12 Days to Dollar Demolition Summit

![]() Dollar Demolition Summit

Dollar Demolition Summit

The media is ignoring it, but a global summit gets underway in 12 more days — and the future of the dollar is at the top of the agenda.

The media is ignoring it, but a global summit gets underway in 12 more days — and the future of the dollar is at the top of the agenda.

Leaders of the BRICS constellation of nations gather for their annual meeting in Kazan, Russia from Oct. 22–24. Member nations now include the original four of Brazil, Russia, India and China… the later addition of South Africa… and this year’s entrants of Iran, the United Arab Emirates, Ethiopia and Egypt.

For months it’s been an open secret that the BRICS will take the wraps off a common currency — and that it will likely have a 40% gold backing.

Over time, it would pose the first credible threat to the U.S. dollar’s status as the globe’s reserve currency.

The economic heft of the combined BRICS membership is formidable.

The economic heft of the combined BRICS membership is formidable.

“Russia, UAE and Iran make BRICS an oil output heavyweight,” says Paradigm’s macroeconomics maven Jim Rickards. “Russia, China and South Africa are among the world’s largest gold producers. India and China alone have a combined population of 2.8 billion or 35% of the entire population of the globe.”

The BRICS have built up a financial structure parallel to the Western one dominated by the United States…

- “In 2014,” says Jim, “the BRICS created the New Development Bank (NDB), which functions along the lines of the World Bank to promote infrastructure development in emerging economies.

- “In 2015, the BRICS established the Contingent Reserve Arrangement (CRA), which acts as a swing lender to members experiencing temporary balance of payments difficulties. In this regard, the CRA functions somewhat like the International Monetary Fund.”

All told, “the BRICS are part of an emerging Global South that is challenging the Collective West for world economic and geopolitical dominance.”

![]() The Golden Bridge to a BRICS Currency

The Golden Bridge to a BRICS Currency

But what kind of threat does a BRICS currency pose to the dollar, really?

But what kind of threat does a BRICS currency pose to the dollar, really?

“The starting point is to distinguish between a payment currency and a reserve currency,” says Jim.

“A payment currency is used to settle purchases and sales of tradable goods and services. A reserve currency is the denomination of the currency in which national savings are invested, typically in U.S. Treasury securities or gold…

“The BRICS currency is very far along in establishing itself as a viable payment currency. The prerequisites are: agreed-upon value (which can be fixed to another currency, floating or pegged to a weight of gold), secure payments channels (basically high-speed, encrypted digital pipes for authenticated message traffic), digital ledgers, and an agreed issuer (the NDB based in Shanghai may be suitable for this purpose but another institution could be created).

“The single most important element is a sufficiently large membership in the BRICS currency union such that a recipient of BRICS payments can use them for purchases in many jurisdictions for many goods and services…

“Beyond the nine current members, there is a waiting list of over 20 aspiring members including economic powers such as Nigeria, Venezuela, Indonesia, Malaysia, Turkey, Thailand and Vietnam.”

A reserve currency is harder to pull off — and will take more time.

A reserve currency is harder to pull off — and will take more time.

“The prerequisite here is a large, liquid bond market,” Jim goes on. “That bond market has to be surrounded by extensive transactional and legal infrastructure including: securities at all maturities (30 days to 30 years), an underwriting system (primary dealers in the U.S.), an auction system for sales of new issues, a repo market to finance inventories, futures, options, other derivatives (swaps), settlement channels, custodians (DTCC, others), etc.

“Above all, holders need a good rule-of-law regime on which to rely in the case of disputes or defaults. All of these elements exist in the reserve currency bond market nonpareil - the U.S. Treasury securities market. None of it exists in the form of a putative BRICS bond market.”

But… as we’ve chronicled since early 2022… the U.S. government is squandering that rule-of-law advantage.

But… as we’ve chronicled since early 2022… the U.S. government is squandering that rule-of-law advantage.

Hopefully you know the story by now: Russia invaded Ukraine and Washington responded with unprecedented sanctions — freezing the dollar-based assets of Russia’s central bank, including U.S. Treasuries.

“Given this rogue behavior by the U.S.,” says Jim, “countries are becoming more cautious about large U.S. Treasury note reserves.”

It is no coincidence that gold has jumped from $1,800 an ounce in early 2022 to over $2,600 now.

“Central banks have been net buyers of gold since 2010,” Jim reminds us, “but the tempo of gold buying has increased as the U.S. rule of law begins to crumble. Gold is a physical non-digital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

The BRICS currency won’t supplant the dollar as the globe’s reserve currency right away — but gold will serve as a bridge on the way to that destination.

As a reminder, the broad stock market is up strongly this year — but gold is up even stronger. And during the nasty bear market in stocks during 2022, gold held its own. Jim says you’re missing out if you don’t have a 10% allocation in your portfolio to gold.

[Editor’s note: This week only, we’re opening up the weekly Rickards Uncensored livestream to all Paradigm Press readers, not just Rickards Uncensored subscribers.

With the election less than four weeks away, Jim will put on his pundit hat. He wears it with the credibility of correctly calling the twin shocks of 2016 — Brexit in the U.K. and Trump in the U.S. He also forecast a year ago that Joe Biden would drop out of the race.

While Jim says the latest polling data shows Trump pulling ahead, he says the reason for this shift will shock you.

Jim’s FREE briefing gets underway at 10:00 a.m. EDT tomorrow. We’ll send you an email with a link shortly beforehand, so watch your inbox.]

![]() The Truth About Inflation

The Truth About Inflation

The official inflation rate continues trending down — just not as fast as Wall Street economists thought.

The official inflation rate continues trending down — just not as fast as Wall Street economists thought.

The Labor Department issued the September consumer price index this morning and it came in at 2.4% year-over-year.

On the one hand, that’s the lowest since early 2021. On the other hand, the “expert consensus” of economists figured on 2.3%. On the other-other hand, the trend has been down for six-straight months after a long period of moving sideways, stuck above the 3% level.

If the numbers don’t square with your cost of living, that’s because of how the statisticians have monkeyed with the numbers for decades now. To recap…

- Hedonic adjustments. If the price of a new car goes up, but the manufacturers add new features to the new models, well then the price of a new car hasn’t really gone up, has it?

- Substitution. If you start buying hamburger because steak is too expensive, well, your price of beef hasn’t really gone up, has it?

Revolting, this statistical sleight-of-hand, but it is what it is.

We’ll also remind you that while the Federal Reserve has a target inflation rate of 2%, history demonstrates it won’t get there until the end of this decade or even later. A return to 3% or even 5% or higher inflation is much more likely before we return to the kind of milder inflation we experienced during the 2010s.

In any event… today’s numbers don’t meaningfully alter the outlook for the next Fed meeting: Checking the futures market this morning, there’s an 87% probability the Fed will cut the fed funds rate a quarter-percentage point on Nov. 7. At least for now, there will be no repeat of last month’s half-point cut.

With the release of the September inflation numbers, the Social Security cost-of-living adjustment has been set for 2025.

With the release of the September inflation numbers, the Social Security cost-of-living adjustment has been set for 2025.

It’s a paltry 2.4% — which compares with 3.2% this year… 8.7% in 2023… and 5.9% in 2022.

The Social Security Administration says the 2025 bump will translate to an extra $50 a month for a typical recipient. Yeah, don’t spend it all in one place.

If the increase doesn’t jibe with your cost of living, well, that’s the idea. The Social Security reforms of the early 1980s included changes to the way the inflation rate is calculated. (See above.) The reformers, led by future Federal Reserve chair Alan Greenspan, were explicit about their aim — to keep a lid on Social Security cost-of-living increases.

And it’s not just Social Security recipients getting hosed next year: If you’re still in the workforce, the threshold at which Social Security taxes are no longer collected on your income rises from $168,600 to $176,100 — a 4.4% increase.

There’s no noticeable reaction in the markets to the slight upside surprise on inflation.

There’s no noticeable reaction in the markets to the slight upside surprise on inflation.

The major U.S. stock averages are in the red, but not by much: At 5,778, the S&P 500 is a quarter-percent off its latest record close notched yesterday.

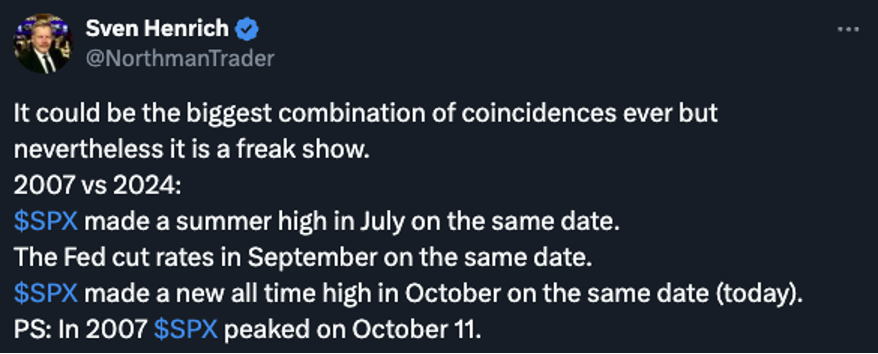

And speaking of that S&P record, here’s something interesting posted on X yesterday…

Key point: That October 2007 peak at 1,576 was as good as it got going into the 2008 financial crisis. The S&P wouldn’t reclaim that level until the spring of 2013.

No, that’s not a guarantee of a market meltdown next year, but the parallels are a little spooky, no?

Precious metals are in the green — gold at $2,622 and silver at $30.77. But Bitcoin is struggling at just over $60,500. Crude is up over 2% and back within a few pennies of $75.

![]() Reality Show Star by Day, Data Broker by Night

Reality Show Star by Day, Data Broker by Night

The company that allowed hackers to steal 2.7 billion data records with Social Security numbers has filed for bankruptcy.

The company that allowed hackers to steal 2.7 billion data records with Social Security numbers has filed for bankruptcy.

You might remember this one from August — an outfit called National Public Data, providing background checks for corporate clients and being sloppy with its security. And if you don’t remember the case you should get on the stick and freeze your credit file with all three of the credit reporting agencies. Details in our initial write-up here.

Once you take care of that, good luck getting recompense for your trouble. In its bankruptcy filing, National Public Data says, “The enterprise cannot generate sufficient revenue to address the extensive potential liabilities, not to mention defend the lawsuits and support the investigations. The debtor’s insurance has declined coverage."

If the bankruptcy papers are to be believed, National Public Data is basically one guy named Salvatore Verini — running the business out of his home in south Florida using $5,000 worth of computer gear consisting of two desktops, one laptop and five Dell servers. You can’t make this stuff up.

If the bankruptcy papers are to be believed, National Public Data is basically one guy named Salvatore Verini — running the business out of his home in south Florida using $5,000 worth of computer gear consisting of two desktops, one laptop and five Dell servers. You can’t make this stuff up.

Per the filing, National Public Data is owned by a company called Jerico Pictures — which seems like an odd name for a data broker’s parent firm.

But sure enough, Verini’s role as “producer/showrunner at Jerico Pictures” turns up on the homepage of his personal website…

And he has an IMDb page where we learn that “Sal can recently be see [sic] in the reality show Country Daze (2019) which he is also the executive producer of.” Apparently it ran on a cable channel called FYI.

The fact that a D-list reality-show star can pursue a side hustle as a data broker underscores how the operators in this sector have ample incentive to hoover up as much data as possible — and almost no incentive to protect that data.

"It's a vast, interconnected, opaque industry with hundreds of companies people have never heard of making billions of dollars per year selling your personal data,” says Lena Cohen of the Electronic Frontier Foundation.

“Without strong privacy legislation,” she tells The Register website, “individuals face an uphill battle sorting things out in cases like this."

The mind boggles…

![]() It’s Getting Spicy in the Mailbag

It’s Getting Spicy in the Mailbag

After Tuesday’s edition, a reader inquires: “Why do you state, ‘I can say with certainty it’s not the government steering hurricanes in the direction of 'red' enclaves’?"

After Tuesday’s edition, a reader inquires: “Why do you state, ‘I can say with certainty it’s not the government steering hurricanes in the direction of 'red' enclaves’?"

“Do you have proof? Because if you don't have proof then you cannot say it with ‘certainty.’”

Dave: It’s not up to me to prove a negative, any more than it’s up to me to prove the moon isn’t made of green cheese.

It’s up to the right-wingers to prove their case when they say hurricanes are being “engineered.” To date, their evidence is just as wanting as the left-wingers who say hurricanes are getting bigger/stronger because of “climate change.” A pox on everyone…

Meanwhile, after I took flak all year from anti-Trumpers, pro-Trumpers are making up for lost time…

Meanwhile, after I took flak all year from anti-Trumpers, pro-Trumpers are making up for lost time…

“I was very disappointed in your Bullet No. 5 Tuesday,” a reader writes. “Your obvious bias against Trump was showing.

“You said Trump sent weapons to Ukraine, which is true, but is not the entire context. Those weapons were sold to Ukraine for around $47 million. That is much different than giving them billions like this administration has done and you should have made that clear.

“I thought I could trust all of my subscriptions to publish the unbiased truth without having to fact-check. I don’t care which way your political views lean but this kind of bias should not be sent to subscribers that pay to get the facts, not just part of the facts. If I wanted that I could just watch the news.

“Thanks for considering my concerns.”

Dave: What facts did I get wrong? The amount of weapons sold to Ukraine under Trump relative to Biden is immaterial.

The fact is that he did it and the fact is that those weapons sales fueled the cycle of escalation between Washington and Moscow along with the other factors I cited. (Oh, I forgot, NATO expanded on his watch and he tried to stymie the Nord Stream pipeline, which he brags about to this day.)

Reality doesn’t care about your tribal loyalties. As I said last month to another reader, go read The Gateway Pundit if all you want is to have your biases confirmed. We want readers who can think independently and who don’t fall for the power elite’s divide-and-rule schemes — because independent thought is the only way any of us can build and preserve wealth.

And then there’s this one: “After reading Tuesday’s email, I’m getting the impression you want to vote for Harris.”

And then there’s this one: “After reading Tuesday’s email, I’m getting the impression you want to vote for Harris.”

Dave: Are you trolling me or is your reading comprehension really that poor?

More than once this year, I’ve said there’s no voting our way back to “normal” — however you might define that.

But even more to the point, as Sy Leon said in the subtitle to his 1970s classic None of the Above, the lesser of two evils… is evil.

Over the summer, Richard Maybury — one of the greybeards of the newsletter biz — made a compelling case for voting third-party, especially in close contests.

“The two major parties want desperately to keep their duopoly. The thought that a third party might get enough votes to alter the outcome is terrifying to them…

“Voting for anyone other than a major party candidate does send a message that is noticed. It means you purposely ‘threw away’ your vote on someone who couldn’t win to tell the power junkies they have not gotten away with brainwashing you.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets