What If the Election Is Undecided on Inauguration Day?

![]() In Case of a “Clear Trump Win,” Break Glass

In Case of a “Clear Trump Win,” Break Glass

The saying goes that “markets hate uncertainty.” Which is worth contemplating one week before an Election Day whose outcome likely won’t be known on election night.

The saying goes that “markets hate uncertainty.” Which is worth contemplating one week before an Election Day whose outcome likely won’t be known on election night.

On election night 2016, Dow futures plunged 750 points — a huge number back then — when it looked as if the outcome was in doubt.

It was only after Hillary Clinton grudgingly made it known she wouldn’t contest the outcome that markets rebounded. The Dow ended the day up 257 points.

How about 2020? The election was held on Tuesday, Nov. 3. It wasn’t until Saturday, Nov. 7 that it was evident Joe Biden would win Pennsylvania and thus the presidency.

Despite the uncertainty, the S&P 500 rose 6% from Monday’s close to Friday’s close.

So what gives? Wall Street rallied because on election night it was already evident that control of Congress would be divided — no matter who won the presidency. All else being equal, Mr. Market likes gridlock.

(In the end, the joke was on Mr. Market — when Democrats took both of Georgia’s Senate seats in a January runoff and Vice President Harris became the 50-50 tiebreaker.)

So what about 2024? Well, you don’t have to look far for mainstream analysis of how Donald Trump might contest the outcome after Election Day. We’ll leave it to others to argue how realistic or fanciful those scenarios might be.

As always, we prefer to take on the story no one else is telling: What might Democrats do to contest the outcome after Election Day?

We don’t have to speculate here: We already know from the cards the Democrats laid on the table in 2020.

We don’t have to speculate here: We already know from the cards the Democrats laid on the table in 2020.

As The Boston Globe reported, on June 12 of that year nearly 80 “political operatives, former government and military officials and academics quietly convened online for what became a disturbing exercise in the fragility of American democracy.”

The gathering was organized by something called the Transition Integrity Project. According to TIP’s mission statement, it was “launched in late 2019 out of concern that the Trump administration may seek to manipulate, ignore, undermine or disrupt the 2020 presidential election and transition process.”

To this day, the names of many TIP participants remain unknown. But not all…

“All of our scenarios ended in both street-level violence and political impasse,” said Rosa Brooks, a former Pentagon official who organized the June 12, 2020 exercise.

“All of our scenarios ended in both street-level violence and political impasse,” said Rosa Brooks, a former Pentagon official who organized the June 12, 2020 exercise.

The participants spun up four possible scenarios. Here’s the crude graphic TIP made to accompany its final report…

It was Scenario No. 4 that got the most media publicity. As The Boston Globe article described it, “a narrow Biden win ended with Trump refusing to leave the White House, burning government documents and having to be escorted out by the Secret Service.”

But it was Scenario No. 3 — “clear Trump win” — that startled even many of the participants in this exercise.

But it was Scenario No. 3 — “clear Trump win” — that startled even many of the participants in this exercise.

Playing the part of Joe Biden that day in June 2020 was none other than that ultimate swamp creature John Podesta — Hillary Clinton’s 2016 campaign manager and currently Biden’s “climate czar.”

Under Scenario No. 3, Trump achieves victory in the Electoral College — but Podesta-as-Biden wins the popular vote by a five-point margin and refuses to concede.

He alleges voter suppression. He persuades the Democratic governors of Michigan and Wisconsin to send their own slates of electors to the Electoral College, to counter the electors sent by those states’ Republican legislatures.

Then he encourages California, Oregon and Washington to threaten secession unless congressional Republicans agree to a series of majority-rule “reforms” — granting statehood to the District of Columbia and Puerto Rico, dividing California into five states to boost its representation in the Senate and abolishing the Electoral College.

From TIP’s final report: “One of the most consequential moves was that Team Biden on Jan. 6 provoked a breakdown in the joint session of Congress by getting the House of Representatives to agree to award the presidency to Biden (based on the alternative pro-Biden submissions sent by pro-Biden governors). [Vice President] Pence and the GOP refused to accept this, declaring instead that Trump was reelected under the Constitution because of his Electoral College victory.

“This partisan division remained unresolved because neither side backed down, and Jan. 20 arrived without a single president-elect entitled to be commander in chief after noon that day.

“It was unclear what the military would do in this situation.”

How the markets might react in such a situation is also “unclear.”

![]() Gold: Too Far, Too Fast

Gold: Too Far, Too Fast

If it feels as if the dollar price of gold has risen too far, too fast… Paradigm trading pro and hedge fund veteran Enrique Abeyta says you’re right.

If it feels as if the dollar price of gold has risen too far, too fast… Paradigm trading pro and hedge fund veteran Enrique Abeyta says you’re right.

The Midas metal is up another $24 today, in record territory at $2,765.

Enrique will be the first to acknowledge that “this breakout is happening after a decade-and-a-half period of consolidation. It’s also happening amid renewed concern about U.S. deficits and potential dollar weakness.

“I honestly think gold will move higher from here,” he goes on. “That said, I would NOT buy gold at current levels.”

Understand, he’s saying this with a trader’s mindset. Compared with buy-and-hold investing, “trading involves taking advantage of more tactical moves in a security that span weeks or months. The return may be smaller, but it’s about finding higher-probability bets.”

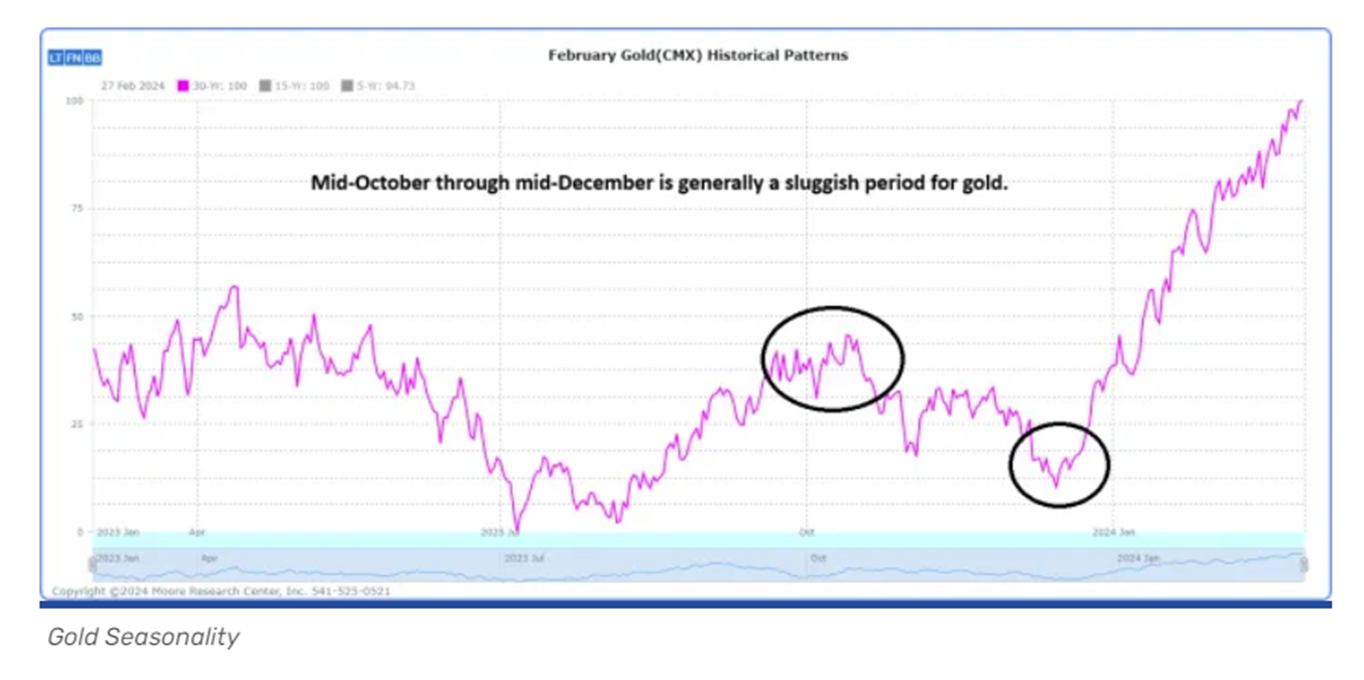

And he doesn’t see the probabilities on gold’s side right now. Among other factors, “check out this chart,” he says, “showing the 30-year historical seasonality of gold.”

“Gold prices usually peak in mid-October,” Enrique says, “trade poorly into year-end, and then rally in the new year.

“Why is this? I suspect it has to do with the historical strength of stocks into year-end, but I don’t know for certain.

“But from 30 years on Wall Street, I know that many money managers are inclined to drive stock prices higher into year-end to juice their paychecks. Gold can be a source of capital to fund these stock purchases.”

Word to the wise. If you want more insights like these, sign up for our new Truth & Trends e-letter where Enrique and chart hound Greg Guenthner give you an edge every trading day. Sign up here and look for new issues Monday–Friday at 8:00 a.m. Eastern.

Lest we overlook silver, it’s up 1.7% and back above $34.

Lest we overlook silver, it’s up 1.7% and back above $34.

Keen observers of the precious metals markets say silver won’t prove itself until it can break over $35. By the same token, the gold stocks represented by the HUI index would have to surpass 350 — and it’s at 333 today.

If Enrique is right that gold is set for a short-term fall, silver and the miners won’t be breaking through just yet. Look for some year-end bargain-hunting opportunities.

With five of the “Magnificent 7” companies reporting their quarterly numbers this week, the major stock indexes are quiet.

With five of the “Magnificent 7” companies reporting their quarterly numbers this week, the major stock indexes are quiet.

At last check, the S&P 500 is up less than a quarter percent at 5,834. The Dow is slightly in the red, the Nasdaq is up a half percent. Google parent Alphabet reports its numbers after the close today.

Stocks are holding their own even as bonds continue tanking — pushing yields higher. The yield on a 10-year Treasury note is up to 4.32%, approaching highs last seen in early July.

Crude is in danger of breaking below $67 a barrel. It’s done that twice in the last two months, but the move didn’t stick either time. If it does this time, we could soon be looking at 18-month lows for crude.

![]() Food Lobbyists Go to War

Food Lobbyists Go to War

Talk about a skewed headline: “Meat Industry Set for Guidelines Fight,” says this morning’s Wall Street Journal.

Talk about a skewed headline: “Meat Industry Set for Guidelines Fight,” says this morning’s Wall Street Journal.

The federal government is in the process of revising its Dietary Guidelines for Americans. Put together by the Department of Agriculture and the Department of Health and Human Services, there’s a new edition every five years.

“A committee of scientists advising the U.S. government on its next round of dietary guidelines has drafted recommendations that would tell Americans to limit how much red meat they eat,” says the Journal. “It is part of an effort to nudge us to eat more plant foods, including beans, peas and lentils.”

Elaborating on that headline, the paper’s framing is that “the meat industry pushed back on the draft recommendations” — in particular, the National Cattlemen’s Beef Association.

That makes it sound as if the cattlemen are the only lobbying organization weighing in. Hardly…

The draft guidelines exhibit “status-quo thinking and the interests of giant ultra-processed multinationals that have long worked to shift people away from natural foods and toward processed junk,” tweets Nina Teicholz. “These companies have captured USDA.”

The draft guidelines exhibit “status-quo thinking and the interests of giant ultra-processed multinationals that have long worked to shift people away from natural foods and toward processed junk,” tweets Nina Teicholz. “These companies have captured USDA.”

Teicholz burst on the scene a decade ago with her book The Big Fat Surprise — challenging the dogma that demonizes saturated fat.

Around the same time, the journal Annals of Internal Medicine published an analysis pulling together decades of previous studies concluding that — contrary to conventional wisdom — saturated fat does not cause heart disease.

But conventional wisdom still carries the day among the scientists advising the government about the guidelines.

“In some cases,” Teicholz wrote yesterday, “corporate and ideological interests are intertwined — such as with one expert committee member who is an ideological vegan, and Beyond Meat underwrites his entire center at Stanford.”

Discouraging, but not surprising. The Dietary Guidelines for Americans have been a joke ever since they were introduced in 1980 at the behest of Sen. George McGovern (D-South Dakota).

Discouraging, but not surprising. The Dietary Guidelines for Americans have been a joke ever since they were introduced in 1980 at the behest of Sen. George McGovern (D-South Dakota).

Makers of processed foods responded by removing fat and substituting sugar. By the early 1990s, Americans were downing entire boxes of “SnackWell’s” cookies in one sitting and thinking it was all good because they were “fat-free.”

The explosion in American obesity more or less coincides with the introduction of the Dietary Guidelines and the jihad against saturated fat.

If Elon Musk is looking for federal projects to eliminate in a Trump administration, scrapping the guidelines would be as good a place to start as any. Presumably RFK Jr. would approve?

(I don’t think Musk is serious about cutting $2 trillion from the federal budget, but that’s a story for another day…)

![]() “Bailouts for Me, but Not for Thee…”

“Bailouts for Me, but Not for Thee…”

If you still operate under the delusion that the United States observes “equality under the law,” you haven’t heard about the First National Bank of Lindsay.

If you still operate under the delusion that the United States observes “equality under the law,” you haven’t heard about the First National Bank of Lindsay.

First, let’s rewind to the regional bank crisis of last year: When Silicon Valley Bank went under, the powers that be decided everyone’s deposits would be protected — even if they went far, far beyond the $250,000 limit on FDIC deposit insurance.

That’s because highly connected tech investors and companies kept their money at SVB. Mark Cuban and Bill Ackman were among the finance heavies who brought immense pressure to bear.

Thus, everyone was made whole — even Roku Inc. (ROKU), which held $487 million in cash at SVB.

Obviously that would be a drain on the FDIC’s insurance fund. To help replenish it, the government ordered a “special assessment” on healthy banks that conducted their business responsibly — unlike SVB.

Ultimately, those costs were covered by you — via the fees and commissions and anything else you pay your bank.

Fast-forward to this month and the demise of a small-town bank in Oklahoma.

Fast-forward to this month and the demise of a small-town bank in Oklahoma.

The authorities are still trying to figure out what brought down the First National Bank of Lindsay, population 2,864. The Office of the Comptroller of the Currency says it discovered “false and deceptive bank records and other information suggesting fraud.”

In the meantime, another small lender has agreed to take over the bank’s insured deposits.

But the bank also held $7 million in deposits exceeding the $250,000 limits — and the fate of those deposits is up in the air.

“The FDIC said that it would make 50% of First National customers’ uninsured funds available, and that the amount could increase as the FDIC sells the bank’s assets,” reports The Wall Street Journal. “But there were no assurances.”

It’s tempting, of course, to blame the victim. The $250,000 limit is per bank. If you’re well-to-do and you have a substantial cash pile, it’s not hard to spread it among three or four banks. It’s even easier if you have a spouse and you maintain separate accounts; the per-bank limit in your household effectively rises to $500,000.

But the point today is that if your bank gets in trouble and you’ve got the clout of Silicon Valley behind you (or Wall Street, or the federal government)... the power structure of this country has your back.

If you’re a small-town car dealer or a rural rancher… not so much.

![]() Mailbag: Billionaire Politics

Mailbag: Billionaire Politics

“Dave, it is interesting that some of the billionaire class (I remember when millionaires were impressive) are providing tacit support of Trump,” a reader writes after yesterday’s edition.

“Dave, it is interesting that some of the billionaire class (I remember when millionaires were impressive) are providing tacit support of Trump,” a reader writes after yesterday’s edition.

“Musk and Ackman are on the Trump train. Meanwhile, Bill Gates gave a dark money PAC $50 million to support Harris.

“Macro maven Jim Rickards explained in his weekly Five Links that donation is hoped to buy a candidate for a pet project (sharks with laser beams attached to their heads, anyone?).

“Musk donated $75 million to Trump's campaign. What could Musk want from Trump for $75 million?”

Dave responds: Good question. At the very least, one can be forgiven for side-eyeing his commitment to “draining the swamp” — given his reliance on tax credits for Tesla and government contracts for SpaceX.

“When I read yesterday’s Bullet No. 1 I couldn't help but connect it to something else I heard/read that I think was from you but I can't recall,” writes another.

“When I read yesterday’s Bullet No. 1 I couldn't help but connect it to something else I heard/read that I think was from you but I can't recall,” writes another.

“Some historian (William Strauss I think) researched internal civil unrest/war for centuries across many countries and came to the conclusion that a prerequisite is a divided elite class. Without that, it won't happen. If the elite class stick together they're powerful enough to control the masses.

“Does this ring a bell for you? If so I have two questions. First, was it William Strauss or someone else? Second, do you think this divide in elites brings the U.S. closer to civil war?

“Thank you for all you do. Love the 5! (No buts!)”

Dave: We addressed this directly three weeks ago. It’s Peter Turchin who posits that you can’t have a civil war without competing factions of elites.

You might be confusing Turchin with Neil Howe — who was the late William Strauss’ longtime partner in formulating a “Fourth Turning” conception of historical cycles. Both Turchin and Howe came out with books around the same time last year.

I’ve not gotten around to reading any of Turchin’s books — I’m much more familiar with Strauss-and-Howe generational theory — but superficially the proposition seems plausible.

Where that leaves us plebes, it’s hard to say. I just want to stay out of the crossfire…