Missed Carvana's 400% Surge?

![]() “Echo Trades” Go Boom

“Echo Trades” Go Boom

“‘Echo trades’ usually only occur once a decade. But when they do, they can generate returns of 100%, 200% or even 500% in just a few months,” says Enrique Abeyta, the newest addition to the Paradigm Press team.

“‘Echo trades’ usually only occur once a decade. But when they do, they can generate returns of 100%, 200% or even 500% in just a few months,” says Enrique Abeyta, the newest addition to the Paradigm Press team.

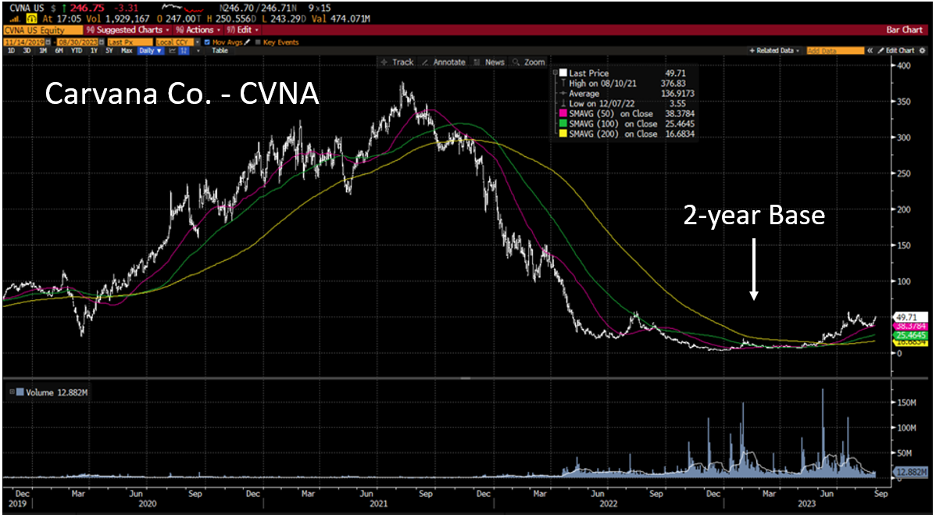

“Often, they set up some of the biggest stock market returns of all time,” he adds. A prime example of an echo trade in action? The Carvana (CVNA) story is like a phoenix rising from the ashes.

“Carvana was a well-positioned company with a great business model and a huge market,” Enrique says.

Nevertheless, CVNA shares plummeted from over $375 in 2021 to just $3.55 in 14 months.

“After the company survived the pullback, the stock consolidated for a period. [What] happened next is the company began to fulfill its initial promise, and that trade became an ‘echo boom,’ rising over 300% in less than a year.”

Indeed, CVNA has surged about 400% year-to-date, now trading around $250 per share. This dramatic turnaround embodies the essence of an echo trade.

But how about a “stock that has yet to take off in earnest — but is set up for an echo boom…

“The company is cloud-based communications software company Twilio Inc. (TWLO),” says Enrique.

“The company is cloud-based communications software company Twilio Inc. (TWLO),” says Enrique.

“Unless you follow the software industry, you might not know the company,” he says, but Twilio is like the Swiss Army knife of software, allowing “customers to integrate all their communications onto a single platform.

“TWLO went public back in 2016 and does over $4 billion in revenue today. That’s less than 1% of their total addressable market of over $500 billion in the communications software space.

Like Carvana, Twilio’s chart tells a familiar tale. After soaring to $450 per share in 2021, it nose-dived nearly 90%...

“After trading in a range between $45 and $76 for almost two years, the stock recently broke out to trade above $90 per share…

And the parallels between Twilio and Carvana are striking. Both crashed hard, both consolidated and both came back from the dead.

It's like watching history repeat itself. “Let’s put this in the context of a longer chart,” Enrique says, “and you can see the echo trade that’s developing with TWLO…

It's like watching history repeat itself. “Let’s put this in the context of a longer chart,” Enrique says, “and you can see the echo trade that’s developing with TWLO…

“This chart looks a lot like the chart of Carvana from the middle of 2023 before it took off again. Just take a look for yourself…

While there are no guarantees in the stock market, Enrique believes TWLO has all the hallmarks of an echo trade. “I hope you consider buying shares of TWLO before it becomes an echo boom,” Enrique says.

“We’re not done yet though…

“What I haven’t mentioned until now is that I have a proprietary indicator that helps me identify when an echo trade becomes an echo boom.

“It’s an indicator used by Wall Street professionals managing trillions of dollars and costs tens of thousands of dollars to access,” he says. “I’ll share more details with you soon.”

![]() Stocks: “Never More Expensive”

Stocks: “Never More Expensive”

“The ‘Buffett Indicator’ is saying that, relative to the size of the U.S. economy, stocks have never been more expensive,” says Paradigm editor Davis Wilson at The Million Mission.

“The ‘Buffett Indicator’ is saying that, relative to the size of the U.S. economy, stocks have never been more expensive,” says Paradigm editor Davis Wilson at The Million Mission.

“This indicator got its name from a comment Warren Buffett once made to a reporter…

“Buffett said that comparing the market capitalization of all U.S. stocks to the size of the U.S. economy offered the clearest picture of where valuations stand at any given moment.

“Right now, the S&P 500 is worth around 1.7 times the entire U.S. gross domestic product,” Davis says. “Maybe this explains why Berkshire Hathaway has been consistently selling stocks and its cash pile just hit a record $325.2 billion…

“Of course, I prefer when stocks are cheap and thus have a higher floor and higher upside potential.

“That being said, high valuations can present a unique trading opportunity,” notes Davis.

“That being said, high valuations can present a unique trading opportunity,” notes Davis.

“High valuations increase volatility in the stock market,” he adds. “This means high-priced or ‘expensive’ stocks often experience larger or more frequent price swings compared with lower-priced or more stable stocks.

“These fluctuations can create profitable opportunities for traders, particularly those using short-term strategies like I’m using here at The Million Mission.

“My entire trading philosophy revolves around finding these profitable opportunities to buy high-quality companies on pullbacks,” says Davis. “Opportunities like this are on the horizon.

“Currently, on my ‘Watch List’ are three stocks — Nvidia (NVDA), Meta Platforms (META) and Rocket Lab (RKLB),” he says. By the way: “Nvidia reports earnings later today. It’s the must-watch event of the week.

“Stay tuned, because volatility is coming and that’s great news for us.”

Taking inventory of the stock market today, the three major U.S. indexes are slumping. The tech-heavy Nasdaq is down about 1% to 18,795 while the S&P 500 and Big Board have pulled back 0.80% and 0.35% respectively.

Taking inventory of the stock market today, the three major U.S. indexes are slumping. The tech-heavy Nasdaq is down about 1% to 18,795 while the S&P 500 and Big Board have pulled back 0.80% and 0.35% respectively.

- Target Corp. reported disappointing Q3 earnings today, causing TGT shares to plummet over 20%. The retailer's earnings per share came in at $1.85, significantly below analysts' expectations of $2.29. Target's net income decreased by 12% to $854 million compared to the same period last year. The company cites a “volatile operating environment” impacting its bottom-line performance. We’ll see if holiday shopping can turn things around for the retailer.

As for commodities, crude is up 0.20% to $69.54 for a barrel of West Texas Intermediate. Precious metals, meanwhile, are of two minds. Gold is up 0.85% to $2,653.40 per ounce; silver, on the other hand, is down 0.25% to $31.20.

Likewise, the two major cryptos are moving in opposite directions at the time of writing. Bitcoin is up 0.90% to $93,765. At the same time, Ethereum’s down 0.80% to $3,085.

![]() Experts on Crypto’s Bullish Future

Experts on Crypto’s Bullish Future

Bitcoin recently hit an all-time high over $94,000 as investors anticipate a shift in regulatory attitudes and more. Experts weigh the implications of Trump’s victory on the cryptocurrency landscape…

Bitcoin recently hit an all-time high over $94,000 as investors anticipate a shift in regulatory attitudes and more. Experts weigh the implications of Trump’s victory on the cryptocurrency landscape…

First, with Trump's election, the U.S. also welcomed the most pro-crypto Congress in history, triggering what many are calling the most substantial crypto bull run in years.

“The pendulum has swung violently from maximum opposition to a complete embrace,” says Nic Carter of Castle Island Ventures. “The fundamental reality of Bitcoin in the U.S. is forever changed.

“There’s a very real prospect that Bitcoin comes to be seen as a strategic reserve asset for governments, and if the U.S. looks likely to do that, other nations will try to front-run.”

Carter predicts a price around $900,000 per Bitcoin over the next decade. “But it will be a windy and nonlinear path to get there.”

Brian Armstrong, CEO of Coinbase, expresses optimism about a new era for crypto in the U.S. “We couldn’t be in a better position,” he says, “to get clarity and start to rebuild this industry in America.”

Brian Armstrong, CEO of Coinbase, expresses optimism about a new era for crypto in the U.S. “We couldn’t be in a better position,” he says, “to get clarity and start to rebuild this industry in America.”

Armstrong likewise notes that being anti-crypto is now seen as politically risky. “As to what’s in store for the future of crypto — the crypto voter won,” he emphasizes.

The Winklevoss twins, co-founders of the Gemini exchange, highlight: “The Bitcoin price surge is fueled by optimism for the future. An optimism we haven’t seen in America in a very long time.

“This is not an illusory zero-interest-rate phenomenon, late-stage growth hype, COVID stimulus or anything like that. This is real,” they conclude.

“As for how long this run will last, we think this cycle is different. We have a [pro tech] president-elect, a red Senate, a red House and popular vote mandate from the country to build. Factor in the prospect of a strategic Bitcoin reserve, and all bets are off.”

![]() King Endorses Wright

King Endorses Wright

“The Department of Energy people like it when the secretary of energy has completed graduate-level work in mechanical and electrical engineering,” says Paradigm’s mining-and-energy expert Byron King, joining us to weigh in on Trump’s cabinet pick to head the DOE — CEO Chris Wright of Liberty Energy.

“The Department of Energy people like it when the secretary of energy has completed graduate-level work in mechanical and electrical engineering,” says Paradigm’s mining-and-energy expert Byron King, joining us to weigh in on Trump’s cabinet pick to head the DOE — CEO Chris Wright of Liberty Energy.

“Right away, he's a smart guy, especially in energy,” Byron notes, highlighting Wright's qualifications in contrast to Biden’s energy secretary, Jennifer Granholm, who set “a super-low bar for energy knowledge.”

As for Wright’s credentials: impeccable. Byron’s impressed by Wright’s academic background from institutions including MIT and Berkeley.

Plus, Byron praises Liberty Energy as a well-managed company. “Fracking is actually a LOT of high-end math, physics, chemistry and engineering” which requires significant expertise.

Byron provides further historical context for the DOE, emphasizing that it’s not solely focused on energy policy. “Much of the old Atomic Energy Commission work” — rooted in national security and nuclear weapons management — “was folded into the DOE.

“The job of the energy secretary is NOT to screw around with these people,” he says, referring to the highly educated staff working at national labs. He underscores, then, the importance of having knowledgeable leadership in this complex environment.

“Wright is a splendid choice from Trump,” Byron summarizes. “The guy has the education and technical background to run the DOE.” Overall, Byron believes Wright will be beneficial for U.S. energy policy while effectively representing oil and gas interests.

![]() Ship of Fools?

Ship of Fools?

If you’re feeling salty about the election results, residential cruise line Villa Vie promises to whisk you away. You can even choose your own adventure aboard the ship Odyssey, ranging from…

If you’re feeling salty about the election results, residential cruise line Villa Vie promises to whisk you away. You can even choose your own adventure aboard the ship Odyssey, ranging from…

- The one-year “Escape From Reality” package

- A two-year “Mid-Term Selection” getaway

- Three-year “Anywhere but Home” excursion

- Or go all-in with the four-year “Skip Forward” extravaganza.

Keep in mind, skipping Trump’s presidency altogether will set you back about $160,000 per person — which might be cheaper than assisted living. (Or therapy!)

And hey, they look like fun…

Courtesy: villavieresidences.comIt’s 5 o’clock somewhere…

But CEO Mikael Petterson insists cruise life isn't just for, say, disgruntled Democrats. The Odyssey even hosted dueling election watch parties, with Fox News and MSNBC viewers segregated to opposite ends of the ship.

So if you’re itching to escape the political circus and trade your ballot for a beach towel, hop aboard the Odyssey. After all, who needs civic engagement when you can sip cocktails while pretending the world’s problems don’t exist?

Too judgy? Maybe so… Cheers to you, reader! We’ll be back at it tomorrow.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets