Fallen Pharma Phenom

![]() A Staggering 108X Gain Then… Bupkis Now

A Staggering 108X Gain Then… Bupkis Now

How the mighty have fallen.

How the mighty have fallen.

One-time biotech phenom Gilead Sciences (GILD) trades this morning for a little over $94 a share — no more than it traded for in early 2016.

The year 2015 was as good as it got for GILD — over $120 a share as the company rode the wave of a treatment for hepatitis C called Sovaldi.

As chronicled in our voluminous archives, Gilead sold $10.3 billion of Sovaldi in 2014 — at a cost of $1,000 a pill, or $84,000 for a 12-week course.

[That was in the United States. In Egypt, Gilead charged $900 for a course of treatment. That’s how messed up the U.S. health care system is, but we don’t want to get sidetracked from our main point today…]

Seen in the context of a share price that’s gone nowhere for over eight years, it’s easy to forget how Gilead made enormous fortunes for early investors.

Seen in the context of a share price that’s gone nowhere for over eight years, it’s easy to forget how Gilead made enormous fortunes for early investors.

Gilead’s signature breakthrough came in the 1990s — a treatment for AIDS. As Paradigm’s biotech maven Ray Blanco reminds us, it turned AIDS “from a virtual death sentence into a survivable condition — even something that could be managed.

“Today, a large number of those being treated for HIV in the developing world are taking Gilead’s antiviral drugs.”

Those with the foresight to get in on GILD in the late ’90s scored a staggering gain of 10,861% by the time of GILD’s peak in 2015.

That is, they made 108X their money in less than 20 years.

Come to think of it, GILD’s trajectory is a lot like Apple’s — then a go-go growth company and nonstop innovator that made many people wealthy, now a mature dividend-paying stalwart resting on its laurels. (At least AAPL’s share price has kept rising; heck, at nearly $250 this morning, it sits at an all-time high.)

We recount this history by way of introducing you to what might be “the next Gilead” — with similarly staggering profit potential.

Ray mentioned it here yesterday. Leveraging the research power of AI, this company might well be sitting on a holy-grail treatment for everything from Alzheimer’s to cancer to diabetes to heart disease to arthritis.

And the scientists behind it are set to make an earth-shaking announcement tomorrow in New York at 9:00 a.m. EST.

As you can well imagine, the time to get in would be before that announcement. We urge you to follow this link and give Ray’s report a look right away.

![]() Inflation: Moving in the Wrong Direction

Inflation: Moving in the Wrong Direction

The mainstream spin on the official inflation numbers issued this morning is… amusing.

The mainstream spin on the official inflation numbers issued this morning is… amusing.

But… but… we were told inflation was getting under control!

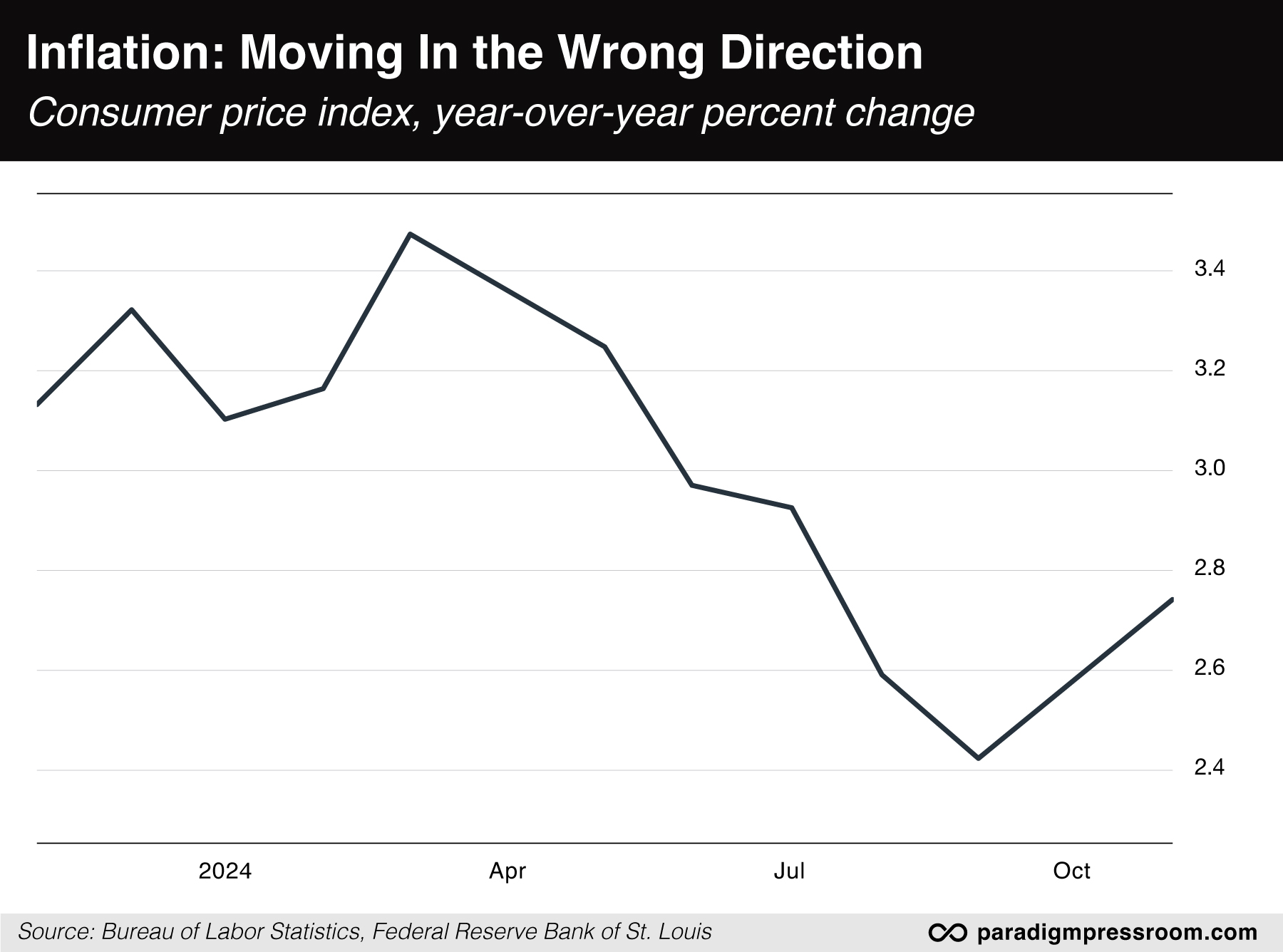

Anywho, the consumer price index rose 0.3% month-over-month and 2.7% year-over-year. This is the second-straight month the official inflation rate has been moving in the wrong direction.

Yes, gasoline prices are coming down but nearly everything else is going up: Food prices are up, for instance, as bird flu is bringing on tighter supplies of poultry and eggs.

And the biggest driver of all, seeing as it makes up a third of the index, is housing — up 0.3% month-over-month and 4.7% year-over-year.

If you’ve been keeping up with these missives regularly, the new uptrend should be no surprise: As we’ve been saying since last year, the historical evidence is overwhelming that once inflation sails beyond 5% — as it did in 2021–22 — getting back to “normal” 2% levels can take a decade or longer.

Not that any of this will deter the Federal Reserve from cutting short-term interest rates again at its next meeting a week from today.

Not that any of this will deter the Federal Reserve from cutting short-term interest rates again at its next meeting a week from today.

The betting in the futures markets this morning shows a 96% probability the Fed will cut the fed funds rate another quarter-percentage point to 4.5%.

Inflation notwithstanding, the Fed will not violate expectations by pausing a rate-cutting cycle it started only three months ago.

Now, the next meeting beyond this one could be another matter: There will be another month’s worth of inflation data by the time of the Jan. 29 meeting. Three months of a rising inflation rate might well change the Fed’s tune.

But that’s then and this is now: Mr. Market is waving off the inflation numbers.

But that’s then and this is now: Mr. Market is waving off the inflation numbers.

At last check, the Dow is ruler-flat at 44,245. But the S&P 500 is up two-thirds of a percent to 6,075 — not far from last week’s record close. And the Nasdaq is up 1.2% into record territory — and only 75 points away from 20,000.

Gold’s move over $2,700 couldn’t stick yesterday, but today it might — the bid up $24 to $2,717. Then again, we’re not seeing the action confirmed in silver and the mining stocks: Silver still can’t crack $32.

Elsewhere in the commodity complex, crude is up nearly a buck to $69.50 — the highest in a week.

Bitcoin has pushed its way back over $100,000 — but just barely.

![]() What Does a Treasury Secretary Do, Anyway?

What Does a Treasury Secretary Do, Anyway?

“Now that Donald Trump has settled on his choice for treasury secretary, it's helpful to consider what the treasury secretary actually does,” says Paradigm’s macro maven Jim Rickards.

“Now that Donald Trump has settled on his choice for treasury secretary, it's helpful to consider what the treasury secretary actually does,” says Paradigm’s macro maven Jim Rickards.

The nod went to hedge fund manager Scott Bessent. Senate confirmation is all but certain.

“The single most important function of the treasury secretary is to manage the U.S. Treasury securities market,” Jim writes in a recent dispatch to readers of Rickards’ Insider Intel.

“This is the largest, most liquid bond market in the world. It includes short-term debt (Treasury bills of up to 1-year maturity), intermediate-term debt (Treasury notes in various maturities such as 2-, 5- and 10-year notes) and long-term debt (20-year notes and 30-year bonds).

“While running the Treasury bond market is critical, it is also straightforward. The treasury secretary simply consults with the major banks (the ‘primary dealers’) to see what they and their customers want.

“If demands for Treasury bills are high (because they are the most liquid instruments and serve as the best form of collateral), then it behooves the Treasury to issue more Treasury bills. Don’t try to sell sneakers if the customers want hoodies.

“The other main job of the Treasury is to take care of the U.S. dollar,” Jim goes on.

“The other main job of the Treasury is to take care of the U.S. dollar,” Jim goes on.

“Many investors assume that supporting the dollar is the job of the Federal Reserve. It’s not. The Fed prints dollars (by buying Treasury securities from the primary dealers) and it manages short-term interest rates, but that’s not the same as managing the value of the dollar.

“Like running the government bond market, managing the dollar is a critical task but not an especially difficult one. The treasury secretary’s job is simply to say that Treasury supports a ‘strong dollar’ or a ‘sound dollar’ or something similar. Say it and keep saying it. Any other observation on the topic will immediately cause turmoil or worse in foreign exchange markets.

“If the treasury secretary ever says he supports a weaker dollar, you will immediately see the dollar crash in foreign exchange markets along with higher market interest rates, weaker bank stock prices and increased inflation expectations. If the treasury secretary says he wants a ‘stronger dollar’ (as opposed to simply supporting a sound dollar), the same type of turmoil will result in the opposite direction. Foreign currencies (mainly the euro and yen) will crash, interest rates will fall and stocks of banks and U.S. importers will rally.

“The lesson is don’t do either. Leave it alone. Just say ‘strong dollar’ and move on.”

Jim says all the most-skilled treasury secretaries of the last century followed this route even amid major challenges — Henry Morgenthau under FDR, James Baker under Reagan, Robert Rubin under Clinton.

Alas, Rubin’s acolyte Timothy Geithner did not. During Obama’s first term, the dollar sank to an all-time low relative to other major currencies.

Now, you ask? “As a seasoned market professional,” says Jim, “Bessent will almost certainly grasp the importance of this part of the job.”

![]() Follow-up: Draft Registration

Follow-up: Draft Registration

After spending much of this year tiptoeing toward reinstituting the draft… Congress is now backing away.

After spending much of this year tiptoeing toward reinstituting the draft… Congress is now backing away.

Last summer, we took note when early versions of the annual military-spending bill included two eye-opening planks.

One would address the poor compliance with draft registration. Young men ages 18–26 are supposed to not only register — but also notify the Selective Service System every time they change address. The new bill would have authorized SSS to cross-reference with the databases of the IRS, Social Security and other federal agencies — registering young men automatically.

Another provision of the bill would have required young women to register for the draft.

The bill was under debate at a time when people like Christopher Miller — Donald Trump’s last defense secretary — were talking up some sort of national-service requirement because it would create a sense of “shared sacrifice.”

As we said at the time last summer, it’s nearly impossible to tease out the economic impact of a draft. It’s been more than 50 years since the U.S. military adopted the all-volunteer force.

As we said at the time last summer, it’s nearly impossible to tease out the economic impact of a draft. It’s been more than 50 years since the U.S. military adopted the all-volunteer force.

But if a significant number of young men — and maybe women — were withdrawn from the labor force, the economic impact would be palpable.

Fast-forward to the present: As usual, Congress is under the gun to pass the annual military spending bill before wrapping up its business for the year a week from Friday.

And it appears both of these provisions have been stripped from the bill.

That’s according to the anti-draft activist Edward Hasbrouck — who did a brief prison term in the ’80s for refusing to register. He follows these matters as closely as anyone.

Hasbrouck suspects the proposal to make women register is dead and buried — but the automatic-registration proposal will surely resurface in the next Congress.

“As long as compliance with the self-registration requirement of the Military Selective Service Act continues to plummet,” he writes, “lobbying for a switch to ‘automatic’ registration is likely to remain the highest existential priority for the SSS.”

![]() Mistrust

Mistrust

“Corrupt health care,” says the subject line of a reader’s email — a hot topic after the murder of insurance CEO Brian Thompson.

“Corrupt health care,” says the subject line of a reader’s email — a hot topic after the murder of insurance CEO Brian Thompson.

“On the CDC’s own website they point out ‘more than 500,000 people in the United States have died from an overdose involving opioids since 1999.’ That is both prescriptions and illegal. The site does not break it down legal vs. illegal.

“And remember these deadly drugs were marketed as safe and non-addictive!!! The fact that a drug that kills that many people is still being prescribed says one thing loud and clear: Profits are the ONLY thing that matters. Any arrests made for deaths caused by legal prescriptions?”

Dave responds: There’s myriad evidence to illustrate the corruption in the system — to wit, the pricing discrepancy with Sovaldi noted above. (In the United States, much of that obscene cost has been shouldered by taxpayers – seeing as many hep-C patients are covered by Medicaid, the VA or prison health care.)

And then there’s this: Only yesterday, Bloomberg Law reported that “the U.S. Department of Health and Human Services is extending through 2029 liability protections for those producing and administering COVID-19 vaccines.”

How convenient as the number of cancers and cardiovascular issues continues to grow — a jump that coincided with the jabs’ introduction four years ago. (Yes, correlation does not equal causation, but the correlation is worth investigating, no?)

Meanwhile, independent reporter Ken Klippenstein did what the corporate media would not — publish the “manifesto” of Luigi Mangione, the suspect in Thompson’s murder.

Already, a few sharp-eyed folks are noticing its style doesn’t jibe with Mangione’s prolific posts on social media…

Others wonder if the cops really have the right guy…

And still others point out the pistol in the photo released by the cops sits next to a magazine that’s much longer than the grip.

I’m not saying any of this to cast doubt on the official story. But I am saying that the level of mistrust among everyday folks should surprise no one given the events of the last 60-plus years — from JFK to Jeffrey Epstein.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets