Nailed It

![]() “The Most Accurate Forecast in the World”

“The Most Accurate Forecast in the World”

“It’s useful to revisit the election outcome with reference to how we did in terms of our forecasts and analyses for readers,” says Paradigm’s macro expert Jim Rickards.

“It’s useful to revisit the election outcome with reference to how we did in terms of our forecasts and analyses for readers,” says Paradigm’s macro expert Jim Rickards.

“In a nutshell,” he says, “we crushed it.”

- Accordingly, on Nov. 1, Jim and his team predicted that Donald Trump would win the election. He estimated that the Trump-Vance team would receive 312 Electoral College votes, and projected that Republicans would secure 54 Senate seats and 224 seats in the House of Representatives.

“The final result? Trump-Vance got 312 Electoral College votes, and the Republicans ended up with 53 Senate seats and 220 seats in the House. You can’t come much closer than that,” notes Jim.

“In fact, it was the most accurate forecast in the world.

“It’s worth considering — not just the fact that we got it right — but how we did it…

“We don’t rely on any one indicator to the exclusion of others,” Jim says. “Our proprietary models use numerous inputs including polls, anecdotal evidence, media coverage, debate performance and even candidates’ body language. It’s the combination of all of these inputs that yields the best results.

“We don’t rely on any one indicator to the exclusion of others,” Jim says. “Our proprietary models use numerous inputs including polls, anecdotal evidence, media coverage, debate performance and even candidates’ body language. It’s the combination of all of these inputs that yields the best results.

“Most analysts don’t use anecdotal evidence because they claim it’s not ‘scientific’ and does not fit into their statistical models,” Jim says. “But if you keep running into Trump voters in casual environments, it’s reasonable to assume there are a lot more around. That’s a scientific inference.

“Another factor we [weighed] is that Trump didn’t fire anyone on his campaign,” adds Jim. “Trump fires people when he doesn’t like their performance. [This] told me that his internal polling was strong and he liked his chances in the race.

“Again, it doesn’t fit into most models, but it is powerful evidence if you know how to use it.

“We also spend a lot of time interpreting body language,” Jim says. “This is not anything Nate Silver looks at” — perhaps the most (in)famous election forecaster — “but they teach it at CIA and elsewhere.

“If you’ve ever been through a security clearance lie detector test with observers watching you from behind see-through mirrors (I have), you know what I mean.

“Sometimes a mere smile or frown when the candidate leaves a meeting tells you all you need to know,” Jim explains. “Watch for foot tapping (nervous), wrinkles and lines in the face and neck (stress) and even wiggling when you’re in your seat (lying).

“Then there’s the issue of polls.” To read them accurately requires “a three-step process…

“Then there’s the issue of polls.” To read them accurately requires “a three-step process…

“Treating all polls as equal will produce bad results,” says Jim. “In the first place, discard polls that have poor track records or small sample sizes or are out-of-date.

“Focus on recent polls with large sample sizes and good track records (Trafalgar, Rasmussen, AtlasIntel, Baris) and you’ll be much better off.”

Jim also points out other polling variables you should take into consideration — namely, how pollsters sample adults, registered voters and likely voters.

As an election approaches, for instance, pollsters should shift their focus from surveying adults and registered voters to targeting likely voters.

Polls of likely voters can yield more accurate results, producing results that differ significantly from other polling samples, particularly in close races. In other words: Be sure to read a poll’s fine print.

“Then ask if even the best pollsters have a skew,” Jim says. “The answer is almost always yes. The skew in 2024 was against Trump.

“[Since] the polls were all skewed against Trump and their headline results showed Trump tied or with a small lead, then our conclusion was that Trump would sweep all seven battleground states…

“That was our forecast,” says Jim, “and that’s how we got to 312 electoral votes for Trump.

“Before the excitement of the U.S. presidential election fades (soon to be replaced with infighting over appointments, confirmations and policies), it’s useful to revisit the election’s outcome,” Jim says

“Before the excitement of the U.S. presidential election fades (soon to be replaced with infighting over appointments, confirmations and policies), it’s useful to revisit the election’s outcome,” Jim says

“Remember, the models we use to forecast elections are useful for forecasting market trends as well for investors like you.

“Our forecast was not only highly accurate, it stood in contrast to top names like Nate Silver, Nate Cohn (New York Times), the Economist and many others who said the race was ‘too close to call’ or who gave Kamala Harris a slight edge.”

The most accurate forecast in the world?

“That’s important for giving readers confidence in our political and market forecasts going forward,” Jim concludes.

[Warning to American retirees: Jim Rickards just uploaded this brief clip.

In the long run, Jim believes Trump’s presidency will be good for the stock market and the overall economy. But in the short term, Trump 2.0 and the U.S. stock market could collide.

If you currently have money in the market...

Or you’re thinking of buying stocks soon...

Then you need to watch this immediately.]

![]() Uranium, Employment… Crypto

Uranium, Employment… Crypto

“There’s an area of the market that speculators need to keep an eye on as the holidays approach… I’m talking about uranium,” says Paradigm’s chart hound Greg Guenthner.

“There’s an area of the market that speculators need to keep an eye on as the holidays approach… I’m talking about uranium,” says Paradigm’s chart hound Greg Guenthner.

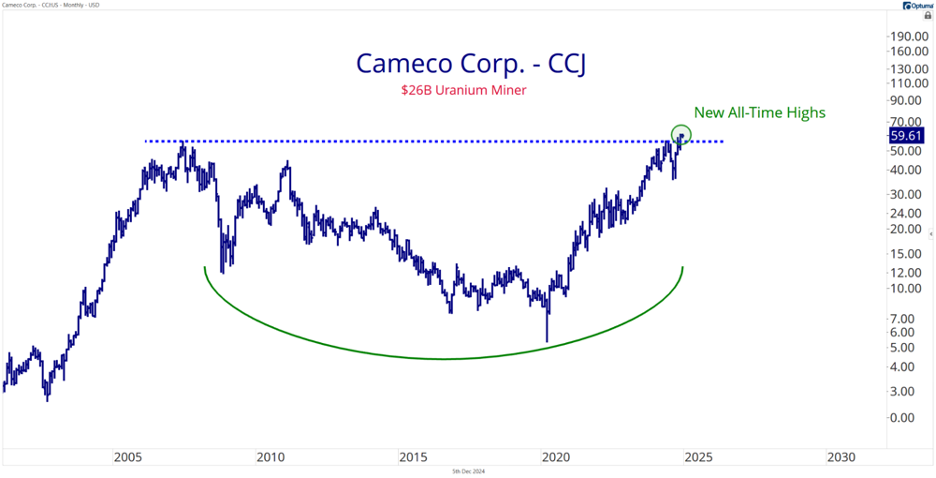

“A few uranium miners are breaking out to new all-time highs,” he notes. “We have a fresh uranium trade over at The Trading Desk where we bought calls on Cameco Corp. (CCJ) earlier this week:

“CCJ can be tricky,” says Greg. “But you can clearly see the stock finally breaking free of a huge base by taking out those previous highs from all the way back in 2007. Wow!

“I like CCJ on multiple timeframes,” he adds. “Not only is it coming out of this big base, but it’s also pushing toward a shorter-term breakout from tight consolidation on the daily chart.

“This is the type of stock that can rally double digits in a matter of days — which makes it the perfect play to grab into ideal market conditions,” Greg emphasizes.

The Bureau of Labor Statistics is out with its November jobs report, showing a rebound in employment — with 227,000 jobs added, exceeding economists’ expectation of 200K.

The Bureau of Labor Statistics is out with its November jobs report, showing a rebound in employment — with 227,000 jobs added, exceeding economists’ expectation of 200K.

At first blush, this stat seems like a net positive. Job growth, however, was concentrated in just a few sectors: primarily health care and hospitality-leisure. Hmm, despite the holiday-shopping season, retail lost 28,000 jobs. Plus, the unemployment rate ticked up to 4.2% last month.

Of course, official figures don’t fully capture the extent of unemployment or underemployment in the U.S. That said, in spite of the optimistic official job numbers, the Fed will continue its rate-cutting course when the FOMC meets again later this month. Because not to do so would spook the stock market.

For what it’s worth, the financial media is attributing the Nasdaq’s record high today to the better-than-expected jobs report.

For what it’s worth, the financial media is attributing the Nasdaq’s record high today to the better-than-expected jobs report.

At the time of writing, the tech-heavy index is up 0.60% to 19,820. Meanwhile, the S&P 500 is up 0.15% to 6,080 while the staid Dow is down 0.25% to 44,645.

Checking on commodities, oil is down in the dumps. A barrel of WTI is selling for $67.47, down 1.25%. Gold, on the other hand, is up 0.40% to $2,659 per ounce. Silver? Up 0.30% to $31.62.

But it’s the crypto market that’s getting all the attention today. Bitcoin is up 1.35%, above $100,000. Not to be forgotten, Ethereum is up 5.5%, over $4,000.

![]() Meme Stock or Bitcoin Proxy?

Meme Stock or Bitcoin Proxy?

“MicroStrategy (MSTR) has two lines of business,” observes Paradigm editor Davis Wilson at The Million Mission. Put succinctly: “MicroStrategy vs. Bitcoin,” he says.

“MicroStrategy (MSTR) has two lines of business,” observes Paradigm editor Davis Wilson at The Million Mission. Put succinctly: “MicroStrategy vs. Bitcoin,” he says.

“Business #1: MicroStrategy develops and sells enterprise analytics solutions, helping organizations analyze data for better decision-making.

“Business #2: MicroStrategy owns $38 billion worth of Bitcoin.

“Let’s start by valuing Business #1,” Davis says. “According to the company’s most recent filings, Business #1 had around $450 million in revenue over the last year and was not profitable.

“Enterprise software companies like this typically trade around five–10 times revenue,” he notes.

“We’ll split the difference here at 7.5 times revenue which means Business #1 is valued around $3.375 billion ($450 million times 7.5).

“Now add Business #1 and Business #2 together and you get $41.375 billion. Subtract the $4.3 billion of debt on the company’s balance sheet and you get a market cap of $37.075 billion.

“The stock market should value MicroStrategy somewhere around $37 billion… Except the stock market currently values MicroStrategy at $88 billion,” Davis says.

“The stock market should value MicroStrategy somewhere around $37 billion… Except the stock market currently values MicroStrategy at $88 billion,” Davis says.

“Clearly, MicroStrategy’s enterprise business (Business #1) doesn’t matter to investors.

“In fact, it seems like it doesn’t matter too much to MicroStrategy either, as it’s hardly talked about or referenced in quarterly calls or reports.

- “MicroStrategy is a pile of Bitcoins worth $38 billion that stock market investors are currently buying/selling for $88 billion,” Davis says. “This makes no sense…

“MicroStrategy knows this and is using the incredibly high demand for their stock as an opportunity to sell new shares on the open market.

“This was a strategy popularized by GameStop and AMC during the meme frenzy of 2021,” he adds. “If people want to buy your stock at ridiculous prices, sell it to them.

“You’ll dilute existing shareholders (they typically don’t like that), but you’ll get to pocket the money you make by selling new shares and use it, in MicroStrategy’s case, [to] buy more Bitcoin.

“Yet people continue to buy the stock despite this dilution, and it’s trading at more than twice the value of its underlying business and Bitcoin pile.

“Investors [will] likely get burned in the near future,” he estimates, “when the mainstream starts to catch on to how ridiculous MicroStrategy’s current valuation really is.”

Davis’ takeaway: “If you want to buy Bitcoin, just buy Bitcoin… not MicroStrategy, which is really just an overvalued pile of Bitcoin anyway.”

[NOTE: Bitcoin has jumped about 40% since Trump’s election. And some smaller crypto coins have more than doubled.

Not only did Paradigm’s crypto authority James Altucher predict Trump’s November victory, he also predicted that Trump’s win would kick off a huge boom in the crypto market.

And a historic meeting happening this Tuesday morning, Dec. 10, could be the key to extending the rally through Trump’s presidency and beyond.

Investors who get into James’ top SIX coins — before this Tuesday morning meeting — will be in a prime position to profit.

That’s why I’m sending you James’ exclusive presentation today… So you can get all the details before Tuesday.]

![]() AI Jesus (Ugh)

AI Jesus (Ugh)

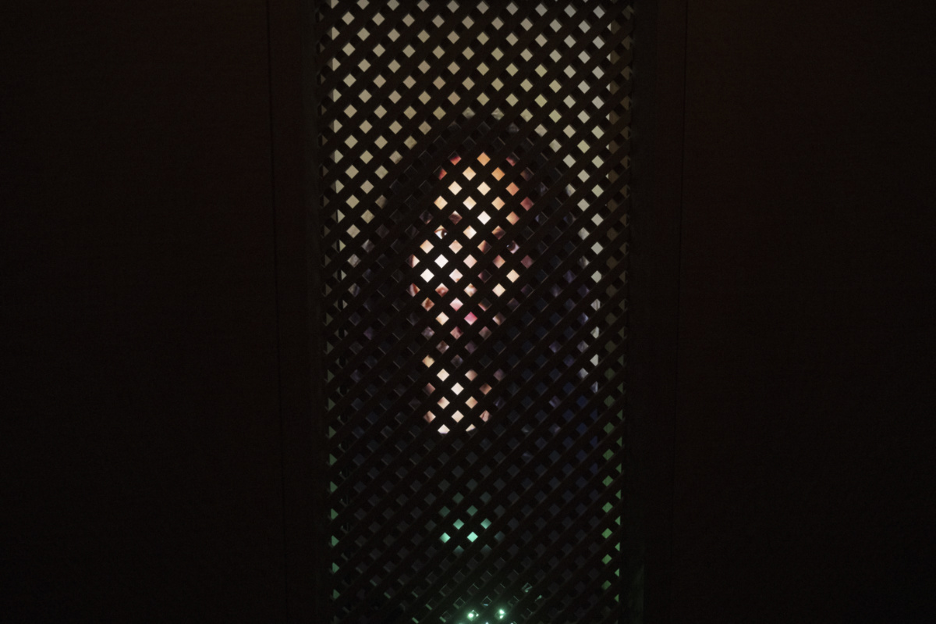

St. Peter's Chapel in Lucerne, Switzerland, introduced an eyebrow-raising art installation: an AI-powered “Jesus” nestled within a confessional booth.

St. Peter's Chapel in Lucerne, Switzerland, introduced an eyebrow-raising art installation: an AI-powered “Jesus” nestled within a confessional booth.

The brainchild of researchers and a local theologian, this experimental project — dubbed Deus in Machina — which ran from August–November, aimed to explore the intersection of faith and artificial intelligence.

Visitors could pour out their hearts, in 100 different languages, to a holographic representation of Christ which responded based on its training in scripture and theological texts — “leaving open,” cautions Substack’s The Pillar, “the possibility it could offer biblical interpretations or spiritual advice at odds with [Roman Catholic] Church teaching.” Uh-oh…

Image courtesy: X

Nightmare fuel

While the creators insist the installation is not meant to replace actual confessions or human interaction, the project has sparked both curiosity and controversy — some find it thought-provoking while others label it blasphemous

By the way, this isn't the first attempt to merge Catholicism with AI. Earlier this year, Catholic.com launched a ChatGPT-powered bot called “Fr. Justin.” But the AI feature was shut down after the avatar simulated hearing confession and offering absolution of sins. Uh-oh!

Other visitors to the website claimed the virtual priest was “inappropriate, misleading or just plain creepy.” (Nope, not gonna say it.)

As the Church grapples with the digital age, these experiments highlight the challenges of integrating AI into matters of faith. While technology may offer new ways to explore religion, when it comes to matters of the soul, personal connection is still irreplaceable.

![]() Mailbag: “I Have Questions”

Mailbag: “I Have Questions”

“Two questions, in particular, come to mind,” says a longtime contributor, “which you conveyed perfectly in a pie chart a couple years ago…

“Two questions, in particular, come to mind,” says a longtime contributor, “which you conveyed perfectly in a pie chart a couple years ago…

“IMHO this is the most brilliant graphic anyone ever created,” he declares. “It still applies!”

Indeed. Accordingly, we updated the image to reflect just how wild 2024 has been…

Hang in there, reader, and have a great weekend!

Best regards,

Emily Clancy

Paradigm Pressroom’s 5 Bullets