Export to America, Invest in America

![]() “If You Want to Export To America, You Must Invest In America”

“If You Want to Export To America, You Must Invest In America”

OK, we’re filing this one away for future reference…

OK, we’re filing this one away for future reference…

(By the way, I’m seeing the exact same wording on tweets posted by several users at X. Bots much?)

Japanese tech billionaire Masayoshi Son — CEO of SoftBank Group — paid a call on Donald Trump yesterday at Mar-a-Lago. He promised to invest $100 billion in the United States over four years, creating 100,000 jobs in data centers, semiconductors and energy.

“Masa,” as he’s known in Japan, has a mixed reputation for his business prowess — “a colorful character known as much for his major flops as his big accomplishments,” the BBC describes him diplomatically.

Over the years his major investments in the United States have included Uber, T-Mobile and Nvidia.

But his most infamous U.S. investment was WeWork — the startup that tried to “disrupt” the business of subleasing office space by… well, creating an app with which you could sublease office space. According to a 2023 Business Insider article, SoftBank’s losses on WeWork total $14.4 billion and counting.

Anyway, the Masa photo op yesterday underscores what’s been advertised as the second Trump administration’s approach to trade.

Anyway, the Masa photo op yesterday underscores what’s been advertised as the second Trump administration’s approach to trade.

If you were to sum it up in a catchphrase, it’s this: If countries want to export to America, they must invest in America.

“Tariffs are two things if you look at it," Trump told Bloomberg News editor-in-chief John Micklethwait in October. "No. 1 is for protection of the companies that we have here, and the new companies that will move in because we're going to have thousands of companies coming into this country.

"The higher the tariff,” he went on, “the more likely it is that the company will come into the United States and build a factory in the United States, so it doesn't have to pay the tariff.”

The model here, many pundits and observers tell us, is the treatment the Reagan administration gave Japan in the 1980s.

The model here, many pundits and observers tell us, is the treatment the Reagan administration gave Japan in the 1980s.

As you’ll recall if you were around then, Japanese automakers were eating Detroit’s lunch with cars that were better built and more responsive to American consumers’ needs.

A Reagan-era official named Robert Lighthizer drove a hard bargain — jacking up tariffs on Tokyo until Tokyo cried uncle. As a result, Hondas began to be built in Ohio, Toyotas in Kentucky, Nissans in Tennessee.

Lighthizer returned to Washington as U.S. trade representative during Trump’s first term. He won’t be around for a second term; he was angling for treasury secretary but that job went to Wall Street veteran Scott Bessent instead.

But Lighthizer has plenty of acolytes who will be in the second Trump administration — people who share his worldview and know his playbook.

Still… how useful is the playbook now compared with the Reagan years?

Still… how useful is the playbook now compared with the Reagan years?

The trading partner with whom Washington had the biggest beef then was Japan — an ally.

The trading partner with whom Washington has the biggest beef now is China — which few call an ally and many inside the Beltway consider an adversary.

In Washington these days, everything China does is viewed through the lens of “national security.” Every technology and every industry is considered potentially “dual use” — with both civilian and military implications.

So how is “If you want to export to America you have to invest in America” supposed to work now?

Let’s say one day Trump follows through on his campaign promise to slap a 60% tariff on all Chinese exports to the United States.

And let’s say the next day, Chinese President Xi Jinping strides before the cameras…

Yes, Mr. Trump. I see the light. I see the error of our ways. Effective today, I will marshal the resources of my nation’s mighty industries to build 50 new gleaming factories in each of your 50 states.

Well, you know what the reaction would be the day after that in Washington, right?

NOOOO! What’s his hidden agenda?! It’s a Trojan Horse!

And that reaction wouldn’t just come from Team MAGA. Democrats and Never-Trump Republicans would say the same thing.

So then what?

No, your editor doesn’t have an answer to that question. But we’re raising it today because no one else is. And the answers that emerge over the next four years will be market-moving. We’ll aim to keep you ahead of the curve, because there will be investing opportunities to emerge from the chaos.

(Oh, and we’ll also keep track of Masa’s promise of $100 billion in investment and 100,000 jobs.)

A brief postscript: Come to think of it, even allies aren’t always welcome to invest in America.

A brief postscript: Come to think of it, even allies aren’t always welcome to invest in America.

Both Trump and Joe Biden oppose the bid by Japan’s Nippon Steel to acquire U.S. Steel.

Nippon Steel promises to plow $2.7 billion into U.S. Steel’s archaic and decrepit American operations.

That’s not chump change: Barron’s says it amounts to two years of U.S. Steel’s operating profits. U.S. Steel says without an infusion of Nippon Steel’s cash, it might have to close factories in Pennsylvania.

But it seems no amount of money is good enough for Washington in this instance.

The Treasury Department panel that reviews foreign acquisitions for national-security concerns has to make a decision on the deal by this Sunday.

![]() The Fed Must Preserve Its Credibility

The Fed Must Preserve Its Credibility

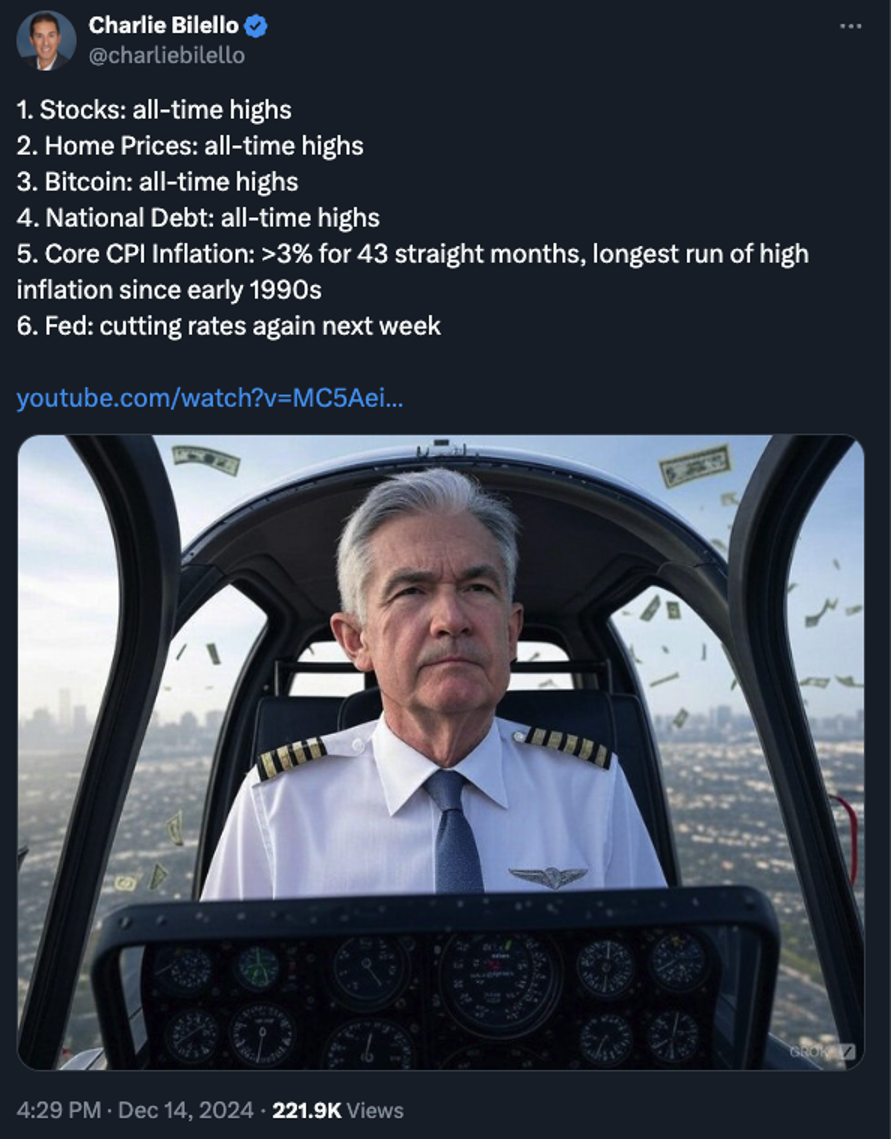

So… remind me why the Federal Reserve is cutting interest rates again?

So… remind me why the Federal Reserve is cutting interest rates again?

Starting today, the Federal Reserve’s Open Market Committee is gathered in Washington for one of its two-day policy-setting meetings.

At the conclusion of the process tomorrow afternoon, Jerome Powell and crew will cut the fed funds rate another quarter percentage point to 4.5%. For perspective, it was 5.5% before the Fed embarked on its current rate-cutting cycle in September.

Going back more than 40 years, the current rate-cutting cycle is unique in that long-term interest rates have responded by rising.

Usually, longer-term rates like the 10-year Treasury note fall in sympathy with short-term rates controlled by the Fed. And it’s those longer-term rates that determine the rates consumers pay for things like mortgages. But go figure: A 30-year fixed that was 6.1% when the Fed began cutting rates three months ago is now 6.6%.

It’s not normal by recent standards. It suggests the bond market is sniffing out a resurgence in inflation during 2025 — something the official inflation numbers are already hinting at.

But the Fed can’t very well start a rate-cutting cycle and then abort it only three months later. That wouldn’t be good for the Fed’s precious credibility.

So… a rate cut tomorrow is in the bag. And Paradigm macro maven Jim Rickards says right now, another cut at the next meeting in late January is “the most likely outcome” — especially if there’s any sign of inflation stabilizing.

Going into the Fed meeting, traders are chewing on two economic numbers out this morning — neither one of them good.

Going into the Fed meeting, traders are chewing on two economic numbers out this morning — neither one of them good.

- Retail sales jumped 0.7% in November, more than expected. But the number is severely skewed by a leap in auto sales, likely the result of folks who had to replace their cars destroyed by Hurricanes Helene and Milton. If you back out auto sales, the jump is only 0.2%, in contrast with Wall Street’s expectation for 0.4%

- Industrial production fell 0.1% in November. Oops, the “expert consensus” was looking for a 0.3% increase. Manufacturing grew less than expected; mining/energy production fell outright, and so did utility output. (So much for the “rebound” from the hurricanes and the Boeing strike.) All told, 76.8% of U.S. industrial capacity was in use last month — the lowest since the spring of 2021 and well below the long-term average of 79.7%.

Whether it’s the punk economic numbers or something else, nearly every asset class is in the red today.

Whether it’s the punk economic numbers or something else, nearly every asset class is in the red today.

The Dow is taking the biggest hit among the major U.S. stock indexes — down two-thirds of a percent at last check. CNBC informs us that the Dow is “poised for its first nine-day losing streak since the ’70s.”

Isn’t Big Data wonderful, serving up utterly useless factoids like this? You’d hardly guess from that headline that the Dow is down all of 3.5% from a record high over those nine trading days.

The Nasdaq and the S&P 500 are holding up better, each down about a half percent.

Bitcoin took a run at $108,000 but at last check is back to $106,225.

![]() The Case for Intel (Even Now)

The Case for Intel (Even Now)

“Intel is still a big value at current prices,” says Paradigm tech specialist Ray Blanco.

“Intel is still a big value at current prices,” says Paradigm tech specialist Ray Blanco.

Ray is among several members of our team who’ve been bullish on INTC all year — even as its share price has been steadily cut in half, and then some.

As we mentioned briefly at the start of the month, CEO Pat Gelsinger “got quit” — abruptly announcing his retirement a little less than four years into his attempted turnaround. Ironically, perhaps, the news has sent the share price still lower.

But Ray says two capable replacements are under consideration — Marvell Technology CEO Matt Murphy and semiconductor veteran Lip-Bu Tan. “Both bring valuable expertise that could help advance Intel's transformation,” says Ray.

“The thesis for Intel remains intact despite the recent turmoil. At a current valuation of around $89 billion, Intel represents a strategic American asset trading at a big discount to its potential value.”

For one thing, Intel is set to collect $7.86 billion in taxpayer subsidies thanks to the CHIPS Act of 2022 — plenty of resources to upgrade its fabrication plants.

“The company's distributed network of American fabs remains a unique strategic advantage that single-location manufacturers cannot match,” Ray goes on. “I believe the board's apparent retreat from Gelsinger's vision is concerning but unlikely to derail Intel's ultimate foundry ambitions.

“The geopolitical necessity for domestic advanced chip manufacturing grows stronger as tensions with China increase. Intel remains the West's best hope for achieving semiconductor manufacturing independence at leading-edge nodes.

“While Gelsinger's departure introduces new execution risks, Intel's stock price of around $20 fails to reflect the company's strategic importance and potential.”

![]() The Only Way a Ukraine Ceasefire Happens

The Only Way a Ukraine Ceasefire Happens

The commodity complex is showing little reaction to the latest provocation in the Russia-Ukraine war.

The commodity complex is showing little reaction to the latest provocation in the Russia-Ukraine war.

Ukraine is claiming responsibility for the killing of a Russian general, Igor Kirillov. He was outside an apartment building in Moscow when a device hidden in a scooter was detonated remotely.

But there’s no safe-haven response to be seen in the markets: Precious metals are sinking further into the doldrums as the dollar remains strong; gold is down to $2,639 and silver to $30.31. Crude has tumbled back below $70.

The killing comes at a delicate moment for Washington’s involvement in the war — 35 days before Inauguration Day.

The killing comes at a delicate moment for Washington’s involvement in the war — 35 days before Inauguration Day.

As you might have heard, Donald Trump has called for a ceasefire in Ukraine.

“The manner in which Trump did this was interesting,” Jim Rickards writes to his Strategic Intelligence readers.

“In an interview, he referred first to the fall of Assad in Syria and the fact that Russia had been Assad’s biggest supporter alongside Iran. That much is true. Then Trump went further and said Russia’s loss in Syria combined with huge losses in Ukraine would drive Russia to seek peace and set the stage for a Trump-initiated ceasefire.

“That shows Trump has badly misread the situation.”

Jim says Trump has little negotiating power. Russian losses pale in comparison with Ukrainian losses, and Russia’s economy is holding up fine — Western sanctions notwithstanding. “A ceasefire is possible,” Jim allows — “but only on Russian terms.”

“The concern now,” he continues, “is that Trump has been taken in by the warmongers in Washington, London and Paris and imagines that Russia is dealing from a position of weakness. They’re not. Let’s hope that Trump quickly wakes up to the realities on the ground and does not get sucked into another endless war.”

That said, there’s something encouraging on the “endless war” front — which brings us to Bullet No. 5…

![]() Comic Relief

Comic Relief

Sometimes it’s not what’s being said, but who’s saying it…

Sometimes it’s not what’s being said, but who’s saying it…

One wonders if Elon Musk is whispering something similar in Donald Trump’s ear — a counterweight to Trump’s many advisers eager for regime change in Tehran. We can only hope…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets