Trump Tightens His Grip

![]() From Princess Leia’s Lips to Donald Trump’s Ears?

From Princess Leia’s Lips to Donald Trump’s Ears?

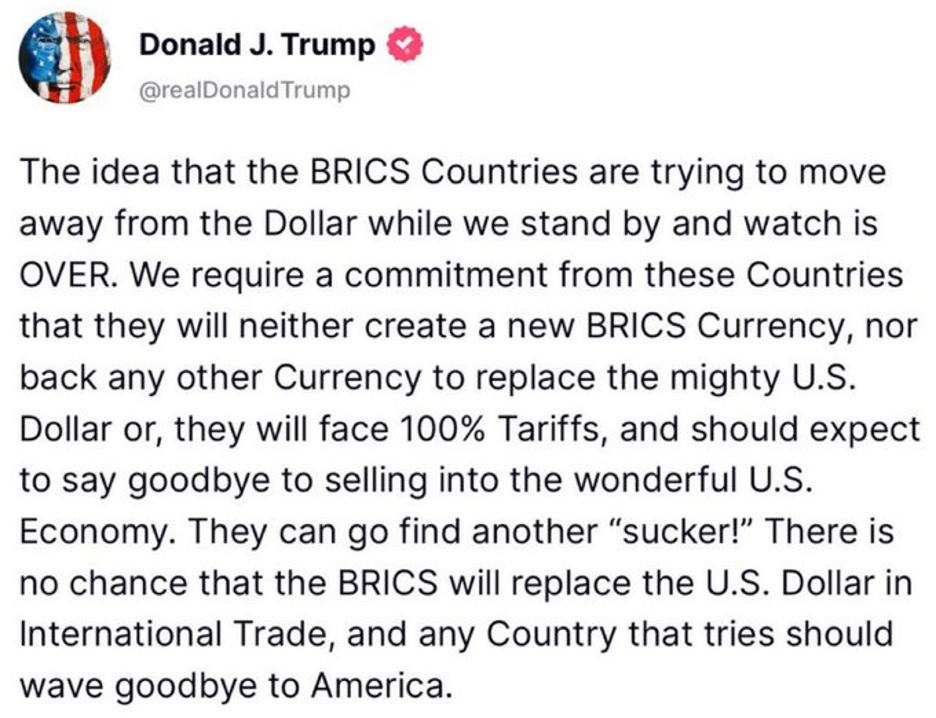

When I saw Donald Trump issue the following threat over the weekend, a classic line from the original Star Wars movie came to mind…

When I saw Donald Trump issue the following threat over the weekend, a classic line from the original Star Wars movie came to mind…

Before we get to that line of dialogue, here’s some essential background if you’re not up to speed…

The BRICS is a grouping of nine nations comprising 43% of the world’s population… 28% of global economic output… and 29% of global oil production.

The core members of Brazil, Russia, India, China and South Africa were joined this year by the United Arab Emirates, Egypt, Ethiopia and Iran.

Much of this group — certainly Russia, China and Iran — have long been the targets of U.S. sanctions or other forms of economic warfare.

Much of this group — certainly Russia, China and Iran — have long been the targets of U.S. sanctions or other forms of economic warfare.

When Russia invaded Ukraine in early 2022, the Biden administration responded with unprecedented economic sanctions — freezing the dollar-based assets of Russia’s central bank.

Other governments around the world — especially those not on friendly terms with Washington — looked around and wondered if they might be next.

One immediate response was for these nations’ central banks to load up on gold. It’s no coincidence that gold’s price has soared from roughly $1,800 in early 2022 to well over $2,600 now.

In the meantime, the BRICS have taken halting steps toward establishing a common currency. To date, they’ve only got so far as smoothing out the process of payments among member nations.

Trump is essentially saying: This far, and no farther. You will not challenge the dollar’s role as the globe’s reserve currency.

The line that comes to mind here is from Princess Leia: “The more you tighten your grip, Tarkin, the more star systems will slip through your fingers.”

The line that comes to mind here is from Princess Leia: “The more you tighten your grip, Tarkin, the more star systems will slip through your fingers.”

Because it’s not just Biden’s Russia sanctions at issue here. It’s also Trump’s Iran sanctions.

“If Trump’s first term proved anything,” writes the foreign policy analyst Daniel Larison, “it is that other states cannot be so easily intimidated through economic warfare.

“Pressure usually provokes defiance and resistance. When the targeted country is one that has a history of being bullied or attacked by the U.S., it is even more likely that a pressure campaign will blow up in Washington’s face.

“In the case of Iran, ‘maximum pressure’ caused an expansion of Iran’s nuclear program, increased tensions, greater regional instability and attacks on U.S. troops in the region. It very nearly resulted in a war.

“The U.S. has continued waging the same economic war under Biden, and Iran’s nuclear program is now more advanced than it has ever been. By any measure, ‘maximum pressure’ has made everything worse.”

So now what, with Trump returning to office?

“The ‘mighty U.S. dollar’ is apparently so ‘mighty’ that you need to threaten countries so they don’t abandon it,” says an arch tweet from the internet entrepreneur Arnaud Bertrand.

“The ‘mighty U.S. dollar’ is apparently so ‘mighty’ that you need to threaten countries so they don’t abandon it,” says an arch tweet from the internet entrepreneur Arnaud Bertrand.

“BRICS countries should totally take him to his word and go ahead with this: 100% tariffs on BRICS products would actually further undermine the dollar. It'd reduce demand for it due to reduced trade, and it'd cause significant inflation in the U.S., also negative for the dollar.

“This is akin to saying ‘if you try to undermine the dollar, I'll do it as well.’"

Trump’s heart might be in the right place… but he’s swimming upstream against the current of history.

Even if punitive measures against Russia, Iran, etc. weren’t backfiring, the fact is that reserve currencies have a limited shelf life.

Sometime in the 21st century the dollar will lose its role as the globe’s reserve currency — as the British pound did in the 20th century, the French franc in the 19th, the Dutch guilder in the 18th and so on.

The best defense will likely be gold. Certainly that’s been the case so far in the dollar’s slow-motion dethronement.

Probably a slug of Bitcoin, too — just in case younger generations gravitate toward a store of value that’s digital.

![]() Backsliding to Third-World Status

Backsliding to Third-World Status

OK, who had “Martial Law in South Korea” on their 2024 bingo card?

OK, who had “Martial Law in South Korea” on their 2024 bingo card?

Shortly before U.S. markets opened today, South Korean President Yoon Suk Yeol took to late-night TV — declaring martial law and labeling opposition parties as “shameless pro-North Korean anti-state forces that are plundering the freedom and happiness of our people” because… well, apparently because the opposition wouldn’t play ball on a 2025 budget.

You can’t make this stuff up.

Yoon’s announcement came complete with a destroying-democracy-in-order-to-save-it vibe. Protests, political parties and the National Assembly itself are banned — all to “protect the constitutional order of freedom.”

Oh, “fake news” is banned too because of course it is.

Whelp, South Korea’s experiment with parliamentary democracy lasted 37 years. During that time it became an honest-to-God first-world country. Nice while it lasted.

It’s uncertain whether South Korea’s stock market will open for business tomorrow. (Seoul is 14 hours ahead of New York.) The government is promising “unlimited liquidity” to prop up markets. Gee, what could go wrong?

The South Korean won has tumbled 2.3% against the U.S. dollar, and the iShares MSCI South Korea ETF (EWY) is down 6% on the day — but that’s the extent of the market impact we see so far.

The South Korean won has tumbled 2.3% against the U.S. dollar, and the iShares MSCI South Korea ETF (EWY) is down 6% on the day — but that’s the extent of the market impact we see so far.

The out-of-nowhere jolt to geopolitical tensions has propelled crude 2.2% higher to $69.61 a barrel — but oil’s jump might also reflect the fact that the “ceasefire” in Lebanon for which Joe Biden took much credit last week looks like a sick joke now.

Gold is flat at $2,637, although silver has gained a quarter to $30.74.

As for the major U.S. stock indexes, they’re all in the red today — but by no more than a third of a percent. The S&P 500 and the Nasdaq both notched record closes yesterday.

“With just about four trading weeks left in 2024, we have been gifted by one of those magical markets that overdelivers on momentum moves and breakouts,” Greg Guenthner tells his Trading Desk readers. “That means we’ll need to toss some of our common sense out the window. Many ideas that the market would deem ‘too stupid to float’ are going to do well in this type of environment. Embrace it!”

Sean Ring agrees in today’s Rude Awakening — saying the S&P 500 is setting up to soar from 6,000-ish now to 6,580. “Although the financial plumbing may have many problems,” he says, “the charts give zero indication to sell. This is a relentless bull market.”

Speaking of which…

![]() A December to Remember

A December to Remember

“Historically we are big fans of the concept of seasonality — the idea that the stock market acts differently at different times of year,” says Paradigm trading pro Enrique Abeyta.

“Historically we are big fans of the concept of seasonality — the idea that the stock market acts differently at different times of year,” says Paradigm trading pro Enrique Abeyta.

“Some consider this ‘voodoo’ but these are relationships where we have consistently made money for the last three decades.

“We mention it because we are going into the STRONGEST time of the year — December.

“On average, the stock market is up just about 60% of all months. For December, though, the stock market is up 75% of the time. It is also up double what it would be during a normal month.

“In election years it is up 80% of the time. We think because folks had been on the sideline waiting for the dust to clear.

“Finally, when the stock market is up big going into December — up 20% or more — it was up 90% of the time in recent years.

“Even the few times the market is down in December in these years, it is not down much.

“December might be a time for winding down on a personal basis but for trading we think it is a time to push on the gas.”

Elsewhere, Bitcoin took a spill below $94,000 for the first time in nearly a week today — and while it’s too soon to declare cause-and-effect, this happened…

Elsewhere, Bitcoin took a spill below $94,000 for the first time in nearly a week today — and while it’s too soon to declare cause-and-effect, this happened…

Well, that’d be one way for the outgoing Biden administration to thwart any plans by the incoming Trump administration to create a Bitcoin reserve, no?

If cause and effect is at work, it’s short-lived: The flagship crypto is back to $95,540.

![]() Comic Relief

Comic Relief

We’re not sure if this is a commentary on AI — but regardless, this takeoff on 2001: A Space Odyssey is a hoot…

We’re not sure if this is a commentary on AI — but regardless, this takeoff on 2001: A Space Odyssey is a hoot…

![]() Nuclear War? No Worries…

Nuclear War? No Worries…

“Please stow the doom p0rn,” a reader writes after Friday’s edition.

“Please stow the doom p0rn,” a reader writes after Friday’s edition.

“Very obviously Sleepy Joe's release of the ATACMS was nothing more than him [or his handlers] saying, ‘I'm still in CHARGE.’ Nice, giving Trump an out.”

Concurs another: “Dave, take a deep breath! We are not on the verge of WWIII. Why on earth would Putin launch a nuclear attack anywhere, when he knows Trump will take office in two months and basically give him anything he wants?

“You are failing to see the situation for anything more than it is, which is to give Zelenskyy more bargaining power when it comes to a ceasefire or end to the invasion.

“It's this type of fearmongering (not the first time) that I see in your publication that has made me decide to not renew my subscription.”

Dave responds: You’re dumping your paid subscription because you’re put off by something in a free bonus publication? OK.

Anyway, I’m seeing a lot of this line of argument on social media — especially after Trump appointed retired Gen. Keith Kellogg as his “special envoy” for Russia/Ukraine.

It seems Kellogg’s plan to end the war in Ukraine is… get this… to continue arming Ukraine!

"Biden should have provided Ukraine with the weapons it needed to win quickly, but instead, he was afraid of potential Russian 'escalation’,” he wrote in late 2023.

Anticipating a second Trump term, Kellogg wrote, “Trump might very well remove the Biden-era constraints on arms transfers and give Ukraine the weapons it needs to win, including long-range weapons to strike within Crimea and Russia. If faced with the prospect of a costly military defeat, Putin may very well prefer negotiations."

Ah yes, and then Trump the consummate dealmaker will present Putin an offer he can’t refuse.

This line of thought ignores the proverbial elephant in the room: For all the bravery and sacrifice on the part of Ukrainians…

This line of thought ignores the proverbial elephant in the room: For all the bravery and sacrifice on the part of Ukrainians…

Russia. Has. Already. Won.

Russian victory in December 2024 is as certain as Allied victory was in December 1944. Yeah, Ukraine might have one more Battle-of-the-Bulge last hurrah — but that’s it.

“The war on the ground is moving rapidly in Russia’s favor,” Jim Rickards wrote his Strategic Intelligence readers yesterday.

“Russian forces are advancing across the entire battlefront from Vuhledar and Kurakhove in the south to Chasiv Yar in the center and to Vovchans’k in the north. Russia Army Group North (‘Sever’) is also annihilating the Ukrainian invasion force in the Kursk region of Russia around Sudzha.

“Once certain intermediate villages and logistical hubs are secured, there is little standing in the way of Russian conquest of major Ukrainian cities including Kharkiv, Dnipro, Zaporizhzhia and Odesa.

“Russia will effectively control all of Ukraine east of the Dnipro River and the entire Black Sea and Sea of Azov coastlines from Rostov-on-Don to Odesa. Ukraine will be left as a landlocked rump state operating on Russian terms.

“Due to dishonest U.S. media, the American people are not prepared for any of these outcomes.”

So yes, Putin probably won’t rise to Biden’s bait in the next 49 days; reliable analysts like Gilbert Doctorow who follow Russian-language media have said as much since my write-up on Friday.

But Gen. Kellogg is still laboring under the delusion that the war will end on terms other than those dictated by Putin… well, it could be a bumpy early 2025.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets