“We Will Not Rest” (Crypto Goes to D.C.)

![]() The Blockchain’s Voting Bloc

The Blockchain’s Voting Bloc

The cryptocurrency industry’s unprecedented political engagement during the 2024 election cycle has set the stage for a seismic shift in the U.S. regulatory landscape.

The cryptocurrency industry’s unprecedented political engagement during the 2024 election cycle has set the stage for a seismic shift in the U.S. regulatory landscape.

Coinbase, a leading cryptocurrency exchange, spearheaded this effort alongside venture firm Andreessen Horowitz through Fairshake, a pro-crypto super PAC that spent a staggering $173 million during the 2024 election.

The group’s aggressive strategy included a $40 million campaign to unseat former Senate Banking Chair Sherrod Brown (D-Ohio), signaling the industry's determination to reshape the regulatory environment.

Emilie Choi, Coinbase’s president and chief operating officer, emphasizes the industry’s unwavering commitment: “The message that we're sending here, to be totally clear, is we're just getting started.

“We will not rest until 100% of the members of Congress understand and are pro-crypto” — a sentiment which underscores the industry's long-term vision for political influence.

Once a cryptocurrency skeptic, President-elect Donald Trump has emerged as a potential game-changer for the industry.

Once a cryptocurrency skeptic, President-elect Donald Trump has emerged as a potential game-changer for the industry.

During his second campaign, for instance, Trump pledged to transform the U.S. into the “crypto capital of the planet” as well as a “Bitcoin superpower” which marks a significant shift in political discourse around digital assets.

Central to Trump’s crypto strategy is the creation of a Strategic National Bitcoin Stockpile, pledging to retain 100% of Bitcoin currently held by the U.S. government — estimated to be worth over $5 billion.

Trump’s pro-crypto stance extends beyond Bitcoin, with proposals for a Bitcoin and crypto presidential advisory council while maintaining — for now, at least — a firm stance against central bank digital currencies (CBDCs).

And the incoming administration’s crypto-friendly composition, including Paul Atkins as the chosen SEC chair and David Sacks as a key adviser on AI and crypto, signals a potential end to what the industry views as “regulation by enforcement” under the Biden administration.

At the state level, Pennsylvania is at the forefront of crypto-friendly legislation.

At the state level, Pennsylvania is at the forefront of crypto-friendly legislation.

The passage of House Bill 2481, dubbed the “Bitcoin Rights” bill — with a decisive 176-26 bipartisan vote in October 2024 — enshrines the rights of individuals and businesses to self-custody digital assets and use Bitcoin as a payment method while also providing guidelines for taxing these transactions.

Building on this momentum, Pennsylvania lawmakers introduced House Bill 2664, the Strategic Bitcoin Reserve Act, in November 2024. If enacted, this legislation would enable the state treasurer to allocate up to 10% of Pennsylvania's General Fund, Rainy Day Fund and State Investment Fund into Bitcoin and crypto-based exchange-traded products, potentially investing up to $970 million in Bitcoin.

With nine other states introducing similar legislation, Pennsylvania’s initiatives reflect a broader trend across the U.S. No doubt: The growing crypto community in Pennsylvania — estimated at 1.5 million residents, or about 12% of the state’s population — represents an important new voting bloc in this closely contested state.

So as the crypto industry celebrates its electoral successes, the coming years will likely see intense debates over the role of cryptocurrency in the American financial system. But with newly elected pro-crypto lawmakers and a supportive administration, the stage is set for potentially transformative changes in U.S. crypto regulation.

[On Inauguration Day Jan. 20, 2025, President Trump is scheduled to sign a flurry of executive orders.

Specifically, President Trump will ignite a crypto supercycle thanks to bill S.4912... And these THREE key moves.

If you do anything today, we suggest you click here now and watch this short presentation to learn how to prepare for this fast-moving development.

With Inauguration Day just a few days from now, there isn’t much time to prepare.]

![]() LA Water Czar’s Brush With Corruption

LA Water Czar’s Brush With Corruption

The career of Janisse Quinones, who was hired as the CEO of the Los Angeles Department of Water and Power (LADWP) in May 2024, demands scrutiny.

The career of Janisse Quinones, who was hired as the CEO of the Los Angeles Department of Water and Power (LADWP) in May 2024, demands scrutiny.

With an annual salary of $750,000 — a steep increase from her predecessor’s $435,000 — Ms. Quinones’ credibility has been called into question in the wake of devastating wildfires in Los Angeles County that have caused somewhere between $200–300 billion worth of property damage. (To say nothing of the death toll.)

Born and raised in Puerto Rico, Quinones graduated from the University of Puerto Rico-Mayaguez with a degree in mechanical engineering in 1998. She joined the U.S. Coast Guard in 2004 and served for 17 years, rising through the ranks to commander and deputy of planning and incident management.

Quinones' utility career started at San Diego Gas & Electric (SDGE), where she held multiple positions, including director of design, planning, construction and — get this — vegetation management.

In 2018, SDGE sent her to Puerto Rico as planning section chief for the Central Incident Management Team’s response to Hurricane Maria.

In 2018, SDGE sent her to Puerto Rico as planning section chief for the Central Incident Management Team’s response to Hurricane Maria.

In Puerto Rico, Quinones’ main responsibility was “to coordinate with all the stakeholders, including the Puerto Rico Electric Power Authority (PREPA), the Federal Emergency Management Agency (FEMA), the U.S. Army Corps of Engineers (USACE) and industry counterparts working on electric grid restoration for the island,” notes a SDGE post from April 2018.

- Interestingly, reports indicate that Quinones also served as Cobra Energy’s vice president of operations during this same time period.

In 2018, Cobra Acquisitions LLC was a newly formed subsidiary of Mammoth Energy Services, an Oklahoma-based oil-and-gas company. “Cobra’s creation [was] Mammoth’s first foray into the utility sector,” The Intercept reports.

Meaning, there were legitimate concerns about the company’s actual expertise in large-scale power grid restoration. No matter! FEMA initially awarded a $200 million contract to Cobra which later ballooned to $900 million.

Just to be clear: While she was in Puerto Rico, Quinones was reportedly working for SDGE… and Cobra Energy… and coordinating with FEMA simultaneously. The incestuous nature of her role certainly raises serious questions about potential conflicts of interest, no?

Wait for it…

Two FEMA employees and the president of Cobra Energy were convicted of disaster relief fraud in Puerto Rico.

Two FEMA employees and the president of Cobra Energy were convicted of disaster relief fraud in Puerto Rico.

The extent of Quinones’ knowledge of these fraudulent activities is unclear; she wasn’t convicted of any wrongdoing, for instance.

But shouldn’t the Los Angeles City Council, who approved her LADWP hire, have looked into the matter? (Forgive me, but… where there’s smoke, there’s fire.)

Even Quinones’ double-dipping — presumably drawing salaries from SDGE and Cobra at the same time — should have raised concerns.

But it’s her post SDGE-Cobra career that should have really raised red flags.

In 2021, Quinones moved to Pacific Gas and Electric (PG&E) as senior vice president of gas engineering, later becoming senior vice president of electric operations.

This after PG&E filed for bankruptcy in 2019. Over liability for several California wildfires. (You can’t make this stuff up.)

Then there’s the DEI of it all: Here’s Ms. Quinones discussing what’s most important about her role at LADWP…

Then there’s the DEI of it all: Here’s Ms. Quinones discussing what’s most important about her role at LADWP…

Hint: No mention of public service

So as Los Angeles grapples with water shortages, devastating fires and loss of life (and lives), Los Angelenos might well be outraged “that funding for [Quinones’] position comes from department revenues generated by its water and power customers,” according to local ABC affiliate.

What’s perhaps most outrageous? Quinones took an oath as an employee of the “Disaster Service Worker Program” — an oath that seems to have been an afterthought (see video above), with little forethought to “disaster” or “service.”

![]() S&P 500: The Trend IS Your Friend

S&P 500: The Trend IS Your Friend

“In my view, the stock market will be up again in 2025 — either by a lot or by a little — but NOT down, like many anticipate,” says Paradigm’s trading pro Enrique Abeyta.

“In my view, the stock market will be up again in 2025 — either by a lot or by a little — but NOT down, like many anticipate,” says Paradigm’s trading pro Enrique Abeyta.

“The outlook is simple,” he says. “Stable(ish) interest rates and stable(ish) inflation, along with positive economic growth and corporate earnings growth, will push the stock market higher.

“If I’m wrong about any of those four variables in a big way, then the outcome will be different,” he adds. “For now, though, I think this is a reasonable view.

“The idea that the market might be up by a little is probably most folks' base case, and I agree.

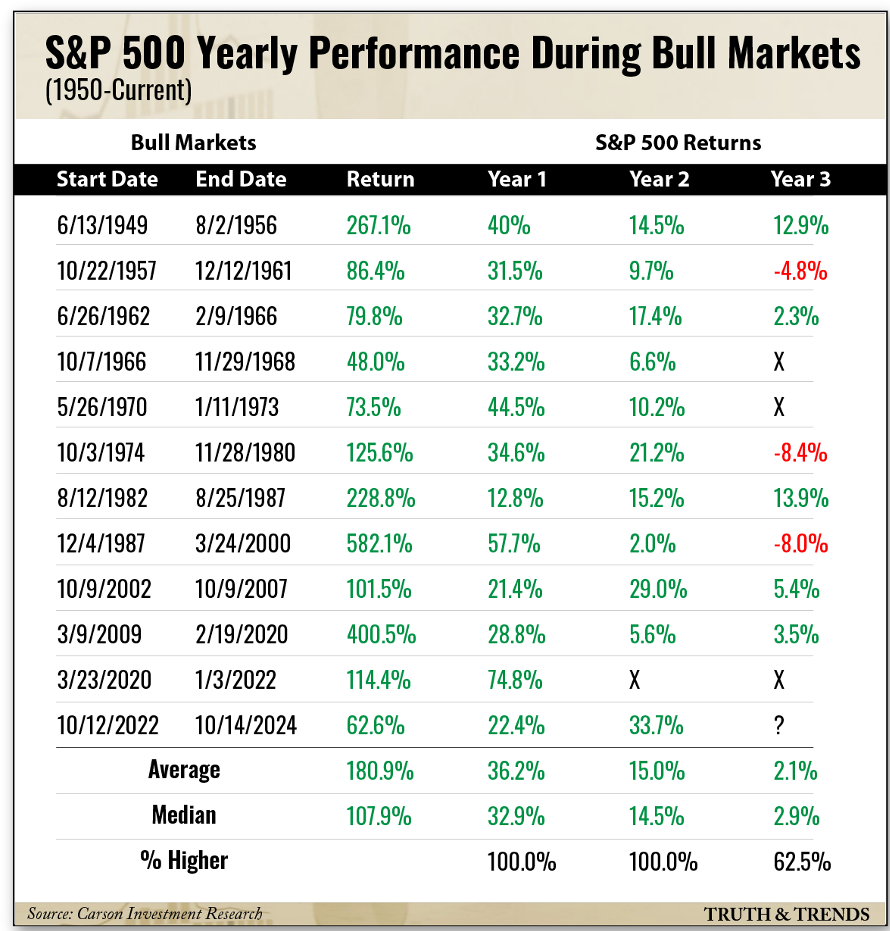

“Here’s a chart from our friend Ryan Detrick at Carson Group showing the history of bull market performance by year.

“You can see the third year of a bull market is usually the most difficult…

“After two strong years (and quite a few political and economic crosscurrents), a choppy stock market in 2025 makes a lot of sense.

“But what if this is wrong?

“Most investors see the stock market up by a lot and expect that trend not to continue. That’s not how the stock market works in the intermediate term…

“The biggest rallies in history have happened in succession,” Enrique notes.

“The biggest rallies in history have happened in succession,” Enrique notes.

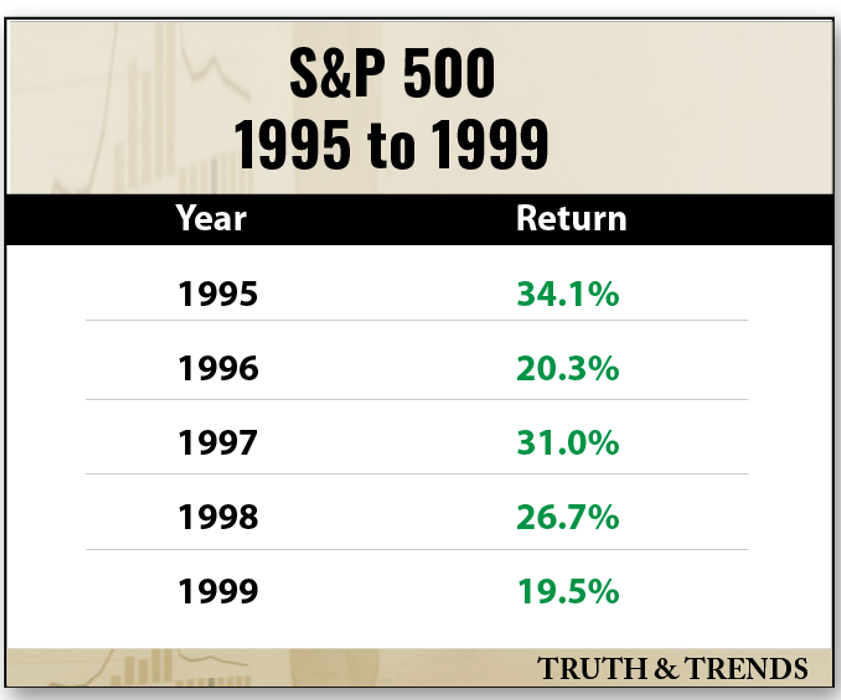

“Here’s another table from Detrick showing how the stock market has performed after two back-to-back 20% years…

“Getting two strong years like that is pretty rare,” he says, “and has only occurred four times since 1950.

“All four times, the market has been higher the next year. The average gain has also been strong, with only 1954 coming in with the ‘up a little’ scenario. The other years in the late 1990s averaged over a 25% return.

“This adds to my conviction that the stock market will not finish the year lower… I am confident THAT outcome is not in the consensus!

“This adds to my conviction that the stock market will not finish the year lower… I am confident THAT outcome is not in the consensus!

“Here’s a quick table showing that period from the late 1990s that I referenced above:

“Will this happen again?” Enrique asks. “I can’t say for sure, but being open to the idea is a good strategy.

“I challenge myself every day to be prepared for the downside,” he concludes. “However, being prepared for unexpected upside also makes a lot of sense.”

As for the S&P 500 today, the index is up about 0.10% to 5,955. Likewise, the Dow is up about 0.10% to 43,255. But the tech-heavy Nasdaq is in the red — down 0.20% to 19,475.

As for the S&P 500 today, the index is up about 0.10% to 5,955. Likewise, the Dow is up about 0.10% to 43,255. But the tech-heavy Nasdaq is in the red — down 0.20% to 19,475.

Oil, meanwhile, is down 1.55% to $78.90 for a barrel of West Texas Intermediate. Precious metals? Gold’s rallying 1.40% to $2,755.30 per ounce; silver is up 1.15% to $31.90.

As for the crypto market, Bitcoin is just slightly in the red, just under $100,000. But Ethereum has pulled back almost 3% to $3,345.

The only major economic of note today, retail sales, shows modest growth in December 2024, rising 0.4% from the month before. Growth was primarily driven by a 0.7% increase in auto sales and a 2.3% increase in furniture purchases. Notably, sporting goods store purchases increased 2.6% while clothing retailers report a 1.5% increase.

The mainstream is chalking such consumer “resilience” up to low official unemployment and supposedly rising wages. Hmm…

![]() Great Moments in Marketing History

Great Moments in Marketing History

An ad from Pakistan International Airlines is having a viral moment on social media for all the wrong reasons.

An ad from Pakistan International Airlines is having a viral moment on social media for all the wrong reasons.

“The ad was meant to promote the resumption of Pakistan International Airlines' flights to the French capital,” the BBC reports.

"Is this an advertisement or a threat?" an X-platform user wonders…

Of course, comparisons to 9/11 in NYC are unmistakable… But, apparently, not to the marketing firm?

While Prime Minister Shehbaz Sharif “has ordered an investigation into the matter,” the airline is no stranger to controversy.

In 2017, PIA faced ridicule after some of its staff sacrificed a goat on the tarmac to bring good luck, following one of the worst air disasters in the country’s history.

Then in 2019, PIA courted controversy again when it told its flight attendants they had six months to lose weight or risk being grounded.

Too bad the ad campaign wasn’t similarly grounded. We can only imagine some unfortunate marketing-firm underling will get the scapegoat treatment. (Hopefully, not that scapegoat treatment.)

![]() California: What Happens Next?

California: What Happens Next?

A longtime reader weighs in with “some predictions of the aftermath of the California fires…

A longtime reader weighs in with “some predictions of the aftermath of the California fires…

“1. The enviros may try to prohibit the rebuilding of the Malibu beach homes that burned.

“2. Many of the unfortunate folks who lost everything will find that their insurance will fall far short of the cost to rebuild due to requirements of building code updates and permitting red tape. I expect there will be more than a few ‘for sale’ signs on scraped empty lots.

“Fox News interviewed a developer who loaded up his pickup with hoses; he and several friends fought off the fire and saved his Malibu home. When asked why he did that, he answered that he was so frustrated with the permitting and delays to get his house built in the first place that there was no way he was going to go through that process again. That’s saying something.

“Out here, the Colorado Front Range cities of Superior and Louisville went through a very similar conflagration (look up the Marshall Fire) so we have some idea of what will happen next.”

Emily: With California officials being a rogues’ gallery of incompetence, it’s little wonder that residents are taking it upon themselves to defend their property. The media, for example, are fixated on Californians exercising their Second Amendment rights to protect from looters.

More power to them.

If there’s anything “hopeful” that might emerge from the ashes, it’s the realization that: No one is coming to save you. (Except, perhaps, your family, friends and neighbors.)

It’ll be interesting to see how that realization plays out in a nanny state like California.

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets