A Two-Front World War?

- So now we’re gonna take on both Russia AND Iran?

- The BRICS 11s’ long game

- Hot take from the whiskey bar

- A Rude prediction: U.S. military defeat

- Precious metals in a pinch (No one said it would be easy

![]() So Now We’re Gonna Take on Both Russia AND Iran?

So Now We’re Gonna Take on Both Russia AND Iran?

After getting crushed last week, the price of oil is rebounding sharply this morning — and not because of a war between Israel and Hamas.

After getting crushed last week, the price of oil is rebounding sharply this morning — and not because of a war between Israel and Hamas.

After all, there’s no oil to speak of in the Levant. No, the reason a barrel of West Texas Intermediate is up nearly four bucks this morning to $86.45 is the possibility of a war between the United States and Iran.

This morning’s Wall Street Journal has a front-page story quoting a Hamas official as saying Iranian security officials helped plan the attacks in Israel during a meeting a week ago today.

Others are more cautious, like the Israeli reporter Barak Ravid, working these days at Axios: “Just because someone in Hamas said something to The Wall Street Journal doesn’t mean it’s true,” he tweeted in Hebrew. “I recommend being a bit reserved when reporting this and not presenting things as fact.”

Still other journalists are questioning the credentials of the Journal’s lead reporter on the article…

But the War Party in D.C. is throwing caution to the wind: “Israel and the United States should go after the Iranian oil refineries and oil infrastructure,” howls Sen. Lindsey Graham (R-South Carolina).

But the War Party in D.C. is throwing caution to the wind: “Israel and the United States should go after the Iranian oil refineries and oil infrastructure,” howls Sen. Lindsey Graham (R-South Carolina).

The Democrats and RINO Republicans are already furious at Tehran for supplying drones to Russia for the war in Ukraine. You can just imagine Joe Biden’s speechwriters trying to come up with a new version of George W. Bush’s “Axis of Evil.”

Meanwhile, the America First faction of Republicans — skeptical about the wisdom of U.S. intervention in Ukraine — have lost their bearings. After a two-year layoff, they’re ready to resume America’s forever wars in the Middle East…

You can see it now: The bloc that took down House Speaker Kevin McCarthy last week goes all-in on $100 billion in new aid for Ukraine — in exchange for expanded aid to Israel and/or some sort of action against Iran.

It’ll be one giant bipartisan kumbaya for national bankruptcy and Armageddon.

Anyway, this is your occasional reminder that any retaliation against Tehran — even if it doesn’t target oil infrastructure — jeopardizes the transit of crude through the Strait of Hormuz.

Anyway, this is your occasional reminder that any retaliation against Tehran — even if it doesn’t target oil infrastructure — jeopardizes the transit of crude through the Strait of Hormuz.

That’s the slender waterway connecting the Persian Gulf to the Gulf of Oman and the Arabian Sea.

And so you have your jump in oil this morning. Precious metals are also benefiting from the flight to safety, gold up nearly $18 to $1,850 and silver adding 18 cents to $21.77.

The major stock indexes are selling off, though not dramatically — the S&P 500 off about a third of a percent and back below 4,300. It being a federal holiday, the bond market is closed.

There’s a bunch more we could say about the Middle East situation today, but colleague Sean Ring ended up saying much of it in today’s Rude Awakening. (Sean is based in Italy, so he’s got a six-hour jump on your editor!) Just two more closing thoughts…

- Given Israel’s control of Gaza’s borders, airspace and ports… and given Israel’s vaunted surveillance systems… how did they miss an attack of this scale?

- How’s that strict gun control they’ve got in Israel working out?

![]() The BRICS 11’s Long Game

The BRICS 11’s Long Game

As it happens, Russia is a founding member and Iran one of the new arrivals in the BRICS grouping of nations.

As it happens, Russia is a founding member and Iran one of the new arrivals in the BRICS grouping of nations.

The expanded BRICS+6 lineup will consist of Brazil, Russia, India, China and South Africa — plus, as of New Year’s Day, Iran, Saudi Arabia, the United Arab Emirates, Ethiopia, Egypt and Argentina.

This constellation includes two of the top three oil producers and six of the top 10 — comprising 43% of global oil production.

And the BRICS were the focus of Jim Rickards’ talk last week at our Paradigm Shift Summit in Las Vegas.

While the BRICS did not announce plans for a new currency at their conference last August, “it was a turning point nonetheless,” said Jim.

Mainstream economists like Paul Krugman and Joseph Stiglitz pooh-poohed the event, but Jim says there’s no denying that additional countries are knocking at the BRICS’ door in response to Washington’s weaponization of the U.S. dollar. Freezing the U.S. Treasury debt held by the Russian central bank in 2022 amounted to “a selective default” by the U.S. government.

Jim also cited his confidential sources as saying that plans are to convert those funds for Ukrainian reconstruction. Yeah, that’ll shore up global confidence in Washington’s intentions!

The lack of an announcement notwithstanding, BRICS member nations will move in the direction of a gold-backed currency for cross-border payments.

The lack of an announcement notwithstanding, BRICS member nations will move in the direction of a gold-backed currency for cross-border payments.

Jim was careful to point out there will be no new gold standard, nor will this currency will be a “petroyuan” or “petroruble,” as many internet screamers insist.

Nor will it even spell the end of the dollar. “In fact, the continued existence of a U.S. dollar- denominated gold market is the essential ingredient in the creation of a [BRICS currency] measured in weight of gold. In effect, the BRICS currency will hitch a free ride on the existing dollar/gold market.”

But as other countries seek to get out from under the dollar’s thumb, dollar trade will continue to erode and gold will increasingly become the global go-to asset.

![]() A Rude Prediction: U.S. Military Defeat

A Rude Prediction: U.S. Military Defeat

The beating war drums in the Middle East serve to highlight one of Rude Awakening editor Sean Ring’s “5 Rude Predictions” unleashed at last week’s summit.

The beating war drums in the Middle East serve to highlight one of Rude Awakening editor Sean Ring’s “5 Rude Predictions” unleashed at last week’s summit.

And it’s a provocative one indeed: “The U.S. military-industrial complex suffers enormous losses: Defense stocks plummet, the U.S. retreats.”

To be sure, it’s not a confrontation with Iran he had in mind — although most U.S. war games involving Iran do not end well for the United States — but rather a confrontation with China over Taiwan.

“Taiwan is not defendable,” said Sean — not with 5,500-mile-long supply lines. But representatives of the power elite like Hillary Clinton talk regularly now about how U.S. aid to Ukraine is supposed to somehow “deter” China — or at least “send a message.”

Sean pointed out — as we did a few days ago — that defense stocks have seriously outperformed the broad stock market since the 9/11 attacks. But he says those days will come to an end with any sort of bad outcome for the U.S. military in a “Big Iron” military confrontation.

Still, Sean doesn’t see that as necessarily a bad thing; he would agree with the Yale historian Paul Kennedy about how America has been at risk of “imperial overstretch” for many decades now. On the other side of those losses would come a new more humble America — an America that Sean believes “will get back to things that America is good at,” including manufacturing.

![]() Hot Takes From the Whiskey Bar

Hot Takes From the Whiskey Bar

No conference we hold is complete without the renowned Whiskey Bar.

No conference we hold is complete without the renowned Whiskey Bar.

A reference to our gone-but-not-forgotten e-letter Whiskey and Gunpowder, the Whiskey Bar is the Paradigm Shift Summit’s concluding free-for-all panel discussion in which libations and hot takes flow equally freely.

Begin with Sean Ring’s insistence that the proper spelling is whisky — which given the 12-year-old Glenmorangie in front of him, seemed reasonable. (All else being equal, if it’s from Scotland it’s spelled whisky and if it’s from Ireland or the United States, it’s whiskey.)

On a more serious note, Paradigm income specialist Zach Scheidt said, “The Fed has absolutely failed” with its interest-rate hikes — if the aim was to bring down housing prices. With 80% of outstanding mortgages still sporting a rate of 3.5% or less, and with current mortgage rates over 8%, the housing market is frozen. That will be good for the ITB homebuilder ETF — until rates start coming down and additional supply returns to the market.

On the 2024 election, “Joe Biden will not be the Democrats’ nominee,” averred Jim Rickards. And on the current trajectory, “Trump will be elected but he will be behind bars at the time.” Jim pointed out that constitutionally, there’s nothing to stop Trump from serving under those circumstances.

There were plenty of one-liners and belly laughs along the way — more than I can possibly convey in the written word.

As I said last week, it’s not our plan to sell access to videos of the Paradigm Shift Summit; we want to keep the event as special as possible. That said, keep an eye out toward year-end. We might offer up some of the sessions as a thank-you if you re-up your paid subscription, or as bonus content during the week between Christmas and New Year’s.

![]() Precious Metals in a Pinch (No One Said It Would Be Easy)

Precious Metals in a Pinch (No One Said It Would Be Easy)

A reader submits a worthwhile inquiry about the practical value of precious metals in a situation where a cashless society goes grid-down…

A reader submits a worthwhile inquiry about the practical value of precious metals in a situation where a cashless society goes grid-down…

“The thing I wonder about — going into a grocery store on Day 10 of a power outage with a pocketful of silver — is what under-40 cashier is going to recognize a silver coin (especially if it is not American)? And what store manager is going to OK the transaction?

“They would have to weigh the coin (to within a gram). As some of the silver would be worn away, the silver content of the coin would need to be known, and two sides would have to agree on a value per ounce for the silver.

“Math would be involved, as well as the metric system, and common sense.”

Dave responds: You forgot an additional complicating factor for low-information store help — the $1 face value on a Silver Eagle and $50 on a Gold Eagle.

It says $50 but it’s worth nearly $2,000…

No one said it would be easy. Or seamless. As a practical matter, you’re going to be engaged in something akin to a barter transaction because there will be no universal agreed-upon value for your precious metals. (If they come from the U.S. Mint, that will give them a perceived cachet that generic bars and rounds lack.)

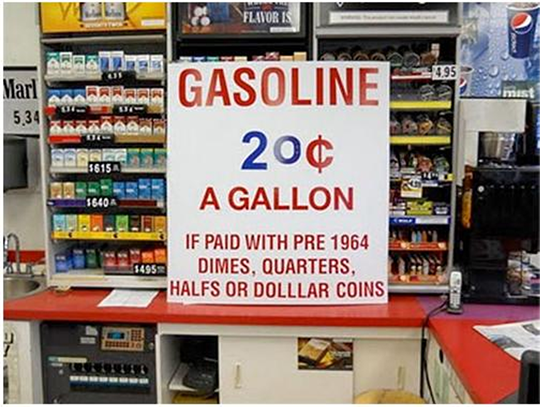

Still, there will be merchants who are more hip to precious metals than others. Your editor recalls a gas station in Oregon making this interesting offer in 2011…

That said, Jim Rickards isn’t altogether keen on junk silver. Nor is he impressed with the gold bars that Costco is selling nowadays — innovative as the concept might prove to be.

“Gold bars are OK as a store of wealth,” Jim told his Strategic Intelligence readers last week, “but they’re impractical for buying goods or barter in emergencies.

“I recommend 1-ounce American Gold Eagles (about $2,500 each) or the quarter-ounce American Gold Eagles (about $700 each). Another good alternative is 1-ounce American Silver Eagles (about $30 each).

“They are much more practical for buying groceries in an emergency.”

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Speaking of precious metals, we’d be remiss not to mention the passing of the legendary gold bug Jim Sinclair.

From a statement released Friday night by the Gold Anti-Trust Action Committee: “James E. Sinclair, long the ‘Mister Gold’ of the United States – an advocate of gold as money, a gold market maker, a gold mining company founder and an internationally known commenter on the markets – died of a heart attack today, his business associate, Bill Holter, confirmed to GATA. He was 82.”

Sinclair did not live to see his forecast of $50,000 gold come to fruition. But along with a few hardy souls like Eric Sprott and our own Jim Rickards, he was ahead of his time in noticing a disparity between the market for “paper gold” instruments like futures… and the market for real hold-in-your-hand physical gold. RIP.