63 Banks on the Brink

![]() A Hog, Hieroglyphics and Hobos

A Hog, Hieroglyphics and Hobos

For those who wish to tune in to Apple’s WWDC next week… there’s an app for that.

For those who wish to tune in to Apple’s WWDC next week… there’s an app for that.

Three days ago, Apple updated its Apple Developer app on iPhones and iPads in preparation for its Worldwide Developers Conference (WWDC) which gets underway on Monday, June 10 at 10 a.m. PT (1 p.m. ET).

Source: MacRumors

Apple Developer app icon

“Apple plans to stream the WWDC keynote event in the Apple Developer app,” says MacRumors, “as well as [other] developer sessions that are set to come out throughout the week.”

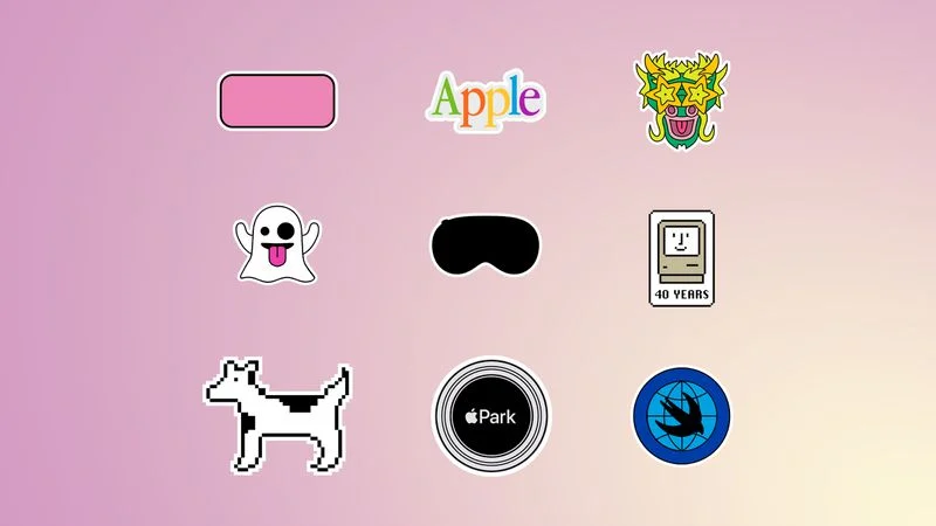

As with every pre-WWDC update, Apple also introduced some new “stickers” — essentially, digital clip art — “many of which are animated, [and] can be used in iMessage, FaceTime and other apps,” MacRumors says.

One of the nine new stickers, in fact, caught my attention. It celebrates a 40-year-old icon. And I mean that literally…

So how exactly does a metal sculpture of a life-size razorback hog figure into Apple’s origin story?

So how exactly does a metal sculpture of a life-size razorback hog figure into Apple’s origin story?

That’s the project Palo Alto-based artist Susan Kare was welding for a museum in Hot Springs, Arkansas when she got a call from a high-school pal in 1982.

As it happens, Kare’s friend worked for the Macintosh team at Apple. Would Kare be interested in doing graphic design for the relative startup?

Two years later, the outcome of the Kare-Apple partnership would be, for one, the smiling “Happy Mac” icon that turns 40-years old this year…

Source: MacRumors

“Happy Mac” sticker (middle row, far right)

“One of the stated goals for the Macintosh project was that the computer should be friendly and appeal to non-technical users,” Kare told Quartz in 2019.

“A smile just seemed like a good way to infuse a positive spin on the icon of the computer.”

And it wasn’t just any computer…

Apple’s 1984 Macintosh was a personal computer — something that would be stationed in family rooms and home offices across the country. Not that Apple was the first company to introduce a PC…

Apple’s 1984 Macintosh was a personal computer — something that would be stationed in family rooms and home offices across the country. Not that Apple was the first company to introduce a PC…

Among the first mainstream PCs, for instance, IBM launched its PC 5150 in 1981.

“It was deliberately drab-black, gray and low-key,” PCWorld notes. And its design conveyed a message — “a serious computer for serious business.”

On the other hand, Susan Kare’s suite of punchy icons made Apple’s Macintosh seem accessible and user-friendly.

Plus, Kare’s icons were “derivative” in the best sense of the word, drawing inspiration from sources including ancient hieroglyphics, Swedish campgrounds and Depression-era hobo symbology.

Thus, derivative isn’t always a putdown. In fact…

Apple built one of the biggest tech businesses in the world by doing something exceptional — taking a wait-and-see approach.

Apple built one of the biggest tech businesses in the world by doing something exceptional — taking a wait-and-see approach.

Back to IBM: The company released the first smartphone in 1994. Apple waited, watched and learned. IBM’s phone failed… Thirteen years later, Apple released a better one.

How about the Sony Walkman? It was one of the first portable audio players. Twenty-two years after its release, Apple dropped the iPod, making the Walkman a relic.

Apple’s latest target? Artificial Intelligence.

Microsoft has ChatGPT. Google has Gemini. Apple has yet to make its own AI footprint.

Starting next week, however, Apple is scheduled to release its first-ever AI product… which, like Kare’s “Happy Mac” icon, is 40 years in the making.

For the rest of the story, with one click, you can reserve a spot for “Apple’s 10X Prediction” briefing with Paradigm’s AI expert James Altucher — an icon in his own right.

Mark your calendar today: This live event is scheduled for Thursday, June 6 at 7:15 p.m. (ET).

While the event is absolutely free, space is limited. Click here now to save your spot.

![]() Big Data Bursts Stock Market’s Bubble?

Big Data Bursts Stock Market’s Bubble?

“This seems significant,” deadpanned Paradigm’s trading pro Greg “Gunner” Guenthner in our editorial instant-messaging channel yesterday…

“This seems significant,” deadpanned Paradigm’s trading pro Greg “Gunner” Guenthner in our editorial instant-messaging channel yesterday…

Holy-overstated-job-growth!

If nothing else, this narrative would support Paradigm editor Sean Ring’s extremely out-of-the-box prediction that the FOMC will cut rates, just once this year, in June — a prediction he made during last week’s rollicking Whiskey Bar panel at The Watergate Hotel.

With the next FOMC meeting exactly one week away… and May job numbers out Friday… things could get interesting.

And, ordinarily, we’d pay no nevermind to the data points out today, but…

“We’re running smack into some big data days this week,” Gunner adds, including today’s ADP Employment and ISM non-manufacturing index.

Private payrolls? At 152,000 in May, that’s way below the 175,000 forecast. On the other hand, the ISM non-manufacturing index was higher than expected: up to 47.1 in May from April’s 45.9 reading.

“I suspect the averages could be running out of steam here and headed for some choppier action,” Gunner says. “Even CNBC is openly wondering how long the market can maintain its ‘bad news is good news’ attitude.”

By and large, the market continues to maintain its feel-good narrative today.

By and large, the market continues to maintain its feel-good narrative today.

The tech-loving Nasdaq, for instance, is up 1.35% to 17,085. This as Nasdaq-listed Nvidia shares crested a record-high $1,199 ahead of the company’s 10-for-one stock split scheduled Monday. At the same time, the S&P 500 bumped up 0.65% to 5,325 while the Big Board is treading water at 38,725.

Commodities, too, are in the green. Crude’s up 0.55% to $73.66 for a barrel of West Texas Intermediate. Gold and silver are both catching bids: The yellow metal is up 1.10% to $2,374 per ounce. The white metal? Up 1.65% to $30.10.

Plus, the crypto market is rallying. Bitcoin is up almost 2%, soaring past $71,000 while Ethereum is 0.45% to $3,810.

Back to Gunner: “If we see soft data,” — especially Friday’s jobs number — “will the market’s worries flip from higher rates to the possibility of an economic downturn?

“Sounds like the perfect topic to fill the 24-hour news airwaves,” he concludes. “Expect more of this talk as summer approaches.”

![]() The Bank Crisis Is Not Over

The Bank Crisis Is Not Over

The last time we touched on the bank crisis in a substantive way in April, we warned of 13 on-the-brink banks. That number increased by 50.

The last time we touched on the bank crisis in a substantive way in April, we warned of 13 on-the-brink banks. That number increased by 50.

According to Q1 data from the Federal Deposit Insurance Corporation (FDIC) this year, there are now 63 at-risk banks.

“Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter,” says the FDIC Quarterly Banking Profile.

“Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase.

“This is the ninth-straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first-quarter 2022,” the FDIC says.

The banking crisis, if you recall, exploded in March last year with the collapse of Silvergate Bank, Silicon Valley Bank (SVB) and, scant days later, Signature Bank.

This year, regulators shuttered Philadelphia-based Republic First Bank with Fulton Bank assuming operations at 32 branches.

While Team Biden and the Federal Reserve claim “resilience” in the U.S. banking system, the FDIC data tells a different story. A true story.

Since March 2023, Paradigm’s macro expert Jim Rickards has maintained any lull in the bank crisis is simply a sort of “halftime” in what will eventually “erupt in even more dramatic fashion.”

How can you prepare? Read on…

![]() An Ounce of Prevention

An Ounce of Prevention

“Preventing failure is more valuable than dealing with failure after the fact,” Jim Rickards warns. “I would advise governments to buy gold bullion,” he adds.

“Preventing failure is more valuable than dealing with failure after the fact,” Jim Rickards warns. “I would advise governments to buy gold bullion,” he adds.

“This does not mean a return to a gold standard, but it would be a prudent diversification of reserve positions and would help to support confidence in sovereign currencies and associated bond markets.

“Individuals can do the same,” Jim encourages.

He’s long advocated that 10% of individual portfolios be allocated to precious metals…

“You can go on your own private gold standard,” Jim says, “just by converting some of your cash into gold bullion (coins or bars). That way, you will be hedged to a great extent.”

[Since you’re here: Access the world’s most popular whole bars and coins — at the best possible prices — with Hard Assets Alliance. It’s a powerful online marketplace that uses an easy-to-navigate platform. Click here to get started today.]

![]() A U.K. Power Washer Gets Hosed

A U.K. Power Washer Gets Hosed

A British entrepreneur got a cease-and-desist letter from a multibillion-dollar airline conglomerate. At issue? The name of his power-washing business.

A British entrepreneur got a cease-and-desist letter from a multibillion-dollar airline conglomerate. At issue? The name of his power-washing business.

Forty-three-year old father Jozsef Spekker, who lives in Staffordshire, England, has owned and operated EasyJetwash for three years now.

He’s a one-man show, charging about £100 (or $127.60) to power wash patios, decks, driveways and more.

Recently, Mr. Spekker received a nastygram from easyGroup, parent company of budget airline easyJet, “ordering him to rebrand his business or face a costly legal battle,” says an article at The Daily Mirror.

“It's mainly the word ‘easy’ which is the problem,” Spekker says. “They explained how my branding was very harmful for their business.”

So let me get this straight: A $4.6 billion Goliath is going after… a bloke with a pressure washer?

Not only that, Sir Goliath himself — easyJet founder Sir Stelios Haji-Ioannou — claims: “Mr. Spekker is one of the most calculating and profiteering brand thieves I have come across in the 30 years I have been doing this job.”

What a (Sir) knob.

Meanwhile, Mr. Spekker confesses: “I am totally scared… I can't fight them in the court,” he says. “Just a few weeks ago I paid off £800 on my credit card and I have no savings.”

As if being a small-business owner weren’t hard enough… Godspeed, Mr. Spekker.

Same to you, reader! And join us for another 5 Bullets episode tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets