Defiance

![]() A Spooky-Accurate Market Call

A Spooky-Accurate Market Call

It was the start of an epic bull market lasting nearly 18 years — and he called it nearly to the day.

It was the start of an epic bull market lasting nearly 18 years — and he called it nearly to the day.

There’s a good chance you’ve never heard of this individual. Mason Sexton is his name. He’s kept a low profile for more than three decades. But back in the early 1980s, he was all over print and broadcast media with a series of bang-on market calls.

One of Sexton’s most eerily accurate calls was this: On Aug. 9, 1982, he forecast “a massive rally in stocks.”

This was a staggering forecast to make at that moment in time – a defiant stand in the face of conventional wisdom.

This was a staggering forecast to make at that moment in time – a defiant stand in the face of conventional wisdom.

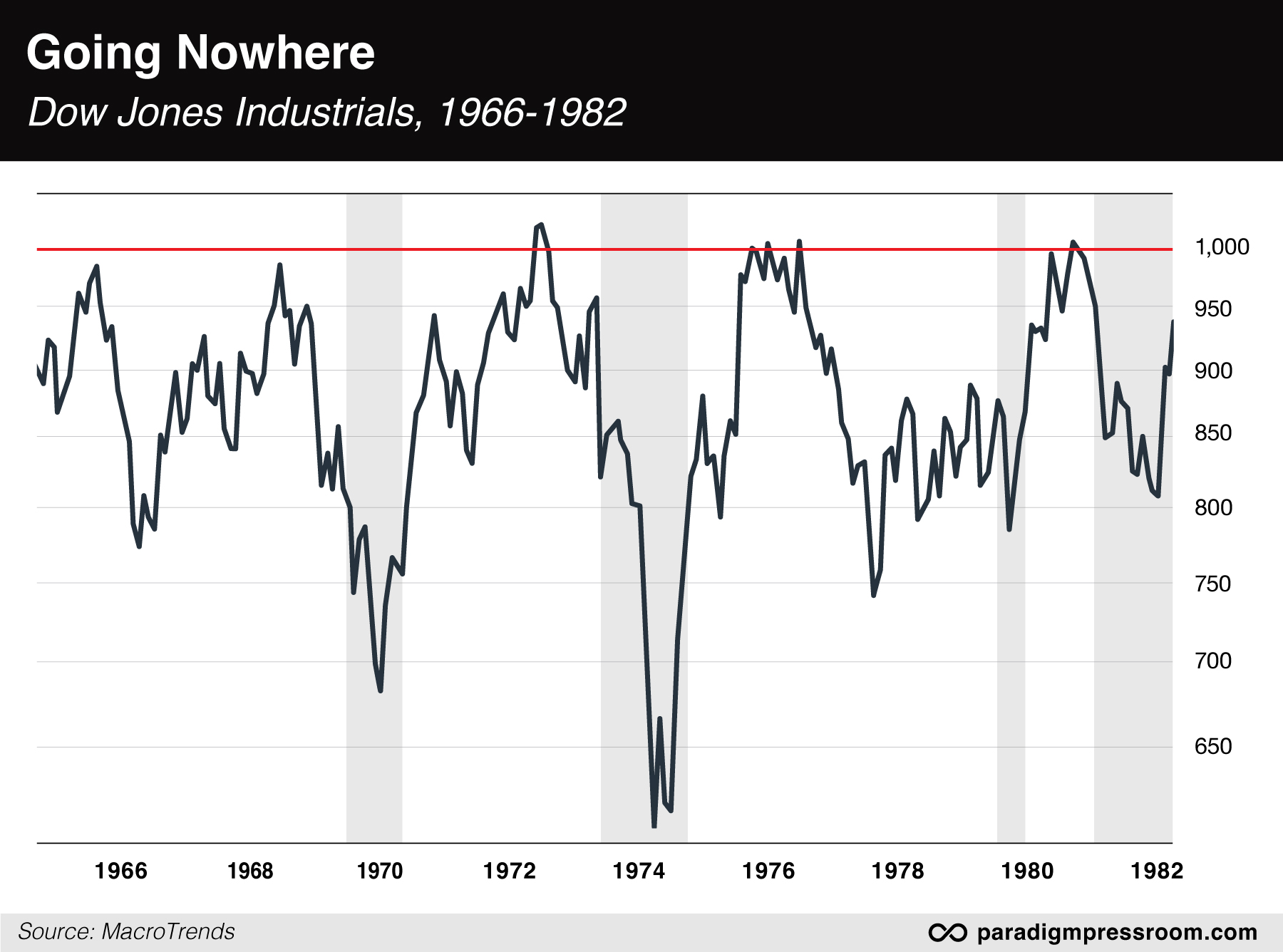

The stock market had gone nowhere for 16 years — the Dow Jones Industrials unable to break through the 1,000 level and stay there.

And it was worse than the numbers suggested, as the inflation of the 1970s ravaged the value of investors’ portfolios.

“By August 1982, the S&P Composite Index was, in real terms, back where it had first been in August 1906,” wrote Russell Napier in his magisterial history Anatomy of the Bear: Lessons From Wall Street’s Four Great Bottoms.

As you might imagine, sentiment was in the toilet. The Federal Reserve under chair Paul Volcker was able to get inflation under control only by throwing the economy into a deep recession. The unemployment rate was approaching 10%. Corporate earnings were getting crushed.

How doomy was the vibe?

Three days before Mason Sexton forecast a “massive rally in stocks”... The Wall Street Journal cited a senior VP at Smith Barney named Alan Shaw: “The spirit of the bear is still with us — fear of financial collapses, both banking and corporate, high interest rates, rekindled inflation, political disarray, poor second-quarter earnings and Middle East hostilities are all keeping grizzly’s image in the fore.”

On Aug. 12, 1982 — three days after Mason Sexton made his “massive rally in stocks” forecast — the Dow hit a bottom that would never be seen again.

On Aug. 12, 1982 — three days after Mason Sexton made his “massive rally in stocks” forecast — the Dow hit a bottom that would never be seen again.

The index closed at 777 that day. Before 1982 was over, it broke through the 1,000 barrier — also a level never to be revisited.

From the bottom on Aug. 12, 1982, the Dow soared 1,409% over the next 17 years and five months — peaking at 11,723 on Jan. 14, 2000 as the tech bubble reached the bursting point.

Sexton’s call, defying all conventional wisdom, wasn’t a one-off.

He also called the crash of 1987, still the biggest one-day percentage drop the stock market ever registered. Of course, the media swooned.

And then Sexton dropped out of the public eye.

Oh, he was still making stunningly accurate forecasts defying the herd. But he was doing it for well-heeled private clients. Among other calls, he nailed the 2008 financial crisis and the COVID crash of 2020 — and the recoveries that followed.

How was Sexton able to time the market so well — and so consistently?

We’re pleased to announce Mason Sexton as the newest member of the Paradigm team. That’s right, he’s coming back into the public eye. And you’ll get a glimpse into his methods during a one-of-a-kind event we’ve scheduled for next Wednesday Jan. 29 at exactly 11:02 a.m. EST.

More important, you’ll get a heads-up on what Mason says is “a very significant market event I believe will occur in the next eight weeks that you need to prepare for now.”

You’ve got a full six days to adjust your schedule to make sure you’re in front of a screen to see what Mason’s talking about. I promise it’ll be worth the effort. The event is called The Prophecy — and we’ll save you a seat as soon as you click this link.

![]() Elon Dumps on Stargate

Elon Dumps on Stargate

Little did I know that as I cast a skeptical eye toward Donald Trump’s Stargate AI photo op in yesterday’s edition… Elon Musk had beaten me to the punch.

Little did I know that as I cast a skeptical eye toward Donald Trump’s Stargate AI photo op in yesterday’s edition… Elon Musk had beaten me to the punch.

“They don’t have the money,” Musk tweeted late Tuesday night — referring to the chief backers of the project, SoftBank and OpenAI. He said he had it “on good authority” that to date, SoftBank has lined up less than $10 billion of the $500 billion needed for the next four years.

Despite Musk’s huge public profile and social media presence, these remarks flew under the radar. Companies whose names are linked to the project all rallied 4% or better yesterday — Oracle, Nvidia, Microsoft. Arm Holdings surged nearly 16%. The giddiness spread throughout the tech sector, lifting the Nasdaq 1.3%.

Of course, leave it to the financial media to focus on the wrong thing.

Coverage in both The Wall Street Journal and the Financial Times is all about petty personal dramas — Musk’s ongoing feud with OpenAI CEO Sam Altman, and Musk openly questioning a project that Trump has chosen to tie up with his own prestige.

In contrast, there was little attempt to explore whether Musk’s claims might or might not be true — even though both papers’ original stories acknowledged there was zero clarity about where the $500 billion would come from.

Pathetic. We’ll stay on top of the real story because the mainstream won’t.

Alas, the “Stargate rally” couldn’t last longer than a day.

Alas, the “Stargate rally” couldn’t last longer than a day.

At last check, the Nasdaq is down a quarter percent and back below 20,000. Apart from Oracle, all the names mentioned a few moments ago are in the red.

But the broader market is looking more stout — with the S&P 500 inching up to 6,095. If that number holds at day’s end it’ll be a record close. The Dow is up about a half percent.

Gold is treading water at $2,753 but silver is losing ground at $30.29. Crude is down nearly a buck and below $75 for the first time in nearly two weeks.

Bitcoin rallied this morning after a tweet from crypto-friendly Sen. Cynthia Lummis (R-Wyoming), urging people to “Stay tuned for 10 a.m.” because “Big things are coming.” And as Bitcoin rallied, social media lit up like a Christmas tree…

In the event, all that happened was that Lummis was named as chair of a new Senate Digital Assets Subcommittee.

Despite the letdown, Bitcoin is holding on to much of the gain it racked up after Lummis’ tweet — $104,571 as we check our screens…

![]() Trump’s Russia Sanctions Threat

Trump’s Russia Sanctions Threat

Someone is giving Donald Trump very bad advice about Russia and sanctions.

Someone is giving Donald Trump very bad advice about Russia and sanctions.

In a social media message directed at Vladimir Putin, Trump said the following yesterday: "Settle now, and STOP this ridiculous War! IT'S ONLY GOING TO GET WORSE. If we don't make a 'deal,' and soon, I have no other choice but to put high levels of Taxes, Tariffs and Sanctions on anything being sold by Russia to the United States, and various other participating countries."

Trump did not attach a deadline to this threat. He did instruct his Russia-Ukraine envoy, the 80-year-old retired Lt. Gen. Keith Kellogg, to reach a settlement in 100 days — basically, the end of April. (So much for ending the war in a day.)

Trump’s bluster isn’t altogether surprising. Ever since his election, it’s been apparent his Ukraine strategy will differ little from Joe Biden’s — more weapons for Ukraine, more sanctions for Russia. Only the end goal is different. It’s no longer “victory for Ukraine” but rather “a stronger position for Ukraine at the bargaining table.”

If yesterday’s threat is supposed to be a negotiating tactic, it won’t work. Russia is already sanctioned to a fare-thee-well and its economy hasn’t been wrecked yet. What can Trump do that Biden hasn’t already?

Besides, Putin has already laid out his terms for negotiation, as Johns Hopkins historian Michael Vlahos writes: “Putin has declared that Russia will not accept a truce, armistice or cease-fire in lieu of a permanent settlement. A long-term compact can be achieved, he insists, only by accommodating Russia’s inviolable strategic needs.

Besides, Putin has already laid out his terms for negotiation, as Johns Hopkins historian Michael Vlahos writes: “Putin has declared that Russia will not accept a truce, armistice or cease-fire in lieu of a permanent settlement. A long-term compact can be achieved, he insists, only by accommodating Russia’s inviolable strategic needs.

“Absent this, negotiation will fail, and failure would surely lead to much buyer’s remorse and dismay among those millions who voted for Trump’s promise to bring the fighting to an end.”

To be sure, Trump is the victim of a “fork” move by Team Biden — described in our digital pages last Friday by Paradigm’s Jim Rickards.

Vlahos says overcoming that move won’t be easy for Trump. He’ll have to take on both Democratic and Republican warhawks and “break the iron narrative of ‘Appeasement’ — where the only strategic choice is between war and surrender.”

But Vlahos says it can be done — if Trump tells the whole story of how for more than a decade Washington “relentlessly curated conflict between Russia and Ukraine, with the ultimate intent of expanding NATO and breaking Russia.”

Trump can also come clean about Ukraine’s losses in the war — between deaths, crippling injuries and desertions Vlahos estimates the number is at least 920,000.

For its part, Moscow is saying only that it’s “very closely monitoring all the rhetoric” from Washington.

"You know that in his first iteration of the presidency,” says Kremlin spokesman Dmitry Peskov, “Trump was the president of America who most often resorted to sanctions methods. He likes those methods.”

To be continued…

![]() The $33,000 Chevy Chevette

The $33,000 Chevy Chevette

Here’s an intriguing development in the used-car market…

Here’s an intriguing development in the used-car market…

At a recent auction in Florida, a nearly mint-condition 1987 Chevrolet Chevette with only 47 miles sold for $33,000.

“Apparently, someone really wanted a final-year Chevette in new condition,” snarks the Motor1 site — pointing out that you can get a new Honda Civic Si for the same money.

But that’s not the whole story — as the veteran auto writer Eric Peters points out on his own website.

But that’s not the whole story — as the veteran auto writer Eric Peters points out on his own website.

Adjusted for inflation, the Chevette’s sticker price in 1987 — $4,995 — is just over $14,000 today.

“That amount of money,” says Peters, “will not buy you anything new that has four wheels that’s legal to put license plates on and drive — in this country, at any rate.

“If it weren’t for the federal government, you would be able to buy something new that’s a lot like the ’87 Chevette only better — like the $13,000-to-start Toyota HiLux Champ pickup you’re not allowed to buy in this country, because the federal regulatory apparat says it is not ‘safe’ (meaning it is not compliant with every last pedantic jot and tittle of the Federal Motor Vehicle Safety Standards ‘Bible’) and because the apparat claims its ‘emissions’ (of the dread gas carbon dioxide which is not a pollutant) are too high.”

The Chevette is also a throwback to an era when cars had external bumpers — “which means you could bump into things without causing damage that will cost you more than a Chevette cost back in ’87,” Peters goes on.

“External bumpers are no longer allowed, chiefly because chrome plating is no longer allowed.” Which is one of many reasons Peters says “you’re paying as much to insure a typical new car for three years as it cost to pay off a new Chevette after about three years, back in ‘87.”

Hmmm… given all that, as well as the relative ease of maintenance compared with newer vehicles… maybe the buyer isn’t so crazy after all?

![]() AI and Electricity

AI and Electricity

On the subject of Stargate and AI and electricity demand, discussed at some length yesterday, a reader writes…

On the subject of Stargate and AI and electricity demand, discussed at some length yesterday, a reader writes…

“Fear not, Dave, I have a hunch that the power needed for the AI surge will come from small nuclear plants to be built on-site and primarily in Texas.”

Dave: In the next four years — which is the promised timeline?

Yes, Trump is promising to cut the red tape to ensure this project gets the electricity it needs… but that’s mighty ambitious.

I’ll be as happy as anyone to see it come about — seeing as I’ve been fretting in these virtual pages about the fragility of the power grid since 2022.

Too, if it comes about, the investing possibilities will be awesome. The biggest name in the space is one that our Ray Blanco has been keen on for a while — and its share price achieved a 6X gain in only eight months last year.

With any luck, many others will follow. We’ll stay on top of it. It’s an enormous opportunity even if Stargate never sees the light of day…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets