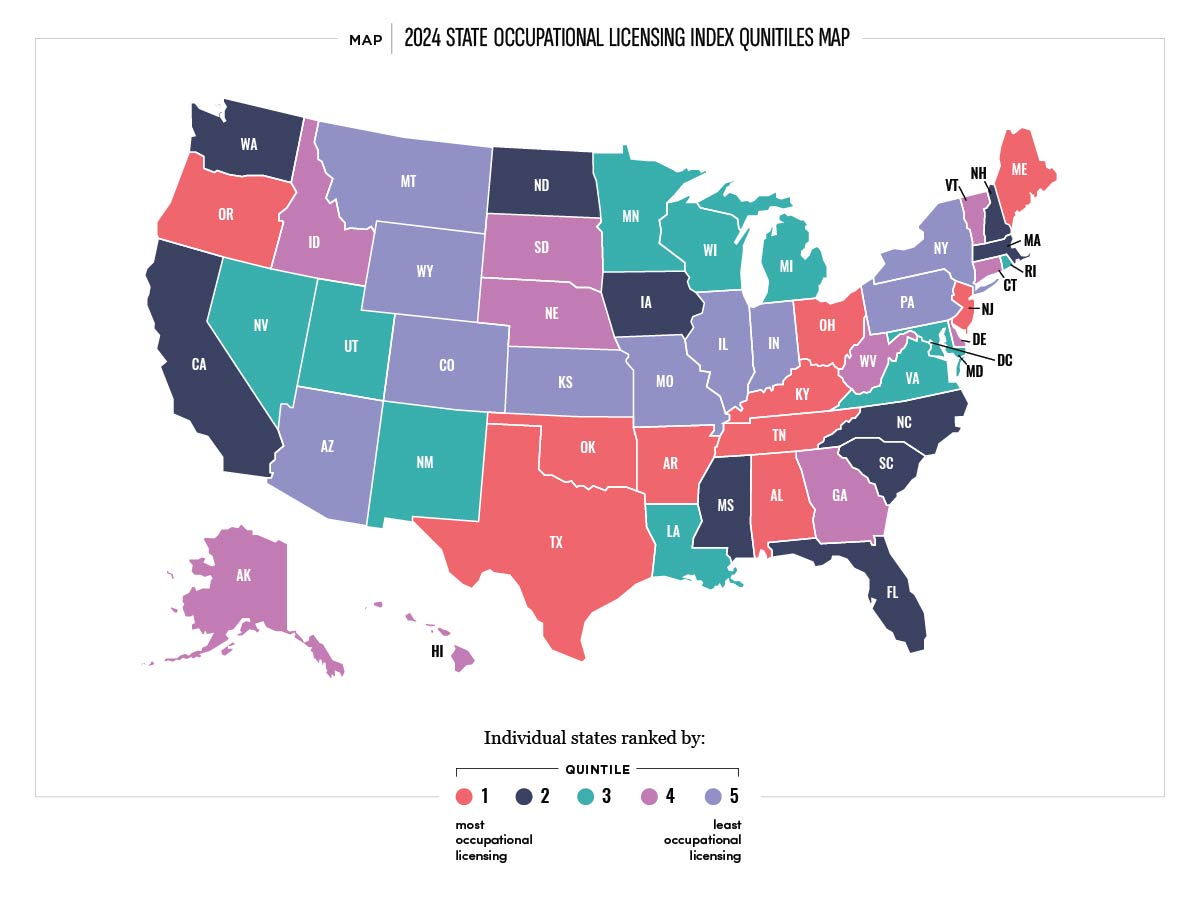

That’s according to data from Archbridge Institute’s State Occupational Licensing Index which includes license requirements for 284 occupations in 2024. Thus, here’s the lay of the land this year…

“In 2024, the state with the highest occupational licensing burden is Texas (No. 1), followed by Arkansas (No. 2), Tennessee (No. 3), Oregon (No. 4), and Alabama (No. 5),” the Archwell Institute says.

“The state with the lowest occupational licensing burden is Kansas (No. 51), preceded by Missouri (No. 50), Wyoming (No. 49), Indiana (No. 48), and New York (No. 47).” [For our eagle-eyed readers, 51st place Kansas results from the inclusion of Washington D.C. (No. 44) in the index.]

You might notice how the demand for professional licenses doesn’t fall neatly into red state/blue state categories. Likewise, this snippet of an Obama-era report circa 2015 seems to openly defy the spirit of big government overreach…

“There is evidence that licensing requirements raise the price of goods and services, restrict employment opportunities and make it more difficult for workers to take their skills across state lines.”

All that to say a little goes a long way.

Take care, reader, and join us again tomorrow!