Trump’s Tariff Torrent

![]() What’s a Tariff Anyway?

What’s a Tariff Anyway?

With tariffs turning the markets upside down this morning, perhaps it’s a good time to step back and think about the basic things.

With tariffs turning the markets upside down this morning, perhaps it’s a good time to step back and think about the basic things.

Like, what is a tariff anyway?

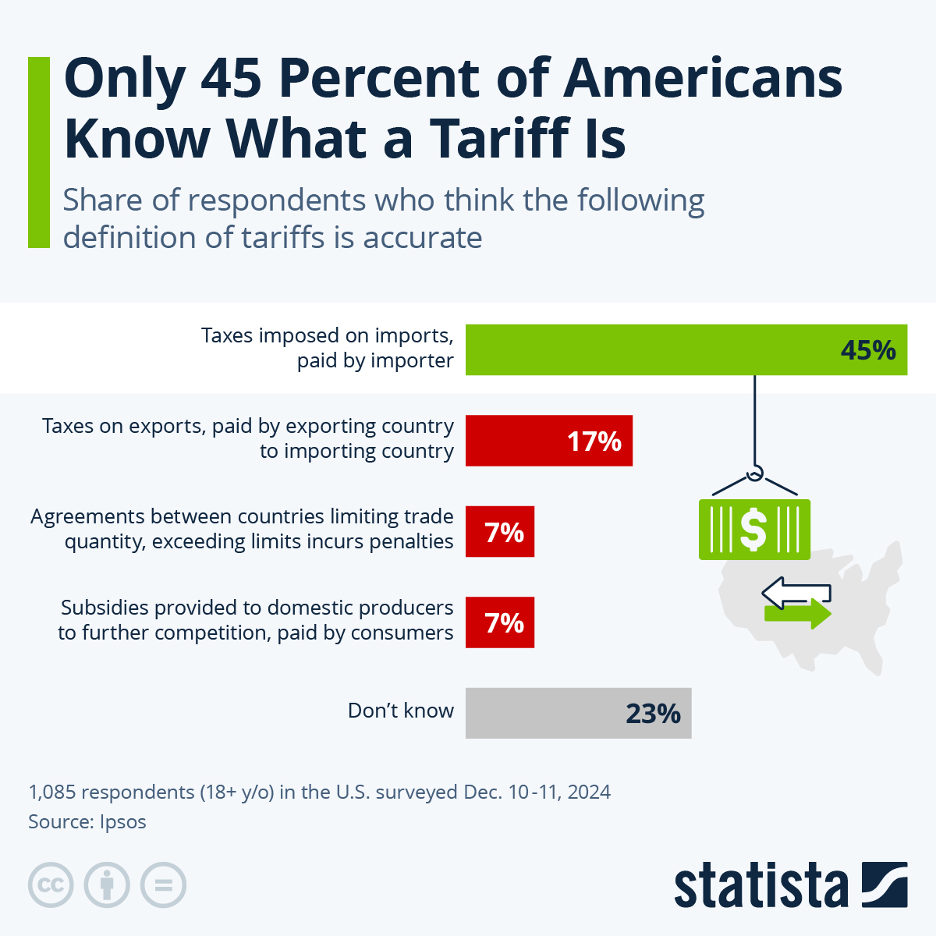

Maybe you know — or think you know — but if survey data is to be believed, more than half of your fellow Americans do not.

The market research firm Ipsos polled nearly 1,100 Americans in December. Courtesy of Statista, here are the results.

There’s a problem, though: Even the “correct” answer as pinpointed by the pollsters is loaded with an assumption.

There’s a problem, though: Even the “correct” answer as pinpointed by the pollsters is loaded with an assumption.

Yes, the “importer” pays the tariff up-front. But then what? Well, the importer might choose to eat some of that cost. But the rest gets passed along to the wholesaler… and then the retailer… and ultimately the consumer.

Saying that tariffs are paid by “importers” is the same sort of misdirection Democrats employ when they say that corporate income taxes are paid by “rich, greedy corporations.”

No, it’s a cost that — like any other cost — gets passed on down the line.

So with that essential background, let’s pose a question…

Are you willing to pay a dime a gallon more for gasoline to stop the flow of fentanyl from Canada into the United States?

Are you willing to pay a dime a gallon more for gasoline to stop the flow of fentanyl from Canada into the United States?

To be clear, I don’t know whether it’ll be exactly a dime. No one does. It might be more, it might be less. But that’s the essence of the bargain Donald Trump is asking you to make.

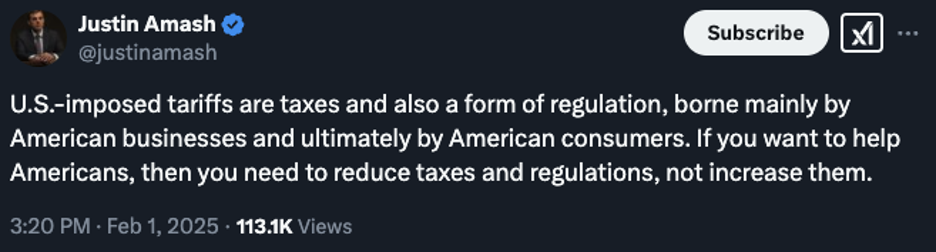

Actually, he’s not asking: You don’t have a choice. Tariffs are a tax, after all, even if you don’t pay them directly.

He didn’t put it in such concrete terms yesterday. He said only, “THIS WILL BE THE GOLDEN AGE OF AMERICA! WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!).”

As you might be aware, effective tomorrow goods from Canada and Mexico will be subject to a new 25% tariff, while goods from China will be subject to a new 10% tariff (above and beyond the existing ones).

It seems his main beef with Canada is a failure “to devote sufficient attention and resources or meaningfully coordinate with United States law enforcement partners to effectively stem the tide of illicit drugs.”

There are exemptions to the tariffs. Most notably, Canadian oil will be taxed at 10%, not 25%.

“Setting a lower tariff for such energy products is Trump telling on himself,” writes Liz Wolfe at Reason this morning — “admitting that tariffs will in fact raise prices.”

“Setting a lower tariff for such energy products is Trump telling on himself,” writes Liz Wolfe at Reason this morning — “admitting that tariffs will in fact raise prices.”

Hmmm… The lower energy tariff and the “PAIN” comment is vaguely reminiscent of events three years ago.

When Vladimir Putin rose to Joe Biden’s bait and invaded Ukraine, Biden tried to brace everyday Americans for higher energy prices with warnings like, “Defending freedom will have costs for us.”

The argument didn’t land well. In the end, Biden chose to evade those costs. He offset rising gasoline prices by draining the U.S. Strategic Petroleum Reserve at a pace no president did before. With the reserve still at a 41-year low, that option is foreclosed to Trump.

So much for the big picture. Let’s move on to the market impact…

![]() Uncertainty

Uncertainty

As the morning wears on, it seems Washington and Mexico City have come to terms to forestall the Mexico-targeted tariffs. But for how long?

As the morning wears on, it seems Washington and Mexico City have come to terms to forestall the Mexico-targeted tariffs. But for how long?

Trump says he will “immediately pause” the tariffs for one month after Mexican president Claudia Sheinbaum announced a deployment of troops to the Mexico-U.S. border.

Where this leaves business owners like Nicolas Palazzi, we don’t know. He’s the founder of a wine-and-spirits distributor in Brooklyn employing 21 people. About 20% of his imports come from Mexico.

“Is it for a day, is it a political flex or is it something that will last for four years?” he asked a BBC reporter ahead of the initial tariff announcement Saturday.

He says his small Mexican suppliers might not survive a prolonged spate of tariffs. “Can you really plan? No.”

That same uncertainty extends to the markets writ large — steep swings as the new week began, now being tempered by the Mexican truce, however temporary.

That same uncertainty extends to the markets writ large — steep swings as the new week began, now being tempered by the Mexican truce, however temporary.

What was a 600-point drop in the Dow Industrials has now been trimmed to less than 150 as we check our screens. That said, the S&P 500 has nonetheless given up the 6,000 level… and the Nasdaq is still down nearly 1%.

A rally in the U.S. dollar index past 110 has now turned into a reversal on the day, below 109.

Crude rallied hard when trading opened for a new week Sunday night, but now most of those gains have evaporated, a barrel of West Texas intermediate up less than a quarter at $72.76. And a steep drop in energy stocks has turned into a rally.

Gold is in record territory at $2,818, silver up as well to $31.57.

Crypto, however, is a hot mess. Bitcoin sits below $99,000 and Ethereum took a wicked spill of over 25%. From lows beneath $2,400, ETH has recovered to nearly $2,700 now.

![]() A Post-DeepSeek Shopping List

A Post-DeepSeek Shopping List

With the benefit of a week’s hindsight, the winners and losers from the DeepSeek story are coming into view — and the trading possibilities are attractive indeed.

With the benefit of a week’s hindsight, the winners and losers from the DeepSeek story are coming into view — and the trading possibilities are attractive indeed.

For one thing, Paradigm trading pro Enrique Abeyta says it was only the AI-related stocks that took the initial hit. “Monday was one of the biggest down days in the stock market in recent history. But in the S&P 500, four stocks went UP for every one went down.”

By the end of last week, the S&P logged a 2.7% gain for the month of January. All else being equal, a strong January bodes well for the rest of the year. (Only twice in the last two decades was this not true — 2018 and 2011.)

Meanwhile, the stocks that did take a hit comprise “a very interesting list of stocks to buy,” Enrique ventures.

“Almost all of these stocks have had strong charts with supportive technical characteristics. They also have had good earnings momentum. Plus, the stocks still managed to stay above their long-term 200-day moving average despite the sell-off.”

An example he cites in today’s edition of our sister e-letter Truth & Trends — the data center infrastructure firm Vertiv Holdings (VRT). The share price bounced off its moving average and analysts’ earnings estimates keep rising.

“Rising estimates are the single best driver of stock prices in the intermediate term,” he reminds us. “When you see estimates going up, the stock almost always follows.”

![]() Follow-Ups

Follow-Ups

For the record: The “Doomsday Clock” is closer to midnight than it’s ever been in its 78-year history.

For the record: The “Doomsday Clock” is closer to midnight than it’s ever been in its 78-year history.

On Friday the Bulletin of the Atomic Scientists issued its annual update to the clock that symbolizes the risk of nuclear Armageddon. They inched it forward one second — 89 seconds to midnight.

“The war in Ukraine, now in its third year, looms over the world; the conflict could become nuclear at any moment because of a rash decision or through accident or miscalculation,” says the Bulletin’s statement. “The nuclear arms control process is collapsing, and high-level contacts among nuclear powers are totally inadequate given the danger at hand.”

This is true; the back-and-forth that Washington and Moscow implemented after the Cuban Missile Crisis in 1962, and continued for the duration of the Cold War? It’s nowhere to be found now.

A year ago, we devoted all 5 of our Bullets to the Doomsday Clock and why it’s even closer to midnight now than it was back in the early ’60s. It’s relevant to our financial beat in the sense that if nuclear war breaks out… there won’t be any markets or economy for us to talk about.

Thursday is the deadline by which the Trump administration is supposed to outline a plan to release the remaining redacted JFK assassination files.

Thursday is the deadline by which the Trump administration is supposed to outline a plan to release the remaining redacted JFK assassination files.

On Jan. 22, Trump ordered the “full and complete release” of all the files. However, the order has loopholes big enough to accommodate JFK’s 1961 Lincoln Continental limo.

Attorney Lawrence Schnapf sued the Biden administration in 2022 when Biden failed to release the records as required by law. (Indeed, Biden handed control of them to the CIA.) He’s dubious about Trump’s commitment to follow through.

“The president could have simply directed the archivist to remove all redactions in the assassination records in its possession and make them available to the American people,” he writes at the JFK Facts Substack. Instead, the language of the order opens the way “for agencies who have been resisting disclosure for over six decades to demand further postponements.”

It’s going to take public pressure to get full disclosure. With that in mind, two Republicans and one Democrat in the U.S. House are circulating a “Dear Colleague” letter for other congressmembers to sign.

Seldom do I think “call your congressman” is worthwhile advice. But perhaps it might make a difference in this case. (You can find your rep by zip code at this link.)

As I wrote to mark the 60th anniversary… the JFK assassination was the moment when Americans’ trust in “the system” first began to erode, and the post-WWII sense that life would keep getting better and better took its first major blow.

If we want a return to the real prosperity of that era, shared by the masses… and not the fake financialized prosperity enjoyed only by a few… perhaps it can start with full JFK disclosure.

![]() From a Skeptical Reader…

From a Skeptical Reader…

“I am skeptical. Very skeptical,” writes a reader who nonetheless overcame his skepticism while watching The Prophecy, featuring Paradigm’s newest editor Mason Sexton — and he subscribed to Mason’s one-of-a-kind trading service,The Map.

“I am skeptical. Very skeptical,” writes a reader who nonetheless overcame his skepticism while watching The Prophecy, featuring Paradigm’s newest editor Mason Sexton — and he subscribed to Mason’s one-of-a-kind trading service,The Map.

“I'm not a mystic or spiritualist. I do however agree with the premise of market moods (markets made up of humans) that can be affected by cosmic events.

“So I bought it.

“Why? Two main reasons:

- “I want to understand shorting better, as I want to play the rise and fall of markets. Very intriguing.

- “Results are results. If I can make back what I spent on the program it's worth it.

“It's funny because Paradigm always has this showmanship thing, and it's clear to me you are uncomfortable with this one. And that could be what pushed me over the edge.

“Let's see how it goes! I'm here for the ride.”

Dave responds: Glad you took the plunge.

Over the last few days as I’ve been introducing Mason to readers, I’ve given zero emphasis to the more, ummm, esoteric aspects of his strategy. I figured it’s just better to let Mason lay out that part in his own words.

But it’s not altogether new territory for me. One sleepy summer day several years ago, I mused at length in these virtual pages about the link between the 11-year sunspot cycle and “mass excitability” in society and the markets.

My tentative conclusion was that while the link was compelling, it didn’t translate to anything you could do to consistently make money in the markets.

But I didn’t know about Mason at the time; back then distribution of his research was limited only to the highest of high-end clients.

Across a 45-year career, he seems to have figured it out — albeit with some even more “mystical” elements thrown in the mix.

That’s all I’ll say about it now — except that the results can’t be argued with. Go ahead and watch Mason’s presentation and decide for yourself.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets