Biden Tries to “Fork” Trump

![]() Biden Tries to “Fork” Trump

Biden Tries to “Fork” Trump

The subject line on today’s edition is purposely provocative, yes — but its inspiration comes from a chess move.

The subject line on today’s edition is purposely provocative, yes — but its inspiration comes from a chess move.

As we hit “send” on today’s edition, less than 72 hours remain in the Joe Biden presidency. There’s still time in which his team can thwart some of the Donald Trump agenda.

Thus, “the fork.”

“In a fork, one player advances a piece to a space where it is attacking two opposing pieces at once,” says Paradigm’s macro maven Jim Rickards.

Example: “A white bishop might advance to a place where it threatens a black knight (ahead and to the right) and a black rook (ahead and to the left) at the same time. The combination of the advance with two lines of attack creates a kind of ‘Y’ pattern, which is how the name ‘fork’ arises. Black might be able to save one of the pieces by moving it out of danger, but the other piece will definitely be lost.

“The idea is that the player caught in the fork may have choices but will definitely lose in some manner when the move is played out.”

As Jim sees it, Team Biden has set up three forks for Team Trump — all related to the economic and kinetic warfare that Washington is waging against Moscow.

Fork Move No. 1: “Biden has imposed new ‘ghost fleet’ sanctions on Russian oil exports,” says Jim.

Fork Move No. 1: “Biden has imposed new ‘ghost fleet’ sanctions on Russian oil exports,” says Jim.

Announced last week, the sanctions target oil tankers that fly under the radar of existing sanctions.

And the radar metaphor is sort of apt — because in many cases these tankers turn off their GPS transponders. Other means of evading the existing sanctions include renaming the ship, or reflagging it.

“Biden’s new sanctions,” says Jim, “prohibit ghost fleet vessels from entering and docking in ports of countries that support the sanctions.”

The oil price popped big-time as soon as the sanctions were announced — and those gains have stuck this week. Gasoline prices are already up an average nickel a gallon nationwide.

Jim describes the fork here like so: “If Trump keeps the sanctions in place, he'll be blamed for causing inflation resulting from higher oil prices. If Trump removes the sanctions, he'll be branded as a Putin puppet. Trump can choose his response, but either way he’ll lose.”

Fork Move No. 2 entails the ongoing escalations on the battlefield in Ukraine.

Fork Move No. 2 entails the ongoing escalations on the battlefield in Ukraine.

Recall that Team Biden shipped intermediate-range ATACMS missiles so Ukraine could strike targets inside Russia. Moscow responded with the first use of its Oreshnik hypersonic missile — targeting a Ukrainian factory, turning it to dust.

“Biden did not get the message,” says Jim. “The ATACMS launches continued, followed by the brazen assassination of a top Russian general and his aide on the streets of Moscow.”

Judging by the statements of Trump’s national security team, it seems the “strategy” will be to carry on with Biden’s policy — but with a different goal. No longer is the goal for Ukraine to eject Russia from the Donbass and Crimea, but rather to give Ukraine “a stronger position at the bargaining table.”

So here’s the fork: If the Biden policy continues, “Trump will get the blame for the ultimate collapse of Ukraine,” Jim says. “On the other hand, if Trump de-escalates, he'll be called a Putin stooge and be blamed for any peace deal that concedes Ukrainian territory to Russia.”

Fork Move No. 3 pertains to what Jim describes as “Biden’s move to steal Russian-owned U.S. Treasury securities to support a loan to Ukraine to be used in its war with Russia.”

Fork Move No. 3 pertains to what Jim describes as “Biden’s move to steal Russian-owned U.S. Treasury securities to support a loan to Ukraine to be used in its war with Russia.”

Recall that two days into the war in February 2022, Washington froze the dollar-based assets of Russia’s central bank.

It was an unprecedented move — and last year, Congress and Joe Biden took it a step further. In addition to the freeze, Washington went on to seize about $50 billion in interest those assets were earning. Those funds were handed to Ukraine in the form of a loan that will likely never be repaid.

“This extreme action,” says Jim, “is one reason why the BRICS nations (Brazil, Russia, India, China, South Africa and other group members) are moving quickly to build non-dollar payment systems and are acquiring gold as a reserve asset that cannot be frozen or converted by the U.S.”

The fork in this case: “If Trump continues to support the loan made with stolen assets, he contributes to the long-term decline of confidence in the dollar. If he stops the loan program and either demands that the loan be repaid or otherwise restores the stolen Russian assets, he will be accused of undermining Ukrainian war efforts or supporting Russia or both.”

There are only a limited number of ways to counter a forking move in chess: “One way to avoid losing a piece in a fork,” says Jim, “is to put one of your opponent’s high-value pieces in jeopardy.”

There are only a limited number of ways to counter a forking move in chess: “One way to avoid losing a piece in a fork,” says Jim, “is to put one of your opponent’s high-value pieces in jeopardy.”

In this case, Jim says Trump “could hold a press conference or give a speech explaining to the American people exactly how Biden has acted in bad faith and jeopardized the best interests of the United States with his forks.”

We’ll see what plays out…

Russia-related forks notwithstanding, Trump will come out of the gate quickly next week — with as many as 100 executive orders already prepared.

Russia-related forks notwithstanding, Trump will come out of the gate quickly next week — with as many as 100 executive orders already prepared.

“Last year,” says Jim, I attended a closed-door meeting with Trump’s former campaign manager.”

This individual described three executive orders in the pipeline that made Jim’s jaw drop.

Based on that meeting, Jim says there’s one money move you should make before Inauguration Day on Monday. He sees profit potential of 100% during Trump’s first 100 days.

![]() Market Miscellany

Market Miscellany

There’s much to unpack with TikTok as a Sunday deadline looms, but let’s tie up some loose ends first…

There’s much to unpack with TikTok as a Sunday deadline looms, but let’s tie up some loose ends first…

The one undeniable winner from this week’s market action is crypto. From under $90,000 on Monday to over $104,000 today, Bitcoin has had an exceptional run. (Is it in anticipation of what our James Alutcher calls “Trump’s crypto supercycle”? Watch this and decide for yourself.)

As for stocks, the major indexes are having trouble getting any sustainable traction. Wednesday’s big rally didn’t have any staying power yesterday… but the indexes are back in the green today. At last check, the S&P 500 is back over 6,000 — if barely — for the first time in over a week.

Gold is on track to end the week over $2,700 and silver over $30 — and that’s even though silver’s in the red today. Crude trades a little under $78.

A couple of middling economic numbers to chew on…

- Housing starts are down 4.4% from a year earlier — and permits are down 3.1%. The housing market is tight, but new construction just isn’t meeting demand

- Industrial production grew much more than expected in December. All told, 77.6% of America’s industrial capacity was in use last month — up from the month before but still well below the five-decade average of 79.7%.

Follow-up: Apple is pulling the plug, at least for now, on its error-laden news alerts powered by AI.

Follow-up: Apple is pulling the plug, at least for now, on its error-laden news alerts powered by AI.

We told you a few days ago how the new Apple Intelligence suite was spitting out totally inaccurate summaries of breaking-news notifications.

Apparently a fix is proving elusive and so the news-alert feature of Apple Intelligence has been suspended. "We are working on improvements and will make them available in a future software update," an Apple flack tells the BBC — one of the news organizations whose headlines were getting distorted.

(Hmmm… Can you still get AI-generated summaries of breakup texts?)

I’m hard-pressed to remember the last time Apple had to totally junk a new feature after it had already come out of beta testing.

As a longtime macOS and iOS user, I’ll say this fiasco is another data point demonstrating how Apple has drifted far, far away from the days of “It just works.”

![]() TikTok Tick-Tock: Two Days

TikTok Tick-Tock: Two Days

It’s almost as if the Supreme Court’s decision today on TikTok is irrelevant.

It’s almost as if the Supreme Court’s decision today on TikTok is irrelevant.

Under a law passed last year, TikTok will be effectively banned come Sunday. As we write, the Supreme Court just upheld the ban — no surprise based on how oral arguments went a week ago today.

The ruling was unanimous — the justices deferring to the government’s “national security” arguments — although liberal Sonia Sotomayor and conservative Neil Gorsuch seemed to have a reservation or two.

(Reminder: There is no publicly available evidence to support the assertion that TikTok is used by the Chinese government to spy on or to propagandize Americans.)

But events are moving quickly. Shortly before the Supreme Court released its ruling, Donald Trump said he’d just got off the phone with Chinese President Xi Jinping.

But events are moving quickly. Shortly before the Supreme Court released its ruling, Donald Trump said he’d just got off the phone with Chinese President Xi Jinping.

He offered little in the way of detail — other than it was a wide-ranging discussion and TikTok was part of it.

On Wednesday, Trump’s national security adviser Mike Waltz told Fox News that Trump is ready to step in to ensure American users still have access to TikTok. The Washington Post says Trump might sign an executive order suspending the law for 60 or 90 days pending some sort of alternative resolution.

But Joe Biden might preempt Trump with action of his own to keep TikTok running as normal. Yes, that’s even though he signed the ban into law! “Americans shouldn’t expect to see TikTok suddenly banned on Sunday,” an anonymous administration official tells NBC News.

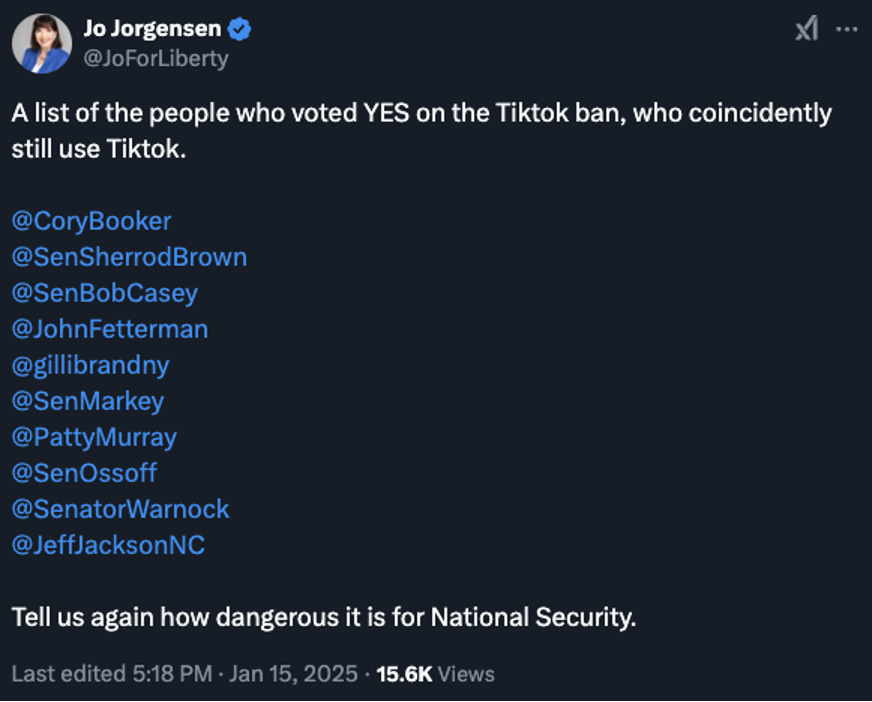

In addition, members of Congress who passed the ban last year are calling for some sort of delay on the ban’s implementation. And at least 10 senators who voted for the ban still have TikTok accounts!

In retrospect, it seems the White House and Congress had every expectation TikTok’s Chinese owners would sell to a U.S. buyer to avoid the ban taking effect. The idea that the owners would stand their ground on principle? Or that 170 million Americans would lose access to a favorite means of exercising their First Amendment rights?

Apparently that didn’t… even… occur to them. Astonishing.

![]() “We’re Here to Spite Our Government”

“We’re Here to Spite Our Government”

Meanwhile the saga of the “TikTok refugees” has taken several more head-spinning turns.

Meanwhile the saga of the “TikTok refugees” has taken several more head-spinning turns.

On Tuesday, we told you how another Chinese-owned social media platform called RedNote had become all the rage — as TikTok users took evasive action ahead of the ban.

It’s still all the rage; 700,000 people signed up in the last two days alone. And many of those new users are blunt about their motives.

"The reason that our government is telling us that they are banning TikTok is because they're insisting that it's owned by you guys, the Chinese people, government, whatever," says a new user with the handle Definitelynotchippy.

"A lot of us are smarter than that though so we decided to piss off our government and download an actual Chinese app. We call that trolling, so in short we're here to spite our government and to learn about China and hang out with you guys."

From where your editor sits, this is wonderful to watch. It’s a low-risk, low-effort way to “spite” the control freaks and power trippers — certainly compared with, say, defying COVID lockdowns or driving long distances to avoid TSA searches at the airport.

Another plus: RedNote seems to be facilitating more cultural outreach over the last week than years’ worth of student-exchange programs. Food, streaming shows, jobs — it’s all up for discussion.

“It's honestly insane,” says one Chinese user. “No one would have expected that we could meet like this one day, openly communicate like this."

Presumably none of this sits well in Washington — and we know it doesn’t sit well in Beijing.

Presumably none of this sits well in Washington — and we know it doesn’t sit well in Beijing.

As another Chinese user said, "Don't we have a [fire]wall? How come so many foreigners can enter, when clearly I can't leave?"

Some of the new American users have already noticed LGBT topics violate the terms of service. And the newbies are frequently reminded by Chinese users “not to mention sensitive topics, such as politics, religion and drugs.”

The whole thing might end as quickly as it began. According to a report from The Information, "Chinese officials raised the issue with RedNote’s government relations team earlier this week, warning that the company needs to ensure China-based users can’t see posts from U.S. users."

As writer John Robb sums up pithily, “U.S. users fleeing TikTok are now trapped between censorious governments.”

![]() A Wild-Firey Mailbag

A Wild-Firey Mailbag

Emily’s expose in yesterday’s edition about the $750K-a-year CEO of the Los Angeles Department of Water and Power brought forth reader outrage/frustration…

Emily’s expose in yesterday’s edition about the $750K-a-year CEO of the Los Angeles Department of Water and Power brought forth reader outrage/frustration…

“The epic failure of Californians' progressive, socialist experiment must first be laid at the feet of those California residents that voted for these incompetent civic leaders that hired public works employees who put DEI ideology above human life,” says one.

“When they take responsibility, then Los Angeles City Council and equity fans like Janisse Quinones must be indicted and prosecuted for violating the public trust. Considering all of the taxes paid by California residents, they have the right to expect that reservoirs are filled, fire hydrants have water to fight fires and fire trucks with qualified personnel are ready to protect their lives and their property.

“With respect to who will bear the burden of this colossal failure of governance, I am opposed to the federal government dumping billions of dollars into that state.

“Rather, I believe the federal government should require the state to borrow the funds itself through the issuance of municipal and state bonds that might be backed by the government (similar to the guarantees accepted by Ford, in lieu of direct government money) and that backing offered under the terms that include strict guidelines for how the funding will be used (in other words, use it on actual work and not on DEI programs, woke agendas and hiring quotas).”

“The deeper I look into the California fires, the deeper the abyss seems,” writes one of our longtimers.

“The deeper I look into the California fires, the deeper the abyss seems,” writes one of our longtimers.

“I can’t possibly go into all of the implications here, but I would love to hear from someone who has expertise in this area. Some obvious concerns are:

- “Much of the value in the property destroyed was in the land, not the house. Assuming they get money only for the house, how many will choose to rebuild in a post-apocalyptic wasteland?

- “If people all decide to move elsewhere due to trauma, livability conditions like ugly ash for years, continued incompetent government and agencies, lack of infrastructure, lack of insurance availability even if you can afford it, permitting processes of three–seven years to build a replacement home, 7% mortgage rates, inflated replacement costs drastically reducing the square footage and quality of any build-back….

- “What happens as everyone starts coming to these realizations and they all try to be the first to sell? My guess is the land will be worth far, far less than the current $3–10 million per acre

- “Then what happens to comps of surrounding properties that are near the fire? How much will their value drop if nearby acreage is worth $100,000, assuming anyone wants to buy?

“People seem to be whistling past the graveyard on this without much attention. Love to hear what the folk at Paradigm think about this, especially if they have any expertise in these areas.”

Dave: Paradigm trading pro Enrique Abeyta has a friend in Pacific Palisades, and others nearby.

“My friends have spoken to many, many real estate agents,” he says. “They’ve been told the land is worthless because there is no infrastructure.” Utilities are trashed, to say nothing of no schools, no stores, no gas stations.

Beyond that, what’s the long-term outlook for the property-and-casualty insurers? Or the municipal bond market?

Much to unpack in the weeks ahead. We’ll do our best…

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets